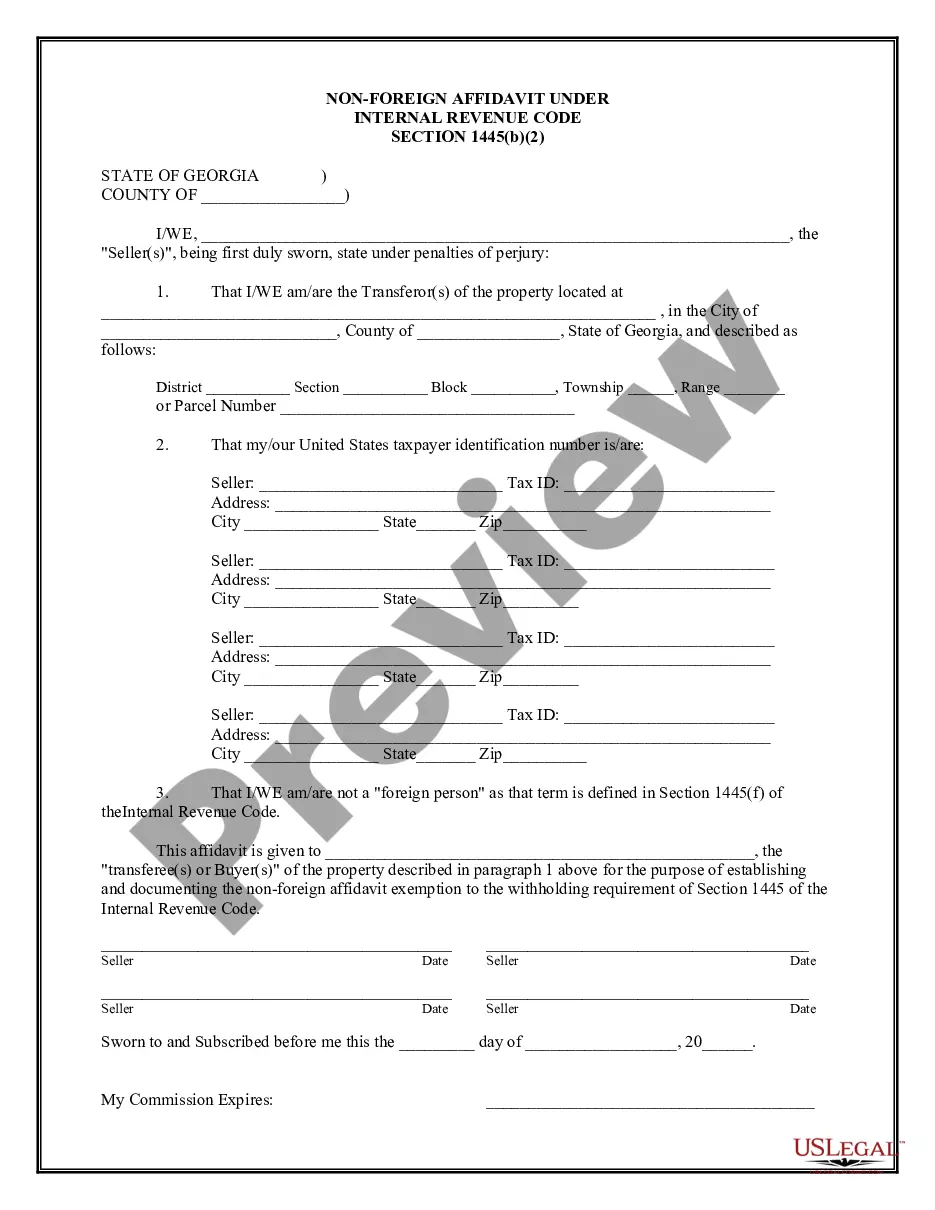

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Savannah Georgia Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Georgia Non-Foreign Affidavit Under IRC 1445?

Acquiring verified templates that adhere to your local regulations can be challenging unless you utilize the US Legal Forms repository.

This is an online collection of over 85,000 legal forms catering to both personal and professional requirements in various real-world situations.

