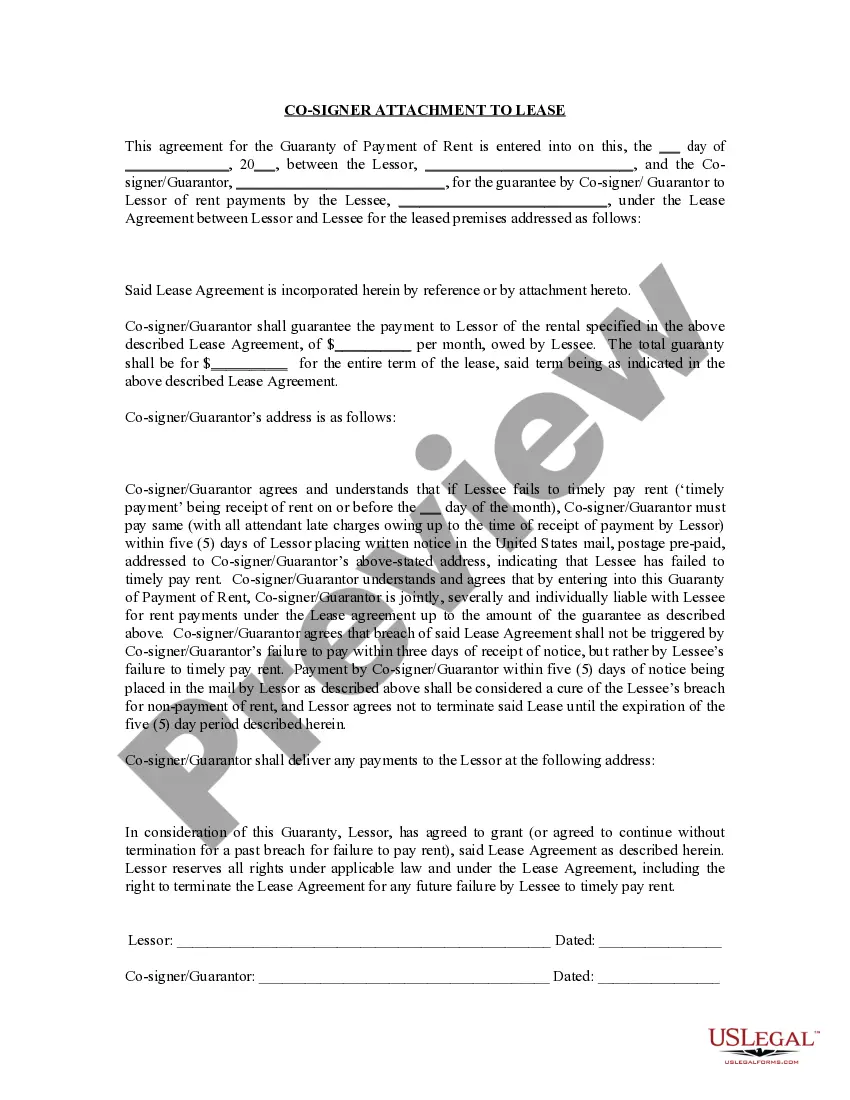

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Wichita Kansas Guaranty Attachment to Lease for Guarantor or Cosigner

Description

How to fill out Kansas Guaranty Attachment To Lease For Guarantor Or Cosigner?

Obtaining validated forms that align with your local laws can be difficult unless you utilize the US Legal Forms library.

It is an online repository of over 85,000 legal documents catering to both personal and professional requirements and various real-world scenarios.

All the files are appropriately organized by usage area and jurisdiction categories, so locating the Wichita Kansas Guaranty Attachment to Lease for Guarantor or Cosigner becomes as straightforward as one, two, three.

Maintaining orderly paperwork that adheres to legal standards is extremely important. Utilize the US Legal Forms library to consistently have vital document templates accessible for all your requirements!

- Review the Preview mode and form description.

- Ensure you have selected the correct one that fits your needs and fully complies with your local jurisdiction standards.

- Search for an alternative template if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

You might need a 'guarantor' so you can rent a place to live. A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead.

If the Deed of guarantee contains a termination provision (allowing the guarantor to withdraw on say two months' notice)- the provision can allow the termination during the fixed term. If any term of the tenancy changes (e.g. rent increase) the guarantee will automatically come to an end. Death of either party.

How long a guarantor agreement lasts. There's no general rule about how long a guarantor agreement lasts. It depends on what's agreed between the landlord and the guarantor. Your guarantor should speak to the landlord if they don't want their liability to continue beyond the end of a fixed term tenancy.

When you cosign on a lease, you're making a legal promise to uphold the terms of the lease and to pay rent if the lessee does not. As a cosigner, your credit could be affected whether or not the person you're cosigning with pays their rent. This uncertainty makes cosigning for an apartment risky.

The guarantor has no right to end the tenancy, so they should consider an agreement that is limited to an initial fixed term. Guarantors should be given a copy of the tenancy agreement, which can be checked for rent review clauses. It may be possible to negotiate a payment of rent in advance instead of a guarantee.

Cosigners have equal responsibility for payment of monthly rental costs, while a guarantor is generally sought for payment only when the property occupant is unable to make the rental payment.

A guarantor guarantees to pay a borrower's debt in the event that the borrower defaults on a loan obligation. The guarantor guarantees a loan by pledging their assets as collateral. A guarantor alternatively describes someone who verifies the identity of an individual attempting to land a job or secure a passport.

A cosigner has more financial responsibility than a guarantor since the cosigner is responsible for rent on day one. The guarantor only steps in if a renter can't make payments. Plus, if a cosigner is a roommate, he or she has to pick up the slack if the other roommates can't make rent.

A guarantor is someone who agrees to pay your rent if you don't pay it, for example a parent or close relative. If you don't pay your landlord what you owe them, they can ask your guarantor to pay instead. If your guarantor doesn't pay, your landlord can take them to court.