Cook Illinois Dissolution Package to Dissolve Corporation

Description

How to fill out Illinois Dissolution Package To Dissolve Corporation?

If you are in search of a pertinent document, it’s challenging to select a more suitable site than the US Legal Forms platform – likely the largest online repositories.

Here you can find a vast array of templates for corporate and personal uses categorized by types and regions, or keywords.

Utilizing our sophisticated search feature, locating the latest Cook Illinois Dissolution Package to Dissolve Corporation is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the account registration process.

Obtain the document. Choose the format and download it to your device.

- Moreover, the validity of each document is confirmed by a team of professional attorneys who routinely examine the templates on our site and update them in accordance with the latest state and county laws.

- If you are already familiar with our platform and possess an account, all you need to obtain the Cook Illinois Dissolution Package to Dissolve Corporation is to Log In to your user profile and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have located the document you require. Review its details and use the Preview feature (if available) to examine its content. If it does not meet your criteria, utilize the Search bar at the top of the page to find the suitable file.

- Confirm your choice. Click the Buy now button. Subsequently, select the desired subscription plan and input your information to create an account.

Form popularity

FAQ

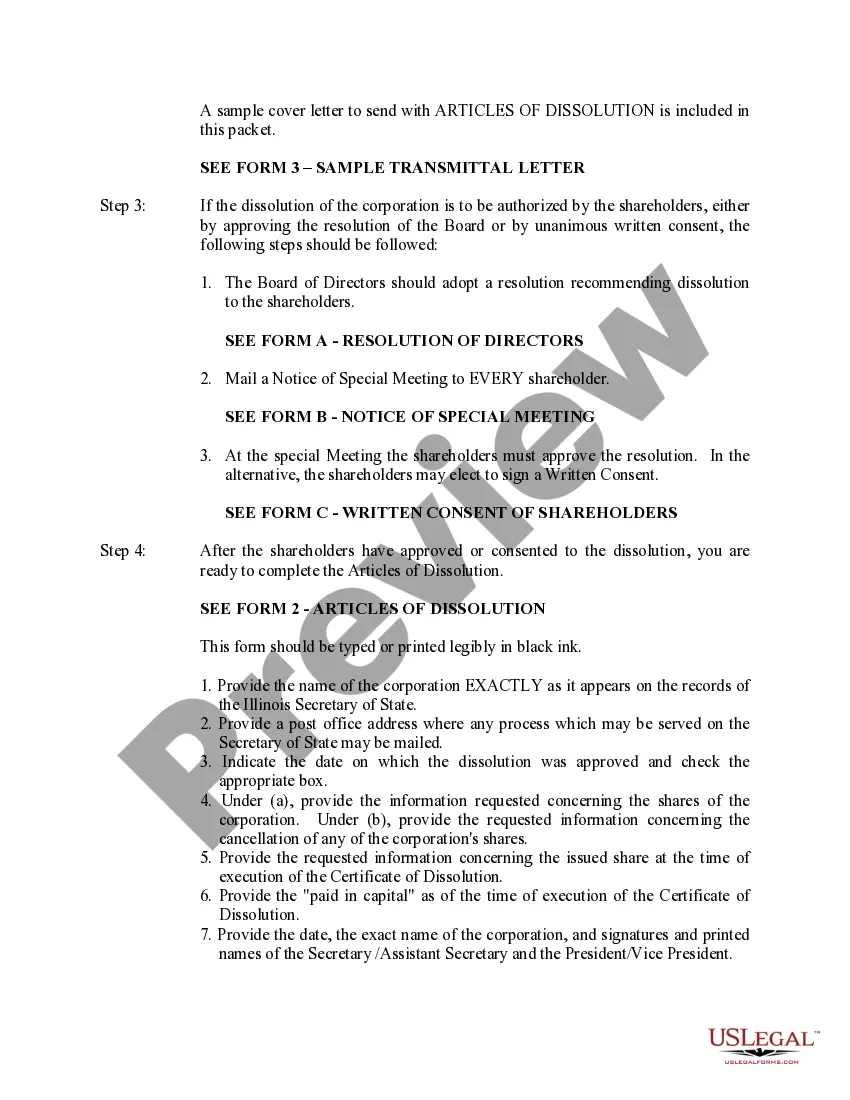

To fill out the articles of dissolution form, start by gathering your corporation's official details, including name, registration number, and address. Then, indicate the reason for dissolving the corporation and complete each section of the form thoroughly. After filling it out, review the Cook Illinois Dissolution Package to Dissolve Corporation to ensure you meet all requirements. Finally, submit the form to the appropriate state department along with any required fees.

To dissolve your corporation in Illinois, start by submitting the Articles of Dissolution form to the Secretary of State. It’s essential to settle any outstanding debts and taxes for compliance. The Cook Illinois Dissolution Package to Dissolve Corporation offers a streamlined approach to gather the necessary paperwork and guidance for your specific situation. Remember, completing this step properly helps protect you from future liabilities.

