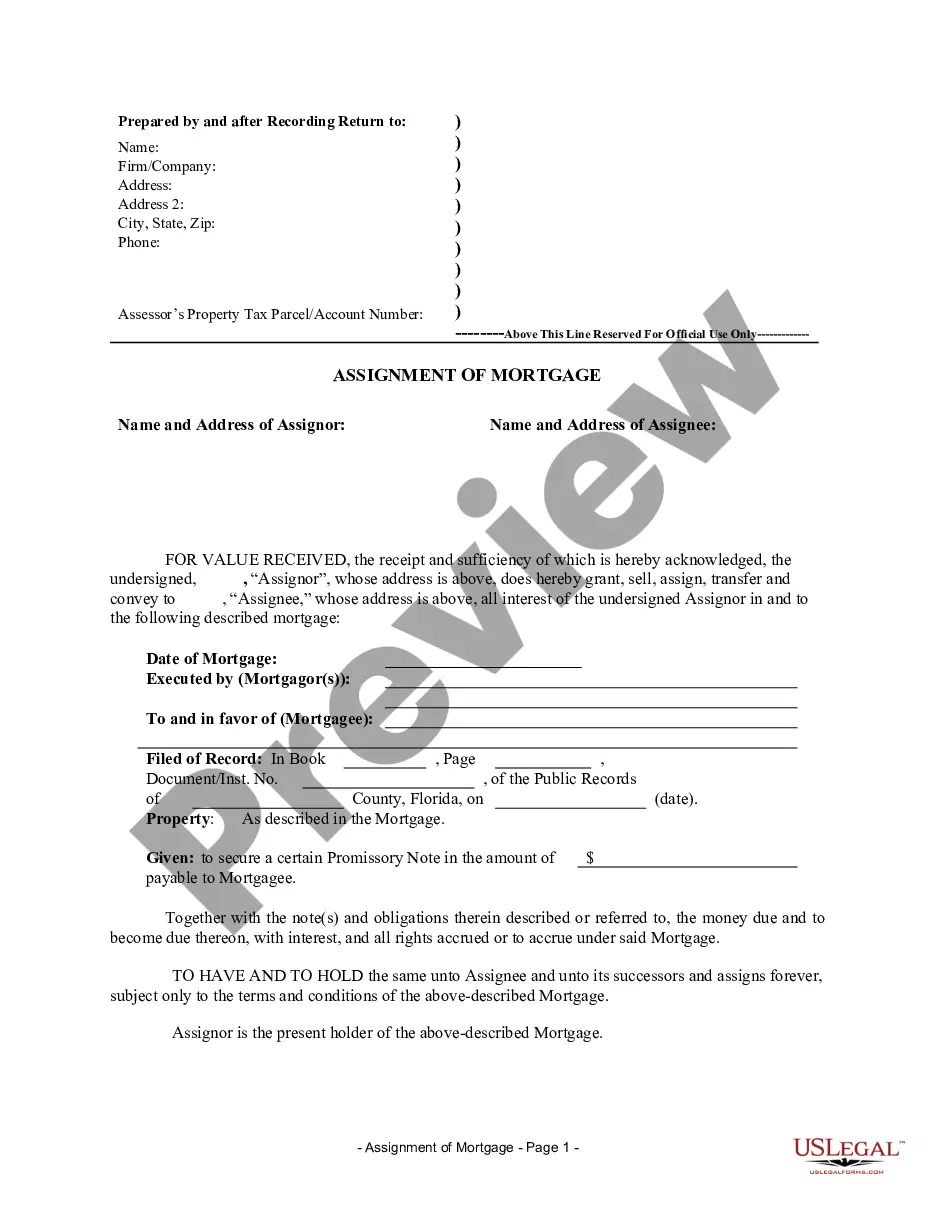

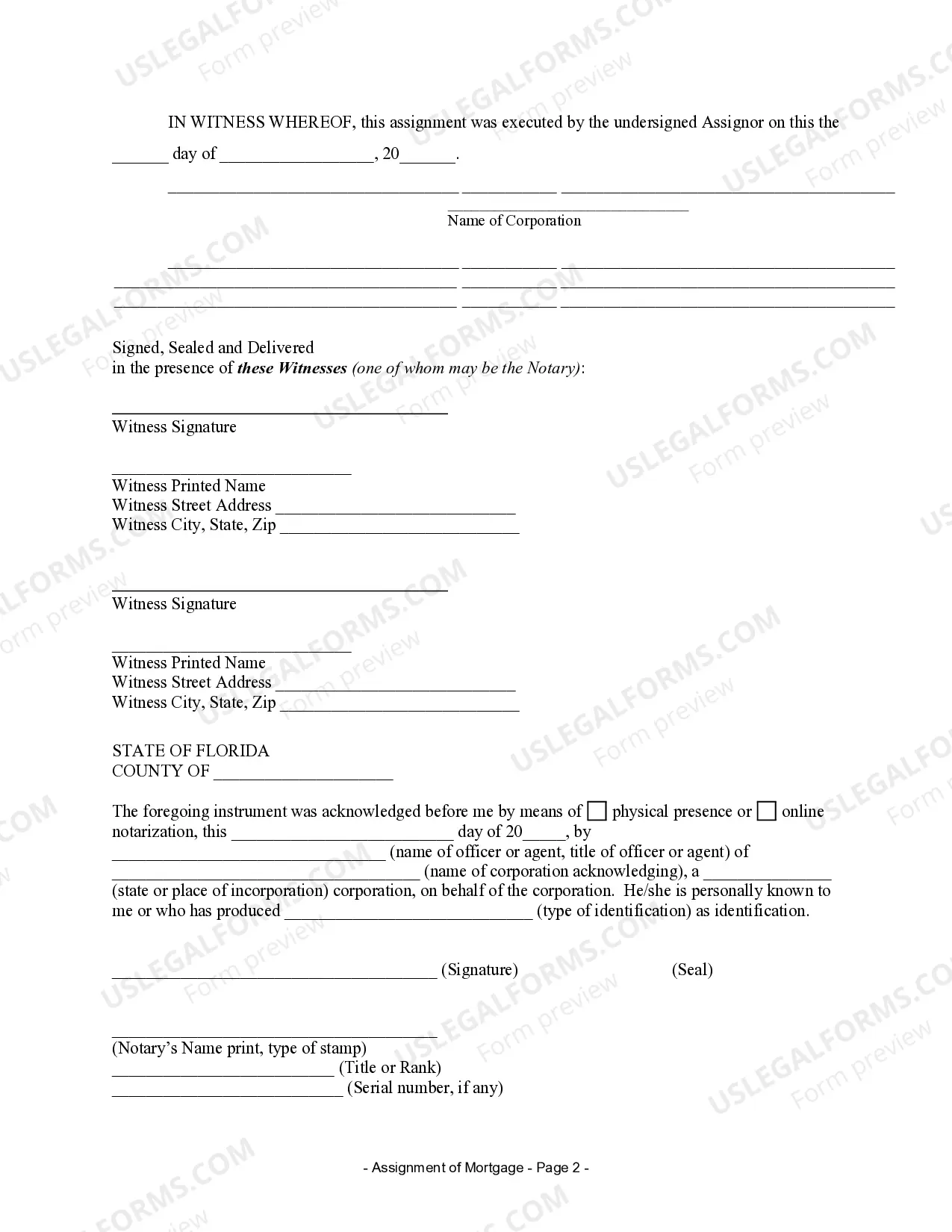

Title: Understanding Hialeah Florida Assignment of Mortgage by Corporate Mortgage Holder Introduction: The Hialeah, Florida Assignment of Mortgage by Corporate Mortgage Holder is a crucial legal process involving the transfer of mortgage rights from one entity to another. This article aims to provide a comprehensive overview of this process while highlighting different types of Hialeah Florida Assignment of Mortgage by Corporate Mortgage Holder. Description: 1. Definition and Purpose of Assignment of Mortgage: The Assignment of Mortgage refers to the legal transfer of a mortgage loan from the original lender (often a corporate mortgage holder) to another party, typically a financial institution or investor. This transfer enables the assignee to become the new mortgage holder and collect payments on the loan. 2. Understanding Corporate Mortgage Holders: Corporate mortgage holders, typically banks or lending institutions, act as lenders in Hialeah, Florida, providing mortgage loans to borrowers. They play a key role as initial lenders before potentially assigning the mortgage to another entity. 3. Primary Reasons for Assignment of Mortgage: a. Loan Sales: Corporate mortgage holders may opt to assign the mortgage to another entity to generate liquidity or reduce risk by selling the loan in the secondary mortgage market. b. Loan Servicing: Mortgage holders may decide to outsource the loan servicing aspect to third-party services who specialize in managing mortgages, thereby assigning the mortgage to another entity. 4. Types of Hialeah Florida Assignment of Mortgage by Corporate Mortgage Holder: a. Interests-only Assignment: In this type, the assignee acquires the rights to collect payments and mortgage interest on the loan. The assignor retains ownership of the mortgage. b. Full Assignment: This type involves the complete transfer of the mortgage loan to the assignee, including both the principal and interest rights. Here, the assignee becomes the new legal owner of the mortgage. 