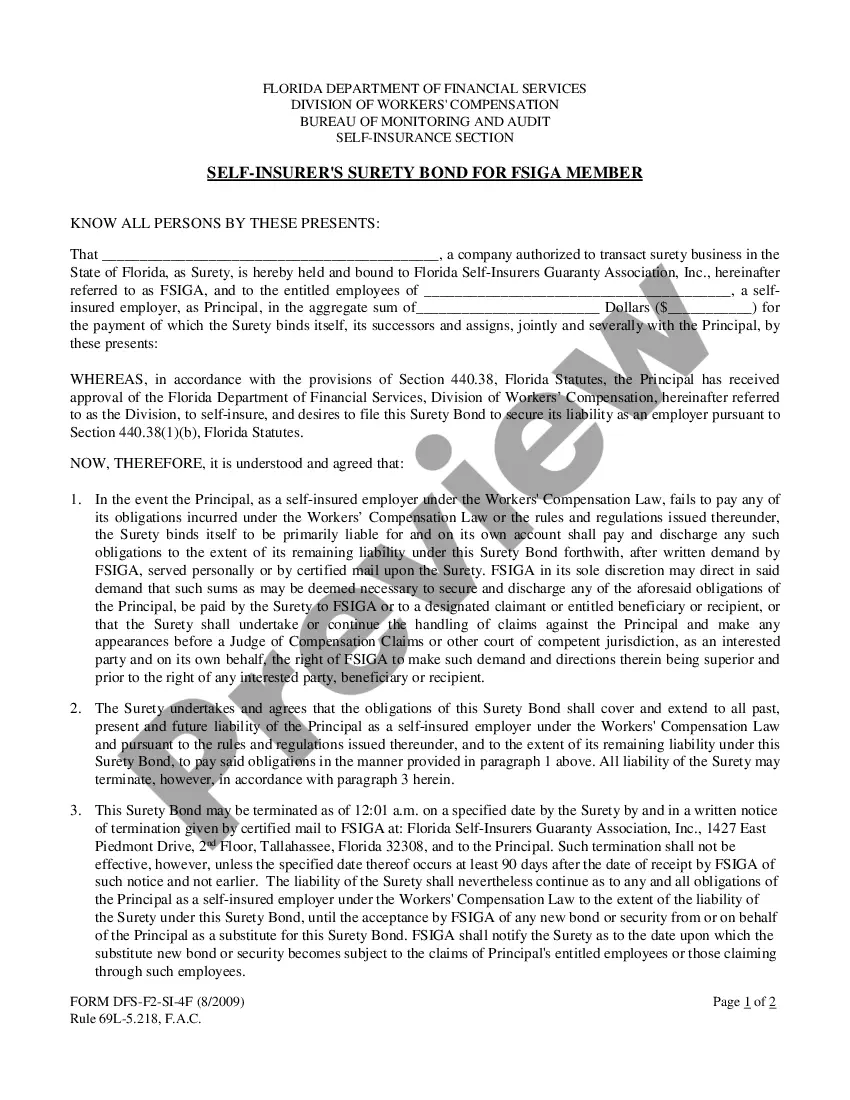

Palm Beach Florida Self-Insurers Surety Bond

Description

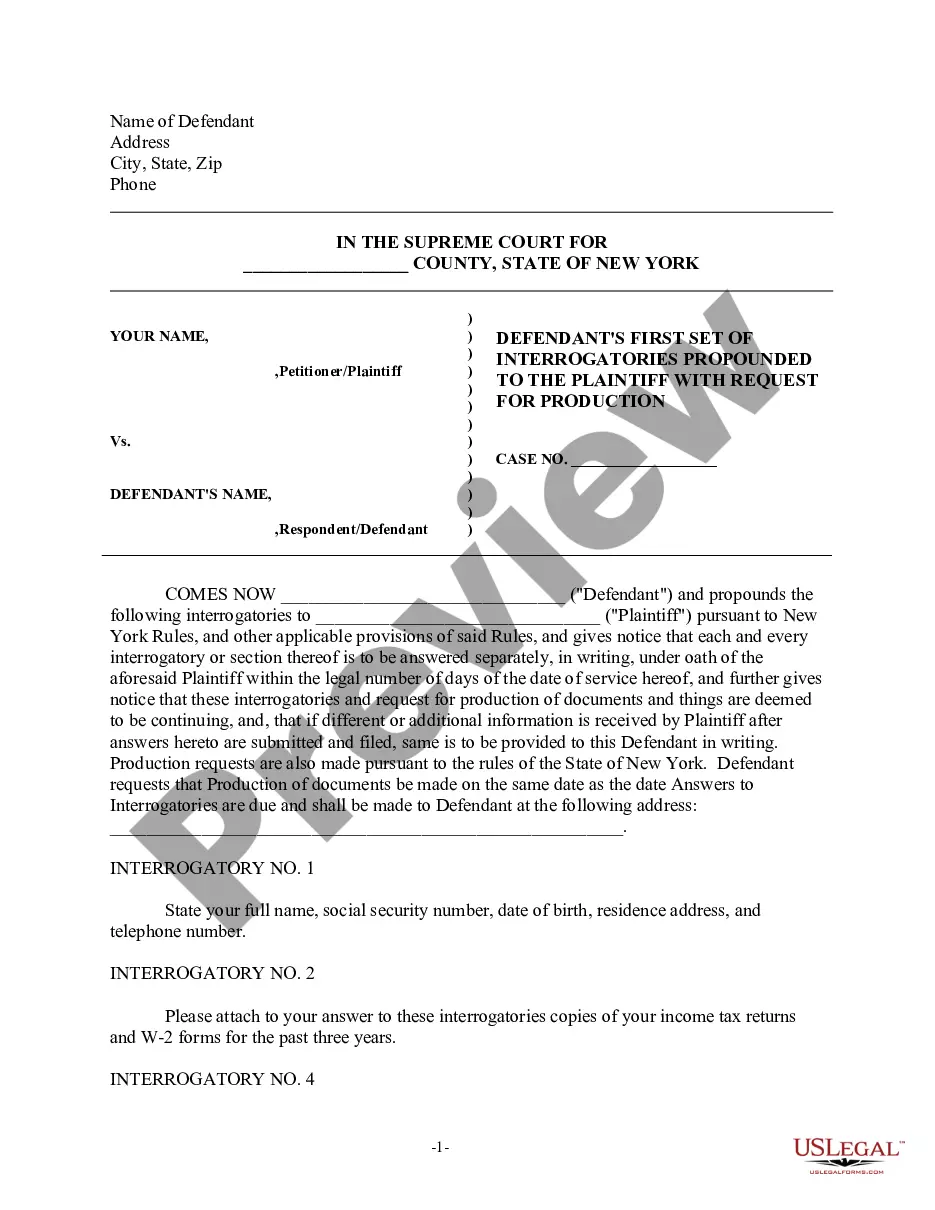

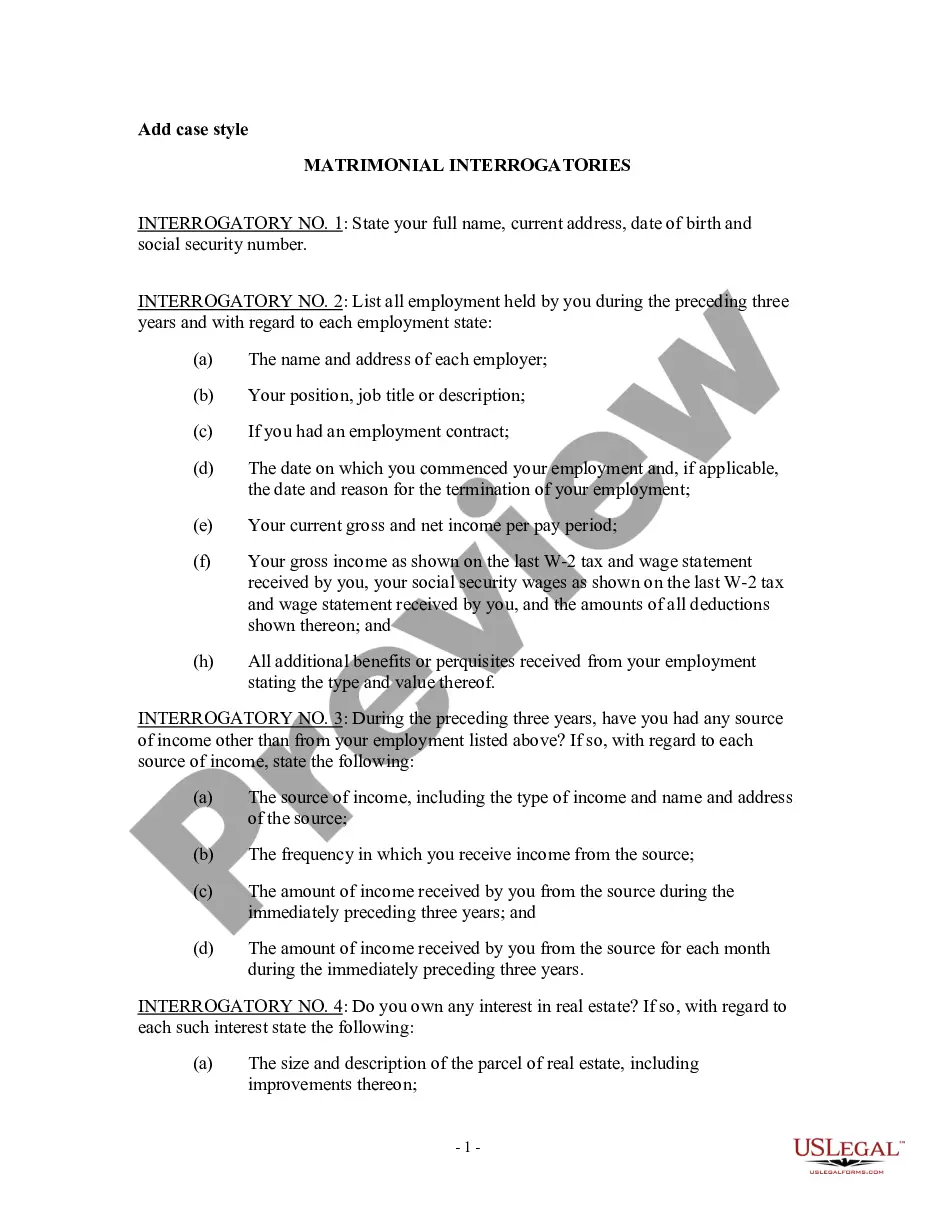

How to fill out Florida Self-Insurers Surety Bond?

Do you require a reliable and economical legal forms provider to obtain the Palm Beach Florida Self-Insurers Surety Bond? US Legal Forms is your primary choice.

Whether you need a straightforward agreement to establish rules for living together with your spouse or a bundle of paperwork to process your divorce through the court, we have you covered. Our site offers over 85,000 current legal document templates for personal and business use. All templates we provide are not generic and tailored according to the regulations of particular states and counties.

To acquire the form, you must Log In to your account, find the necessary form, and click the Download button adjacent to it. Please remember that you can download your previously acquired document templates at any time from the My documents section.

Are you a newcomer to our website? No problem. You can create an account in a few minutes, but before proceeding, ensure to do the following.

You can now set up your account. Then select the subscription plan and continue to payment. Once the transaction is finalized, download the Palm Beach Florida Self-Insurers Surety Bond in any available format. You can revisit the website at any time and redownload the form free of charge.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal papers online for good.

- Check if the Palm Beach Florida Self-Insurers Surety Bond complies with the laws of your state and locality.

