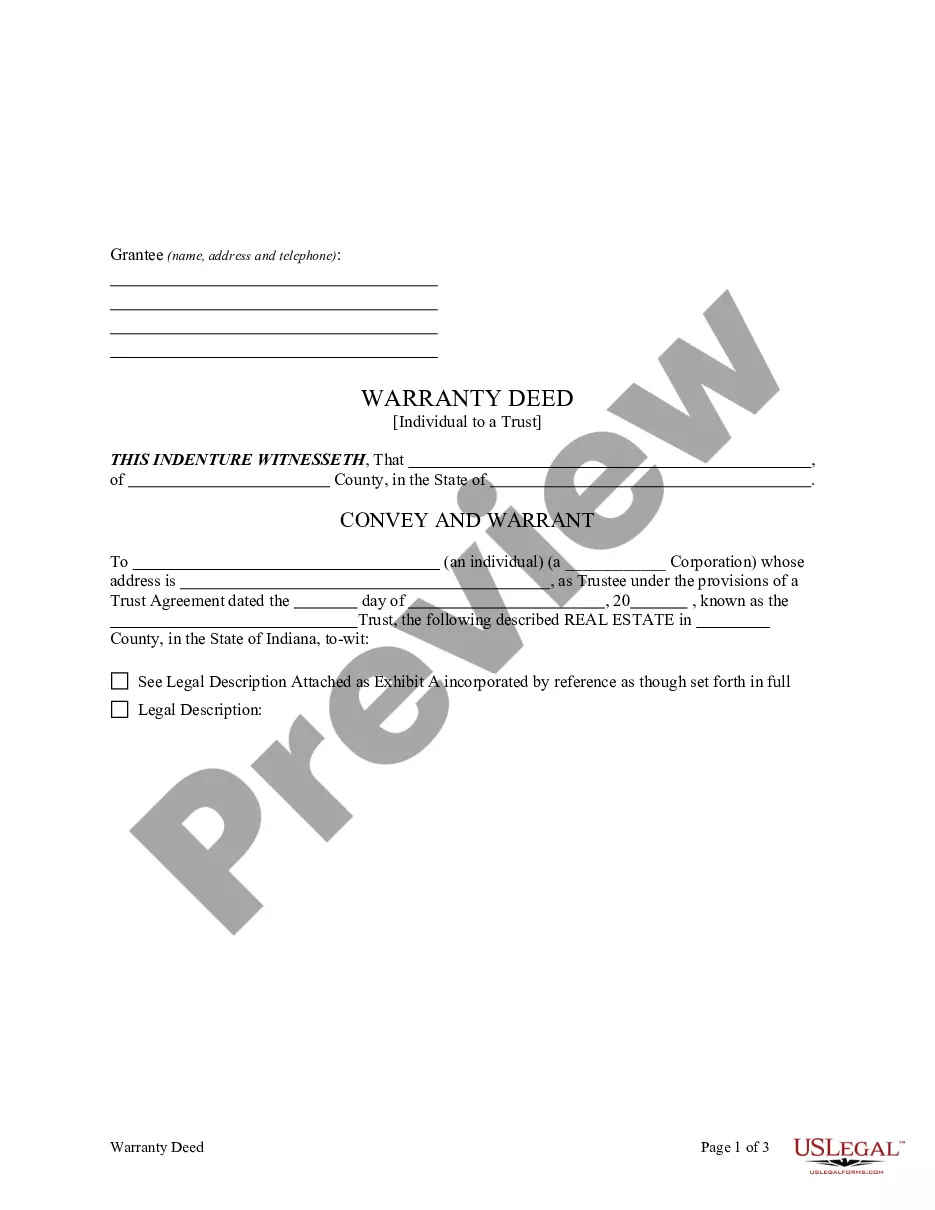

This form is a Warranty Deed where the grantor is an individual and the grantee is a trust. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

