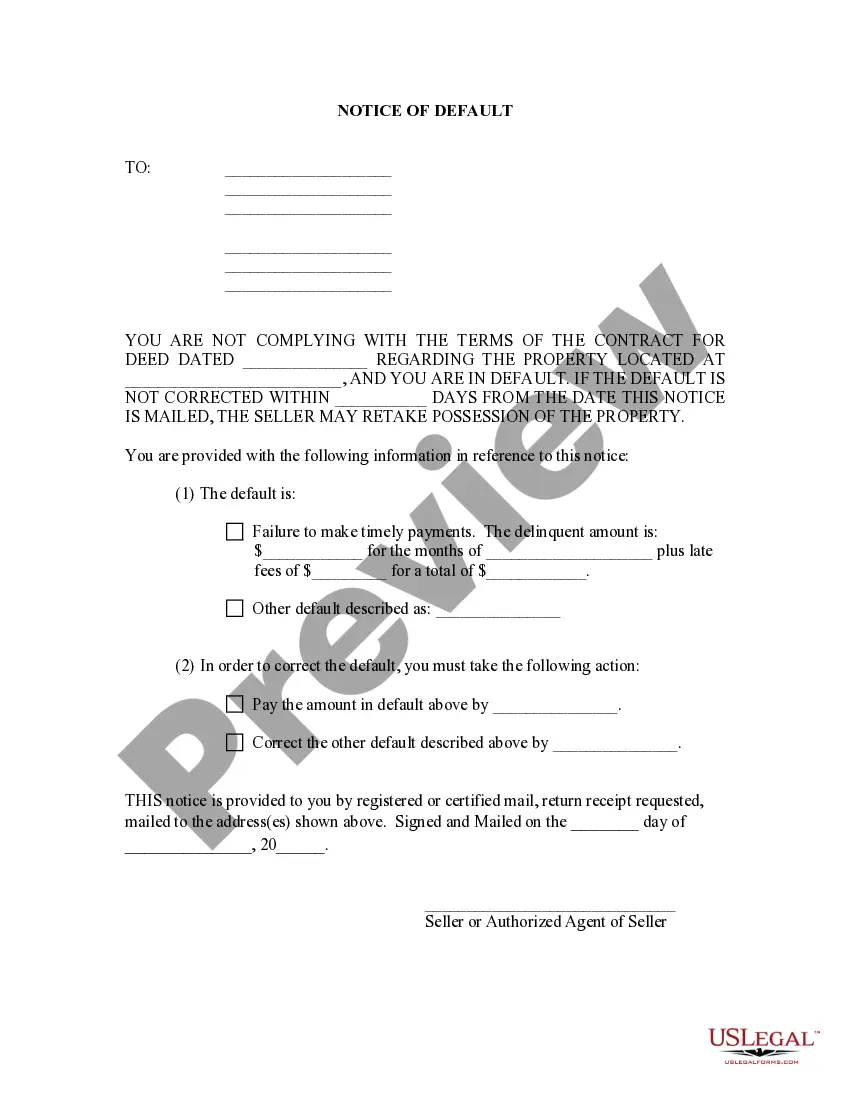

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

South Bend Indiana General Notice of Default for Contract for Deed is an official notification issued by a legal authority or lender to inform the parties involved that a default has occurred in a contract for deed agreement. This document is typically used in the real estate industry and is specific to properties located in South Bend, Indiana. Keywords: South Bend Indiana, General Notice of Default, Contract for Deed, default, legal authority, lender, real estate, properties. There can be various types of South Bend Indiana General Notice of Default for Contract for Deed, depending on the specific circumstances and nature of the default. Some common types include: 1. Monetary Default Notice: This type of notice is issued when the buyer fails to make scheduled payments as agreed in the contract for deed. It states the outstanding payments and provides a deadline for the buyer to rectify the default. 2. Breach of Terms Notice: This notice is sent when the buyer fails to comply with other terms and conditions outlined in the contract for deed, such as maintenance responsibilities or insurance requirements. 3. Termination Notice: If the default remains unresolved within a specified timeframe, a termination notice may be issued, indicating the intent to terminate the contract for deed agreement. This notice provides a final opportunity for the buyer to cure the default before further legal action is taken. 4. Liability Notice: In certain cases, a South Bend Indiana General Notice of Default for Contract for Deed may specify the extent of the buyer's liability for any damages or legal costs incurred by the seller or lender as a result of the default. It is important for all parties involved in a contract for deed agreement to thoroughly understand the terms and potential consequences of default. Seek legal advice if necessary to ensure compliance and protect your rights and investments.