This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are two Trusts. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Jacksonville Florida Quitclaim Deed

Description

How to fill out Florida Quitclaim Deed?

Locating authenticated templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements, addressing a variety of practical situations.

All the records are systematically organized by usage area and jurisdiction, making the search for the Jacksonville Florida Quitclaim Deed as simple as pie.

Maintaining documentation neat and in accordance with legal standards is crucial. Utilize the US Legal Forms library to always have vital document templates accessible whenever needed!

- Review the Preview mode and document description.

- Ensure you’ve chosen the right one that fulfills your needs and aligns entirely with your local jurisdictional requirements.

- Look for an alternative template, if necessary.

- If you discover any discrepancies, use the Search tab above to locate the appropriate one.

- If it meets your criteria, proceed to the following step.

Form popularity

FAQ

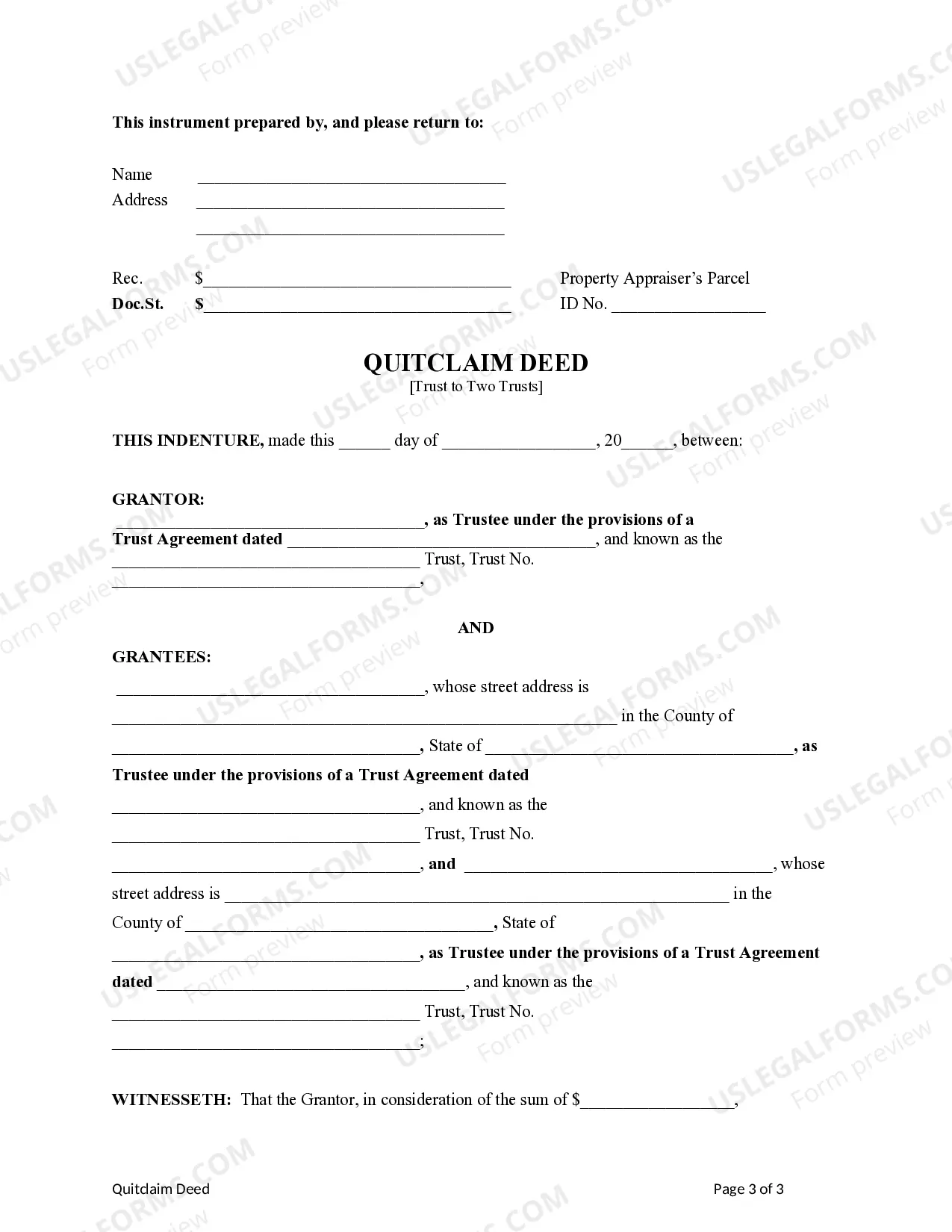

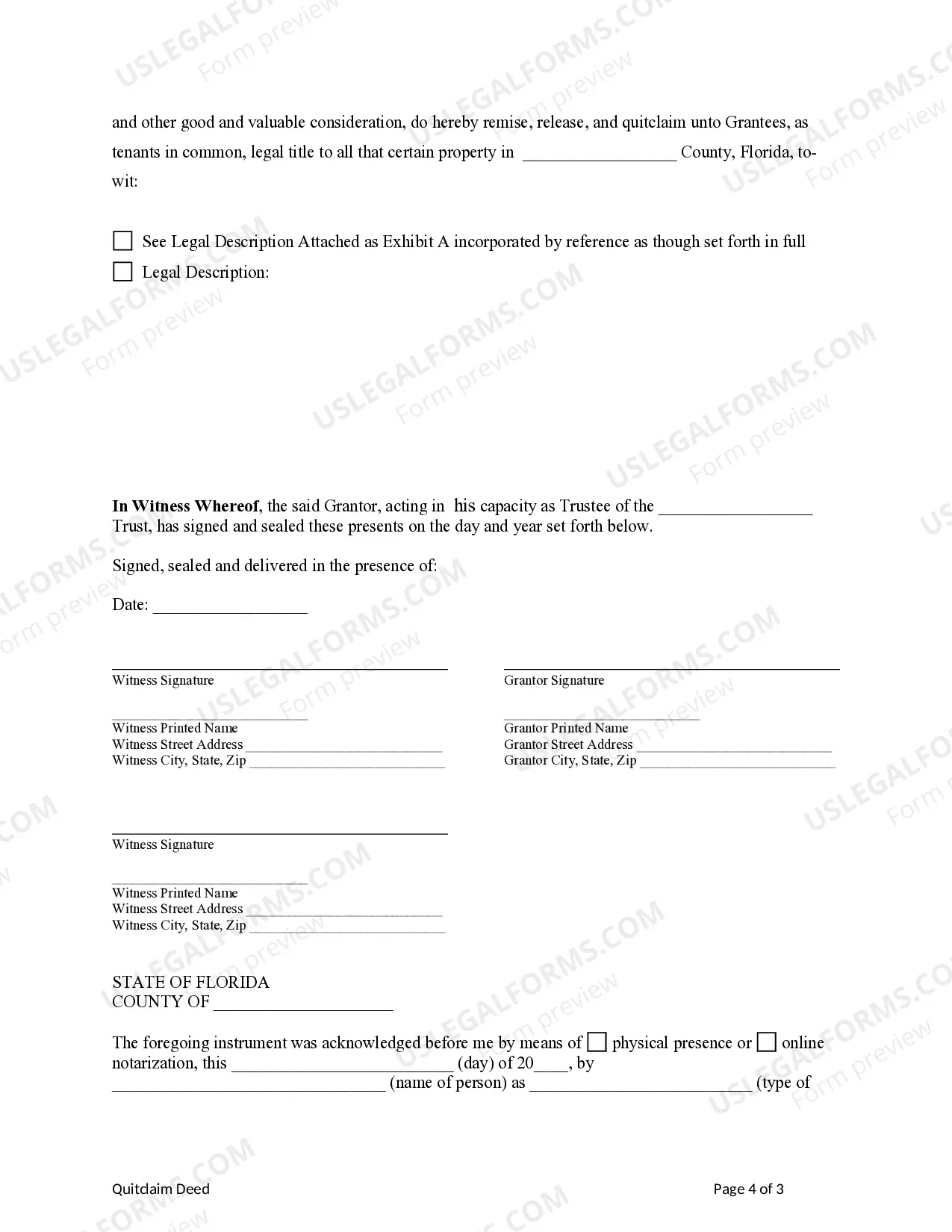

Florida Quitclaim Deeds Should be Properly Filed To ensure the transfer of a quitclaim deed, the original document should be recorded with the county recorder for the county where the relevant property is located. Until the deed is recorded, it is not valid against third-party interests.

