Rockford Illinois Waiver of Homestead Exemption

Description

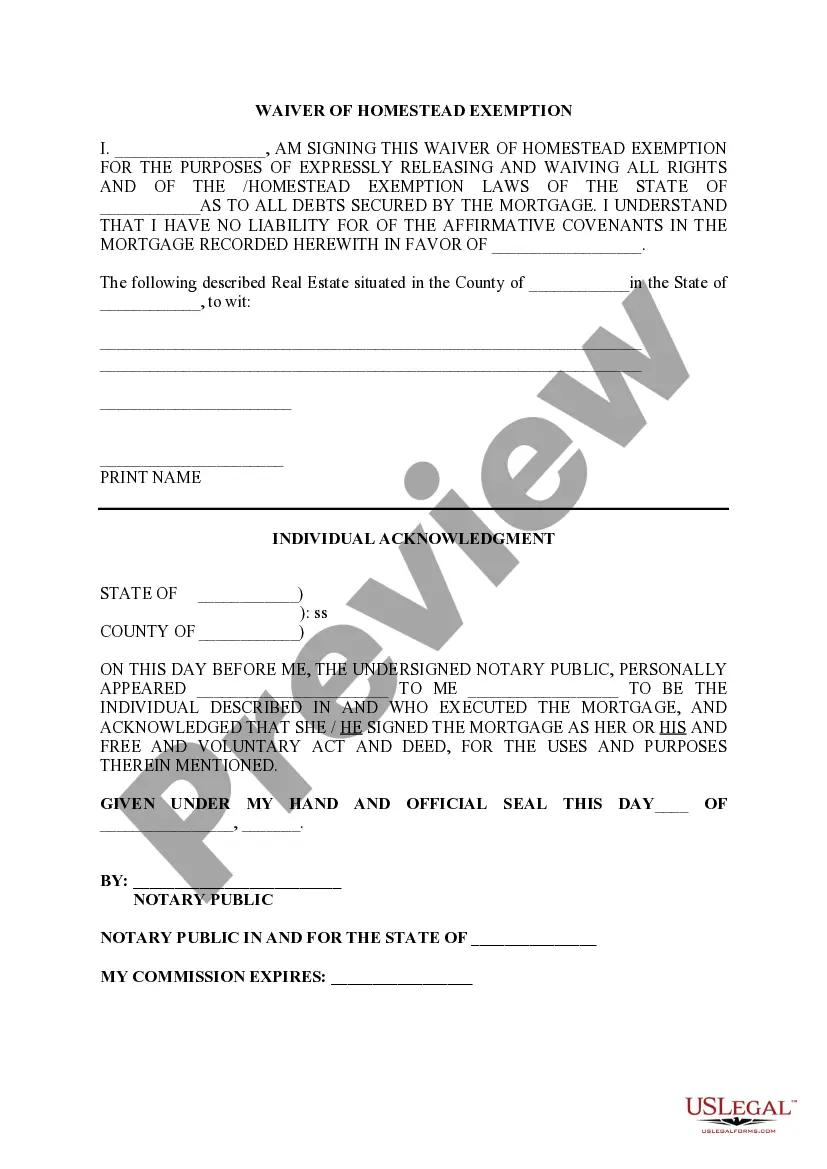

Where statutes specify the manner in which a homestead may be

released or waived in a particular jurisdiction, such statutes must

be strictly followed.

How to fill out Illinois Waiver Of Homestead Exemption?

If you are seeking a pertinent document, it’s exceedingly difficult to discover a superior service than the US Legal Forms site – one of the most exhaustive collections online.

Here you can discover a vast array of templates for organizational and individual purposes categorized by type and region, or keywords.

With our sophisticated search feature, locating the most recent Rockford Illinois Waiver of Homestead Exemption is as straightforward as 1-2-3.

Obtain the document. Select the format and store it on your device.

Make modifications. Complete, alter, print, and sign the obtained Rockford Illinois Waiver of Homestead Exemption.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Rockford Illinois Waiver of Homestead Exemption is to Log In to your account and click on the Download option.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have accessed the sample you need. Review its details and use the Preview option (if available) to examine its content. If it does not satisfy your needs, use the Search field at the upper part of the screen to find the correct document.

- Confirm your selection. Choose the Buy now option. After that, select your desired pricing plan and provide the necessary credentials to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

The waiver of homestead exemption means that a property owner agrees to give up their homestead protection, which usually shields a home from certain types of creditors in Illinois. This can enable homeowners to pursue options like loans or refinancing that may not be available without the waiver. However, it is essential to consider the benefits and risks before proceeding. The Rockford Illinois Waiver of Homestead Exemption can influence your financial decisions significantly, so consulting with a legal expert or a platform like USLegalForms is advisable.

A waiver of homestead in Illinois refers to a legal document that allows a property owner to forfeit their right to claim a homestead exemption. This exemption typically protects a part of a homeowner's equity from creditors during financial hardships. By choosing to waive this right, homeowners may seek specific financial arrangements or qualify for different financial products. Understanding the implications of the Rockford Illinois Waiver of Homestead Exemption is crucial for homeowners navigating these decisions.

The waiver of exemption involves voluntarily relinquishing tax exemptions or benefits designated for property. This can have significant financial consequences for homeowners. Before making such decisions, exploring the Rockford Illinois Waiver of Homestead Exemption can offer clarity and direction.

A waiver of homestead rights refers to a legal acknowledgment by a property owner to give up certain protections related to their home. This could affect their rights during financial transactions. It’s wise to consult resources like the Rockford Illinois Waiver of Homestead Exemption for thorough guidance.

Seniors in Illinois do not entirely stop paying property taxes; however, they may be eligible for tax exemptions once they reach the age of 65. Benefits like the senior homestead exemption allow significant savings. The Rockford Illinois Waiver of Homestead Exemption can also impact how property taxes are assessed for seniors.

A homestead waiver in Illinois allows homeowners to opt out of receiving certain tax benefits associated with homestead exemptions. Homeowners need to weigh the benefits against potential drawbacks carefully. Knowing about the Rockford Illinois Waiver of Homestead Exemption can guide you through this complex consideration.

Homestead exemptions are generally beneficial, as they help homeowners reduce their property tax liabilities. Feeling secure about your financial obligations is essential, and these exemptions serve that purpose. However, understanding options like the Rockford Illinois Waiver of Homestead Exemption is equally important to make informed decisions.

In Illinois, seniors do not stop paying property taxes entirely, but various exemptions can significantly lower their tax bills. Programs like the senior homestead exemption can provide substantial relief. That said, utilizing the Rockford Illinois Waiver of Homestead Exemption requires careful consideration of its effects.

When the homestead exemption is waived, property owners forfeit eligibility for reductions in assessed value for tax purposes. This could result in higher property taxes. Understanding the implications of the Rockford Illinois Waiver of Homestead Exemption is crucial for homeowners before making this decision.

In Rockford, several property tax exemptions exist, including general homestead exemptions and the senior homestead exemption. These exemptions can significantly lessen property tax burdens. Homeowners should explore how the Rockford Illinois Waiver of Homestead Exemption can play a role in their financial planning.