Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Florida Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

We consistently strive to lessen or evade legal repercussions when navigating intricate law-related or financial matters.

To achieve this, we enlist legal solutions that, typically, incur significant expenses.

Nonetheless, not every legal issue is of equal intricacy. The majority can be handled independently.

US Legal Forms is an online directory of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it from within the My documents tab. The process is equally simple if you’re a newcomer to the website! You can establish your account in mere minutes. Ensure that the Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation aligns with the laws and regulations of your state and area. Additionally, it’s crucial to review the form’s description (if provided), and if you detect any inconsistencies with what you initially sought, look for an alternative form. Once you've confirmed that the Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation is suitable for your situation, you can select the subscription option and process the payment. You can then download the form in any appropriate format. For over 24 years, we’ve assisted millions by providing customizable and current legal documents. Make the most of US Legal Forms now to conserve effort and resources!

- Our platform enables you to manage your affairs without resorting to an attorney.

- We provide access to legal document templates that are not always readily available to the public.

- Our templates are tailored to specific states and areas, simplifying the search process considerably.

- Benefit from US Legal Forms whenever you need to obtain and download the Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation or any other document swiftly and securely.

Form popularity

FAQ

To obtain a mortgage satisfaction letter, you should contact your lender directly after paying off your mortgage. Once your lender confirms that all obligations are met, they will issue a satisfaction letter that outlines the release of your mortgage. In Orange Florida, satisfaction, release, or cancellation of mortgage by corporation involves specific requirements, so utilizing services like US Legal Forms can help you navigate the process efficiently.

