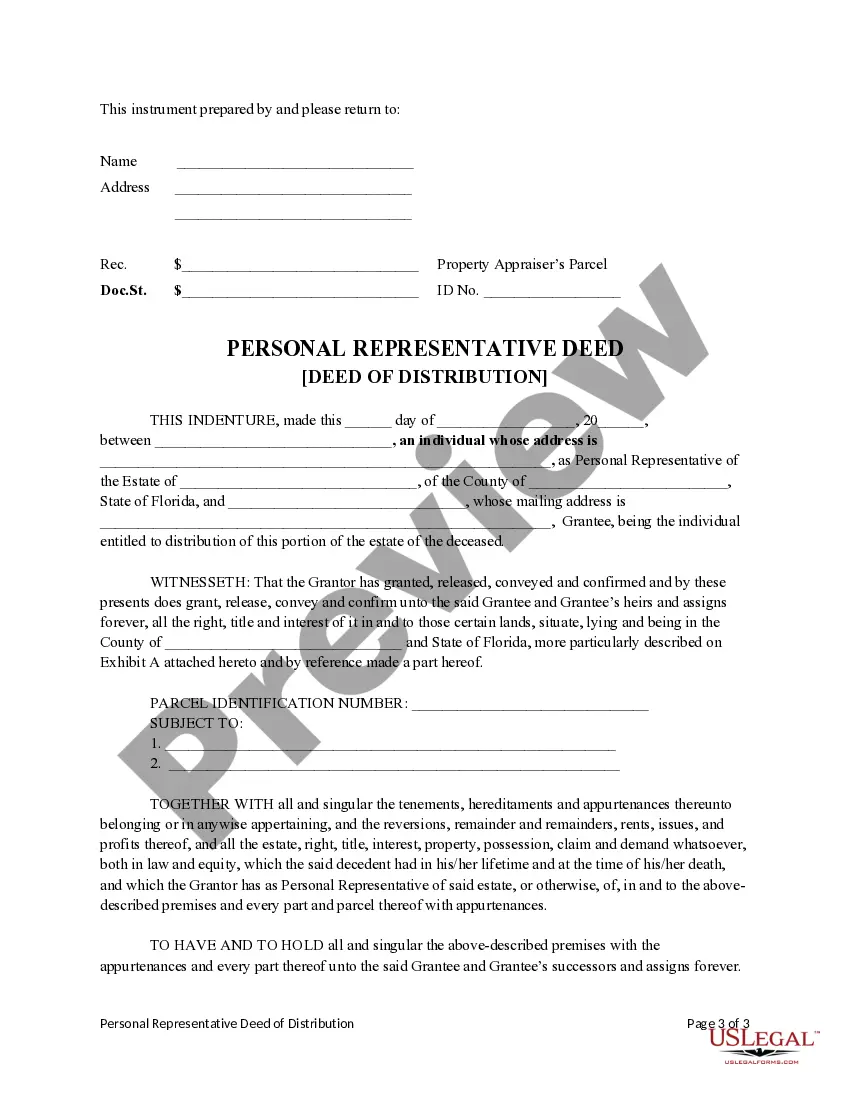

This form is a Personal Representative's Deed of Distribution where the Grantor is an Individual appointed as personal representative of the estate and the Grantee is the beneficiary entitled to receive the property from the estate. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Tallahassee Florida Personal Representative's Deed of Distribution

