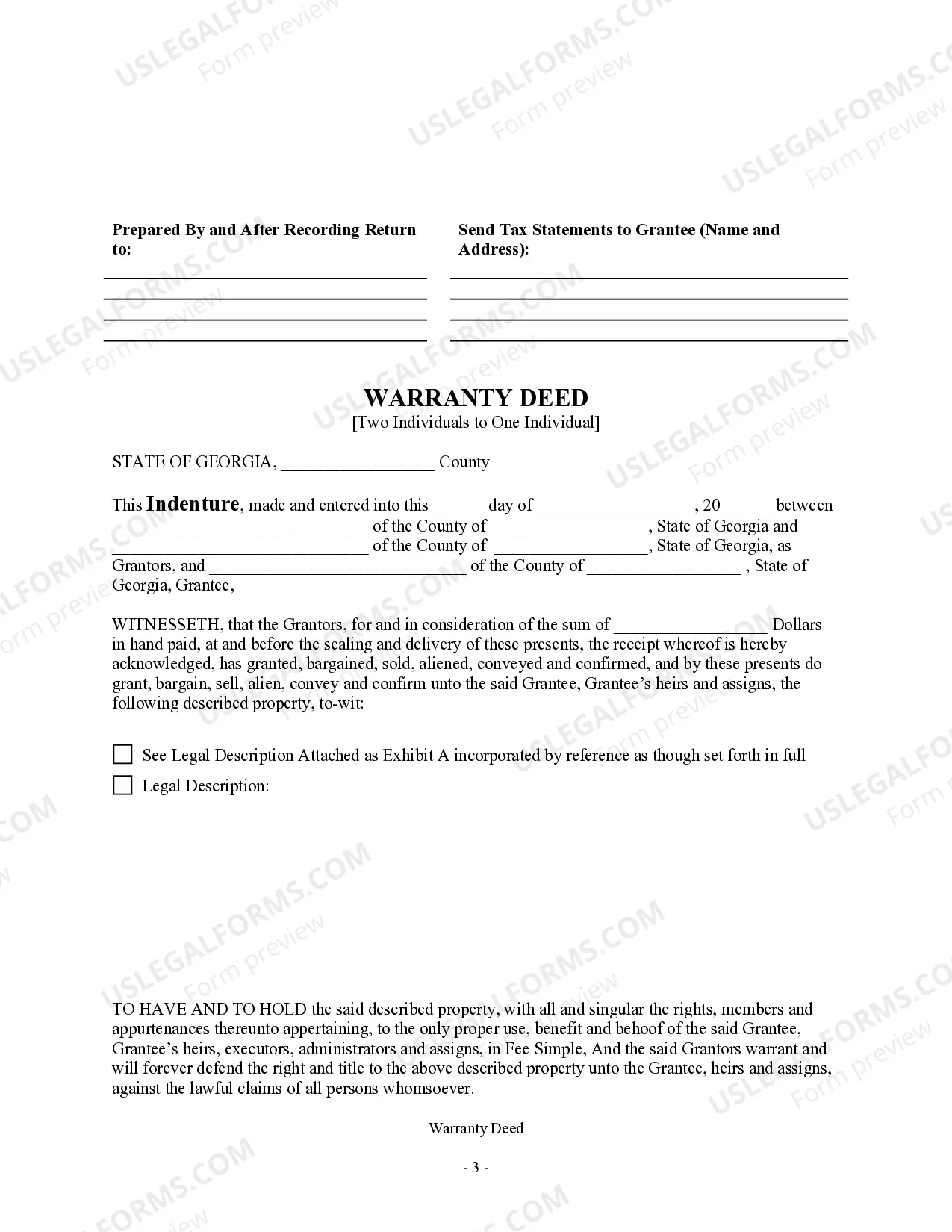

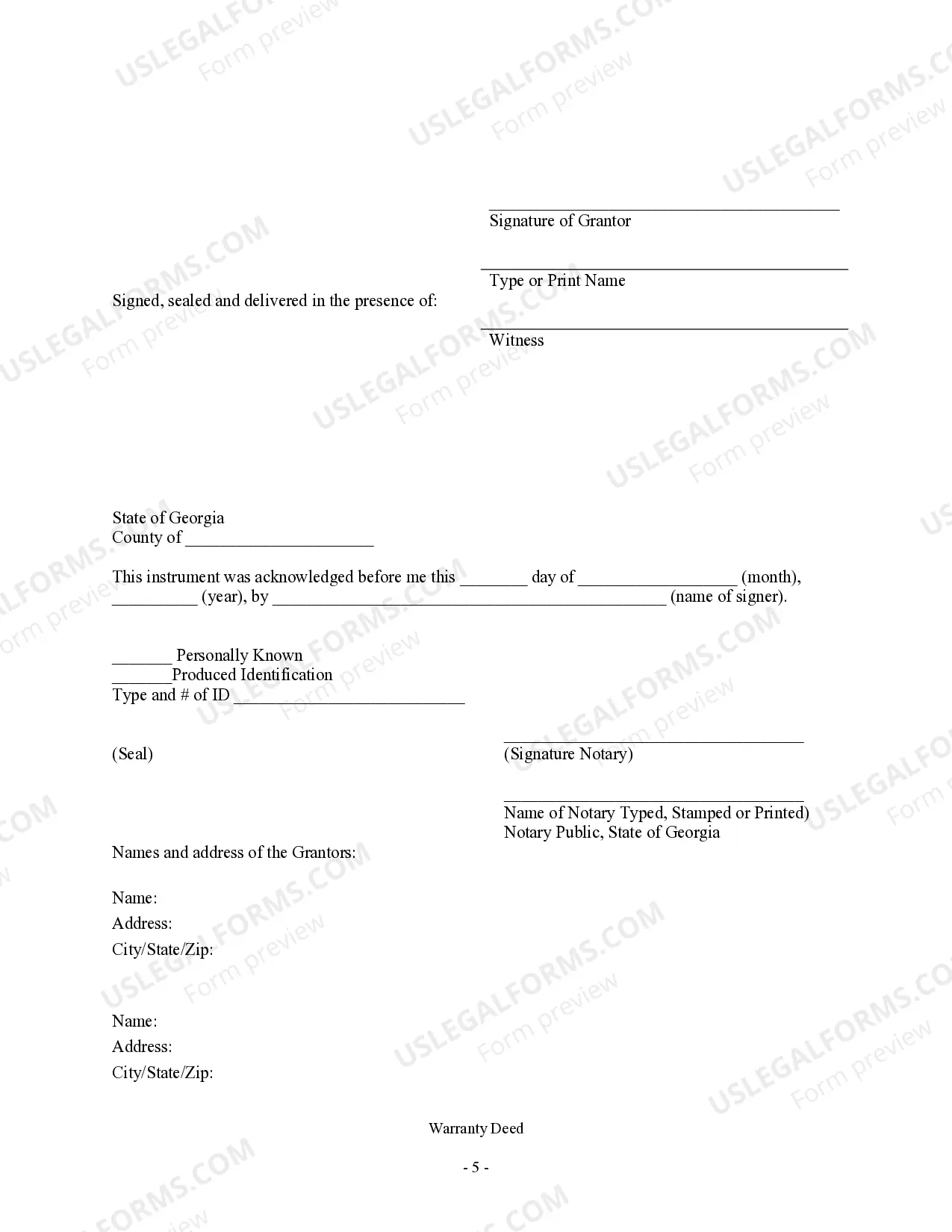

This form is a Warranty Deed between the two individual Grantors and the individual Grantee. Grantors convey and warrant the described property to the Grantee. This deed complies with all state statutory laws.

Atlanta Georgia Warranty Deed - Two Individuals to One Individual

Description

How to fill out Georgia Warranty Deed - Two Individuals To One Individual?

Regardless of one's social or professional standing, finalizing legal paperwork is an unfortunate requirement in today's occupational landscape.

Frequently, it’s nearly impossible for an individual lacking legal expertise to draft such documents from the ground up, primarily due to the intricate jargon and legal nuances they involve.

This is where US Legal Forms can be a game changer.

Verify that the form you discovered is appropriate for your locality since the regulations applicable to one state or county may not apply to another.

Preview the document and examine a brief description (if available) to understand the context in which the paper can be utilized.

- Our platform provides an extensive library with over 85,000 ready-to-use, state-specific documents suitable for nearly every legal scenario.

- US Legal Forms also serves as a valuable asset for associates or legal advisors aiming to conserve time with our DIY forms.

- Whether you need the Atlanta Georgia Warranty Deed - Two Individuals to One Individual or any other document applicable in your locality, everything you need is just a click away with US Legal Forms.

- Here's how to quickly acquire the Atlanta Georgia Warranty Deed - Two Individuals to One Individual using our reliable platform.

- If you are a returning customer, you can directly Log In to your account to access the right form.

- However, if you are not acquainted with our repository, make sure to follow these guidelines before procuring the Atlanta Georgia Warranty Deed - Two Individuals to One Individual.

Form popularity

FAQ

(3) A joint tenancy may be severed by either owner's ?recording of an instrument which results in his or her lifetime transfer of all or a part of his or her interest??(4) Typically, one joint tenant will execute a quitclaim deed of his interest in the property to a third party.

Georgia Quit Claim Deed Also called a non-warranty deed, a quitclaim is one of the methods for transferring residential or commercial property between family members. This legal form conveys only that interest held by the grantor and a title to real estate.

If one of the co-owners dies, his share in the property does not pass to the other co-owners but to the person named in the will of the deceased. The inheritor becomes a tenant-in-common with the other surviving co-owners. This is usually when siblings pool money to buy property.

Property owned in joint tenancy automatically passes to the surviving owners when one owner dies. No probate is necessary. Joint tenancy often works well when couples (married or not) acquire real estate, vehicles, bank accounts or other valuable property together.