All documents are systematically organized according to their purpose and jurisdiction, making it as simple as pie to find the Savannah Georgia Non-Foreign Affidavit Under IRC 1445.

Maintaining organized paperwork that complies with legal requirements is of paramount importance. Leverage the US Legal Forms repository to always have crucial document templates readily available for any needs!

- Review the Preview mode and form description.

- Ensure you’ve selected the right one that aligns with your needs and fully meets your local jurisdiction's standards.

- Search for an alternative template if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the correct one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

A seller's affidavit of non-foreign status is a declaration that affirms the seller is not a foreign entity, thus eligible for specific tax exemptions under U.S. law. This affidavit protects both the seller and buyer from potential tax liabilities during the sale of property. To ensure clarity and compliance in Savannah, Georgia, it is advisable to use a Savannah Georgia Non-Foreign Affidavit Under IRC 1445.

The FIRPTA Affidavit serves to prevent foreign sellers from avoiding tax payments on the proceeds of U.S. real estate sales. It ensures that the IRS receives the appropriate tax withholding at the time of sale. Utilizing a Savannah Georgia Non-Foreign Affidavit Under IRC 1445 allows local sellers to demonstrate their compliance, easing the sale process and avoiding unexpected tax liabilities.

foreign status affidavit is a document that verifies an individual is not considered a foreign person according to U.S. tax laws. Typically, sellers use this affidavit when selling real estate, allowing them to avoid FIRPTA withholding. By submitting a Savannah Georgia NonForeign Affidavit Under IRC 1445, you simplify the transaction process and affirm your nonforeign status.

To create a FIRPTA affidavit, you need to provide evidence of your residency status in the U.S. This includes your name, tax identification number, and a statement confirming that you are not a foreign person per the Internal Revenue Code. When you file a Savannah Georgia Non-Foreign Affidavit Under IRC 1445, you help ensure a smooth transaction and compliance with U.S. tax law.

A FIRPTA statement is often included in closing documents to affirm that a seller is a U.S. citizen or resident. For example, a seller might complete a FIRPTA statement declaring, 'I am not a foreign person as per the IRS definition,' which directly relates to a Savannah Georgia Non-Foreign Affidavit Under IRC 1445. This statement alleviates concerns about tax withholding and provides a clear record that the transaction complies with tax regulations.

The IRC code 1445 refers to the Internal Revenue Code section that addresses the tax implications for foreign sellers of U.S. real estate. Specifically, it requires purchasers of real estate from foreign sellers to withhold a portion of the sale proceeds to ensure tax obligations are met. This code is significant when dealing with transactions involving a Savannah Georgia Non-Foreign Affidavit Under IRC 1445, as it helps establish the residency status of the seller.

Generally, the buyer or their representative is responsible for determining whether the seller is a foreign person or entity. This assessment is crucial for complying with FIRPTA regulations and ensuring proper tax withholding. Utilizing resources like the Savannah Georgia Non-Foreign Affidavit Under IRC 1445 can help clarify seller status and facilitate informed decisions in real estate transactions.

A certificate that confirms a seller is not a foreign person certifies their status to avoid FIRPTA tax withholding requirements. This certificate is often included as part of the Savannah Georgia Non-Foreign Affidavit Under IRC 1445, easing the sale for sellers who meet the criteria. By providing this documentation, sellers can reassure buyers and streamline the transaction process.

A certificate of foreign status is a document that confirms an individual or entity's status as a foreign person. This certificate is important for tax compliance, especially in real estate transactions subject to FIRPTA. Having proper documentation, like the Savannah Georgia Non-Foreign Affidavit Under IRC 1445, can prevent misunderstandings and ensure smooth sales.

For a seller, FIRPTA signifies the potential responsibility of withholding taxes when selling real estate in the U.S. If a seller is a foreign national, IRS regulations may require tax withholding on the property's sale proceeds. A Savannah Georgia Non-Foreign Affidavit Under IRC 1445 serves as an essential document to establish non-foreign status and simplify the selling process.