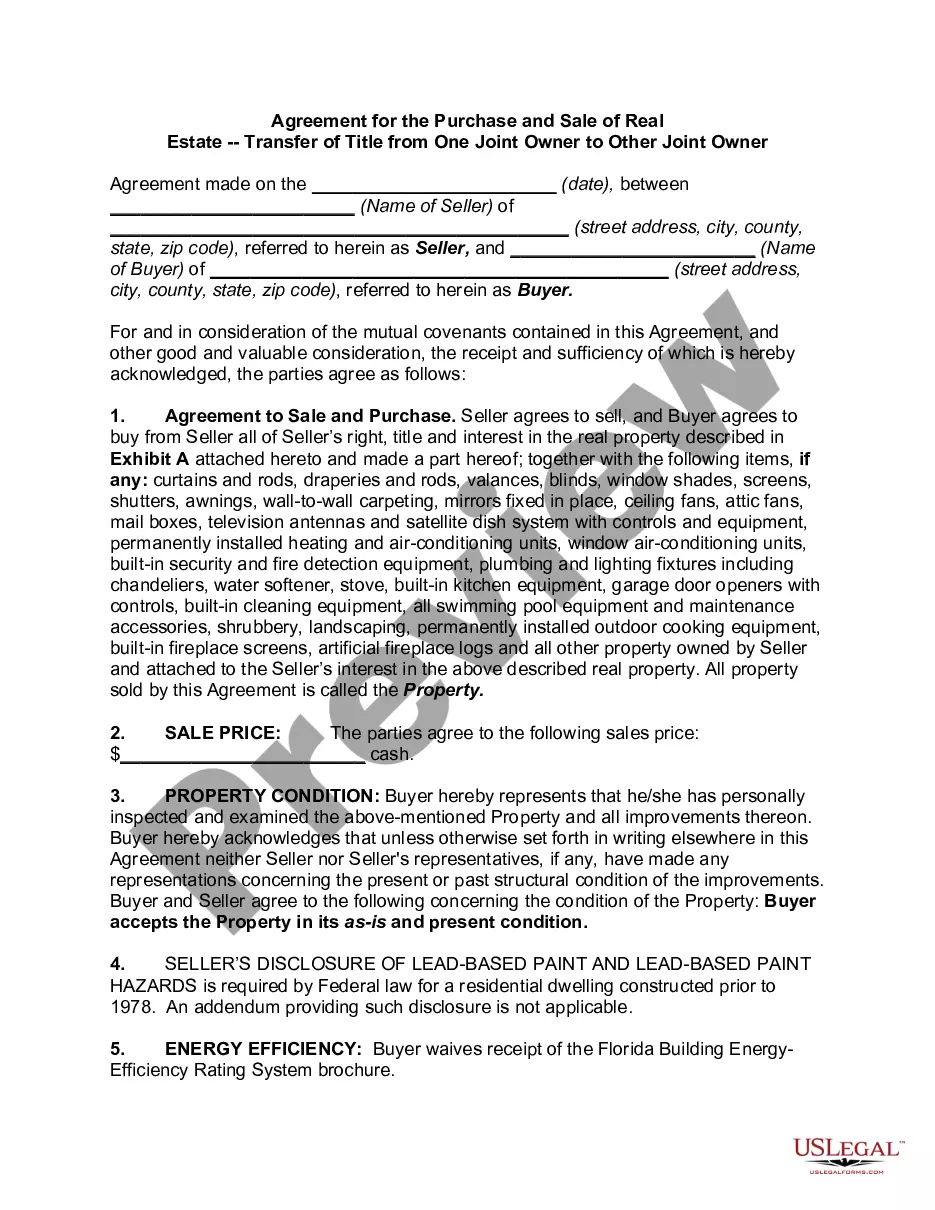

Palm Bay Florida Agreement for the Purchase and Sale of Real Estate Transfer of Title from One Joint Owner to Other Joint Owner

Description

How to fill out Florida Agreement For The Purchase And Sale Of Real Estate Transfer Of Title From One Joint Owner To Other Joint Owner?

Take advantage of the US Legal Forms and gain immediate access to any form you require.

Our advantageous platform with a vast array of document templates enables you to locate and acquire virtually any document sample you desire.

You can download, complete, and validate the Palm Bay Florida Agreement for the Purchase and Sale of Real Estate Transfer of Title from One Joint Owner to Another Joint Owner in just a few minutes instead of searching the internet for hours for an appropriate template.

Using our repository is an excellent method to enhance the security of your record submissions.

If you don't have an account yet, follow the instructions below.

Open the page containing the form you need. Confirm that it is the template you were looking for: check its title and description, and take advantage of the Preview function when available. If not, use the Search field to find the suitable one.

- Our expert legal professionals continually assess all documents to confirm that the forms are suitable for a specific region and adhere to current laws and regulations.

- How can you obtain the Palm Bay Florida Agreement for the Purchase and Sale of Real Estate Transfer of Title from One Joint Owner to Another Joint Owner.

- If you have an account, simply Log In to your profile.

- The Download button will be visible on all the documents you view.

- Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

70 per $100 (or portion thereof) on documents that transfer interest in Florida real property, such as warranty deeds and quit claim deeds. This tax is based on the sale, consideration or transfer amount and is usually paid to the Clerk of Court when the document is recorded.

A new deed must be filed with the local clerk of court's office in order to change the name on a Florida deed, no matter the circumstances leading to the change. Marriages and divorces are some of the most common reasons to alter a deed in Florida. A death in the family may also necessitate a name change to a deed.

Essentially, the property owner who wants to force the actual division or sale of property will petition the Clerk to either physically divide the property and give each owner their own separate parcel or to appoint a commissioner to sell the entire property to a third party and divide the sale proceeds.

Involve a judge. If you can't find a workaround that suits both parties, you do have the option to turn to a judge to compel a sale of the home. Once a judge orders a home to sell, you will need to bring in a real estate agent to sell the home, even if one party isn't happy about it.

A person filing a deed for transfer of Florida real estate ownership must do so through the county comptroller's office where the property is located. There is a small fee for filing and a document stamp tax, which is an excise tax on legal documents delivered, executed or recorded in the state.

A person can file a quitclaim deed by (1) entering the relevant information on a quitclaim deed form, (2) signing the deed with two witnesses and a notary, and (3) recording the deed at the county comptroller's office. In Florida, quitclaim deeds must have the name and address of both the grantor and the grantee.

To transfer a joint ownership property to sole ownership, it is essential for all parties to sign the transfer deed and register it with the Land Registry. People who are interested in becoming the sole owner of the property can buy out the share of their ex-spouse or siblings, or reach a different type of agreement.

Yes! In most cases, ANY co-owner (even a minority owner) can force a sale of the property regardless of whether the other owners want to sell or not.

A joint owner or co-owner means that both owners have the same access to the account. As an owner of the account, both co-owners can deposit, withdraw, or close the account. You most likely want to reserve this for someone with whom you already have a financial relationship, such as a family member.

One of the easiest and most common ways to transfer property rights to another party in Florida is through the use of a quit claim deed. This type of deed conveys the interest you have in a property without providing any warranties or guarantees about the interest you are conveying.