- Review the form's specifications (if available) to understand who and what the form is meant for.

- Reinitiate the search if the form is not applicable for your legal needs.

Form popularity

FAQ

Filling out a surety bond form involves providing specific information about your business, the obligations you are securing, and the parties involved. For a Palm Beach Florida Self-Insurers Surety Bond, it’s essential to gather the necessary details and follow the form's instructions closely. Utilizing resources from US Legal Forms can simplify this process, providing you with templates and guides tailored to your needs. By following these steps carefully, you can ensure a smooth submission.

You can complete a surety bond on your own, but it often requires a clear understanding of the process and documentation necessary for a Palm Beach Florida Self-Insurers Surety Bond. Many individuals find it beneficial to work with an expert or a platform like US Legal Forms to ensure that they meet all legal requirements. Completing the bond correctly helps protect your interests and ensures compliance with local regulations. This way, you can focus on other important aspects of your business.

insured bond is similar to a standard surety bond but is designed for those who wish to selfinsure their risks. By utilizing this type of bond, businesses can prove their financial capability to meet obligations without relying on a thirdparty insurer. If you are looking for a Palm Beach Florida SelfInsurers Surety Bond, this option can support your business strategy while showcasing your risk management capabilities.

To get a surety bond in Florida, you typically need to apply through a licensed surety bond agency or provider. Your financial history, credit score, and the specific bond type will be evaluated to determine eligibility. For a Palm Beach Florida Self-Insurers Surety Bond, using a platform like uslegalforms can simplify the process and help you meet all necessary requirements efficiently.

A self insurance bond is a bond that allows individuals or businesses to bypass traditional insurance by setting aside funds to cover potential liabilities. This bond signifies that the self-insured party can fulfill their financial obligations without relying on an insurance company. For those in need of a Palm Beach Florida Self-Insurers Surety Bond, this option provides more control over their financial resources.

The purpose of an insurance bond is to provide financial security and assurance in various transactions. It protects against potential losses or damages resulting from contractual obligations. In the context of a Palm Beach Florida Self-Insurers Surety Bond, it ensures that the obligations of self-insurers are met, which is essential for maintaining trust in business dealings.

To calculate a Palm Beach Florida Self-Insurers Surety Bond, start by determining the bond amount required for your specific business needs, which typically matches the contractual obligation or legal requirement. Next, consider the underwriting factors, including the financial stability of your business and any claims history. Insurers often evaluate your credit score and other financial metrics to set the premium, which usually ranges from 1% to 15% of the total bond amount. By working with a reputable provider, like US Legal Forms, you can get more tailored assistance in calculating the bond and understanding the application process.