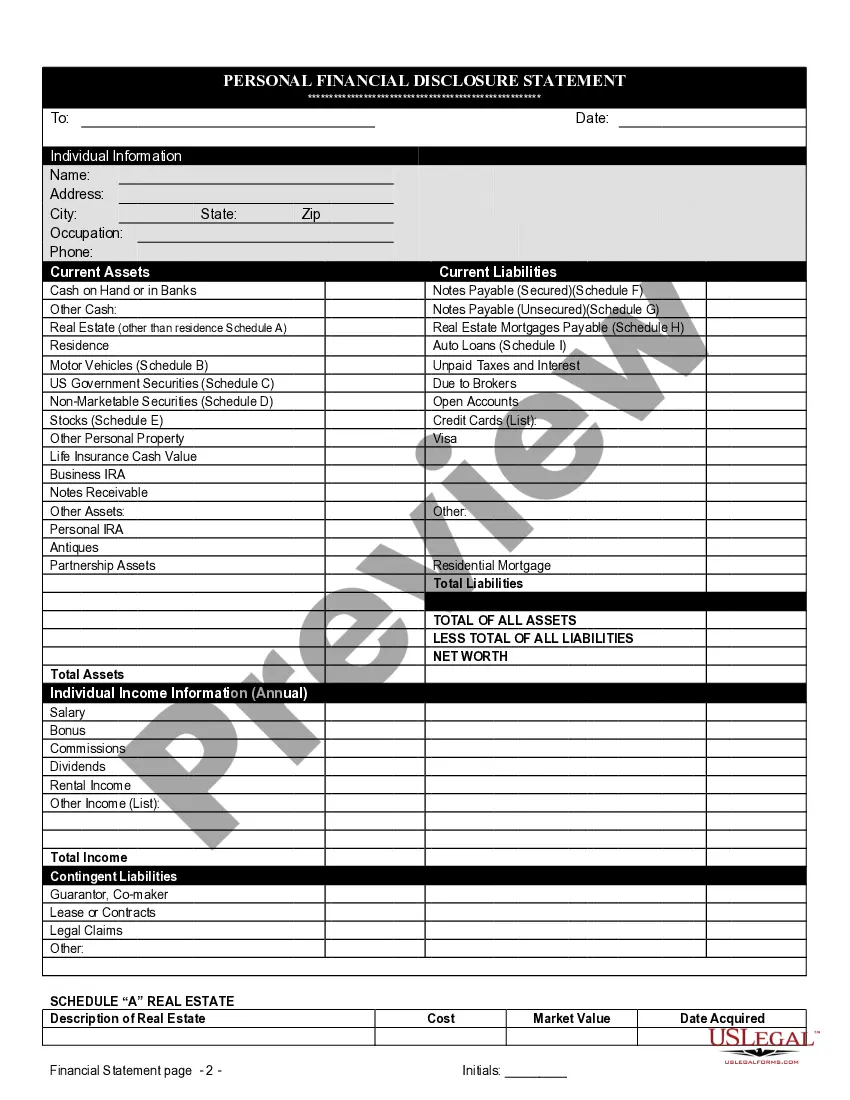

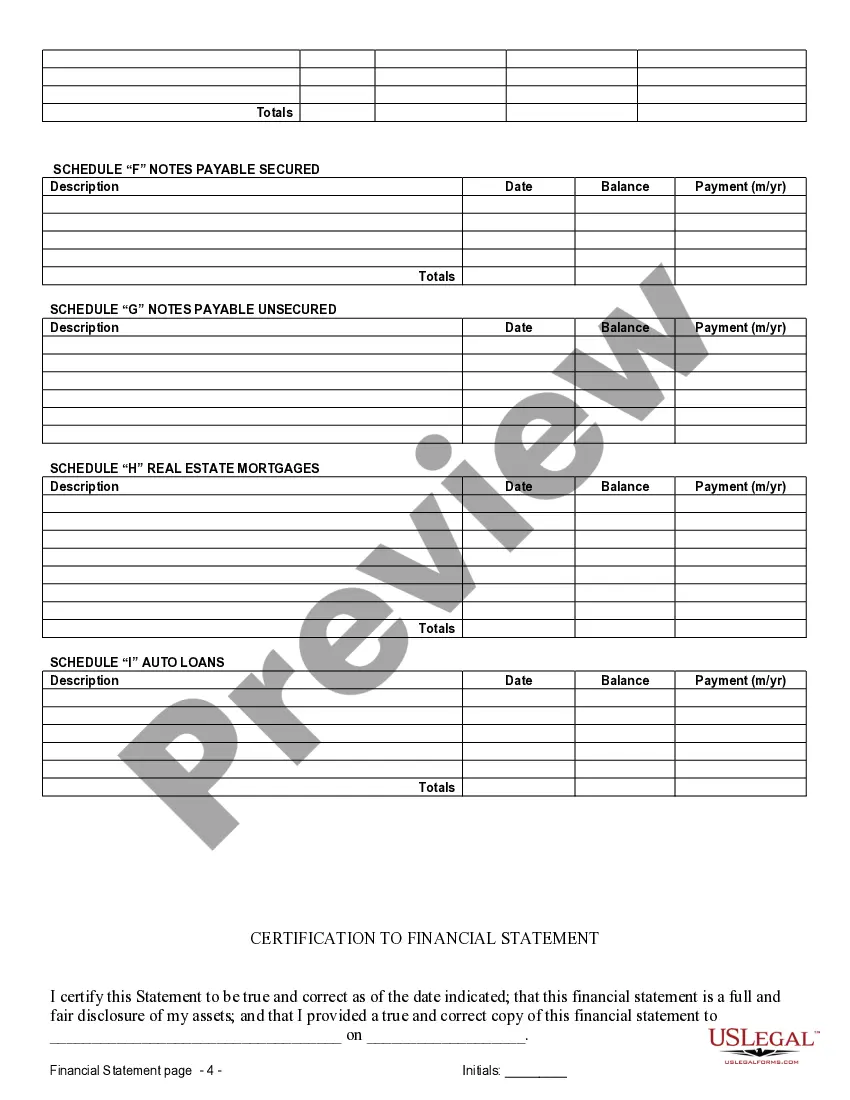

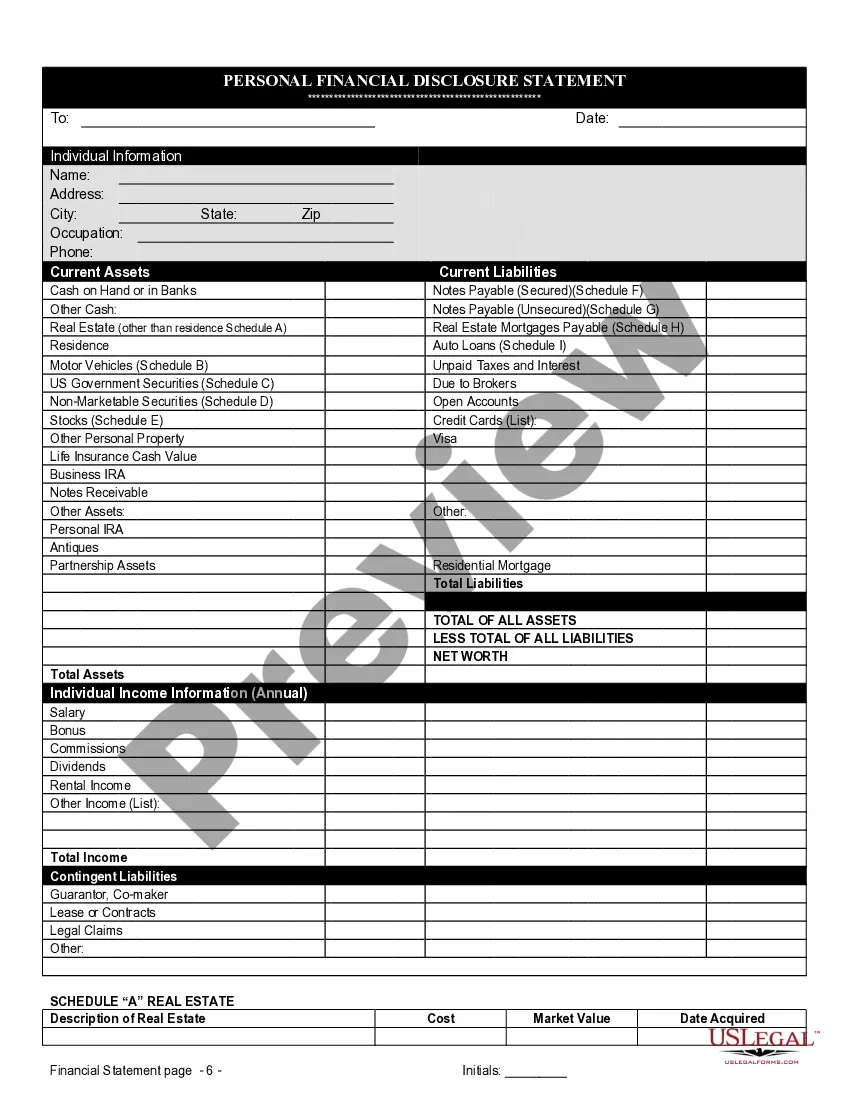

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

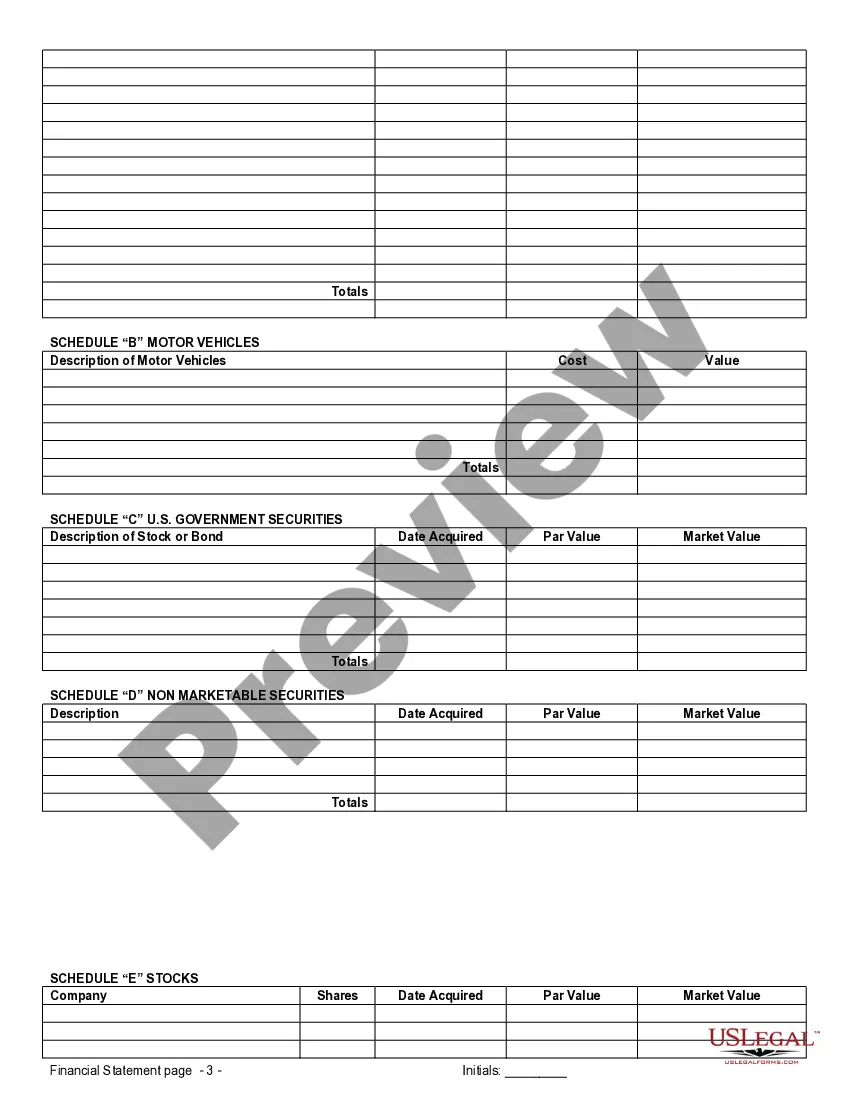

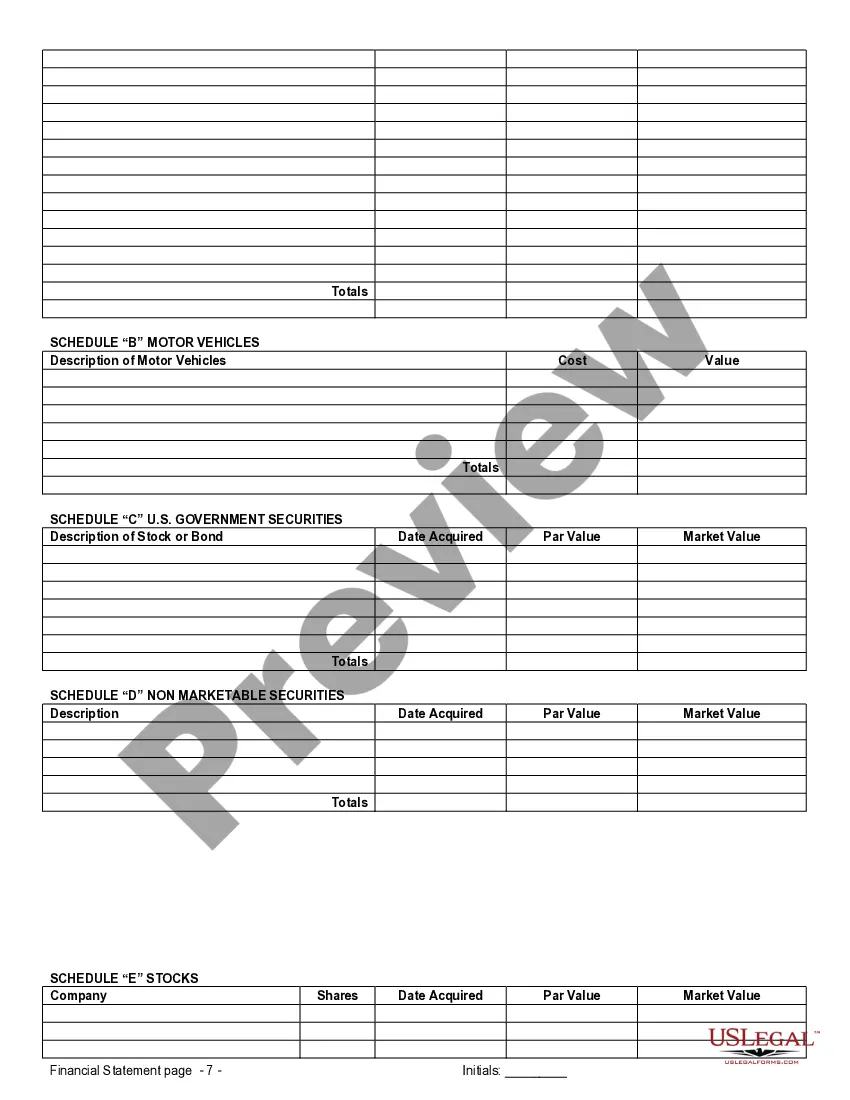

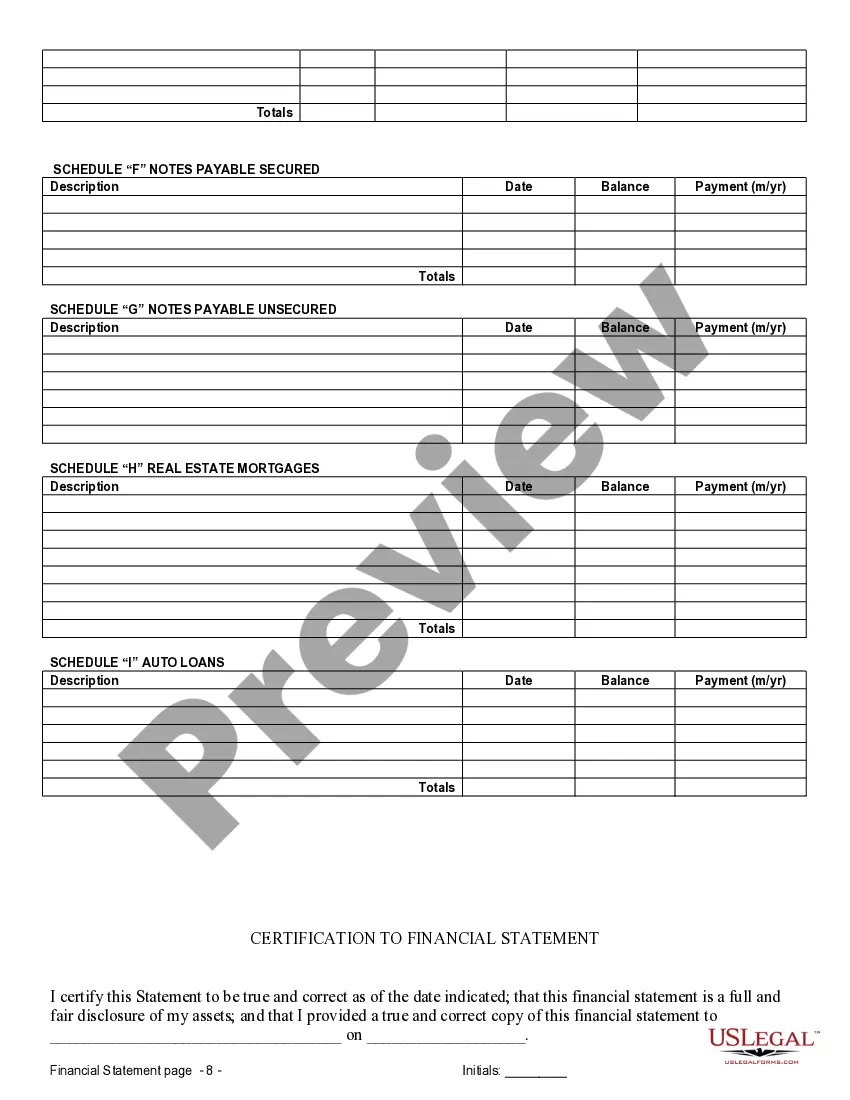

Carmel Indiana Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview Introduction: Financial statements play a crucial role in the creation of a prenuptial or premarital agreement, ensuring transparency and protection for both parties involved. In Carmel, Indiana, couples preparing for marriage often rely on expertly crafted financial statements to establish a comprehensive understanding of each partner's assets, liabilities, income, and expenses. This article will provide a detailed description, highlighting the importance and types of Carmel Indiana financial statements used exclusively in connection with a prenuptial or premarital agreement. Keywords: Carmel Indiana financial statements, prenuptial agreement, premarital agreement, assets, liabilities, income, expenses Types of Carmel Indiana Financial Statements: 1. Personal Balance Sheets: Personal balance sheets serve as a starting point when creating a