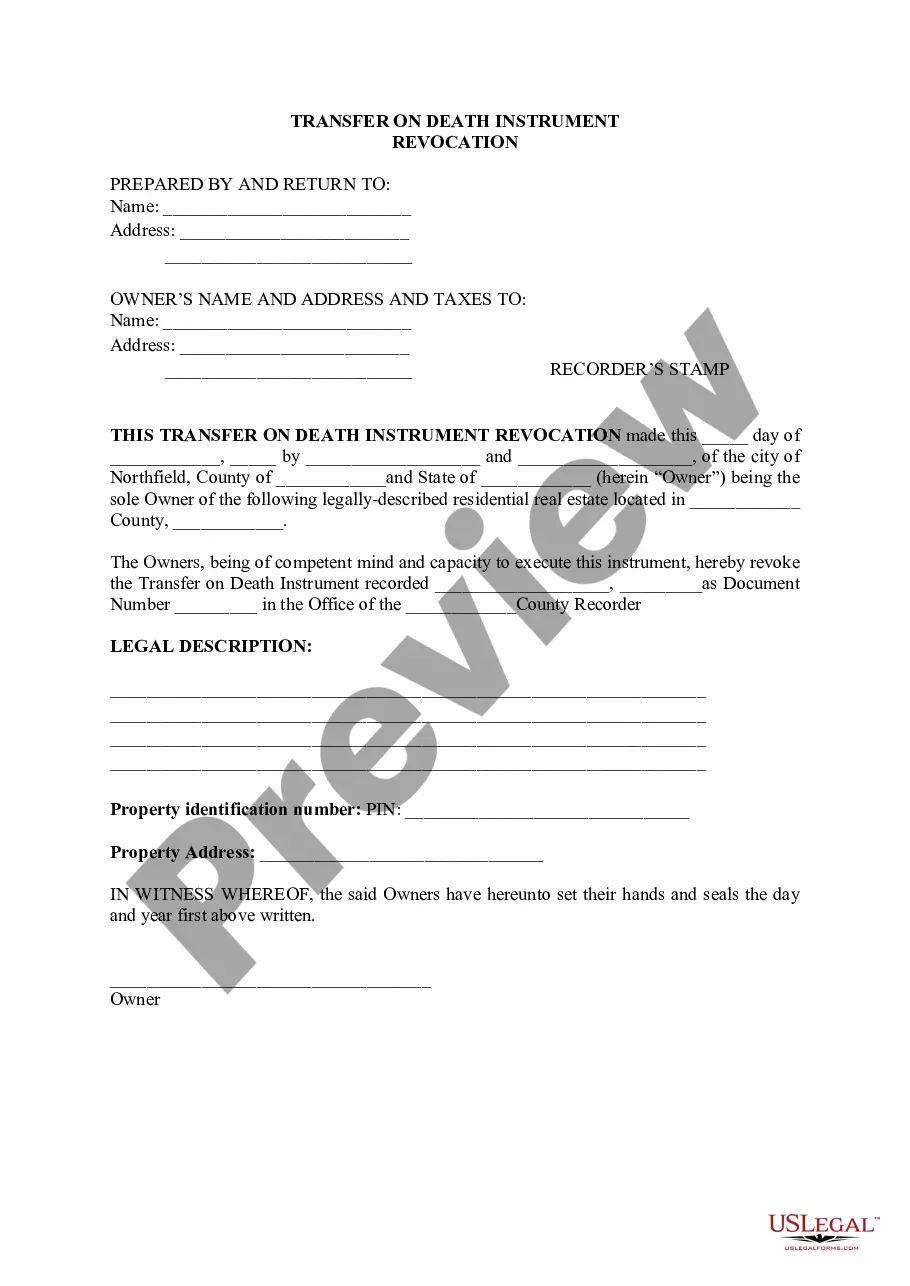

Joliet Illinois Transfer on Death Instrument Revocation

Description

How to fill out Illinois Transfer On Death Instrument Revocation?

Do you require a trustworthy and cost-effective legal forms provider to obtain the Joliet Illinois Transfer on Death Instrument Revocation? US Legal Forms is your ideal choice.

Whether you need a basic agreement to establish rules for living together with your partner or a collection of documents to process your separation or divorce through the court, we have you covered. Our website provides over 85,000 current legal document templates for personal and business needs. All templates we offer are not generic; they are tailored according to the requirements of specific states and regions.

To download the form, you must Log In to your account, find the desired form, and click the Download button next to it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents tab.

Are you a newcomer to our website? No problem. You can effortlessly create an account, but before you do, ensure that you follow these steps.

Now you can set up your account. Then select your subscription plan and proceed with the payment. Once the payment is completed, download the Joliet Illinois Transfer on Death Instrument Revocation in any available file format. You can revisit the website at any time and redownload the form at no extra cost.

Acquiring current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time trying to understand legal papers online once and for all.