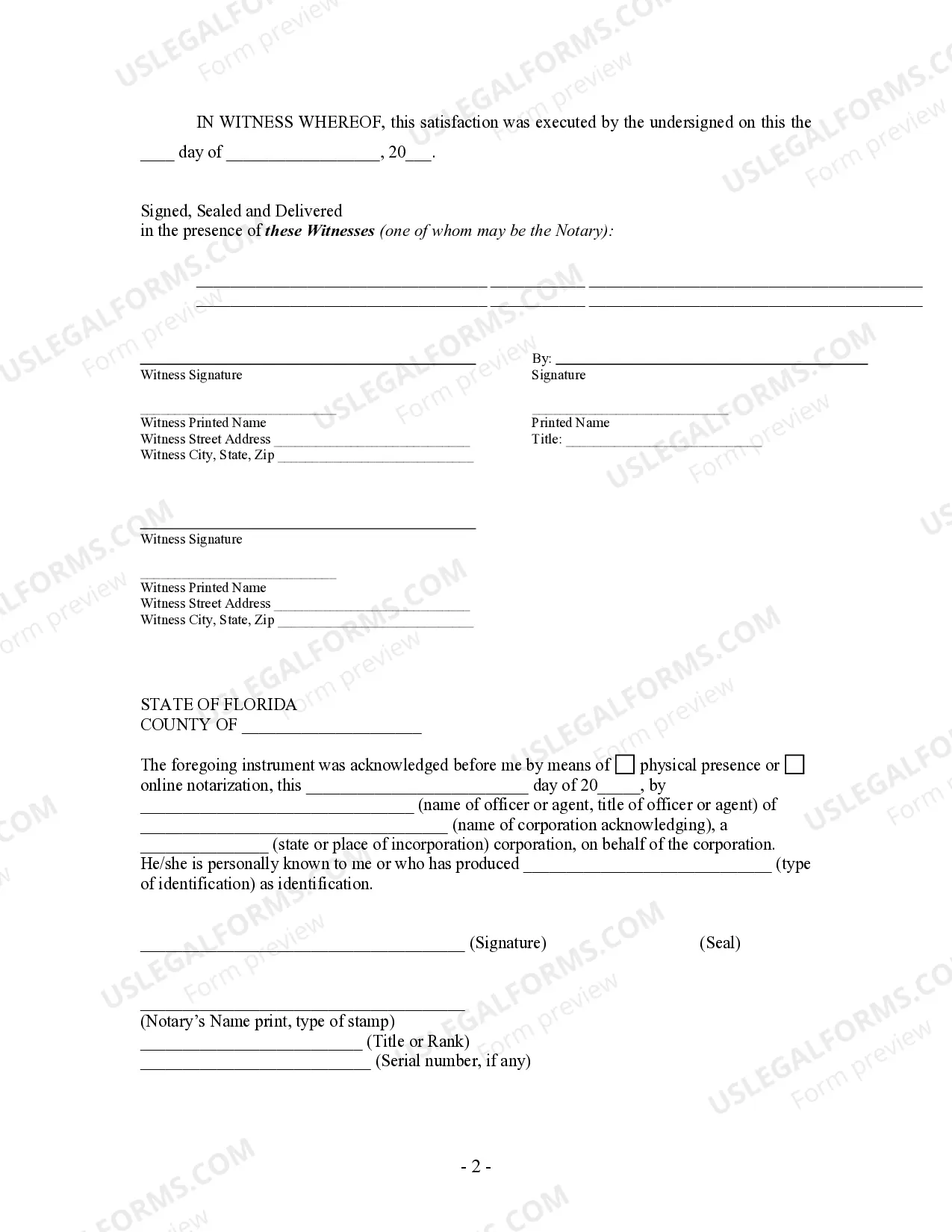

Yes, a satisfaction of mortgage generally requires notarization to ensure its validity. This notarization serves as a verification of the signatures involved, adding a layer of authenticity to the document. In the context of Orange Florida satisfaction, release, or cancellation of mortgage by corporation, notarization is an essential step to ensure the document holds up in legal scenarios. Ensure you consult relevant professionals or platforms like US Legal Forms for assistance.

