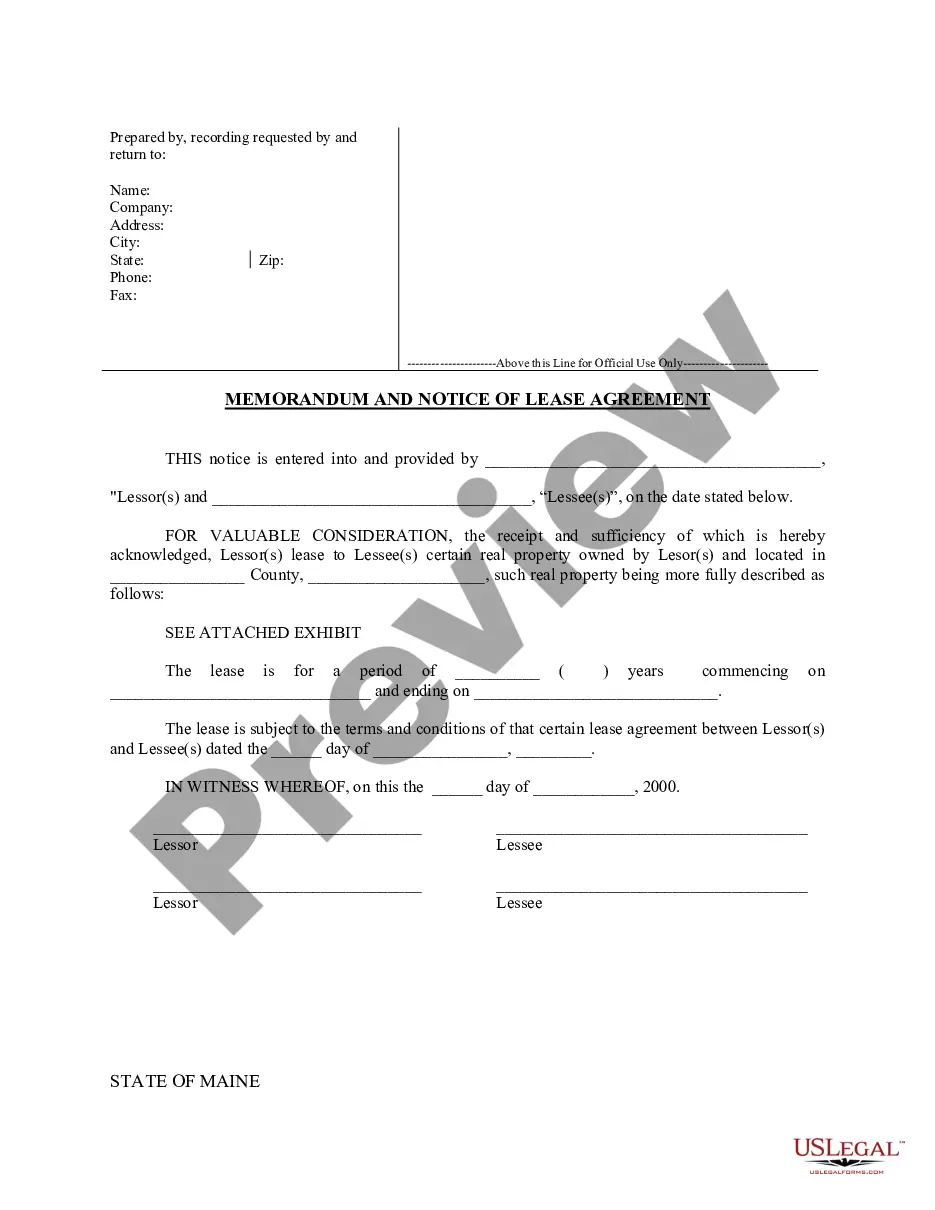

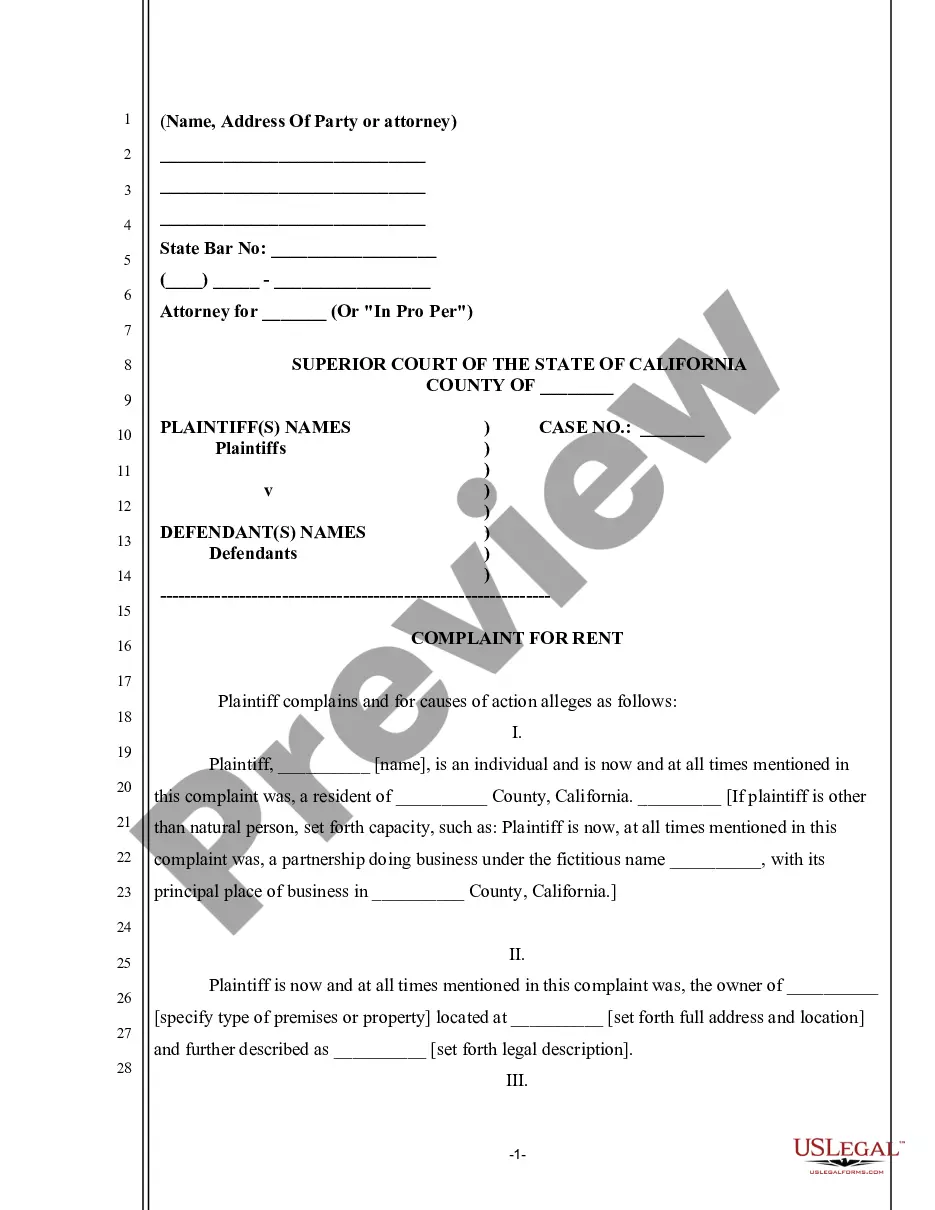

This form is a Quitclaim Deed where the Grantor is an Individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Atlanta Georgia Quitclaim Deed - Individual to a Trust

Description

How to fill out Georgia Quitclaim Deed - Individual To A Trust?

Irrespective of societal or occupational standing, filling out legal documents is a regrettable requirement in contemporary society.

Frequently, it’s nearly impossible for an individual lacking any legal expertise to draft such documents from scratch, primarily due to the intricate language and legal nuances they involve.

This is where US Legal Forms proves to be useful.

Confirm that the template you have located is suitable for your area as the laws of one state do not apply to another.

Review the document and examine a brief summary (if available) of the situations the paperwork can be utilized for.

- Our platform offers an extensive collection of over 85,000 ready-to-use state-specific forms suitable for nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to enhance their efficiency with our DIY forms.

- Whether you need the Atlanta Georgia Quitclaim Deed - Individual to a Trust or any other document that will be recognized in your state or locality, US Legal Forms puts everything at your disposal.

- Here’s how to quickly obtain the Atlanta Georgia Quitclaim Deed - Individual to a Trust using our trustworthy platform.

- If you are already a current customer, you can simply Log In to your account to retrieve the necessary form.

- However, if you are not acquainted with our library, make sure to follow these steps before downloading the Atlanta Georgia Quitclaim Deed - Individual to a Trust.

