Wichita Kansas Assignment to Living Trust

Description

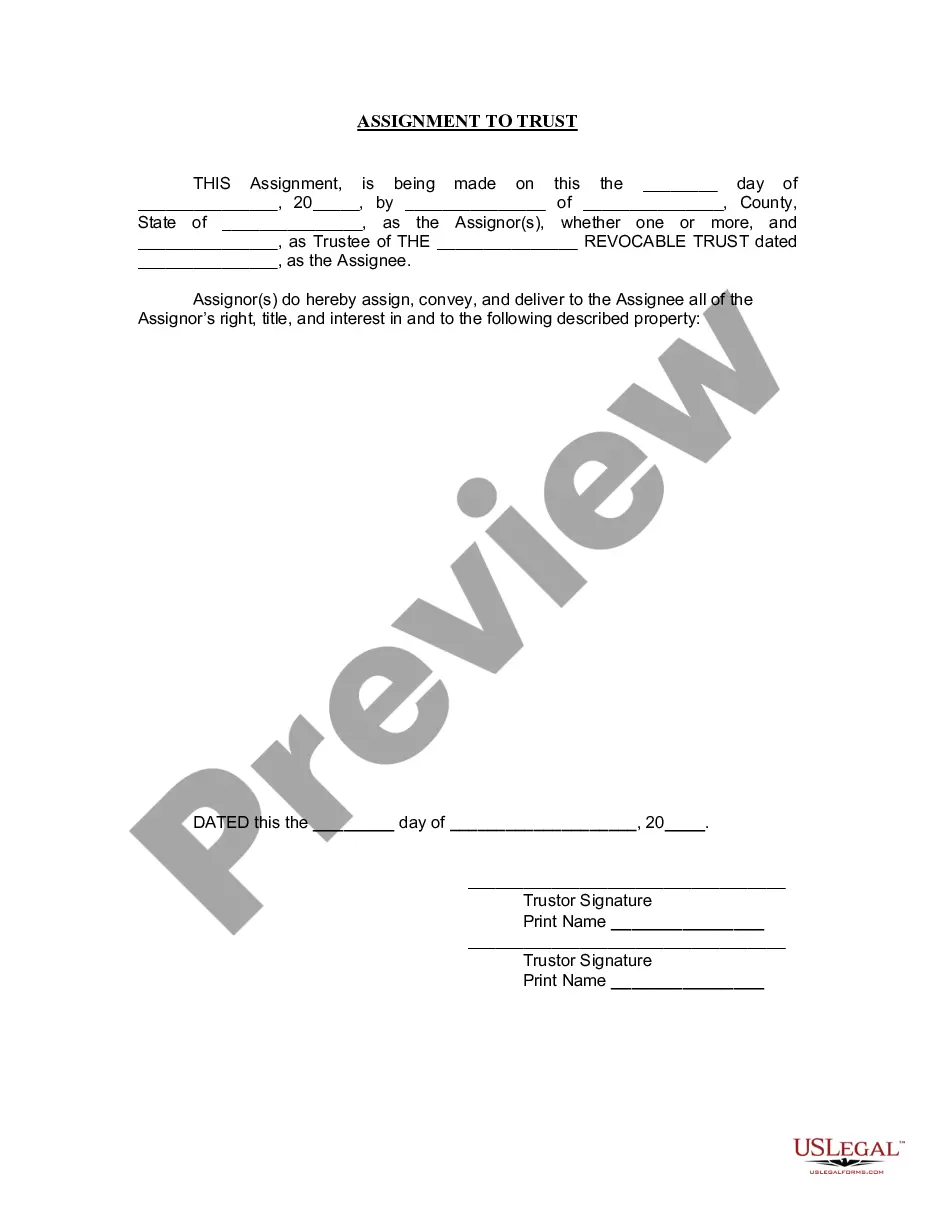

How to fill out Kansas Assignment To Living Trust?

Utilize the US Legal Forms to gain instant access to any form sample you desire.

Our advantageous platform, featuring thousands of document templates, simplifies the process of locating and acquiring nearly any document sample you need.

You can download, fill out, and confirm the Wichita Kansas Assignment to Living Trust in minutes rather than spending several hours searching online for the correct template.

Employing our catalog is an excellent method to enhance the security of your document submissions.

If you haven't set up a profile yet, follow the instructions given below.

Locate the template you need. Ensure it is the document you were aiming to find: verify its title and description, and use the Preview feature if available. Otherwise, use the Search bar to find the suitable one.

- Our experienced attorneys frequently examine all documents to confirm that the templates remain pertinent for a specific area and comply with the latest laws and regulations.

- How can you acquire the Wichita Kansas Assignment to Living Trust.

- If you have an existing subscription, simply sign in to your account.

- The Download option will show up on all the samples you examine.

- Additionally, you can access all previously stored files in the My documents section.

Form popularity

FAQ

By federal and state law, a trust can remain open for up to 21 years AFTER the death of anyone living at the time the trust was created. The special needs trust remains in effect throughout the person's lifetime.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Living Trusts in Kansas The settlor places assets into the trust and chooses a trustee. The trustee can be anyone, but cannot be the only beneficiary of the trust. Many people name themselves to be trustee and select a successor trustee to manage the trust after death.

Most living trusts are revocable, meaning they can be changed or deleted during the settlor's life. An irrevocable living trust becomes permanent once it is created. A living trust in Kansas may be created if the settlor lives in Kansas, the trustee lives or works in Kansas, or trust property is located in Kansas.

You can create a living trust through two different ways: you can hire an attorney or you can use an online program. Hiring an attorney will cost you more than $1,000. If you choose to use the DIY approach, you'll spend a few hundred dollars.

How to Create a Living Trust in Kansas Select the type of trust that best suits your current situation.Take inventory on your property.Select your trust's trustee.Create a trust document.Sign the trust document in front of a notary public. Fund the trust by transferring property and assets into it.

Trust of immovable property. ?No trust in relation to immoveable property is valid unless declared by a non-testamentary instrument in writing signed by the author of the trust or the trustee and registered, or by the will of the author of the trust or of the trustee.

Death within 7 years of making a transfer If you die within 7 years of making a transfer into a trust your estate will have to pay Inheritance Tax at the full amount of 40%. This is instead of the reduced amount of 20% which is payable when the payment is made during your lifetime.

A trust can remain open for up to 21 years after the death of anyone living at the time the trust is created, but most trusts end when the trustor dies and the assets are distributed immediately.