Cook Illinois Bill of Sale of Automobile and Odometer Statement

Description

Form popularity

FAQ

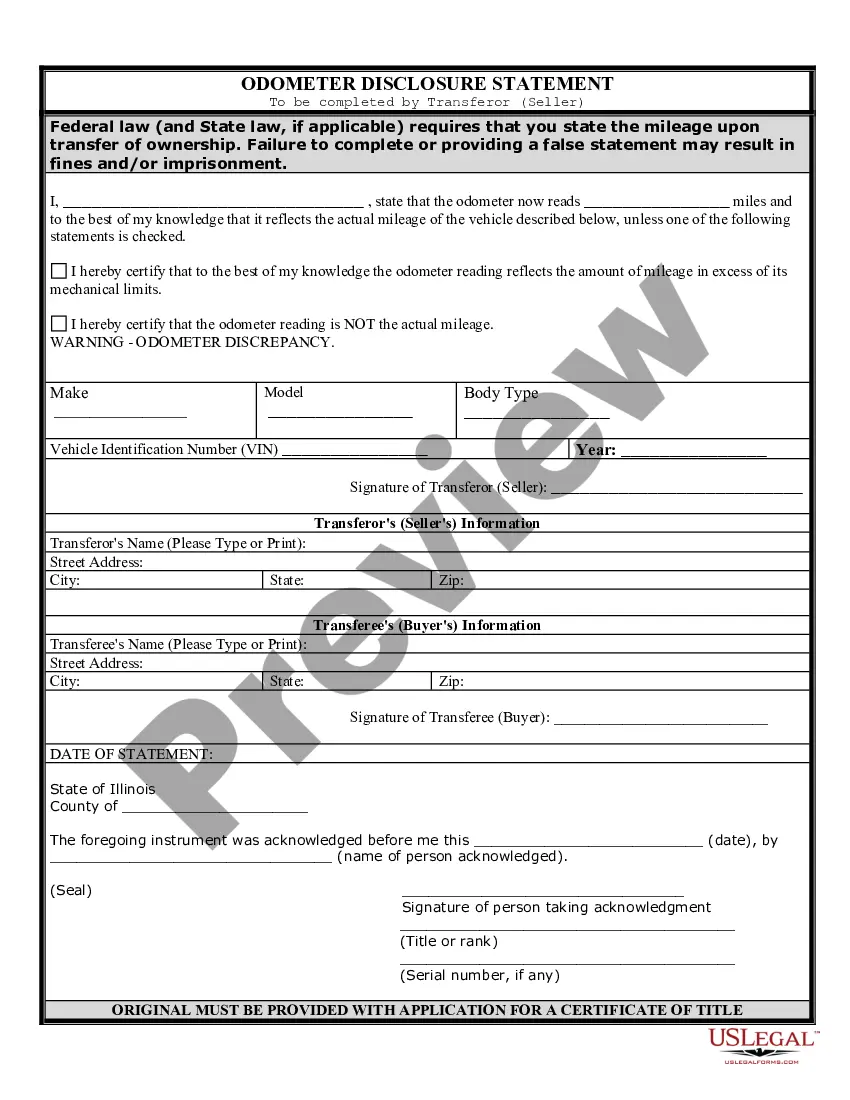

In most cases, an odometer disclosure statement does not require notarization. However, some states may have specific requirements that mandate formal verification. To navigate these regulations smoothly, the Cook Illinois Bill of Sale of Automobile and Odometer Statement provides guidance on what is necessary for your specific situation. It is advisable to check your local laws or consult with uslegalforms for any additional requirements.