Form popularity

FAQ

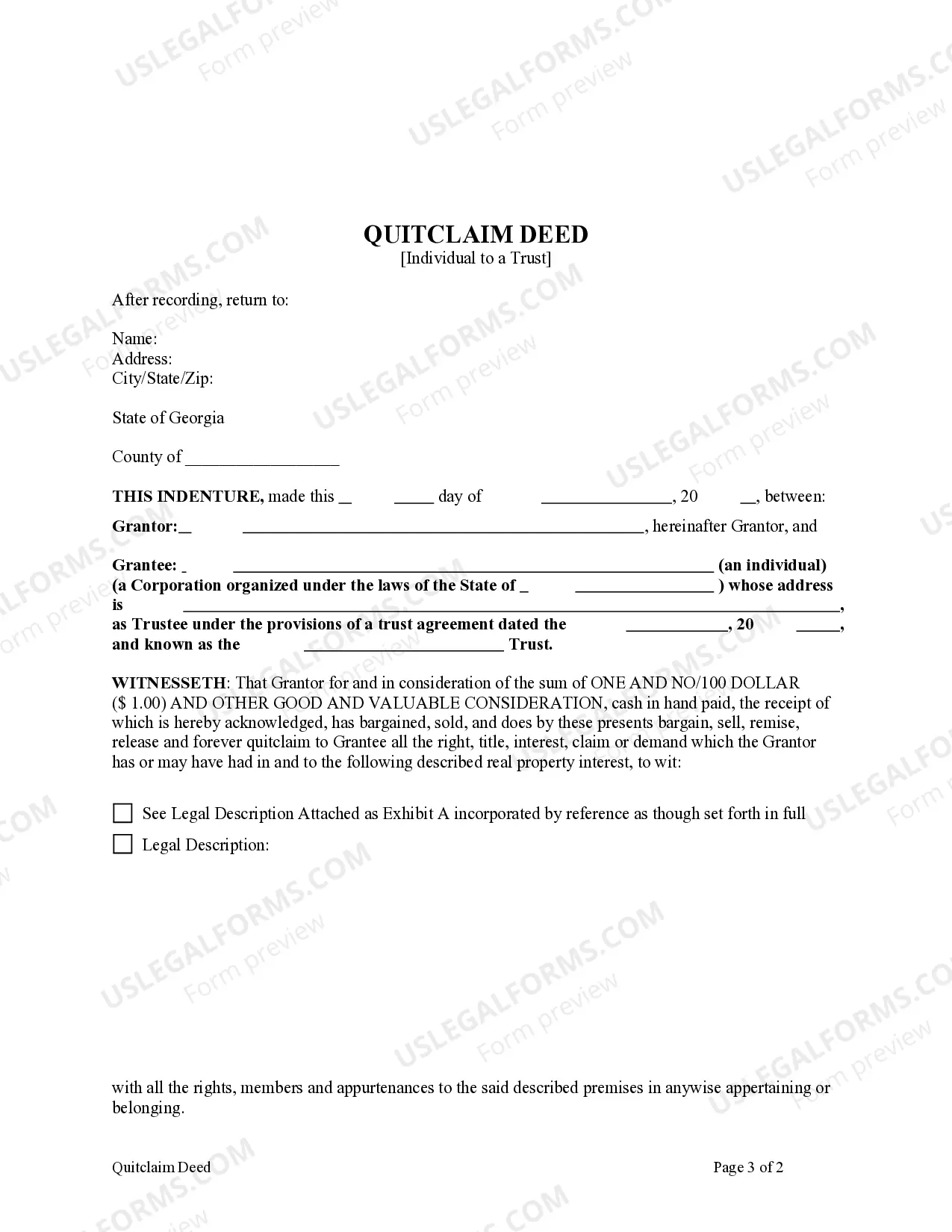

Georgia Quit Claim Deed Also called a non-warranty deed, a quitclaim is one of the methods for transferring residential or commercial property between family members. This legal form conveys only that interest held by the grantor and a title to real estate.

A security deed (deed to secure debt) is the customary security instrument in Georgia. Georgia does not use a Deed of Trust. Two witnesses are required to witness the signature of the grantor for a security deed to be recorded.

A Quit Claim Deed transfers ownership interest of the grantor to the grantee without any warranties or guarantees that title is good or that the property is free of liens or claims. The deed must describe the real property, full legal description. Be signed and notarized by the grantor with a witness.