- Verify if the Joliet Illinois Transfer on Death Instrument Revocation aligns with the laws of your state and local region.

- Review the form’s description (if available) to understand who and what the form is appropriate for.

- Restart your search if the form does not match your particular situation.

Form popularity

FAQ

While you do not need an attorney to set up a transfer on death deed, having one can help you navigate complexities. Especially for a Joliet Illinois Transfer on Death Instrument Revocation, consulting with a legal professional can provide peace of mind. Consider using resources from US Legal Forms to assist with the process if you choose to proceed without legal representation.

To obtain a transfer on death deed in Illinois, you can download the appropriate forms from trusted platforms like US Legal Forms. After filling out the forms, you must sign and record the deed with your local recorder’s office. This ensures that your Joliet Illinois Transfer on Death Instrument Revocation is legally binding and effective for your beneficiaries.

A transfer on death deed may not be suitable for everyone, as it does not avoid probate issues entirely. If the property is heavily encumbered with debts, a Joliet Illinois Transfer on Death Instrument Revocation might complicate matters for heirs. Moreover, once established, it can be difficult to revoke the deed without proper legal procedures, potentially leading to unintended consequences.

Yes, you can transfer a deed without an attorney, but it is often recommended to seek legal advice. Successfully completing a Joliet Illinois Transfer on Death Instrument Revocation requires understanding local laws and procedures. Using resources like US Legal Forms can guide you through the process effectively, ensuring that your transfer is valid and recognized.

The transfer on death instrument statute in Illinois permits property owners to transfer their real estate to designated beneficiaries without the need for probate upon their death. This statute simplifies the estate process and allows for smoother asset transfer during Joliet Illinois Transfer on Death Instrument Revocation. Utilizing USLegalForms can enhance your understanding of this statute, making your estate planning more effective.

The payable on death statute in Illinois allows account holders to designate beneficiaries who will receive their assets upon death, thus avoiding probate. This statute applies to bank accounts, securities, and other financial assets. Understanding how this interacts with Joliet Illinois Transfer on Death Instrument Revocation can clarify your estate planning options. USLegalForms can help you navigate the intricacies of this statute.

While it is not mandatory to hire a lawyer for setting up a Transition on Death deed, it can be beneficial to have one, especially when dealing with Joliet Illinois Transfer on Death Instrument Revocation. An attorney can provide valuable advice on the implications of the deed and help avoid potential pitfalls during the process. If you prefer a more straightforward approach, USLegalForms offers comprehensive resources to assist you.

