Cook Illinois Revocation of Living Trust

Description

How to fill out Illinois Revocation Of Living Trust?

If you have previously utilized our service, Log In to your account and retrieve the Cook Illinois Revocation of Living Trust on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to obtain your document.

You have continuous access to all paperwork you have purchased: you can find it in your profile within the My documents menu whenever you wish to reuse it again. Utilize the US Legal Forms service to effortlessly discover and save any template for your personal or professional needs!

- Verify that you have located an appropriate document. Browse through the description and use the Preview feature, if available, to confirm if it fulfills your needs. If it does not meet your criteria, utilize the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and execute a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Cook Illinois Revocation of Living Trust. Choose the file format for your document and store it on your device.

- Complete your form. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Revoking a trust is generally straightforward if you follow the correct steps outlined in Illinois law. While the process may seem daunting at first, understanding the requirements of the Cook Illinois Revocation of Living Trust can simplify it significantly. By preparing the necessary documents and notifying relevant parties, you can complete the revocation process smoothly. If you prefer assistance, uslegalforms can offer the guidance and resources needed to make revoking a trust easier.

Invalidating a living trust in Illinois requires a legal process, usually grounded in proving incapacity or undue influence during the trust's creation. It’s important to gather sufficient evidence, as the Cook Illinois Revocation of Living Trust will need to be challenged in court. Working with an attorney can significantly enhance your chances of successfully invalidating a trust by ensuring proper legal protocols are followed. Alternatively, uslegalforms can provide you with templates and information to assist in this challenging situation.

To terminate a trust in Illinois, you typically need to follow the terms outlined within the trust document itself. This often involves creating a termination document that reflects your intention to end the Cook Illinois Revocation of Living Trust. Notifying all affected parties, such as trustees and beneficiaries, is essential for a smooth process. For a step-by-step approach, uslegalforms offers helpful tools that can assist you in effectively terminating a trust.

While you can dissolve a trust without a lawyer, it's wise to consult one, especially for complex situations. An attorney specializing in Cook Illinois Revocation of Living Trust can help you understand the implications and ensure that all steps are followed legally. They can also review your trust documents to ensure that your intentions are carried out correctly. If legal advice feels necessary, uslegalforms has resources that guide you on whether hiring a lawyer is the right choice for you.