prenuptial or premarital agreement. Each partner's individual balance sheet details their respective assets, such as real estate, investments, bank accounts, vehicles, and personal belongings. It also outlines liabilities, such as student loans, credit card debts, and mortgages. By analyzing personal balance sheets, couples gain an understanding of the financial foundation they bring into the partnership. 2. Income Statements: Income statements provide an overview of each partner's income and expenses. This statement captures information regarding salaries, business income, rental income, stocks, bonds, and more. Additionally, it includes expenses like regular monthly bills, educational loans, medical expenses, and other recurring costs. Understanding the income statements helps couples gauge each partner's financial obligations and spending patterns. 3. Property and Asset Valuation Statements: Partners in Carmel, Indiana, may hold various types of assets, including real estate, businesses, investments, or valuable collections. Property and asset valuation statements help determine the fair market value of these assets. These statements enlist the services of appraisers or experts to evaluate the worth of properties, including residential or commercial real estate, businesses, and collectibles. Accurate valuation ensures a fair distribution of assets in the event of a separation or divorce. 4. Financial Disclosure Statements: Financial disclosure statements offer comprehensive insights into a partner's financial landscape. These statements require complete transparency, revealing additional details about assets, investments, income sources, debts, and liabilities. The information disclosed in these statements may include bank account details, retirement accounts, tax returns, insurance policies, and any other financial documents deemed necessary. Financial disclosure statements foster trust, promote transparency, and facilitate open communication in a prenuptial or premarital agreement setting. Conclusion: Carmel Indiana financial statements tailored exclusively for prenuptial or premarital agreements form the foundation for a solid financial understanding between partners. Through personal balance sheets, income statements, property and asset valuation statements, and financial disclosure statements, couples in Carmel, Indiana, can confidently navigate discussions about assets, liabilities, income, and expenses. Thus, creating a