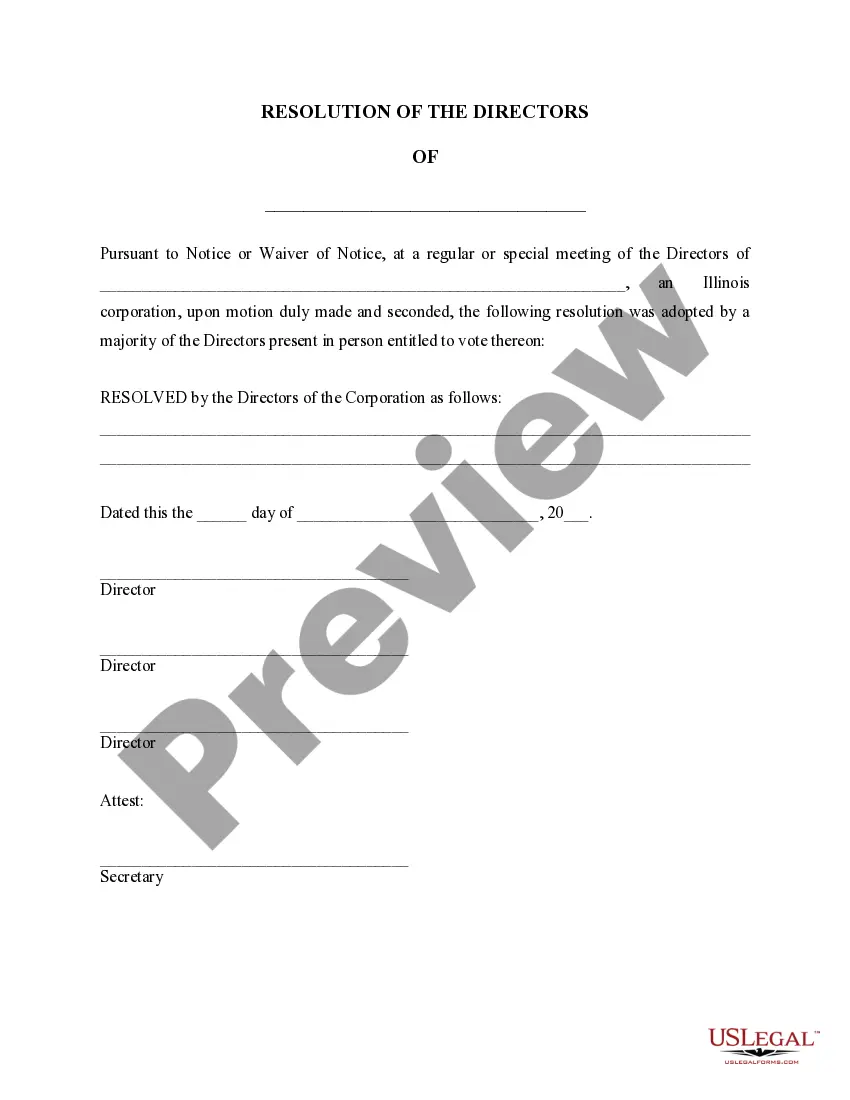

To dissolve an Illinois corporation, start by obtaining approval from your board of directors. Next, ensure all debts are settled, and file the dissolution form with the Illinois Secretary of State. The Cook Illinois Dissolution Package to Dissolve Corporation is designed to guide you through these stages smoothly, ensuring that you meet all legal requirements for dissolution.

The steps to dissolve a nonprofit include getting board approval, notifying members, and filing the dissolution documents with the state. It’s also essential to settle any outstanding debts and distribute any remaining assets according to your bylaws. The Cook Illinois Dissolution Package to Dissolve Corporation lays out these steps clearly, helping you navigate the process with confidence.

Dissolving a not-for-profit corporation in Illinois involves a few key actions. Begin by obtaining board approval for dissolution, then notify the members as required. Finally, submit the dissolution paperwork to the Secretary of State. Utilizing the Cook Illinois Dissolution Package to Dissolve Corporation simplifies this process, ensuring you cover all necessary steps efficiently.

To dissolve a nonprofit corporation in Illinois, you need to follow specific legal steps. First, ensure your board approves the dissolution. Then, file the appropriate documents with the Illinois Secretary of State. The Cook Illinois Dissolution Package to Dissolve Corporation provides a streamlined process, making it easier for you to complete the necessary paperwork.

Yes, filing Form 966 is required to inform the IRS about the dissolution of an S Corporation. This form needs to be submitted along with your final tax return, outlining the corporation's intention to dissolve. It’s important to complete this form accurately to avoid potential issues. The Cook Illinois Dissolution Package to Dissolve Corporation can offer assistance throughout this process.

To notify the IRS about your corporation's dissolution, you submit your final tax return marked as your last return. Be sure to include any exceptional information pertinent to the dissolution. You want to confirm that all tax obligations are fulfilled before proceeding. The Cook Illinois Dissolution Package to Dissolve Corporation provides detailed guidelines for completing this step.

Dissolving a corporation typically begins with drafting a dissolution plan approved by the board and stockholders. You'll then file specific forms with the state that outline the corporation's intent to dissolve. Be sure to settle any remaining obligations and notify involved parties. The Cook Illinois Dissolution Package to Dissolve Corporation offers essential tools to guide you.

The process of dissolving a company starts with formal approval from the board and shareholders. Following that, you must file necessary dissolution papers with your state government. It's also crucial to notify employees, creditors, and stakeholders of the pending dissolution. By using the Cook Illinois Dissolution Package to Dissolve Corporation, you can manage this process effectively.