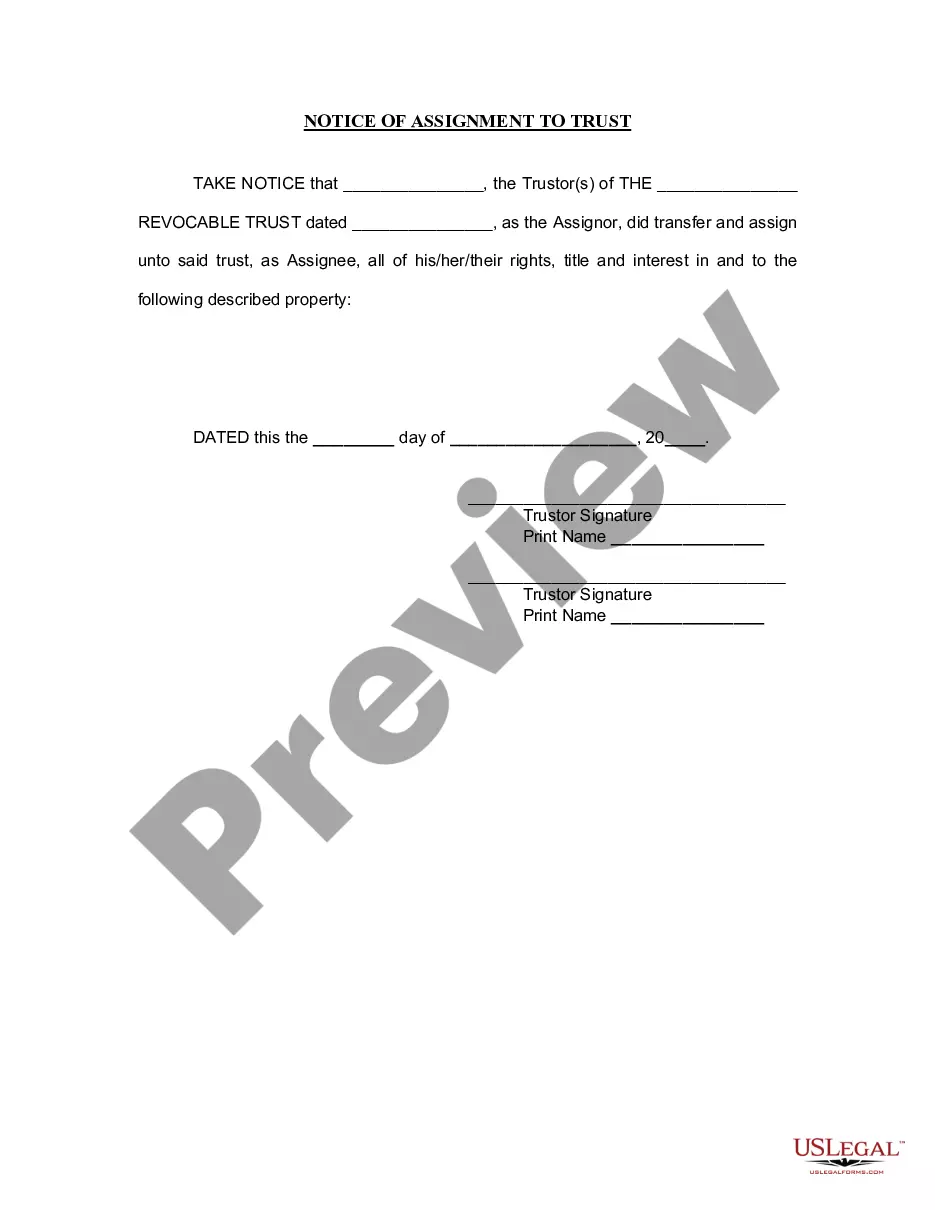

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Atlanta Georgia Notice of Assignment to Living Trust

Description

How to fill out Georgia Notice Of Assignment To Living Trust?

Take advantage of the US Legal Forms and gain instant access to any document you require.

Our convenient platform featuring a multitude of templates enables you to locate and acquire nearly any document sample you may need.

You can save, complete, and sign the Atlanta Georgia Notice of Assignment to Living Trust within minutes instead of spending hours online searching for a suitable template.

Using our collection is a fantastic method to enhance the security of your document submissions.

Initiate the download process. Click Buy Now and select the pricing plan that suits you. Then, create an account and process your payment via credit card or PayPal.

Retrieve the document. Choose the format to acquire the Atlanta Georgia Notice of Assignment to Living Trust and modify and fill it, or sign it per your requirements.

- How can you obtain the Atlanta Georgia Notice of Assignment to Living Trust.

- If you already possess a subscription, simply Log In to your account. The Download option will be visible on all the documents you review.

- Furthermore, you can access all your previously saved files in the My documents section.

- If you haven’t created an account yet, follow these steps.

- Locate the form you require. Verify that it is the template you were looking for: review its title and description, and take advantage of the Preview feature if it is provided. Otherwise, use the Search bar to find the suitable one.

Form popularity

FAQ

In the State of Georgia, creating a living trust means drafting the trust document with your estate planning attorney and signing it in front of a notary public. Once signed and notarized, you must ?fund the trust? by transferring assets to the name of the trust.

Any asset that names a beneficiary directly avoids probate. Assets might include the proceeds from a life insurance policy, IRA, 401(k) and other retirement accounts that name a beneficiary. Payable-on-death or Transferable-on-death accounts, such as bank accounts or securities.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

Is Probate Required in Georgia? Probate isn't always required in Georgia. It is necessary by law if the assets belonged solely to the deceased person with no named beneficiary or with the estate as the named beneficiary. If the assets were included in a revocable living trust, probate won't be necessary.

Trusts are completely private and do not need a court to enact them. The terms of the trust, beneficiaries, and assets are not public record. Trusts are also more difficult to contest than wills. Creating a living trust in Georgia protects not only your assets, but you personally.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

For a Georgia will or trust, the average cost is between $300-600, but the amount you spend depends on how complex the document is and whether you use a template or an attorney. Again, this is an average. Your attorney may charge more or less. Some attorneys may work from a template.

Trusts are completely private and do not need a court to enact them. The terms of the trust, beneficiaries, and assets are not public record.

To make a living trust in Georgia, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Living Trusts In Georgia, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).