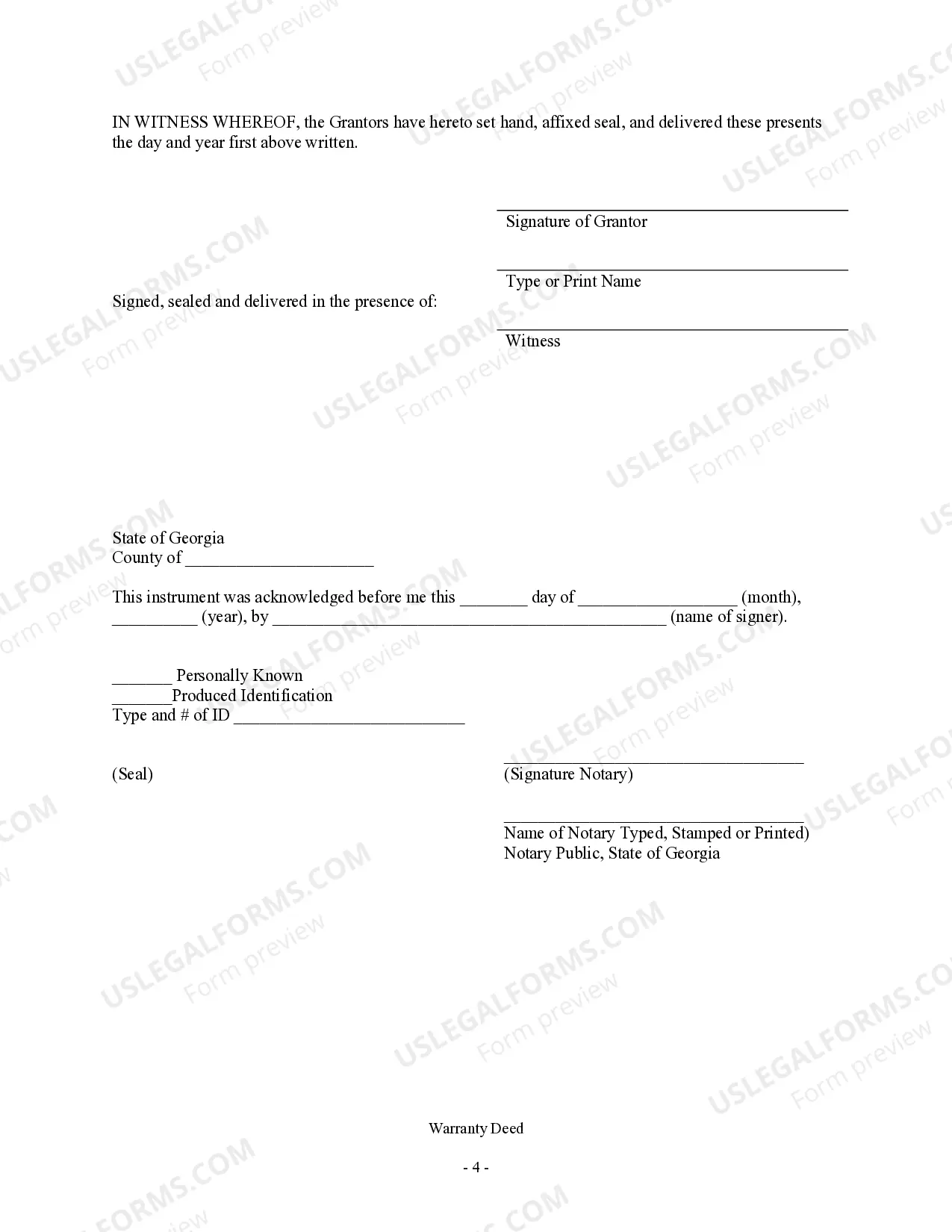

Here are the steps to completing a deed transfer in Georgia: Names the Current Owner and New Owner. Contains a Description of the Property. Signed by Current Owner. Two Witnesses: Unofficial Witness & Notary Public. Complete a PT-61, Transfer Tax Form. Record Deed in County Real Estate Records.

The transfer of the property is usually in the form of a donation (a gift) or the sale of the property to the child. A written contract must be entered into between the parent and child. The following should be carefully considered and the advice of an expert should be obtained.

As joint tenants, each person owns the whole of the property with the other. If one co-owner dies, their interest in the property automatically passes to the surviving co-owner(s), whether or not they have a will. As tenants in common, co-owners own specific shares of the property.

Georgia Gift Deed Information. Gift deeds convey title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to gift property as a charitable act or donation, these conveyances occur during the grantor's lifetime.

The State of Georgia Transfer Tax is imposed at the rate of $1.00 per thousand (plus $0.10 / hundred) based upon the value of the property conveyed. Example: A property selling for $550,000.00 would incur a $550.00 State of Georgia Transfer Tax.

Normally when property is purchased jointly there is a survivorship clause, meaning that on the death of one of the joint owners, their share in the property automatically passes to the survivor(s).