Cook Illinois Quit Claim Deed in Trust

Description

How to fill out Illinois Quit Claim Deed In Trust?

Finding authentic templates that align with your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It is an online database of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the files are correctly categorized by area of application and legal jurisdictions, making the search for the Cook Illinois Quit Claim Deed in Trust as simple as one-two-three.

Submit your credit card information or use your PayPal account to finalize the payment for the subscription.

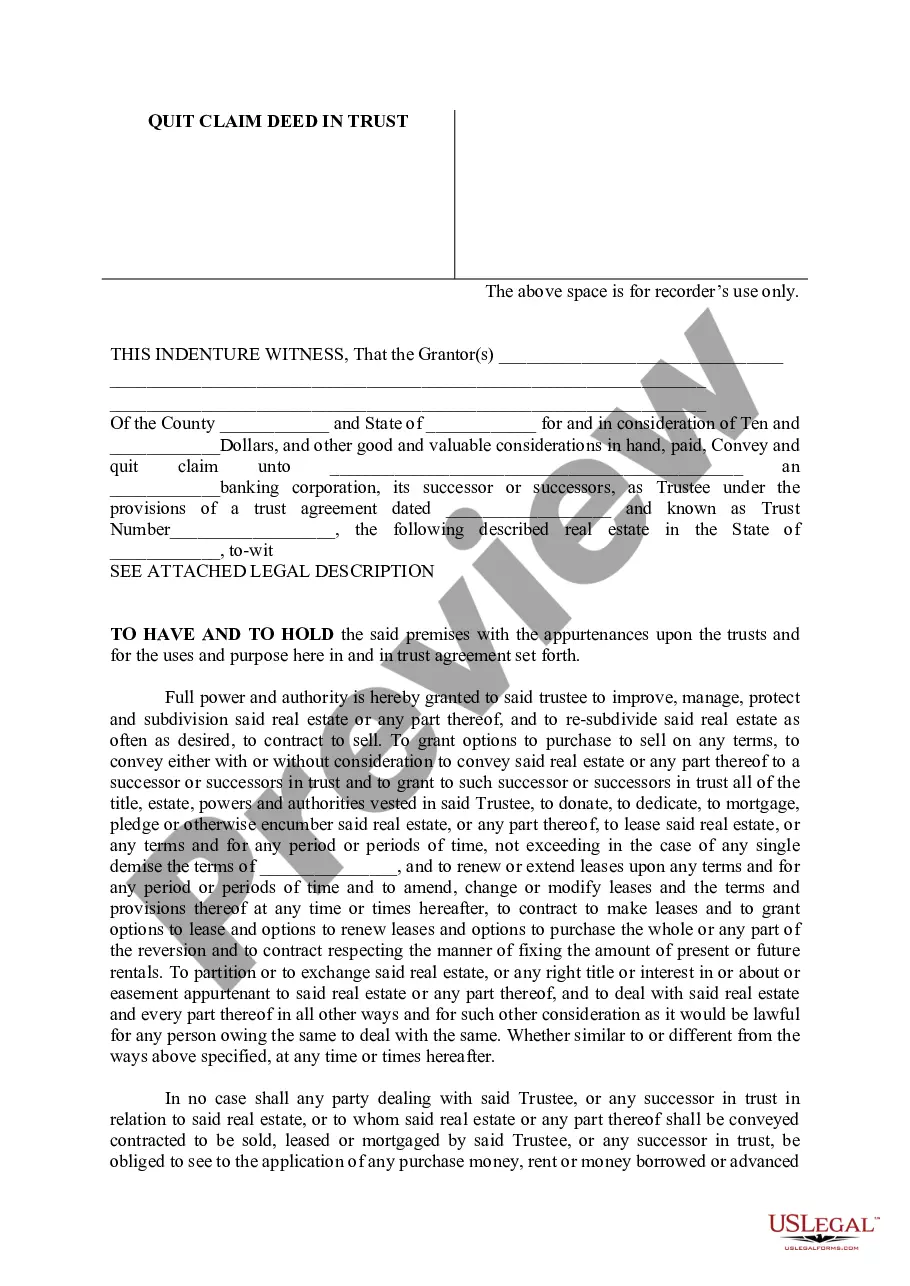

- Review the Preview mode and document description.

- Ensure you've selected the correct one that fulfills your requirements and entirely matches your local jurisdiction stipulations.

