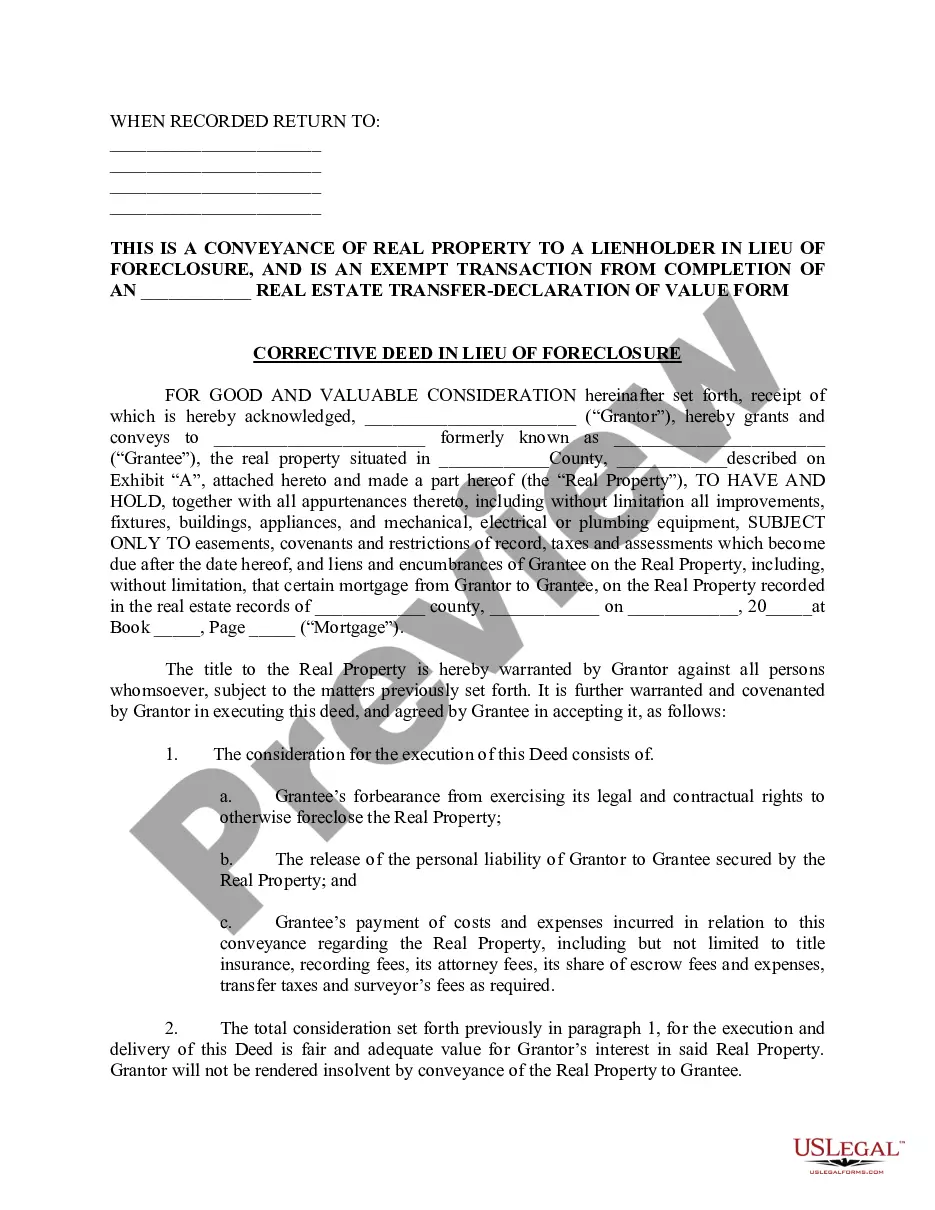

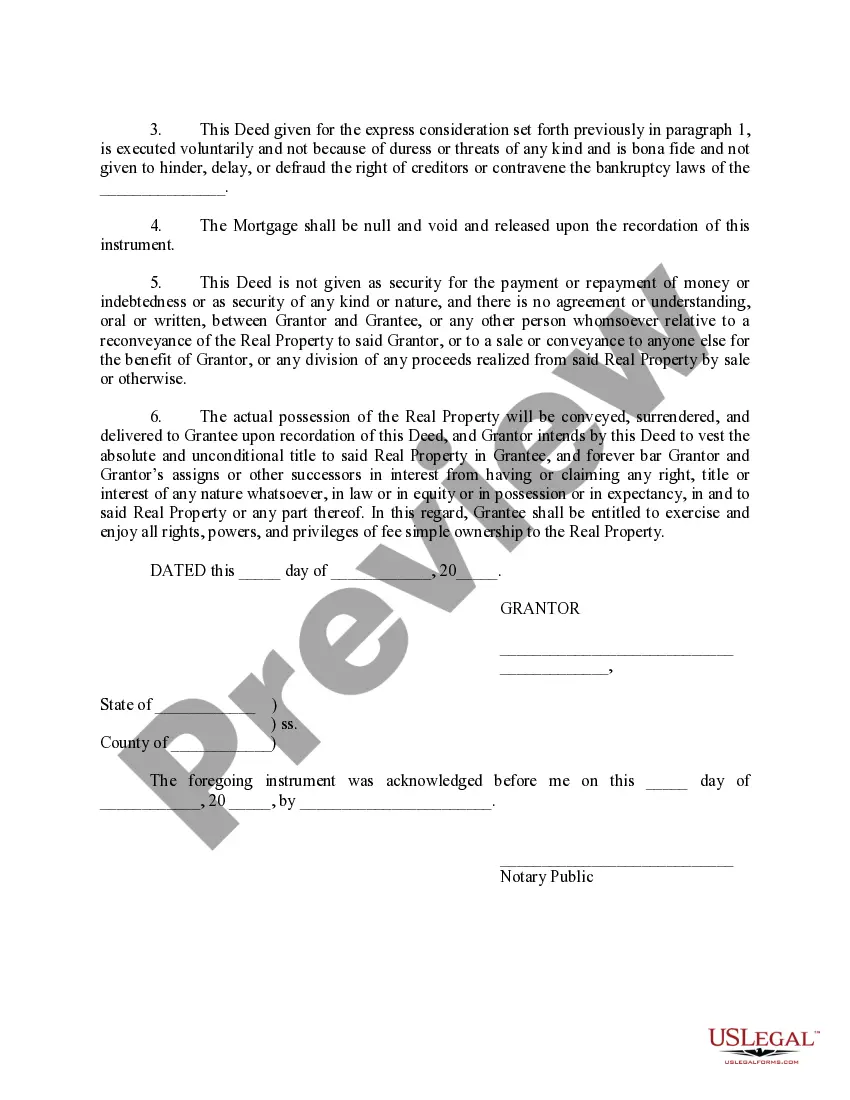

Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure is a legal process that allows homeowners in Cedar Rapids, Iowa to avoid foreclosure on their property by voluntarily transferring ownership to the mortgage lender. This alternative solution is applicable when the property owner is unable to keep up with mortgage payments and wants to avoid the negative consequences associated with a foreclosure. A Corrective Deed in Lieu of Foreclosure in Cedar Rapids, Iowa serves as a means for homeowners to relinquish their property to the lender, satisfying the outstanding debt. It is a mutually agreed-upon resolution that can be beneficial for both parties involved. The lender gains ownership of the property, relieving the homeowner of further mortgage payments and potential foreclosure proceedings. With a Corrective Deed in Lieu of Foreclosure, the homeowner typically avoids the long and costly process of foreclosure. It mitigates the negative impact on the homeowner's credit history, as a foreclosure can have severe consequences and make it challenging to obtain credit or purchase another property in the future. By opting for a Corrective Deed in Lieu of Foreclosure, homeowners can potentially protect their credit and move towards a fresh financial start. It is crucial to note that there are different types of Corrective Deed in Lieu of Foreclosure procedures in Cedar Rapids, Iowa. These may include: 1. Traditional Corrective Deed in Lieu of Foreclosure: This is the standard process where the homeowner voluntarily transfers ownership to the lender, releasing any claims on the property. 2. Negotiated Corrective Deed in Lieu of Foreclosure: In some cases, homeowners may negotiate with the lender to obtain more favorable terms during the deed transfer. This can involve discussions on financial responsibilities or potential assistance programs. 3. Collaborative Corrective Deed in Lieu of Foreclosure: This type involves working with a housing counselor, attorney, or mediator who facilitates communication and negotiation between the homeowner and the lender. The goal is to reach a mutually satisfactory agreement and streamline the transfer of ownership. When considering a Corrective Deed in Lieu of Foreclosure in Cedar Rapids, Iowa, it is important to consult with legal professionals, such as real estate attorneys or housing counselors, to fully understand the implications and ensure compliance with all relevant laws and regulations. These experts can guide homeowners through the process and provide tailored advice based on their unique circumstances. In summary, Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure offers homeowners an alternative solution to avoid foreclosure by voluntarily transferring ownership to the lender. By engaging in this process, homeowners can protect their credit, alleviate financial burdens, and potentially embark on a fresh start. Consulting legal professionals is advised to ensure compliance and understand the different types of Corrective Deed in Lieu of Foreclosure available.

Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure

Description

How to fill out Cedar Rapids Iowa Corrective Deed In Lieu Of Foreclosure?

Do you require a trustworthy and budget-friendly provider of legal forms to obtain the Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure? US Legal Forms is your top option.

Regardless of whether you need a simple agreement to establish terms for cohabitation with your partner or a collection of documents to navigate your separation or divorce through the court, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business usage. All templates we provide are not generic and are designed according to the regulations of individual states and regions.

To retrieve the document, you must Log Into your account, find the required form, and click the Download button adjacent to it. Please remember that you can access your previously acquired form templates at any time in the My documents section.

Are you unfamiliar with our platform? No need to be concerned. You can easily set up an account, but before doing so, ensure that you do the following.

Now you can create your account. Then select your subscription plan and proceed to payment. Once the payment is completed, download the Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure in any available file format. You can revisit the website as needed and redownload the form at no additional cost.

Obtaining current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time figuring out legal documents online once and for all.

- Verify whether the Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure adheres to the laws of your state and locality.

- Examine the details of the form (if available) to understand for whom and what purpose the form is designed.

- Restart your search if the form is not appropriate for your particular situation.

Form popularity

FAQ

To file a Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure, start by contacting your lender and expressing your intention. You will need to gather relevant documents, including your mortgage information, financial statements, and a written request. After completing the necessary forms, submit them directly to your lender for review. For a seamless experience, consider using a platform like US Legal Forms to access templates and resources that facilitate this process.

The timeline for a Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure can vary depending on several factors. Typically, it may take anywhere from a few weeks to a couple of months to complete the process. This duration largely depends on the cooperation of your lender and the necessary paperwork. Engaging with professionals can simplify and expedite the steps involved.

A Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure typically finalizes the transfer of property ownership to the lender. However, reversing this deed can be challenging once it is executed. In some cases, negotiations might allow for a reversal, but this largely depends on lender policies and state laws. Consulting a legal expert or using services like US Legal Forms can help you navigate the complexities of this process.

Negotiating a deed in lieu of foreclosure involves presenting a detailed financial history to the lender. Be honest and clear about your situation and express your willingness to cooperate to make the process smooth. Reach out to uslegalforms for templates and guidance to ease the negotiation process for a Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure.

Receiving a deed in lieu of foreclosure can typically take anywhere from a few weeks to several months, depending on the complexity of your situation. Once all documents are submitted and accepted, the formalities of the title transfer will follow. Engaging with resources such as uslegalforms can expedite the process for a Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure.

The time frame to complete a deed in lieu of foreclosure can vary greatly but often takes several weeks to months. Factors such as lender responsiveness and property conditions can influence this timeline. For a smooth process regarding a Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure, clear communication with your lender is essential.

No, a lender is not obligated to accept a deed in lieu of foreclosure. They have the discretion to weigh the benefits against any potential losses. Therefore, it's vital to present a strong case when seeking a Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure to enhance the odds of lender acceptance.

When negotiating a deed in lieu of foreclosure, start by collecting all relevant financial documents and evidence of hardship. Present your case clearly to your lender, highlighting your willingness to relieve them of the property's maintenance responsibilities. A Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure requires a convincing argument, so be prepared to discuss terms thoughtfully.

A significant drawback for lenders is the potential financial loss involved in accepting a deed in lieu of foreclosure. They may not recover the full amount owed on the mortgage, which can lead to accounting issues and reduced funds for future lending. Understanding these dynamics can be crucial when negotiating a Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure.

Another disadvantage involves giving up your home voluntarily, which can feel emotionally distressing. This process could also limit your chances of negotiating better terms with your lender. If you're facing financial difficulties, consider exploring alternatives before settling on a Cedar Rapids Iowa Corrective Deed in Lieu of Foreclosure.

Interesting Questions

More info

An example of correction: TCC (TC Corporate Holdings Inc) corrected the “s” on “Homes” to “homes”. How many times can I file for bankruptcy/filing amended returns and claims? The statute of limitations for filing claims, claims in amended returns, bankruptcy petitions, and liens is three years from the date of the event. This means that for three years, the original trustee's record is not available. TCC's records are public, and they are retained by the court for three years. The three-year statute of limitations expires after four years. So, in reality, you only have the three years which the statute of limitations applies to (i.e., when the debt is discharged). It is not until you've exhausted all avenues of judicial review, filed and served your notice to the bank holding the mortgage and got the bank to correct the error, that you are entitled to seek a bankruptcy discharge of a mortgage in bankruptcy court.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.