prenuptial or premarital agreement that protects their financial interests while laying the groundwork for a successful and harmonious partnership.Carmel Indiana Financial Statements in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview Introduction: Financial statements play a crucial role in the creation of a prenuptial or premarital agreement, ensuring transparency and protection for both parties involved. In Carmel, Indiana, couples preparing for marriage often rely on expertly crafted financial statements to establish a comprehensive understanding of each partner's assets, liabilities, income, and expenses. This article will provide a detailed description, highlighting the importance and types of Carmel Indiana financial statements used exclusively in connection with a prenuptial or premarital agreement. Keywords: Carmel Indiana financial statements, prenuptial agreement, premarital agreement, assets, liabilities, income, expenses Types of Carmel Indiana Financial Statements: 1. Personal Balance Sheets: Personal balance sheets serve as a starting point when creating a prenuptial or premarital agreement. Each partner's individual balance sheet details their respective assets, such as real estate, investments, bank accounts, vehicles, and personal belongings. It also outlines liabilities, such as student loans, credit card debts, and mortgages. By analyzing personal balance sheets, couples gain an understanding of the financial foundation they bring into the partnership. 2. Income Statements: Income statements provide an overview of each partner's income and expenses. This statement captures information regarding salaries, business income, rental income, stocks, bonds, and more. Additionally, it includes expenses like regular monthly bills, educational loans, medical expenses, and other recurring costs. Understanding the income statements helps couples gauge each partner's financial obligations and spending patterns. 3. Property and Asset Valuation Statements: Partners in Carmel, Indiana, may hold various types of assets, including real estate, businesses, investments, or valuable collections. Property and asset valuation statements help determine the fair market value of these assets. These statements enlist the services of appraisers or experts to evaluate the worth of properties, including residential or commercial real estate, businesses, and collectibles. Accurate valuation ensures a fair distribution of assets in the event of a separation or divorce. 4. Financial Disclosure Statements: Financial disclosure statements offer comprehensive insights into a partner's financial landscape. These statements require complete transparency, revealing additional details about assets, investments, income sources, debts, and liabilities. The information disclosed in these statements may include bank account details, retirement accounts, tax returns, insurance policies, and any other financial documents deemed necessary. Financial disclosure statements foster trust, promote transparency, and facilitate open communication in a prenuptial or premarital agreement setting. Conclusion: Carmel Indiana financial statements tailored exclusively for prenuptial or premarital agreements form the foundation for a solid financial understanding between partners. Through personal balance sheets, income statements, property and asset valuation statements, and financial disclosure statements, couples in Carmel, Indiana, can confidently navigate discussions about assets, liabilities, income, and expenses. Thus, creating a prenuptial or premarital agreement that protects their financial interests while laying the groundwork for a successful and harmonious partnership.