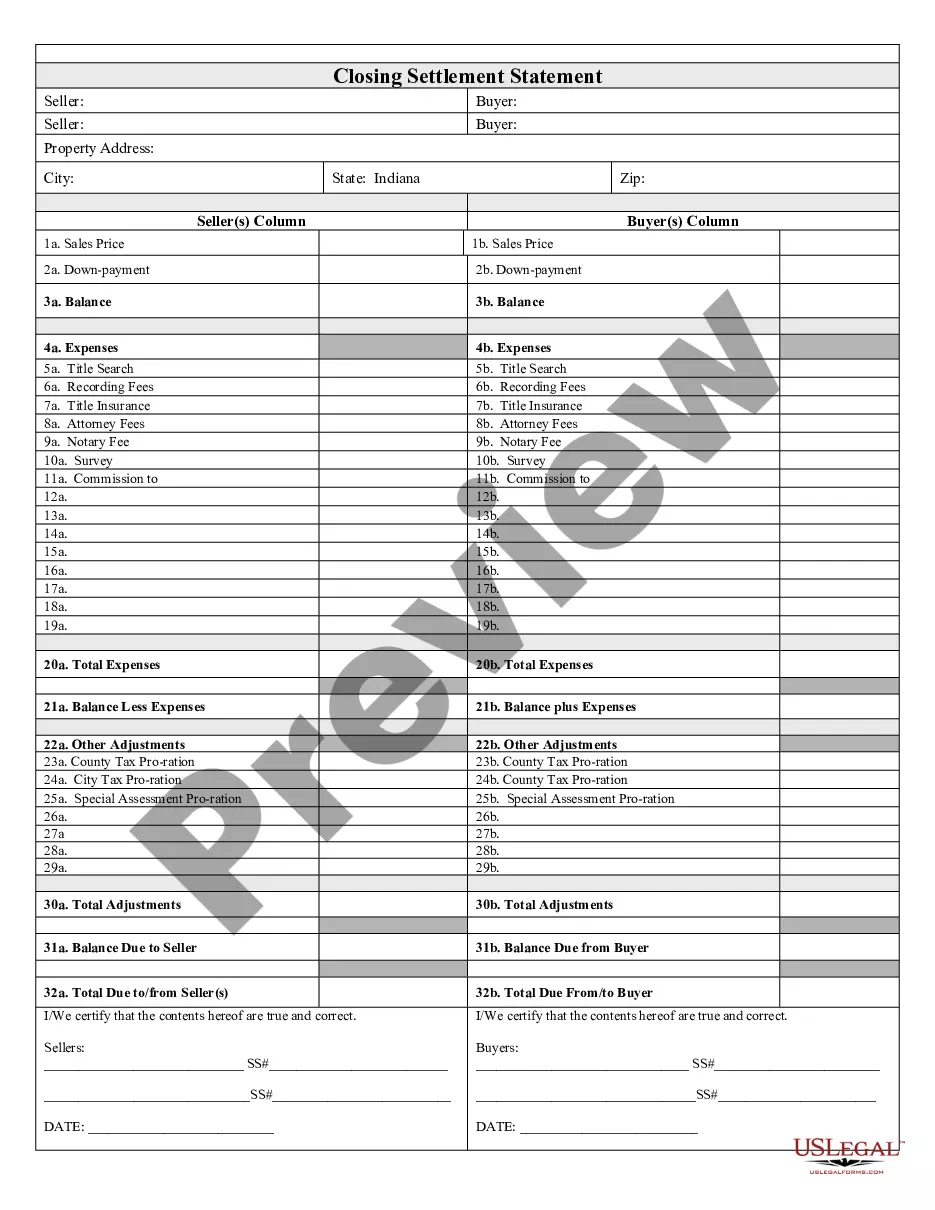

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Indianapolis Indiana Closing Statement

Description

How to fill out Indiana Closing Statement?

If you have previously utilized our service, Log In to your account and download the Indianapolis Indiana Closing Statement to your device by clicking the Download button. Ensure that your subscription is active. If not, renew it as per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to obtain your document.

You have ongoing access to every document you have acquired: you can find it in your profile under the My documents menu whenever you need to access it again. Take advantage of the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Ensure you’ve found the correct document. Review the description and utilize the Preview option, if available, to verify if it fulfills your needs. If it doesn’t suit you, use the Search tab above to find the fitting one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your Indianapolis Indiana Closing Statement. Choose the file format for your document and save it to your device.

- Complete your template. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Unsupervised administration is conducted by personal representatives who operate without court supervision. It is typically authorized pursuant to the decedent's will, although heirs and other interested parties can request unsupervised administration if it is not provided by will and if the estate is solvent.

Unsupervised estates do not require the submission of a final accounting by the estate's executor, also known as a personal representative, to the court before assets are distributed to beneficiaries. Instead, the personal representative must file a final statement with the court.

Once all assets have been distributed, you must provide the court with the full details of the estate transactions so that the estate can be formally closed. This is accomplished by providing a final accounting of the actions you have taken, and filing a petition to settle the estate.

While the probate process isn't necessary for every estate in Indiana, a sizable portion of them will be forced to go before the court. However, there are certain assets of a decedent that will skip past this process, as they already have heirs or beneficiaries chosen. These include: Life insurance.

How long does probate last? Probate has to be kept open for a certain period to allow potential creditors to present a claim against the estate. This claims period is three months in Indiana and six months in Illinois.

You do not have to file this form in court. You can give the form to the person, bank, or company currently holding the assets you have a right to inherit. You'll also have to pay someone else who has rights to the same property what they are owed.

Conducting a probate in Indiana commonly takes six months to a year, depending on the situation. It can take longer if there is a court fight over the will (which is rare) or unusual assets or debts that complicate matters.

In general, expect it to take at least six months up to a year before probate is closed and the assets distributed to the heirs. If there are disputes, claims against the estate or other delays, it could take much longer.

Indiana has two ways to tackle probate: unsupervised and supervised administration. With unsupervised administration, the Personal Representative of the estate can carry out his or her duties without obtaining court approval for things like selling assets or dealing with inheritances and taxes.

As we mentioned above, Indiana only requires probate of estates worth $50,000 or more. Smaller estates do not require administration. The family or personal representative can pay bills and transfer assets using an affidavit or written statement.