Filing With the Clerk A quit claim deed should be filed with the Clerk of Court in the county where the property is located. This will involve taking the deed to the Clerk's office and paying the required filing fee (typically about $10.00 for a one-page quit claim deed).

Pay the fee. The fee to record the deed is $10 for the first page and $8.50 for each additional page. You also must pay taxes. A documentary stamp tax of $. 70 will be levied for each $100 of the sale, transfer, or consideration amount.

Once the form is completed, the deed must be filed with the Recorder of Deed's office in your county. It is advisable to consult with an attorney to assist you in filing a quitclaim deed with the Recorder of Deeds in Florida.

Florida law requires that the grantor must sign the deed in the presence of two witnesses and a notary public. The witnesses must also sign in the presence of the notary.

In fact, taxes may be due on a quit claim deed even when the property is transferred between spouses. With such transfers, if the property is mortgaged, then tax is generally due on half of the outstanding balance.

A person can file a quitclaim deed by (1) entering the relevant information on a quitclaim deed form, (2) signing the deed with two witnesses and a notary, and (3) recording the deed at the county comptroller's office. In Florida, quitclaim deeds must have the name and address of both the grantor and the grantee.

Using a Quitclaim Deed in Florida Florida quit-claim deeds must be properly filed and the original document should be recorded in the county where the property is located. One of the parties will pay the transfer tax to the clerk of the court once the deed has been recorded.