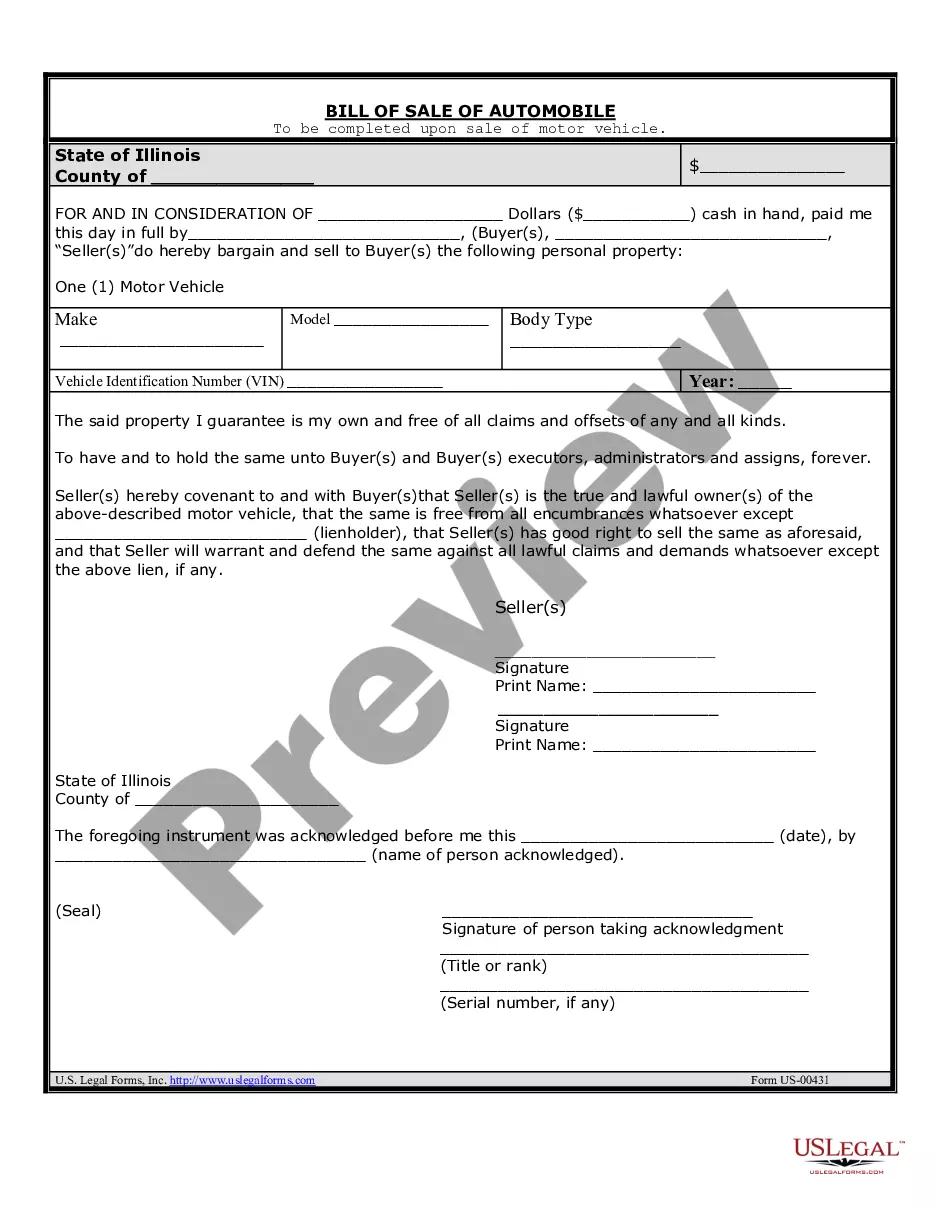

An odometer statement serves as a formal declaration of the vehicle’s mileage at the time of transfer. Using the Cook Illinois Bill of Sale of Automobile and Odometer Statement, you’ll find a well-structured example that outlines necessary components such as the vehicle's details and the involved parties’ signatures. This example demonstrates how buyers and sellers can adhere to legal requirements easily.

An odometer disclosure statement typically includes details such as the vehicle’s VIN, make, model, year, current odometer reading, and the seller's information. For a concrete example, the Cook Illinois Bill of Sale of Automobile and Odometer Statement serves as an excellent template, ensuring that all relevant data is included for a valid transaction. This statement confirms the buyer’s knowledge of the odometer reading at the time of sale.

You can obtain an odometer statement through your state’s Department of Motor Vehicles (DMV) or similar agency. Additionally, online platforms like uslegalforms offer the Cook Illinois Bill of Sale of Automobile and Odometer Statement, making it easy to access and fill out the required information. Simply download the template, and you will have everything you need to create a valid odometer statement.

To fill out a federal odometer statement, you first need to gather information about the vehicle, including the make, model, year, and Vehicle Identification Number (VIN). Next, provide the current odometer reading and confirm that it reflects the actual mileage. You will also need to sign and date the statement. Using the Cook Illinois Bill of Sale of Automobile and Odometer Statement simplifies this process, as it includes all necessary fields for accurate completion.

Yes, Illinois law requires an odometer disclosure statement when transferring a vehicle's title. This requirement aims to protect buyers from potential odometer fraud and ensures transparency in vehicle history. You can conveniently fulfill this requirement using the Cook Illinois Bill of Sale of Automobile and Odometer Statement.

The odometer statement on a bill of sale is a declaration regarding the vehicle's mileage at the time of sale. This statement is required in Illinois to confirm the accuracy of the mileage reading and prevent odometer fraud. Using the Cook Illinois Bill of Sale of Automobile and Odometer Statement will provide the necessary format and language for this disclosure.

To obtain an odometer disclosure statement in Illinois, you can use the Cook Illinois Bill of Sale of Automobile and Odometer Statement, which includes this disclosure. You can find this document online or through the Illinois DMV. Make sure that it is properly filled out, as it's crucial for vehicle registration and transfer.

Yes, the Illinois DMV requires a bill of sale in certain situations, especially when there is no title available. The Cook Illinois Bill of Sale of Automobile can serve as proof of ownership and helps facilitate a smooth transfer. Always check with the DMV for specific requirements based on your unique circumstances.

Yes, Illinois law requires a bill of sale for the transfer of ownership for vehicles. The Cook Illinois Bill of Sale of Automobile and Odometer Statement serves as a crucial document that outlines the terms of the sale and includes important information such as vehicle details and the odometer reading. This document helps facilitate a smooth registration process for the new owner.