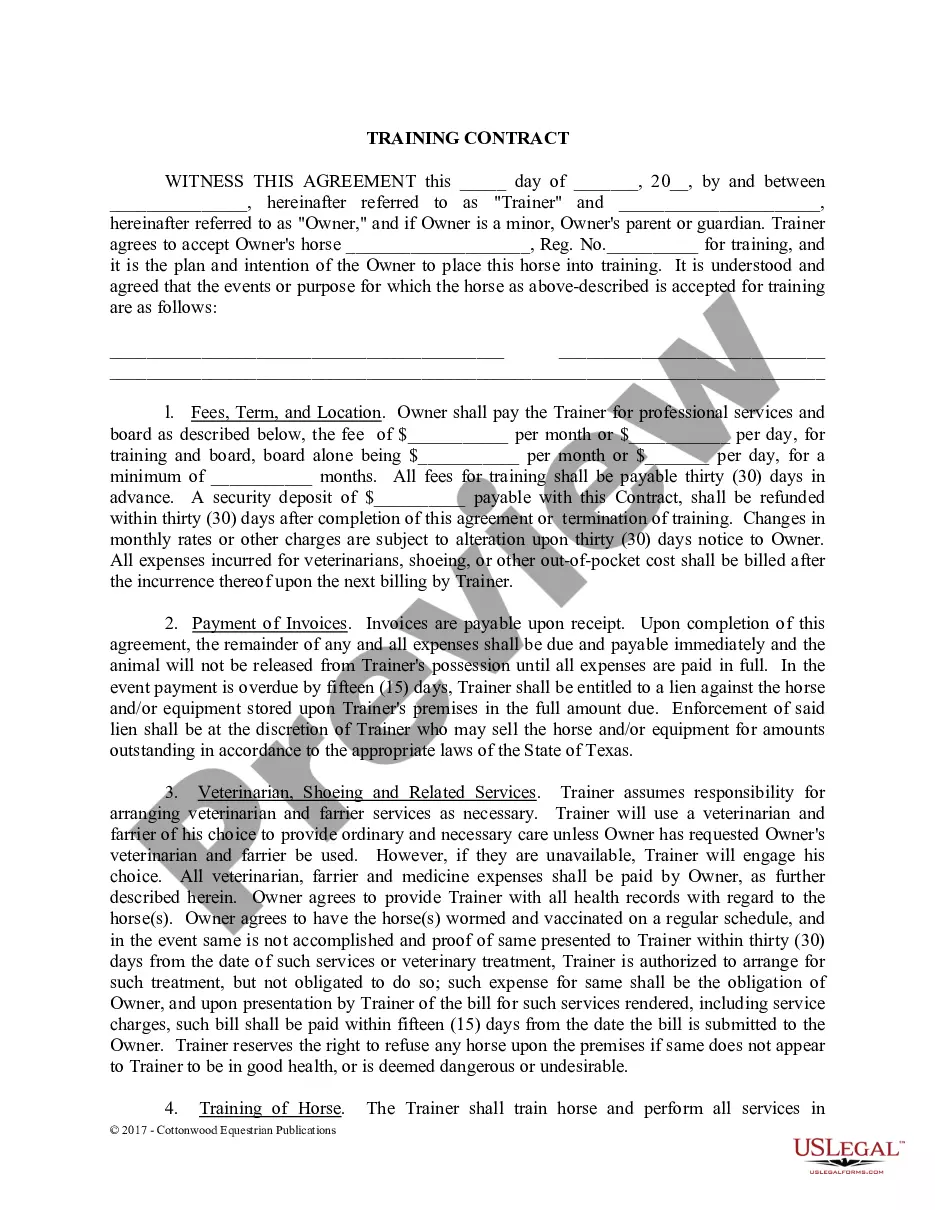

Indianapolis Indiana Warranty Deed from Individual to a Trust

Description

How to fill out Indiana Warranty Deed From Individual To A Trust?

Obtaining authenticated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms database.

It’s a digital repository of over 85,000 legal documents for both personal and business requirements as well as various real-world scenarios.

All the paperwork is accurately sorted by usage area and jurisdiction, making it straightforward to find the Indianapolis Indiana Warranty Deed from Individual to a Trust.

Maintaining documentation orderly and compliant with legal requirements is crucial. Leverage the US Legal Forms library to always have vital document templates for any needs readily available!

- Ensure you’ve selected the correct document that fulfills your requirements and fully aligns with your local jurisdiction criteria.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate template. If it fits your needs, proceed to the next step.

- Click on the Buy Now button and select your preferred subscription plan. You need to register for an account to access the library’s materials.

- Enter your credit card information or use your PayPal account to finalize the payment for the subscription.

- Save the Indianapolis Indiana Warranty Deed from Individual to a Trust on your device to continue working on it and access it in the My documents menu of your profile whenever necessary.

