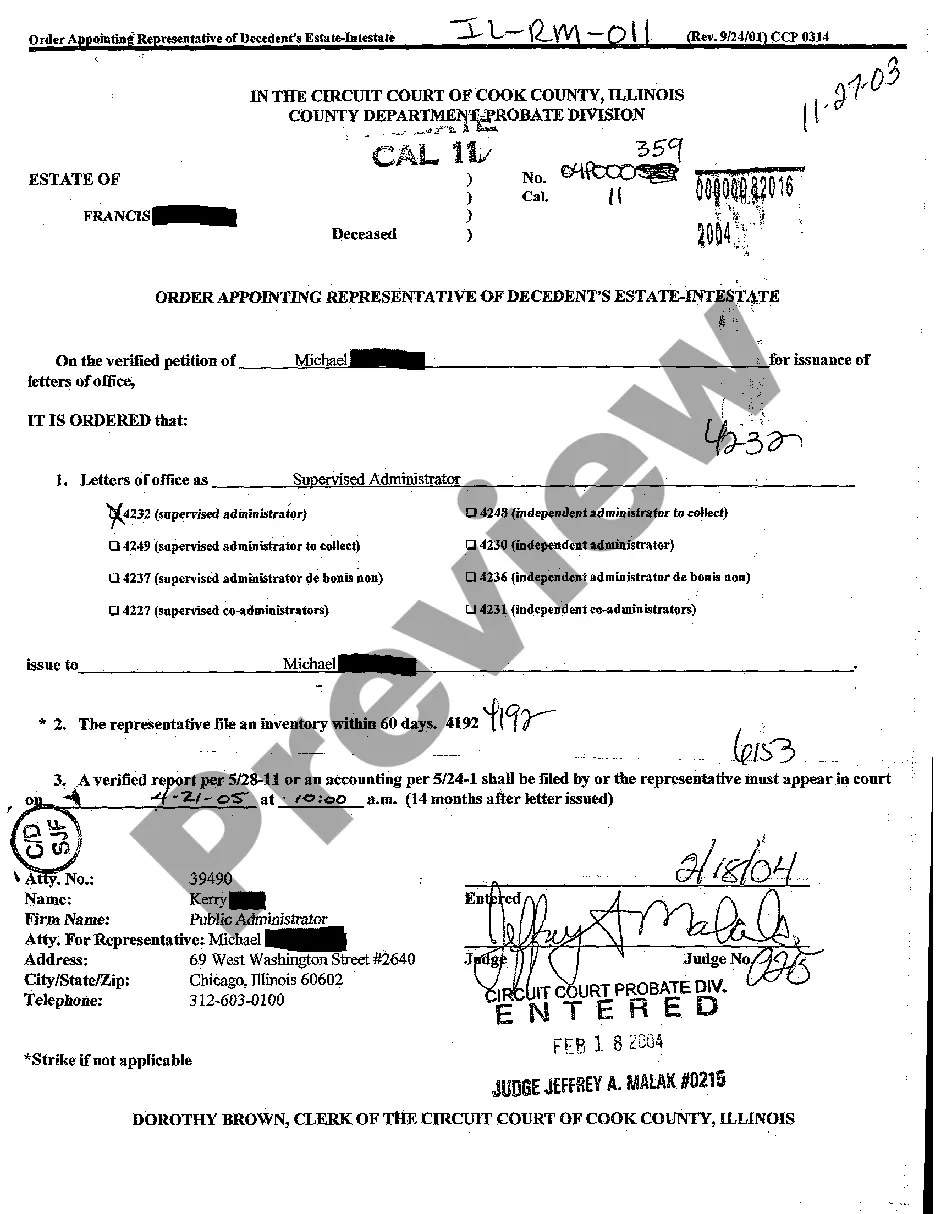

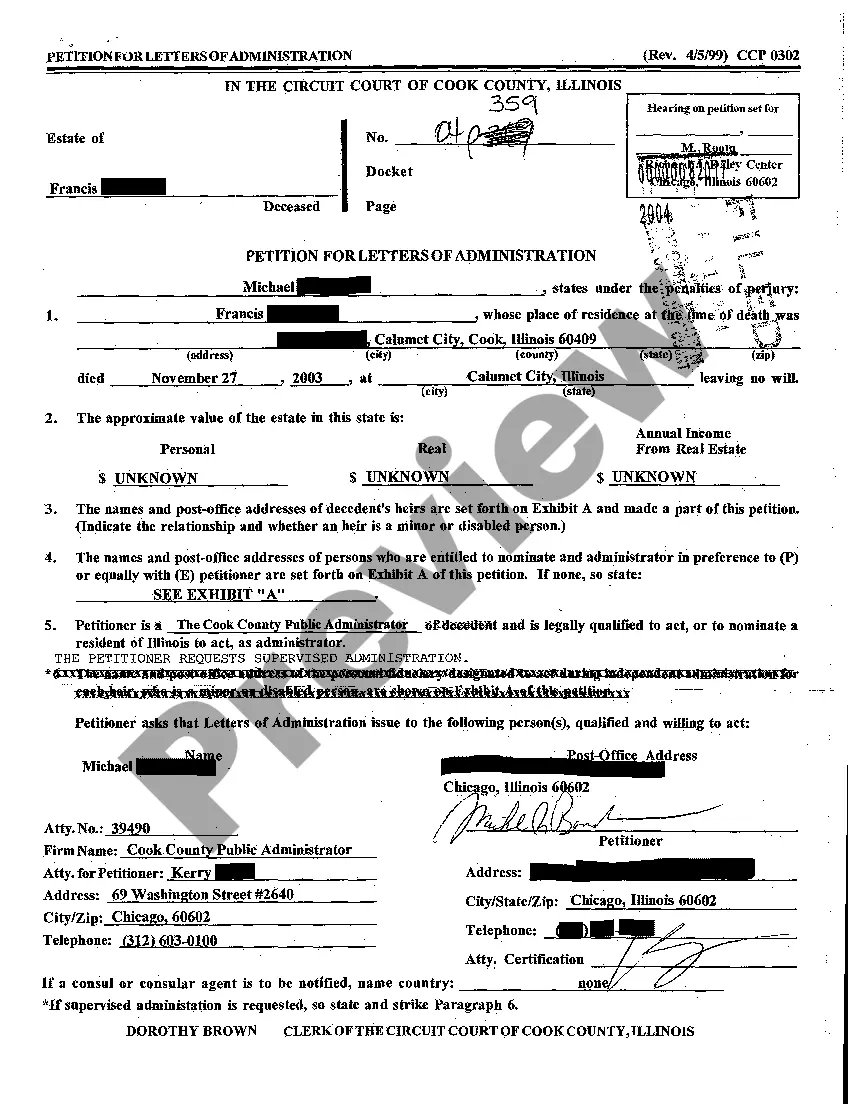

Chicago Illinois Order Appointing Representative Of Decedent's Estate - Intestate

Description

How to fill out Illinois Order Appointing Representative Of Decedent's Estate - Intestate?

Are you searching for a trustworthy and affordable provider of legal forms to purchase the Chicago Illinois Order Appointing Representative Of Decedent's Estate - Intestate? US Legal Forms is your ideal option.

Whether you require a simple agreement to establish guidelines for living together with your partner or a collection of forms to progress your divorce through the legal system, we have you covered. Our site offers over 85,000 current legal document templates for personal and business use. All templates we provide access to are not generic and are tailored to meet the criteria of individual state and local jurisdictions.

To obtain the form, you must Log In to your account, locate the necessary template, and click the Download button next to it. Please note that you can download your previously purchased form templates at any time from the My documents section.

Is this your initial visit to our website? No need to worry. You can create an account in just a few minutes, but before you do, ensure that you.

Now you can set up your account. Then choose the subscription option and proceed with the payment. Once the payment is completed, you can download the Chicago Illinois Order Appointing Representative Of Decedent's Estate - Intestate in any available file format. You can always return to the website to redownload the form at no additional cost.

Finding current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time familiarizing yourself with legal documents online once and for all.

- Verify if the Chicago Illinois Order Appointing Representative Of Decedent's Estate - Intestate complies with your state and local regulations.

- Review the form’s description (if available) to understand who and what the form is designed for.

- Initiate your search again if the template does not suit your particular situation.

Form popularity

FAQ

The difference is the way in which they have been appointed. An Executor is nominated within the Will of a deceased person. If there is no Will, an Administrator is appointed by a Court to manage or administer a decedent's estate.

