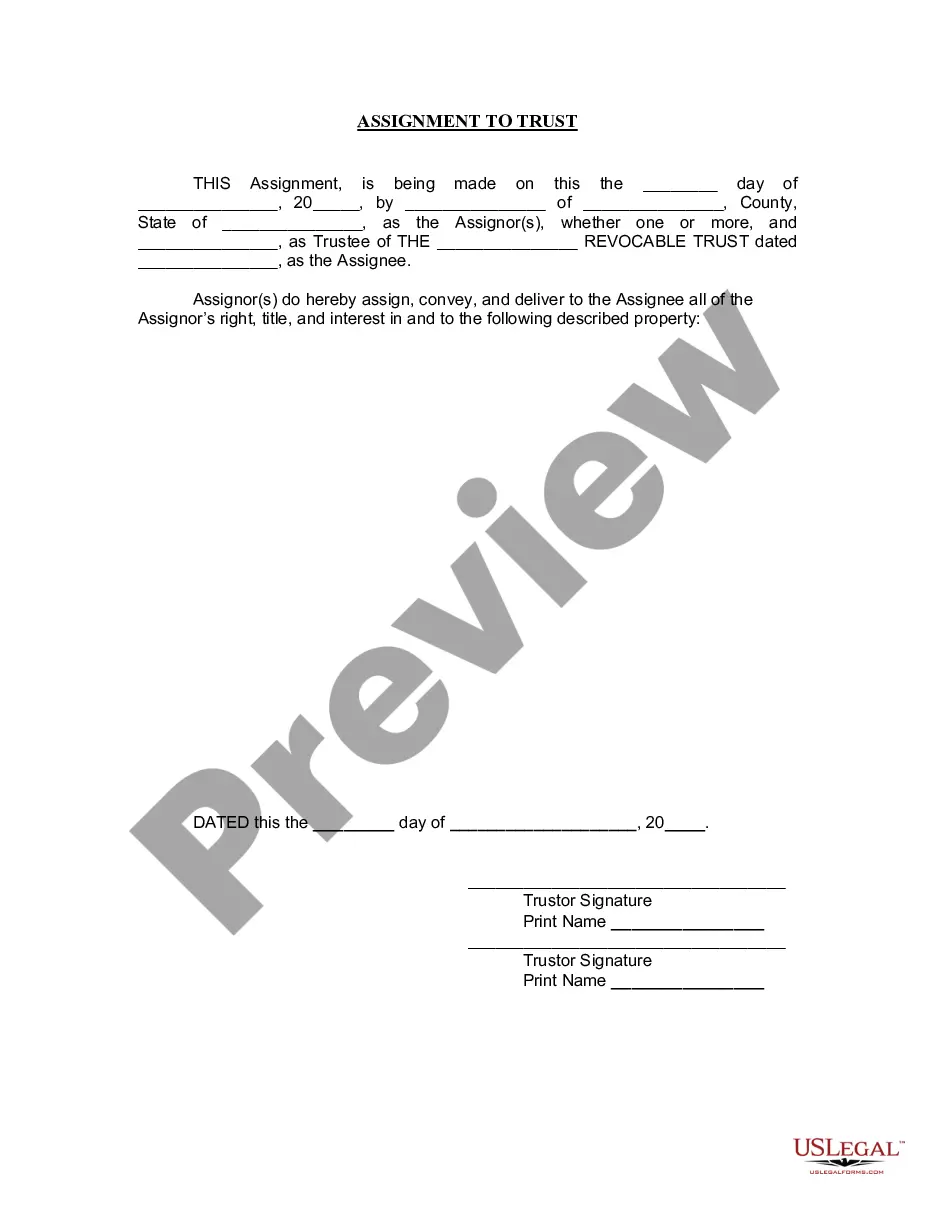

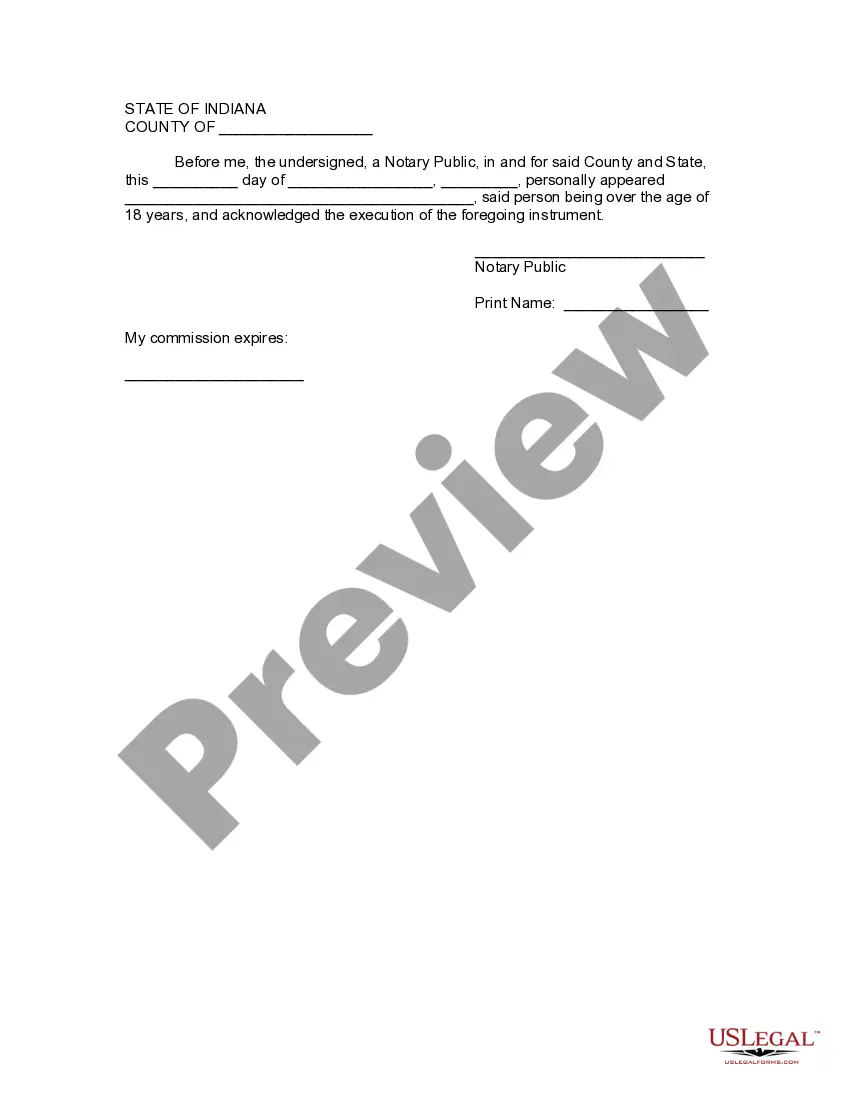

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Indianapolis Indiana Assignment to Living Trust

Description

How to fill out Indiana Assignment To Living Trust?

Do you require a dependable and economical provider of legal documents to obtain the Indianapolis Indiana Assignment to Living Trust? US Legal Forms is your preferred option.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a collection of documents to facilitate your divorce proceedings, we have you covered.

Our platform features over 85,000 current legal document templates suitable for personal and commercial purposes.

All templates we provide are not generic and are tailored to meet the regulations of specific states and counties.

Review the form’s details (if available) to understand who and what the document is appropriate for.

If the template does not fit your particular needs, begin the search anew.

- To download the document, you must Log In to your account, search for the desired template, and click the Download button alongside it.

- Please note that you can download your previously acquired document templates at any time via the My documents section.

- Are you a newcomer to our site? No problem.

- You can quickly establish an account; however, do ensure to check the following.

- Confirm if the Indianapolis Indiana Assignment to Living Trust adheres to the legislation of your jurisdiction.

Form popularity

FAQ

A living trust in Indiana is created by the settlor. He or she transfers assets so they are owned by the trust. A trustee is chosen to manage the trust, and often the settlor selects himself as trustee, with a successor trustee in place to take over after the settlor's death.

Some of the Cons of a Revocable Trust Shifting assets into a revocable trust won't save income or estate taxes. No asset protection. Although assets held in an irrevocable trust are generally beyond the reach of creditors, that's not true with a revocable trust.

To make sure it's done properly, you'll probably want to hire a lawyer, which can put you at least $1,000 out of pocket. For especially large estates, a qualified financial advisor is also essential.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

The bottom line is that a trust provides far more potential asset protection than an outright inheritance. Depending upon the needs of your family, an estate planning attorney can create a trust for you that protects assets and preserves them for your beneficiaries.

The probate process lasts a minimum of three months after the date that notice of the opening of the estate is published in the paper. However, estates normally take nine to twelve months before they are fully administered, and longer in some cases.

There are a variety of assets that you cannot or should not place in a living trust. These include: Retirement Accounts: Accounts such as a 401(k), IRA, 403(b) and certain qualified annuities should not be transferred into your living trust. Doing so would require a withdrawal and likely trigger income tax.

The cost of establishing a living trust in Indiana varies, from about $200 if you do it yourself with computer software to over $1,000 if you hire a lawyer. Don't be dissuaded by the cost of hiring a lawyer in establishing a living trust in Indiana. A trust is a legal document.

Drawbacks of a Living Trust Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.