- Search for another template if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the accurate one. If it suits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

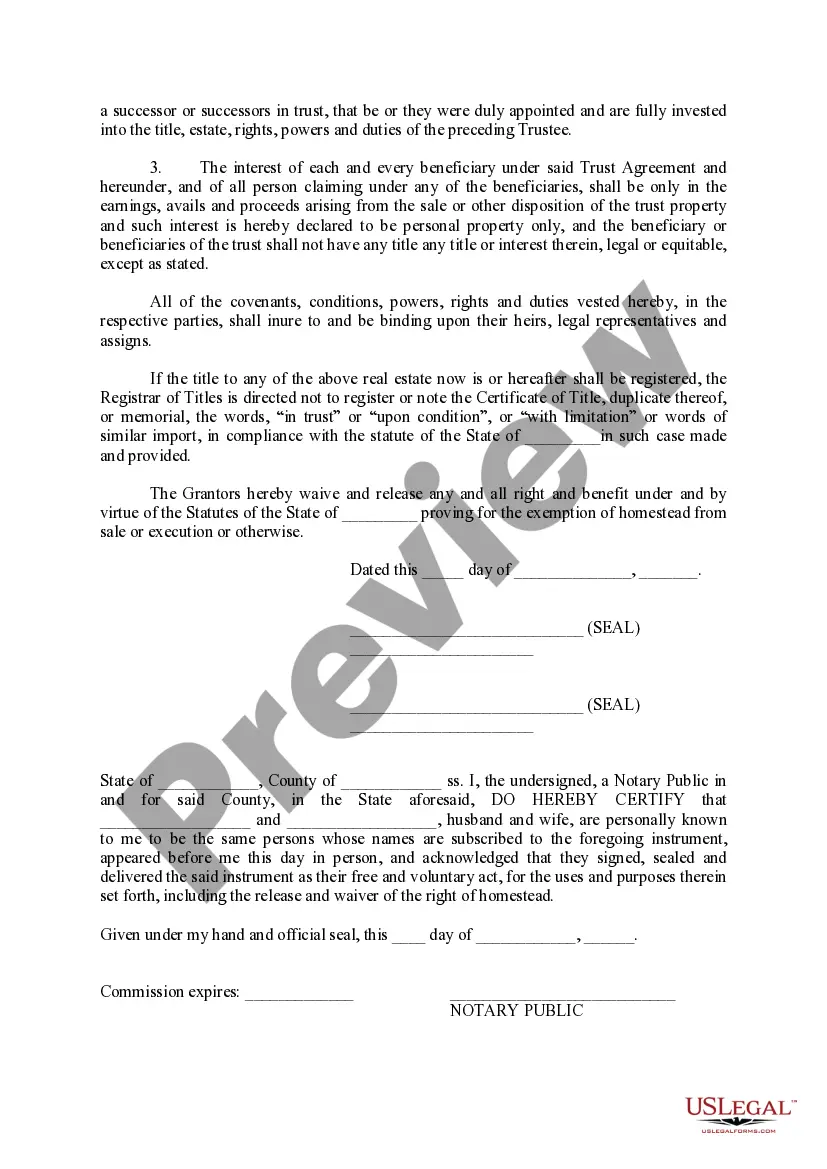

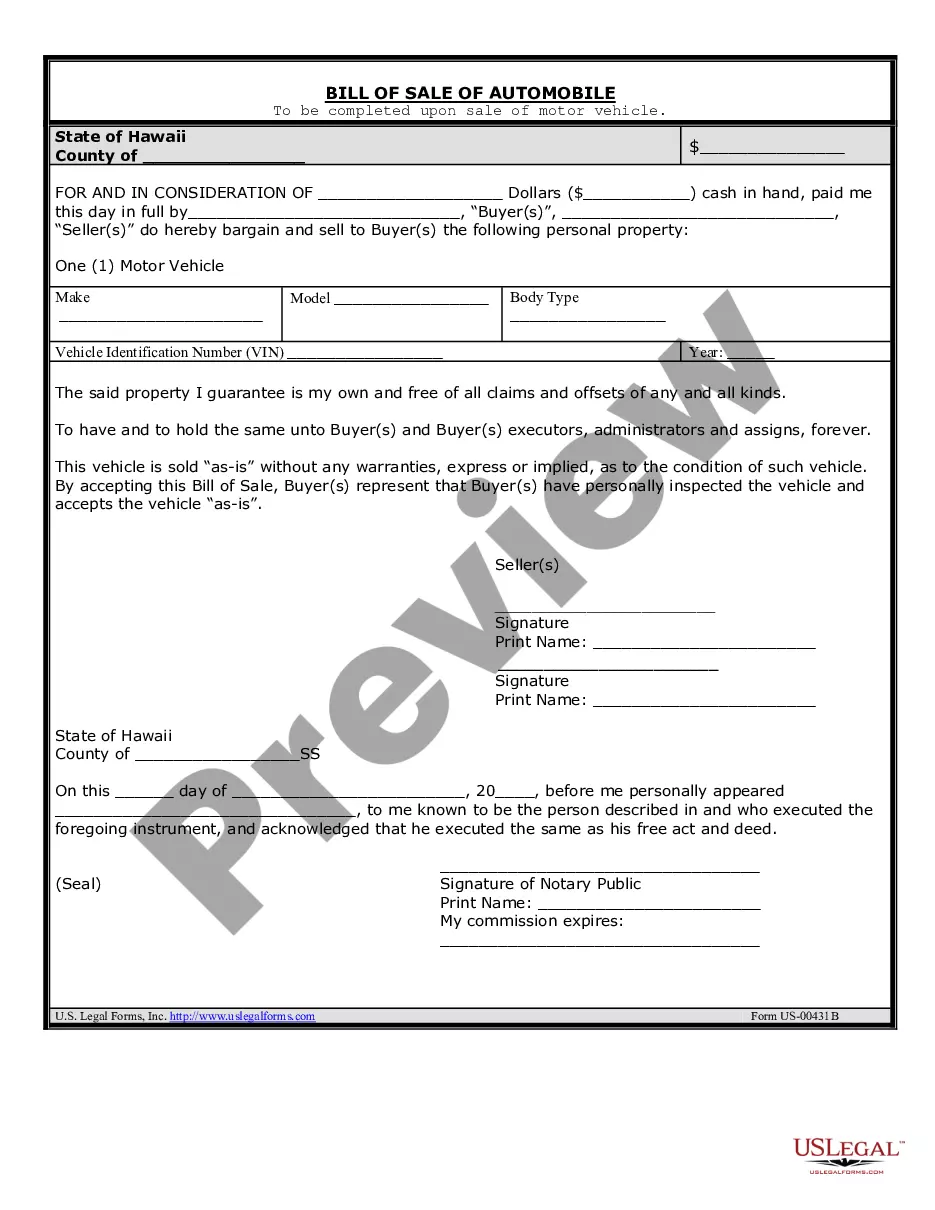

To record a Cook Illinois Quit Claim Deed in Trust, first, complete the deed form accurately. After that, take the signed document to your local county recorder's office. There, you will submit the document along with any applicable fees for recording. Finally, receiving a stamped copy of the deed will ensure that your transfer is officially recorded.

Deciding between gifting a house or placing it in a Cook Illinois Quit Claim Deed in Trust depends on your circumstances. Gifting a house means that your heirs receive it outright, while placing it in a trust adds a layer of control and protection. Trusts can help manage assets and may provide benefits regarding taxes and estate planning. Consider discussing the options with a legal or financial advisor to determine the best route for you.

