Miramar Florida Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

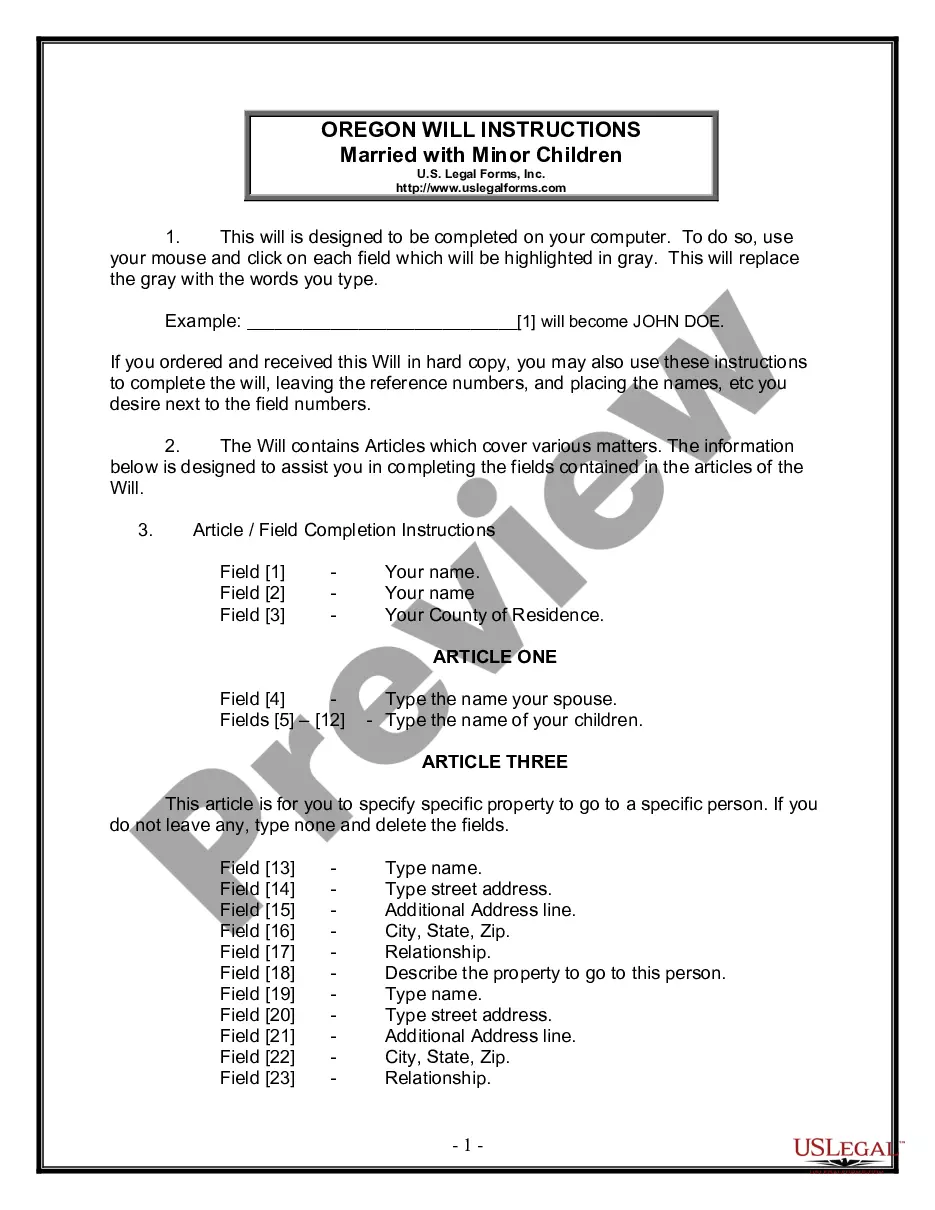

How to fill out Florida Notice Of Assignment To Living Trust?

Regardless of one’s social or occupational standing, completing law-related paperwork is a regrettable requirement in the current job landscape.

Frequently, it’s nearly unattainable for an individual lacking any legal knowledge to compose this type of document from the ground up, primarily due to the complex terminology and legal subtleties involved.

This is the point at which US Legal Forms comes to assist.

You’re all prepared! Now you can proceed to print the document or fill it out online.

If you encounter any issues finding your purchased documents, you can easily access them in the My documents tab.

- Ensure the template you discover is suitable for your locality as the regulations of one region do not apply to another.

- Examine the document and go through a brief description (if provided) of instances where the document may be applicable.

- If the one you chose does not fulfill your requirements, you can restart and look for the appropriate form.

- Click Buy now and select the subscription option you prefer the most.

- Enter your Log In credentials or create a new account from the beginning.

- Select the payment method and proceed to download the Miramar Florida Notice of Assignment to Living Trust once the payment is finalized.

Form popularity

FAQ

While putting your house in a trust can offer benefits, there are some disadvantages to consider. For example, some may face higher taxes if the trust generates income. Additionally, setting up a trust may involve upfront costs and administrative tasks, including filing the Miramar Florida Notice of Assignment to Living Trust. Understanding these potential downsides can help you make an informed decision about your estate planning.

You do not necessarily need an attorney to prepare a living trust in Florida, but having one can help you navigate the complexities of the law. Using platforms like USLegalForms can provide you with templates and guidance for creating valid trust documents, including the Miramar Florida Notice of Assignment to Living Trust. However, an attorney can ensure that your trust meets all legal requirements and effectively addresses your specific needs.

To transfer your property to a trust in Florida, you need to prepare a Notice of Assignment to Living Trust. This document formally assigns ownership of the property to your trust. First, you must create the trust document, and then complete the notice to ensure proper legal transfer. This process provides clarity in property management and helps avoid probate.

To transfer property to a living trust in Florida, you will need to execute a deed that conveys the property into the trust's name. This process generally involves filling out a deed form and properly recording it with the county recorder. By completing these steps, you ensure that your assets are managed according to the terms outlined in your Miramar Florida Notice of Assignment to Living Trust.

No, you do not have to file a trust in Florida to create it, as trusts are private documents. However, if you aim to protect certain assets or clarify ownership, filing a notice may become necessary. Leveraging the Miramar Florida Notice of Assignment to Living Trust can help meet these requirements effectively.

Filing a notice of trust in Florida involves preparing the notice with the required information and then submitting it to the county clerk’s office. You will need to ensure that any real property listed in the trust is mentioned in this notice. Utilizing platforms like uslegalforms can simplify this process significantly.

In general, a trust does not need to be recorded in Florida; however, if it involves real estate transactions, recording the trust can be beneficial. This action provides public notice of the trust's existence and protects the trust's interests. Opting for a Miramar Florida Notice of Assignment to Living Trust can also help establish a clear legal record.

A trust notice in Florida must include the name of the trust, the date it was created, and the names of the trustees. This information helps establish clarity regarding the trust's administration. Including these details in your Miramar Florida Notice of Assignment to Living Trust ensures that all parties are aware of their rights and responsibilities.

To file a notice of trust in Florida, you should prepare a written notice that includes specific details of the trust. This notice should be recorded at the county clerk’s office where the property is located. This step ensures that your intentions regarding the Miramar Florida Notice of Assignment to Living Trust are clear and legally recognized.

In Florida, a trust does not need to be filed with the court. This allows you to maintain privacy and control over your assets. However, when a notice of assignment to a living trust is involved, it’s essential to inform relevant parties. Understanding this process can help ensure that your estate plans are effectively carried out.