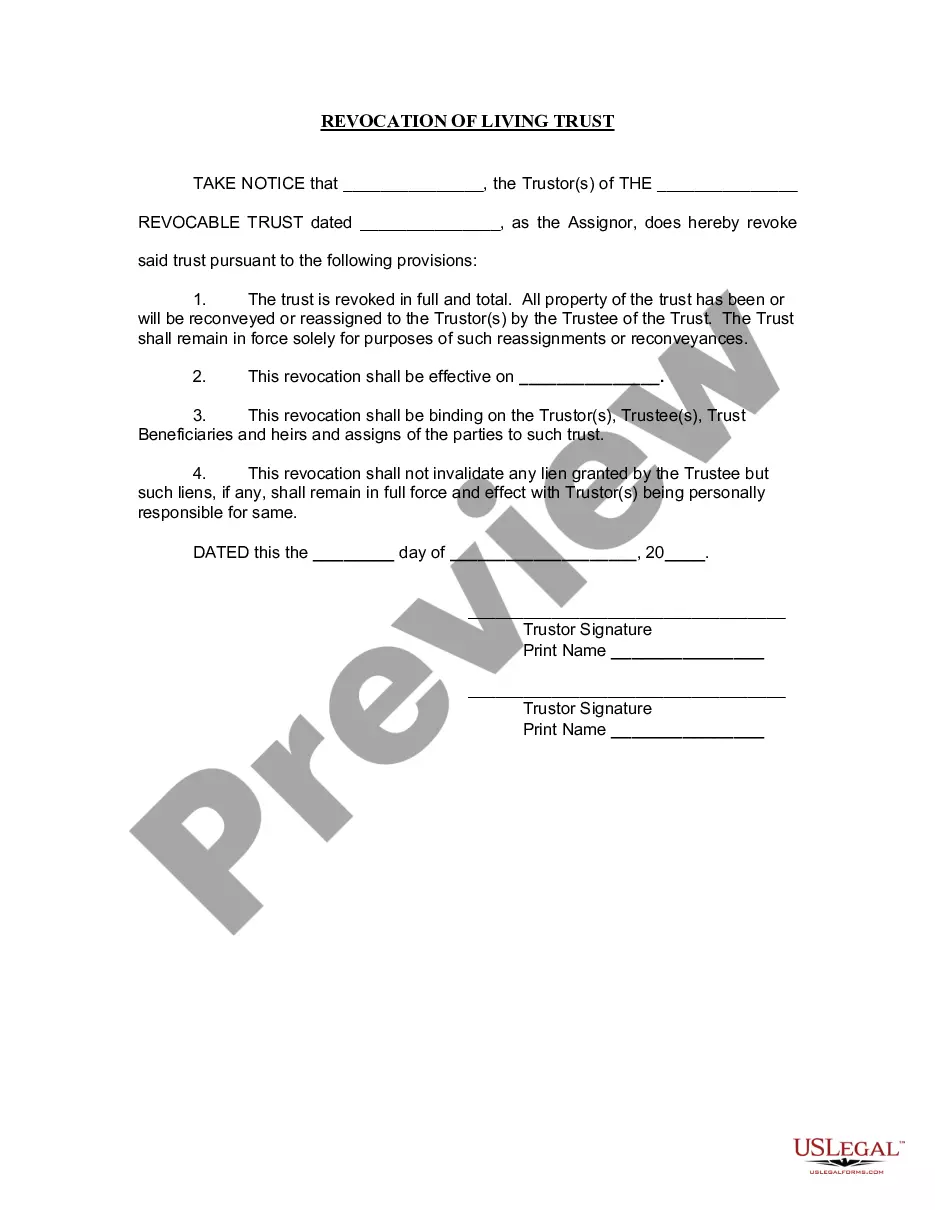

To revoke a trust in Illinois, the trustor must create a formal revocation document, clearly stating their intention to revoke the Cook Illinois Revocation of Living Trust. It's crucial to sign this document in front of a notary to ensure its validity. After that, notify the trustee and any beneficiaries about the trust's revocation to avoid confusion. This process can be easily navigated with the guidance of uslegalforms, which provides templates and resources for a smooth revocation.

The form to terminate a Cook Illinois Revocation of Living Trust usually involves a formal document that clearly states the trust's name, the grantor's intention to revoke, and the effective date. This termination form should be signed and dated by the grantor to ensure its validity. Keep in mind that it is important to notify all beneficiaries about this decision as well. Uslegalforms provides straightforward templates to assist you in creating this necessary documentation.

When you perform a Cook Illinois Revocation of Living Trust, consider the potential tax implications. Generally, revoking a living trust does not trigger immediate tax consequences, but it can affect future taxation on the trust's assets. If the trust generated income or held assets, the consequences may depend on how those assets are managed post-revocation. Consulting a tax professional is essential for understanding the specific impact on your situation.

An example of revoking a trust may involve a grantor declaring in writing the termination of a Cook Illinois Revocation of Living Trust. For instance, the grantor may decide to revoke the trust to redistribute assets in a new estate plan. This written declaration ensures that all intended beneficiaries and parties are informed about the trust's status. To ensure compliance and accuracy, utilizing uslegalforms can streamline the process.

A sample of Cook Illinois Revocation of Living Trust typically includes specific language stating the intention to revoke the trust, along with the trust's name and the names of the grantors. You will often see a declaration followed by signatures from the grantors. This document serves as a formal notice to all parties involved that the trust is no longer in effect. Using a reliable platform like uslegalforms can help you create this document accurately.

Revoking a revocable trust is a straightforward process, provided you follow the legal steps in Illinois. The Cook Illinois Revocation of Living Trust allows you to cancel the trust with a few simple actions, such as drafting a revocation document. While it can feel daunting, the correct approach makes it manageable. For additional support, uslegalforms is there to offer the guidance you need to ensure a smooth revocation.