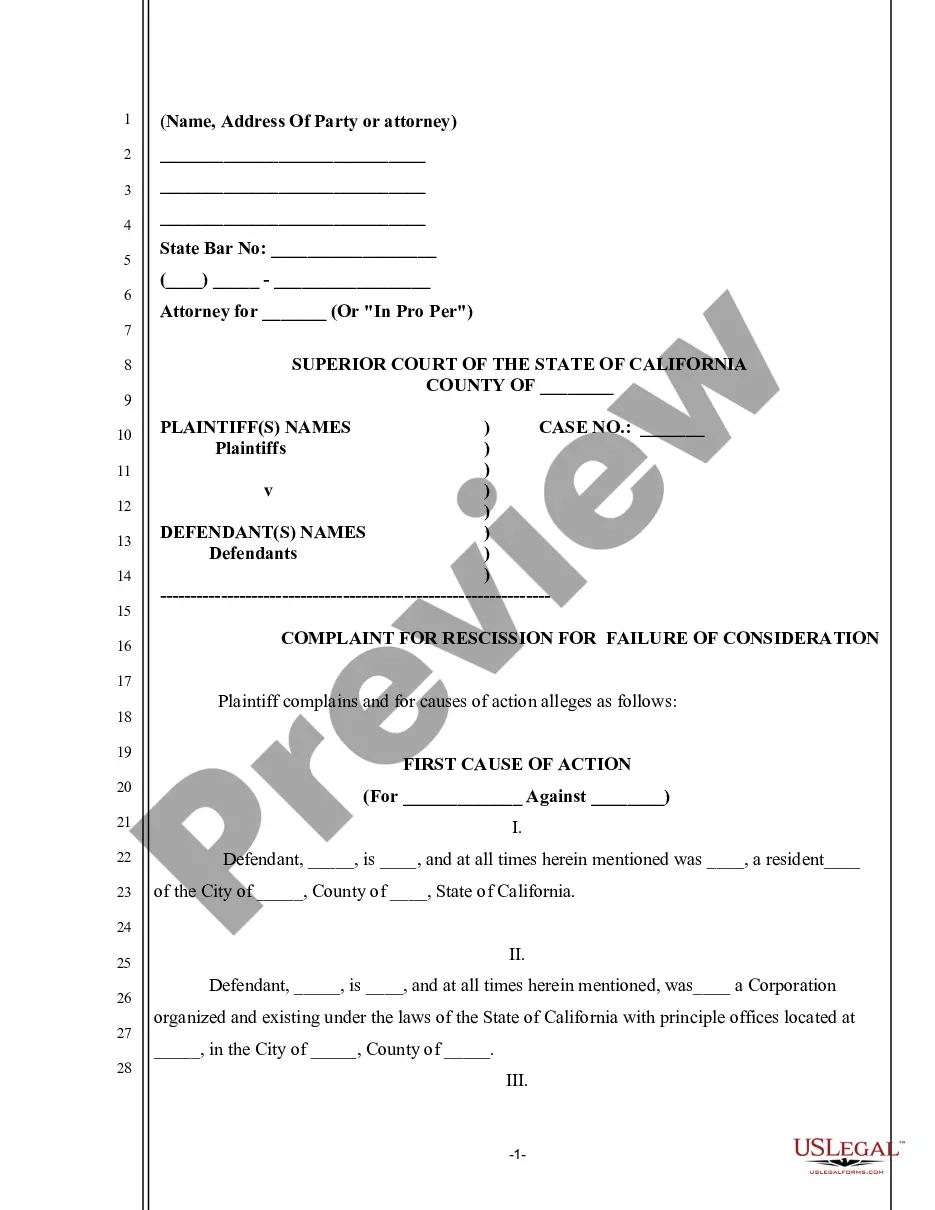

A Cook Illinois Quit Claim Deed in Trust, while useful, also has drawbacks. It provides no guarantees about the property's title, meaning that any existing liens or debts may transfer to the new owner. Additionally, because it often lacks the safeguards of a traditional deed, you may face issues with ownership disputes in the future. It's crucial to weigh these factors before proceeding.