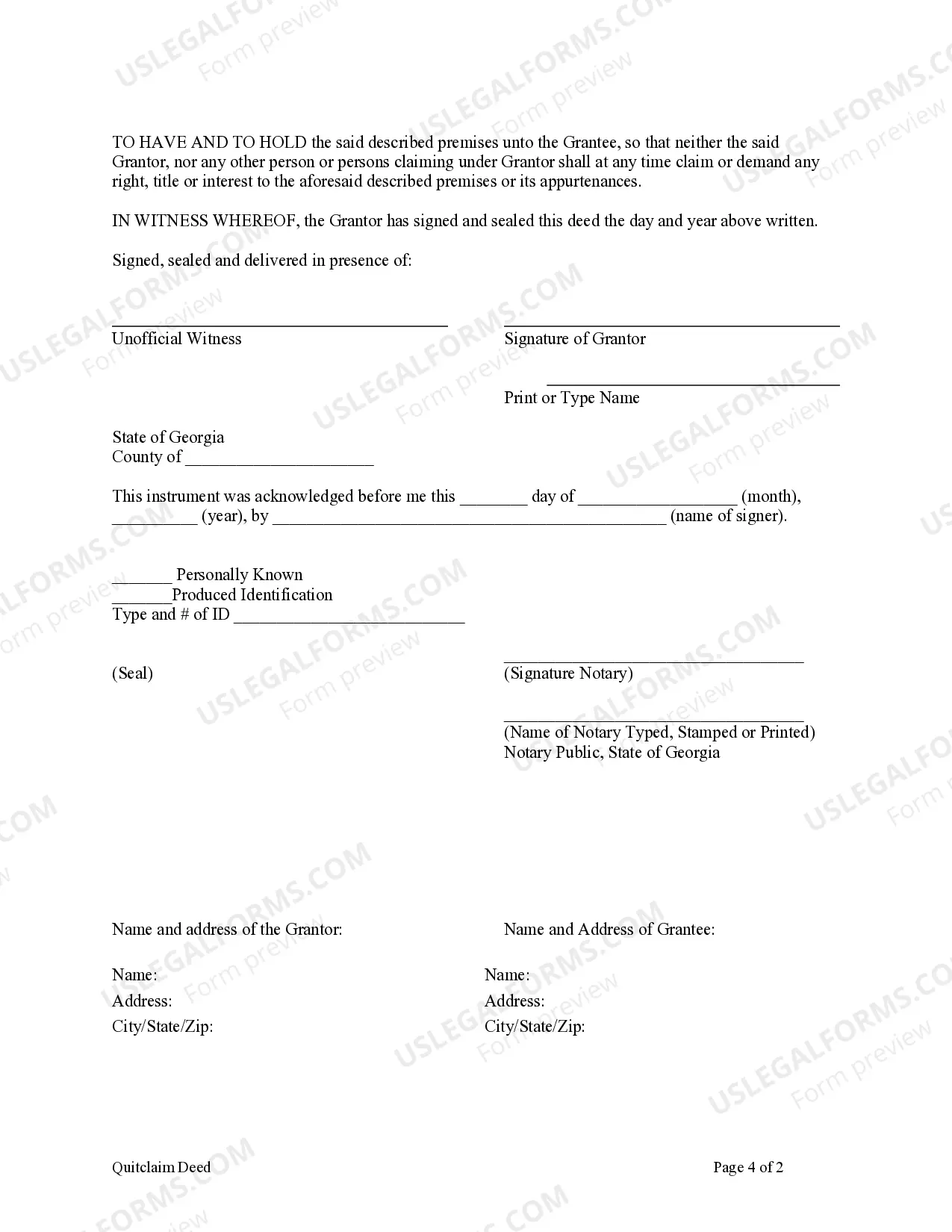

The State of Georgia Transfer Tax is imposed at the rate of $1.00 per thousand (plus $0.10 / hundred) based upon the value of the property conveyed. Example: A property selling for $550,000.00 would incur a $550.00 State of Georgia Transfer Tax.

Here are the steps to completing a deed transfer in Georgia: Names the Current Owner and New Owner. Contains a Description of the Property. Signed by Current Owner. Two Witnesses: Unofficial Witness & Notary Public. Complete a PT-61, Transfer Tax Form. Record Deed in County Real Estate Records.

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

Georgia Gift Deed Information. Gift deeds convey title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to gift property as a charitable act or donation, these conveyances occur during the grantor's lifetime.

Moving Forward Type of DocumentPrior Fee StructureNew FeeDeed of Transfer (e.g., Limited Warranty Deed, Quitclaim Deed)$10.00 for the first page, $2.00 for each add'l page$25.00Security Instrument or Modification of Security Instrument (e.g., Security Deed, ALR)$10.00 for the first page, $2.00 for each add'l page$25.006 more rows ?

How to Write and File a Quitclaim Deed in Georgia Step 1 ? Obtain the Georgia Quitclaim Deed Form.Step 2 ? Fill out Form Details.Step 3 ? Write Deed Delivery Name and Address.Step 4 ? Enter Preparer's Name and Address.Step 5 ? Get Signatures and Have Deed Notarized.Step 6 ? Pay Real Estate Transfer Tax.