Form popularity

FAQ

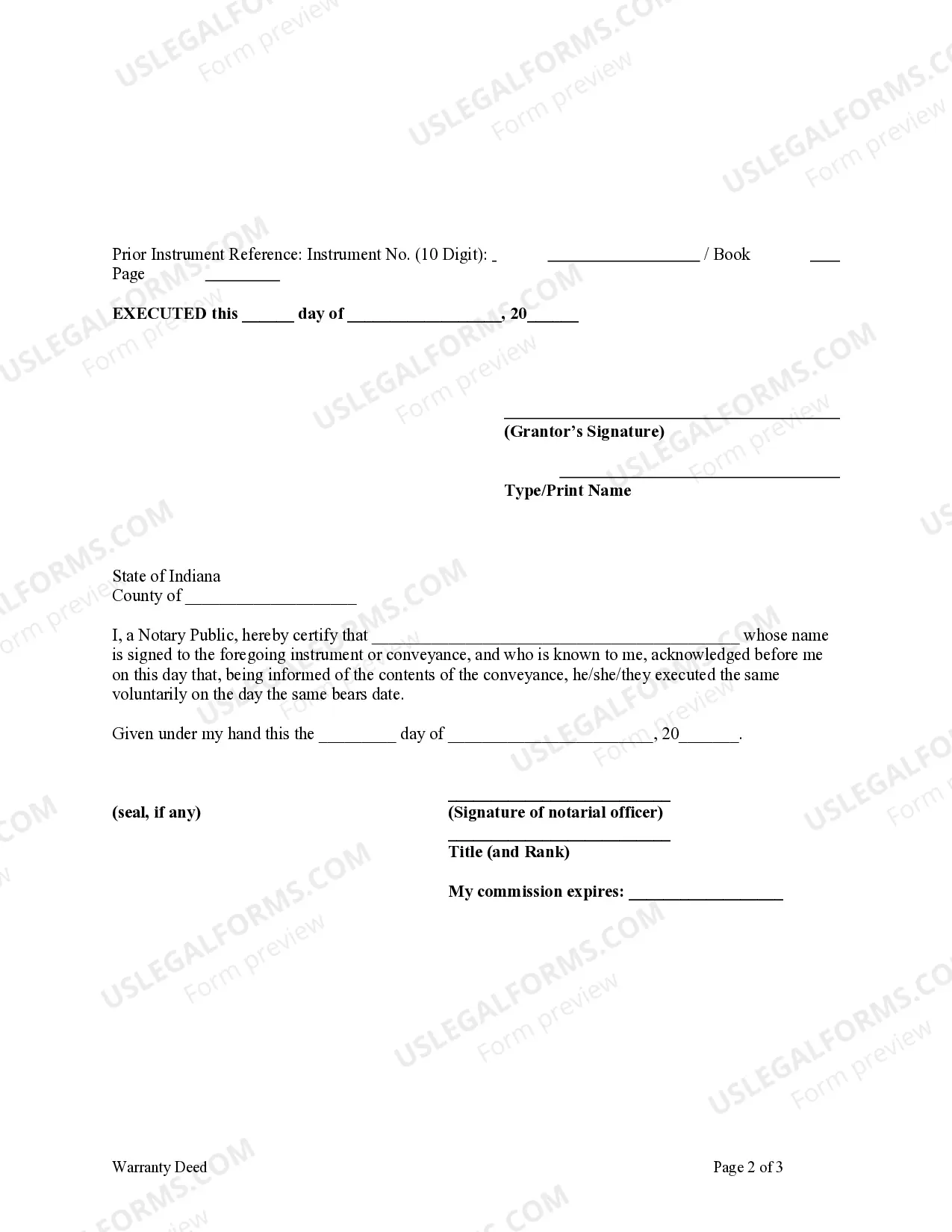

Transferring Indiana real estate usually involves four steps: Locate the prior deed to the property.Create the new deed.Sign the new deed.Record the original deed.

Transferring Indiana real estate usually involves four steps: Locate the prior deed to the property.Create the new deed.Sign the new deed.Record the original deed.

A transfer on death deed can be a very helpful planning tool when designing an estate plan. Indiana is one of many states that allows the transfer of real property by a transfer on death deed.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

The Indiana TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Transfer on probate or administration of an estate on death When someone dies, removing his or her name from the property deed may be necessary in order to complete the probate process and distribute his or her estate to the beneficiaries.

A survivorship affidavit is a legal document that removes the name of a deceased person from title on real property.

Submit your document Marion County Assessor: $10.00 per parcel per document; AND $20.00 for each Sales Disclosure, if required. Marion County Recorder: $35.00 per document. The Assessor is responsible for transferring property in Marion County. The transfer stamp from their office is required before it can be recorded.

Indiana allows you to leave real estate with transfer-on-death deeds, also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death. You can revoke the deed or sell the property at any time; the beneficiary you name on the deed has no rights until your death.