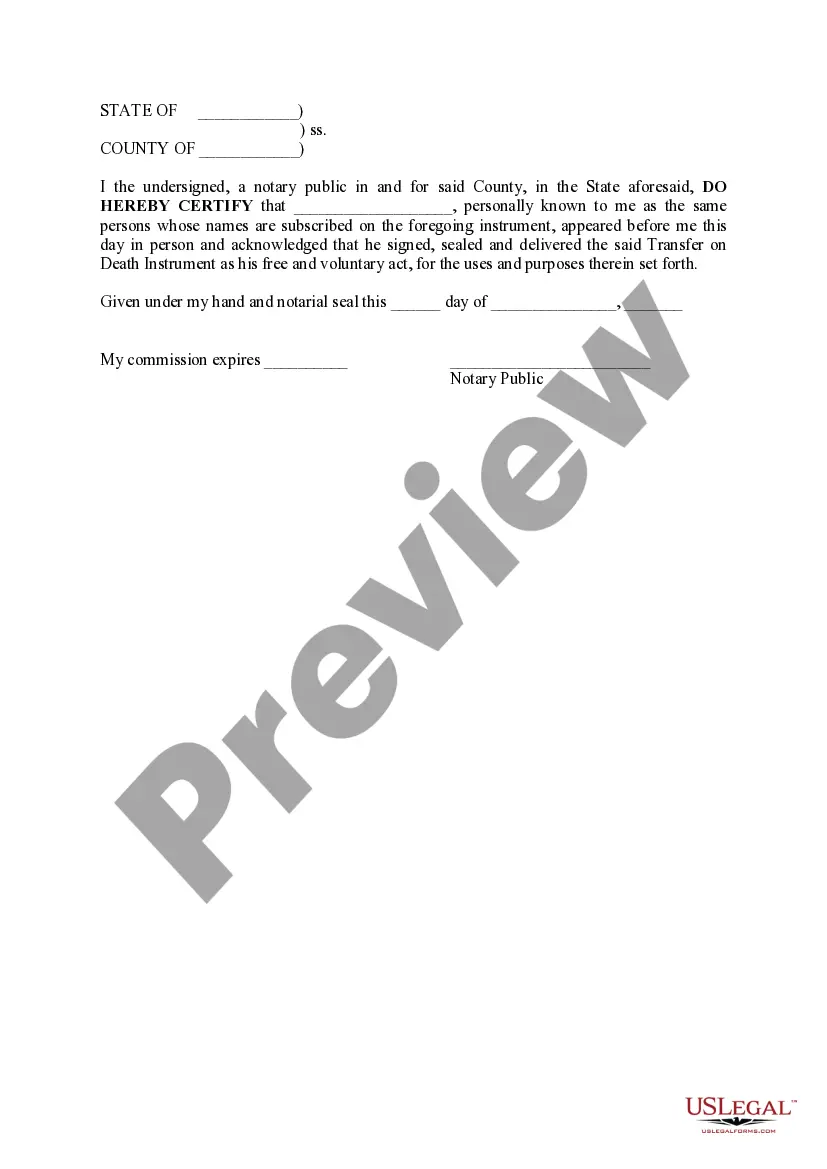

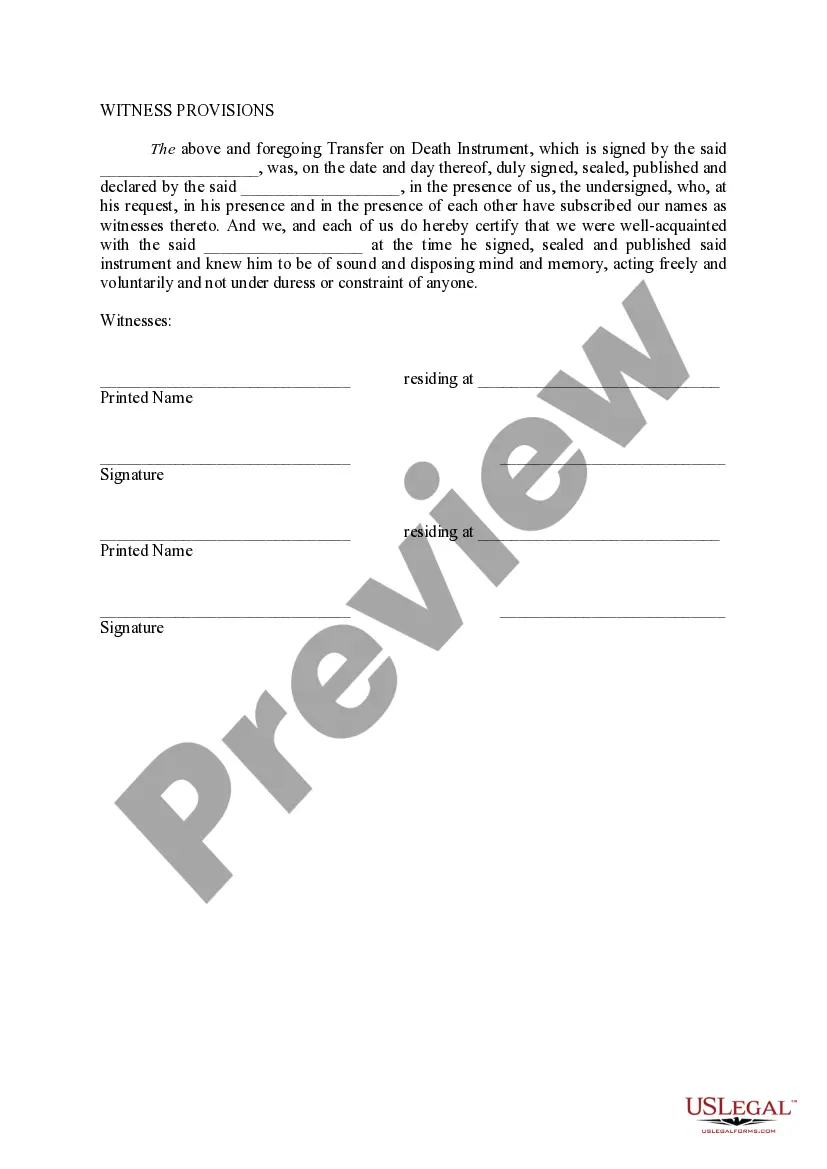

Filing a Transfer on Death Instrument (TODI) in Illinois involves completing a specific form that designates your property to a beneficiary after your passing. You must then sign the form in front of a witness and file it with the local county recorder’s office. To ensure a smooth process, consider utilizing resources from USLegalForms, which can guide you through Joliet Illinois Transfer on Death Instrument Revocation and filing.

A Transfer on Death (TOD) deed can have certain disadvantages, especially regarding potential complications during its revocation, known as Joliet Illinois Transfer on Death Instrument Revocation. For instance, if the owner has outstanding debts, creditors may still claim the property before it transfers to the beneficiary. Additionally, the process can lead to disputes among family members if not all parties are informed about the existence of the TOD deed.

To transfer property after death in Illinois, you must follow the instructions outlined in your transfer on death document. If you have designated a beneficiary through a valid transfer on death deed, they can claim the property directly. In situations involving a Joliet Illinois Transfer on Death Instrument Revocation, it's often wise to consult with professionals to ensure compliance with all regulations.