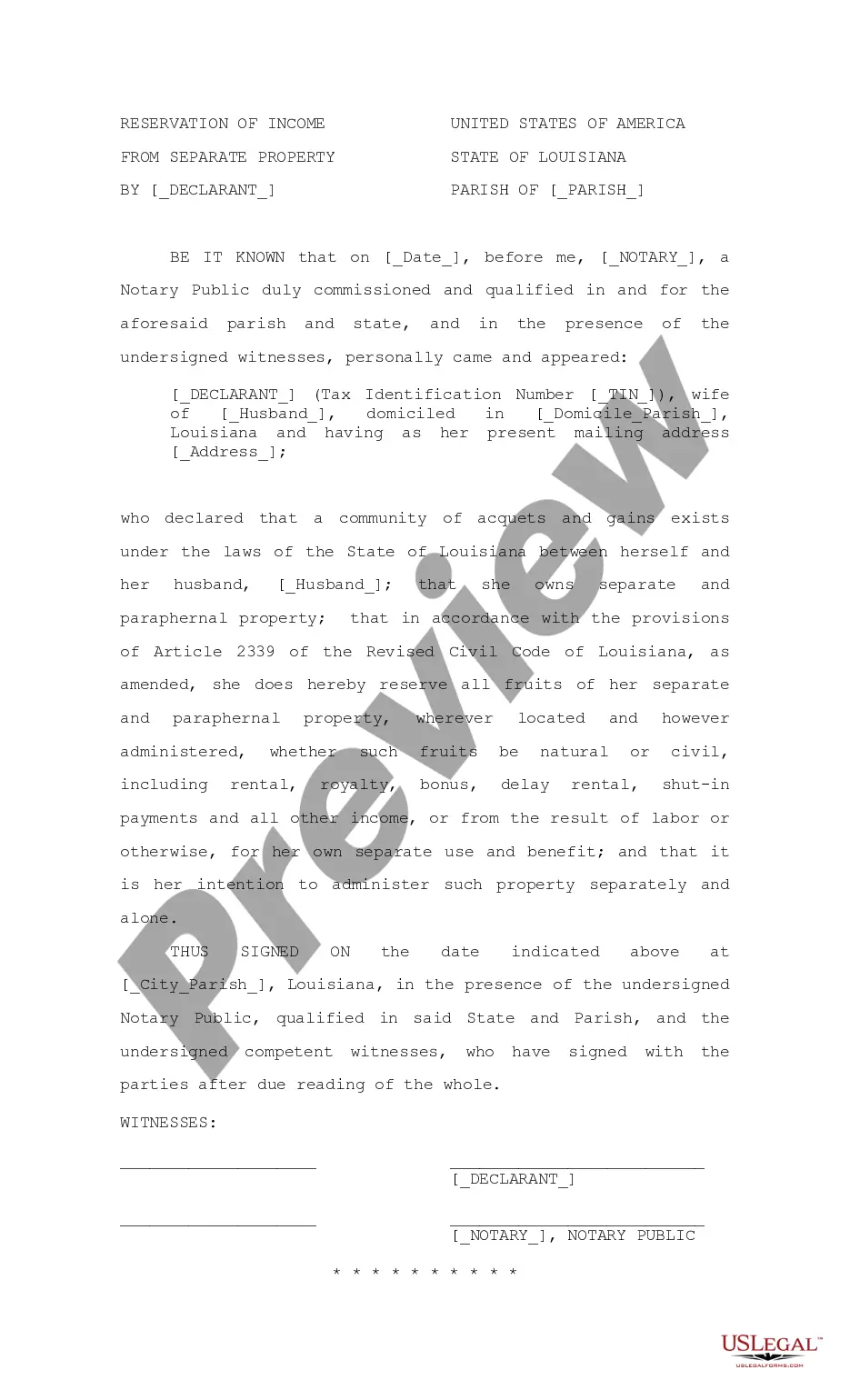

Baton Rouge Louisiana Reservation of Income from Separate Property

Description

How to fill out Louisiana Reservation Of Income From Separate Property?