To obtain your letter of testamentary, you will need to file the will and death certificate in the probate court, along with forms asking for the letter of testamentary. You'll need to provide your information, as well as some basic information about the value of the estate and the date of death.

Illinois lists a few criteria for someone to be nominated or appointed as an administrator of an estate....A person must: Be at least 18 years of age; Be a United States resident; Be of sound mind and mentally competent to handle matters of the estate; and. Not have been convicted of a felony.

Most people file to become an estate executor after the person who owns the estate names that person as executor. An Illinois Circuit Court that has jurisdiction where the estate is located formally appoints an executor of an estate. Any qualifying adult can be named the executor of someone's estate.

To apply for the letters of administration: download the correct paper form. fill in all sections that apply. print the form. sign and date the application. include a cheque with your application (see How to pay) send your completed form and supporting documents to:

In Illinois a lawyer is required for probate unless the estate is valued at less than $100,000 and does not have real estate; in that case the Illinois Small Estate Affidavit says the estate does not require a lawyer for probate court. This can reduce the time and cost to distribute the deceased's assets.

In most cases, the court will not have go beyond the first six classes to successfully appoint an administrator of the estate....A person must: Be at least 18 years of age; Be a United States resident; Be of sound mind and mentally competent to handle matters of the estate; and. Not have been convicted of a felony.

The qualifications to serve as an executor or administrator are: 1) individual is 18 years or older; 2) a United States resident; 3) not a convicted felon; and 4) not under a legal disability.

Section 2 AEL. Defines who personal representatives are and they include executors and administrators. They administer the estate of the deceased. An executor is appointed by will while an administrator is appointed by the Court.

In Illinois, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).