5. Importance of Hialeah Florida Assignment of Mortgage by Corporate Mortgage Holder: a. Legal Clarity: The assignment process ensures a proper record of the transfer of mortgage rights, preventing confusion and potential disputes among parties involved. b. Payment Administration: Assigning the mortgage to another entity allows for efficient payment administration, ensuring borrowers make payments to the correct recipient. c. Risk Management: Assignment of mortgage provides corporate mortgage holders with the ability to mitigate risk by transferring the loan to other entities. Conclusion: The Hialeah Florida Assignment of Mortgage by Corporate Mortgage Holder is a critical process for both lenders and borrowers. It enables corporate mortgage holders to manage risk, generate liquidity, or outsource loan servicing, while borrowers continue making payments with clarity and confidence. Understanding the different types of assignment empowers both parties to navigate the mortgage market effectively.

Hialeah Florida Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Hialeah Florida Assignment Of Mortgage By Corporate Mortgage Holder?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person without any law education to draft such papers from scratch, mostly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our service provides a huge catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you require the Hialeah Florida Assignment of Mortgage by Corporate Mortgage Holder or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Hialeah Florida Assignment of Mortgage by Corporate Mortgage Holder quickly using our trusted service. If you are presently a subscriber, you can proceed to log in to your account to download the appropriate form.

However, in case you are unfamiliar with our platform, make sure to follow these steps prior to downloading the Hialeah Florida Assignment of Mortgage by Corporate Mortgage Holder:

- Ensure the form you have found is specific to your location considering that the regulations of one state or county do not work for another state or county.

- Review the form and go through a quick description (if available) of cases the document can be used for.

- In case the one you selected doesn’t meet your needs, you can start over and search for the needed form.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your credentials or register for one from scratch.

- Select the payment method and proceed to download the Hialeah Florida Assignment of Mortgage by Corporate Mortgage Holder as soon as the payment is done.

You’re good to go! Now you can proceed to print out the form or fill it out online. In case you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.