Are you seeking a reliable and cost-effective provider of legal templates to purchase the Baton Rouge Louisiana Reservation of Income from Separate Property? US Legal Forms is your ideal answer.

Whether you need a straightforward contract to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce proceedings in court, we have you covered. Our platform features over 85,000 current legal document templates suitable for personal and business use. All templates we provide are not generic and are tailored based on the specifications of individual states and areas.

To acquire the form, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please remember that you can access your previously acquired document templates at any time from the My documents section.

Are you a newcomer to our platform? No problem. You can set up an account in just a few minutes, but before that, please ensure to do the following.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Baton Rouge Louisiana Reservation of Income from Separate Property in any available format. You can revisit the website anytime to redownload the form at no additional cost.

Locating current legal forms has never been simpler. Try US Legal Forms today and stop wasting your precious time on research for legal documentation online.

- Check if the Baton Rouge Louisiana Reservation of Income from Separate Property complies with the laws of your state and local area.

- Examine the form’s specifics (if accessible) to understand who and what the form is meant for.

- Restart your search if the form does not fit your specific circumstances.

Form popularity

FAQ

The declaration of separate property in Louisiana is a legal document that formally identifies specific property as separate and not subject to community property laws. This is especially important for couples considering the Baton Rouge Louisiana Reservation of Income from Separate Property. By having a declaration, you can clearly delineate your assets and bolster your financial security.