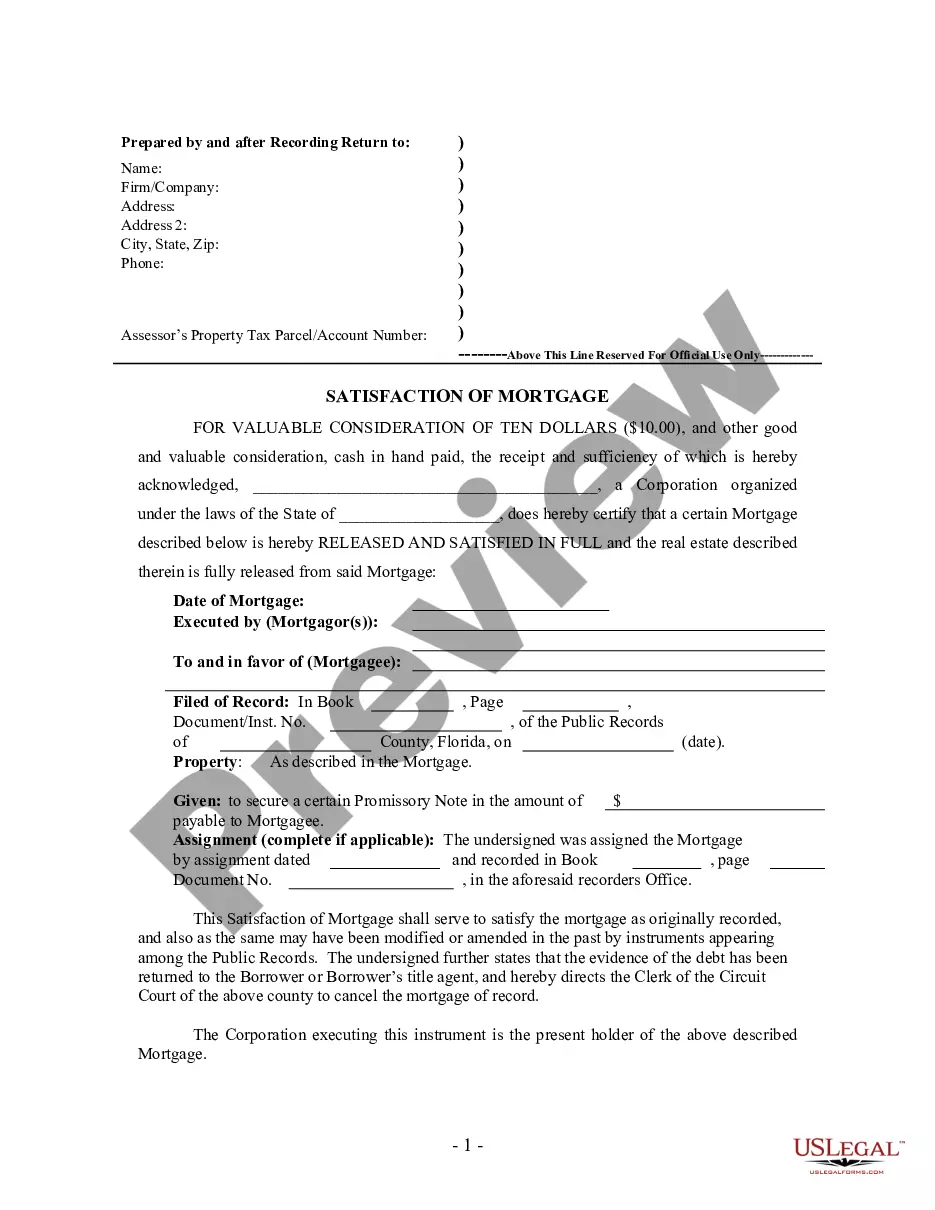

Filling out a satisfaction of mortgage form involves providing specific information about the mortgage agreement, including the names of the parties involved and the property address. It's important to accurately represent all details to comply with the requirements under Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation. For added convenience, platforms like USLegalForms can guide you through the process, ensuring that the form is completed correctly and efficiently.

To record a release of your mortgage, you will need to file the satisfaction document with your local county clerk's office. This step is crucial for establishing that you have completed your payment obligations under the Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation process. Properly recording this document helps prevent any future disputes regarding your mortgage status and secures your ownership rights.

To record a satisfaction of a mortgage in Florida, you must file the satisfaction document with the county clerk’s office where the original mortgage was recorded. Ensure that the document includes correct details, such as the mortgage book and page number. Doing so updates public records and removes the lien from your property. For easy solutions regarding Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, we recommend checking out uslegalforms.

Yes, a mortgage in Florida must be notarized to be valid. The notarization serves as a safeguard, confirming the identity of the signer and the authenticity of the document. This step is imperative whether you are dealing with residential or commercial properties. Always keep in mind the importance of clear processes when navigating Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation.

In Florida, a satisfaction of mortgage typically does not require notarization for the document itself. However, the process may involve signing documents in front of a notary when it comes to the filing of certain related papers. It is always wise to consult a professional to ensure all requirements are met. For queries about Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, utilizing uslegalforms can provide clarity.

When a mortgage is satisfied, the lender officially acknowledges that the debt has been fully repaid. This action removes the mortgage lien from your property. As a result, you gain clear title to the property, which is crucial for future transactions. Understanding this process is vital for those looking into Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation.

Statute 475.41 in Florida outlines the legal obligations of those involved in real estate transactions, particularly related to the cancellation of mortgages. When tackling the complexities of Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation, this statute provides a framework for compliance and protects your interests during property transfers. Knowing this statute helps ensure that your transaction unfolds smoothly.

The 702.11 statute in Florida governs the procedures for a lender's actions related to the foreclosure of a mortgage. This statute is crucial for understanding how Orange Florida Satisfaction, Release or Cancellation of Mortgage by Corporation applies in situations of default. Recognizing your rights under this statute can be pivotal if you experience challenges in managing your mortgage.