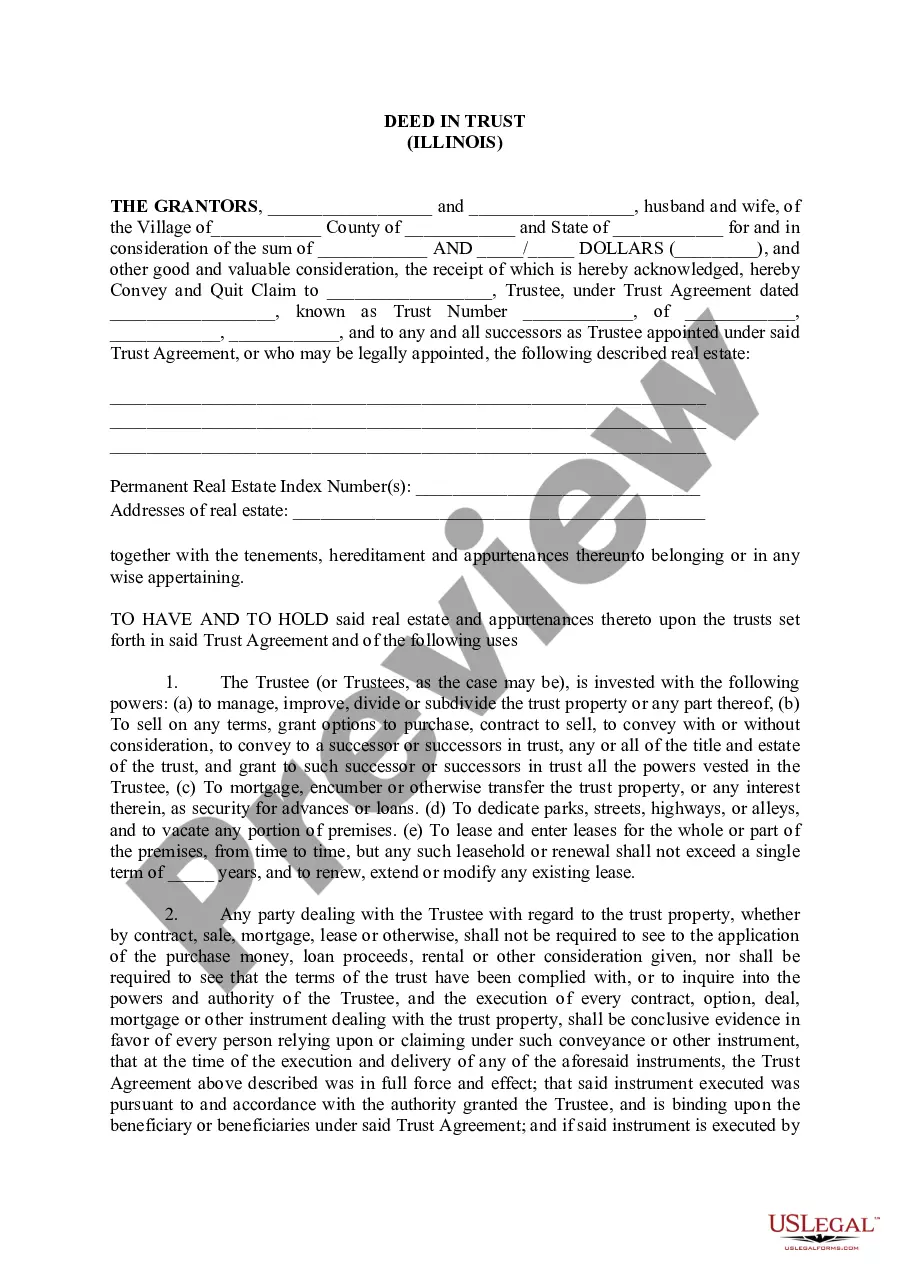

When filling out a Cook Illinois Quit Claim Deed, ensure you include the names of the granter and grantee, a clear legal description of the property, and the effective date of the transfer. It is also essential to notarize the document for it to be valid. If you're unsure about any steps, consider using US Legal Forms, which provides templates and guidance for accurately completing the deed.