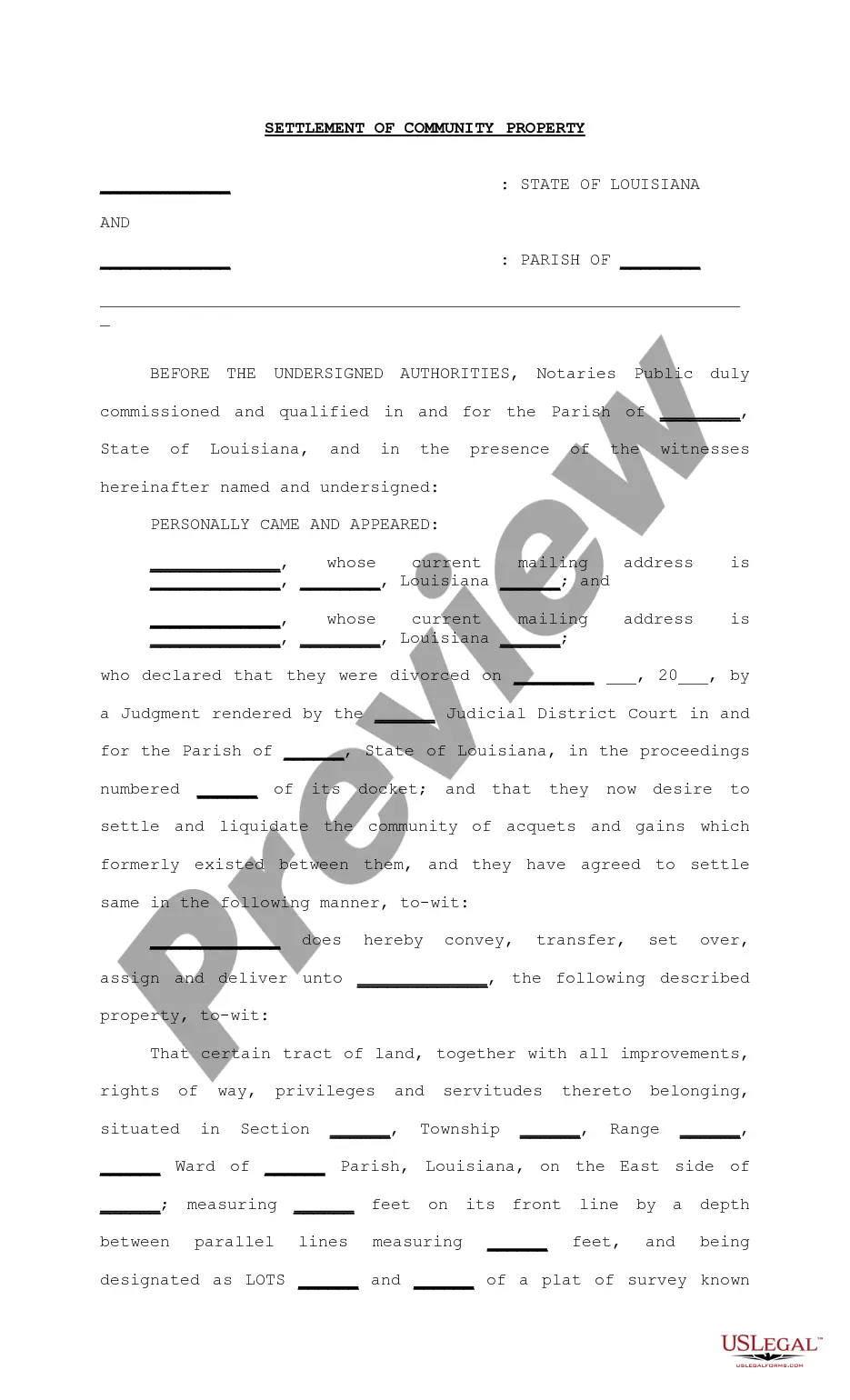

At the death of a spouse, separate property is usually inherited by the deceased's heirs, depending on the existing will or Louisianan inheritance laws. If you want to manage this effectively, it is vital to explore options like Baton Rouge Louisiana Reservation of Income from Separate Property. Doing so can help clarify intentions for separate property ownership.

When a spouse dies, the surviving spouse usually retains rights to the marital home, especially if it is community property. If the deceased owned the house as separate property, it might pass to the heirs instead. Utilizing strategies like Baton Rouge Louisiana Reservation of Income from Separate Property can help ensure clarity in these matters.

In Louisiana, if one owner of a jointly owned property dies, the property typically passes to the surviving owner, assuming it was held as joint tenancy. This is crucial when considering assets and income in light of Baton Rouge Louisiana Reservation of Income from Separate Property. Understanding these details can aid in effective estate planning and asset protection.

Generally, income generated from separate property remains separate, and does not convert to community property. However, the specifics can vary based on various factors, making it wise to explore options like Baton Rouge Louisiana Reservation of Income from Separate Property. Taking proactive steps ensures you maintain control over your assets during and after marriage.

If a spouse dies while the couple is separated, the surviving spouse still retains rights to inheritance under Louisiana law. This creates a potential overlap with Baton Rouge Louisiana Reservation of Income from Separate Property, as the deceased's assets may include both community and separate property. Understanding your rights can help you navigate this challenging situation more effectively.

In Louisiana, separate property typically goes to the owner's heirs upon their death. If a spouse wishes to set specific terms for their estate, it’s essential to consider Baton Rouge Louisiana Reservation of Income from Separate Property. This can clarify the distribution of separate property and ensure that the owner's intentions are honored.

In Louisiana, community property includes any assets acquired during the marriage, whereas separate property refers to assets owned before the marriage or inherited personally. This distinction is important when considering the Baton Rouge Louisiana Reservation of Income from Separate Property, as it can clarify how income generated from these assets is treated. Understanding this difference can help individuals protect their rights during asset distribution.

In Louisiana, a wedding ring is typically classified as community property if it was acquired during the marriage. However, if the ring was given as a gift or is considered a separate property, it can remain separate. To navigate these complexities and understand how the Baton Rouge Louisiana Reservation of Income from Separate Property applies, consider consulting legal advice. This will help clarify how your assets are categorized under state law.

The separate property law in Louisiana designates that certain assets remain the sole property of an individual spouse, provided they meet specific criteria. For those navigating the Baton Rouge Louisiana Reservation of Income from Separate Property, understanding these laws is crucial for ensuring that your income remains protected. Resources like uslegalforms can provide valuable insights and templates to help you manage your property interests effectively.