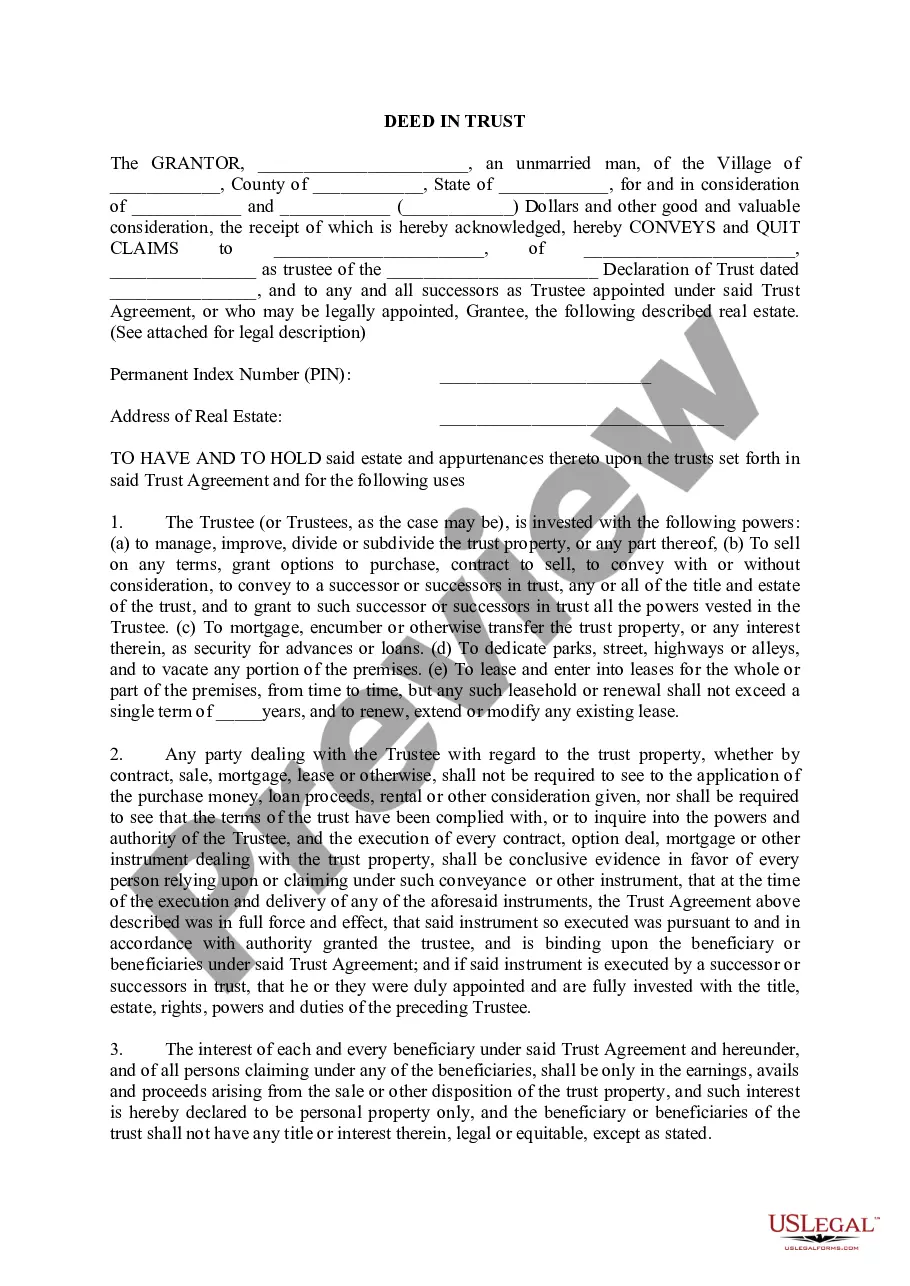

To transfer a property using a Cook Illinois Quit Claim Deed in Trust, start by drafting the quit claim deed with the trust as the grantee. Make sure to include all necessary legal descriptions and sign in the presence of a notary public. After completing the deed, record it with the Cook County Recorder of Deeds to finalize the transfer and ensure it is enforceable.

The primary beneficiaries of a Cook Illinois Quit Claim Deed in Trust are individuals looking to simplify ownership transfer, such as family members or partners. It offers a quick way to transfer property without complicated procedures. Additionally, it helps in estate planning, allowing heirs to receive property directly, reducing potential disputes.

While a Cook Illinois Quit Claim Deed in Trust offers benefits, there are some disadvantages to consider. For instance, managing a trust can involve ongoing fees and administrative tasks that may be burdensome. Also, transferring property into a trust may restrict your ability to sell or mortgage the property without the trust's provisions. It's wise to consult with a legal professional to understand these implications fully.

A quit claim deed in Cook County must include several key elements to be valid. First, it needs the legal description of the property and the names of grantor and grantee. Additionally, you must state the consideration amount and include the notarized signature of the grantor. Utilizing a Cook Illinois Quit Claim Deed in Trust template will help ensure that all necessary details are included and compliant with local guidelines.

Yes, a quit claim deed can transfer property from a trust to an individual or another entity. When using a Cook Illinois Quit Claim Deed in Trust, the trustee can execute the deed, ensuring that the trust's name is clearly stated. This process effectively shifts ownership while simplifying the transfer of title. Always consider consulting a legal professional to confirm the best approach and compliance with state laws.

To transfer a deed to a trust in Illinois, you will need to complete a Cook Illinois Quit Claim Deed in Trust. This document must include the name of the trust and the name of the trustee. Additionally, ensure that the property description is accurate and complies with local regulations. After filling out the deed, sign it and have it notarized before filing it with the county recorder's office.