Description

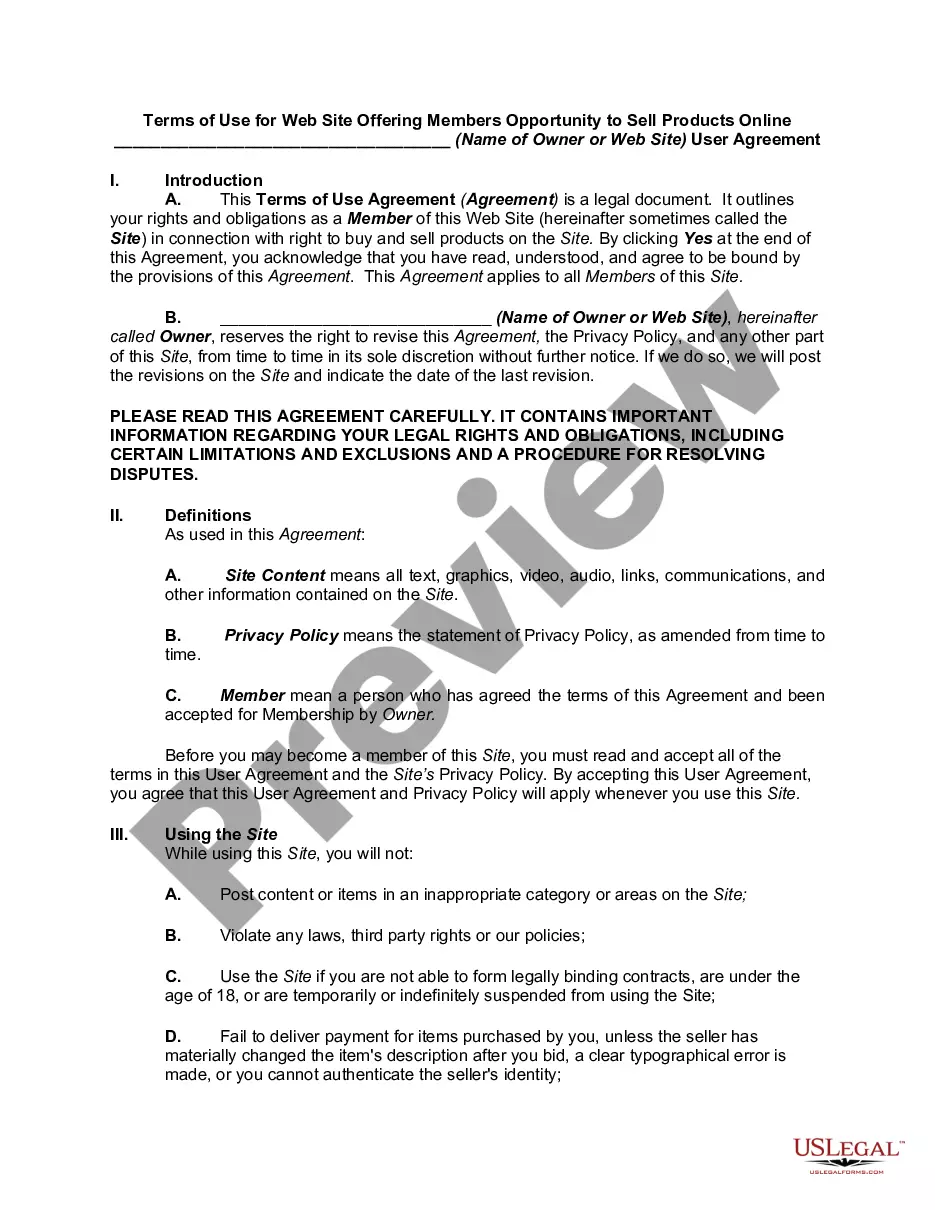

How to fill out Florida Personal Representative's Deed Of Distribution?

Irrespective of social or occupational rank, completing legal documents is a regrettable necessity in today's society.

Too frequently, it’s nearly impossible for someone lacking any legal expertise to create such papers from scratch, largely due to the complex language and legal subtleties they involve.

This is where US Legal Forms steps in to assist.

Ensure the document you have located is suitable for your region since the regulations of one state or region do not apply to another.

Examine the document and review a brief overview (if available) of scenarios for which the document can be applied.

- Our service provides an extensive collection featuring over 85,000 ready-to-use state-specific forms that cater to virtually any legal scenario.

- US Legal Forms also acts as a valuable tool for associates or legal advisors seeking to save time by using our DIY documents.

- Regardless of whether you need the Tallahassee Florida Personal Representative's Deed of Distribution or any other forms that will be valid in your region, with US Legal Forms, everything is at your disposal.

- Here’s how you can obtain the Tallahassee Florida Personal Representative's Deed of Distribution within minutes using our dependable service.

- If you are currently an existing user, you can simply Log In to your account to download the correct form.

- However, if you are not familiar with our archive, make sure to follow these steps before downloading the Tallahassee Florida Personal Representative's Deed of Distribution.

Form popularity

FAQ

According to Florida Probate Code 733.612, ?a personal representative, acting reasonably for the benefit of the interested persons, may properly sell, mortgage, or lease any personal property of the estate or any interest in it for cash, credit, or for part cash or part credit, and with or without security for the

A distribution deed is another way in which to legally transfer real property when the party who is supposed to receive the property cannot be determined from the decedent's will.

Florida Personal Representative's Distributive Deed (intestate) This form is for use by the personal representative of an individual who died without a will. Wills, or last wills and testaments, are estate planning documents used to organize and record how people wish to distribute their assets after death.

A Florida homestead is not subject to probate. Probate proceedings involve only assets subject to creditor claims. The Florida homestead is exempt from creditors, so it is not part of the probate estate.

The personal representative of a Florida estate can sell real property during probate administration. However, as highlighted in the article below, there are some instances when the Florida probate statute requires the estate's executor to get a court order before a property in probate administration can be sold.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

Yes. A personal representative can also be a named beneficiary in the decedent's will. For example, in a family with four siblings, one of the siblings or even the spouse may act as a personal representative. There is no law against it as long as the individual is mentally and physically fit to perform the duties.

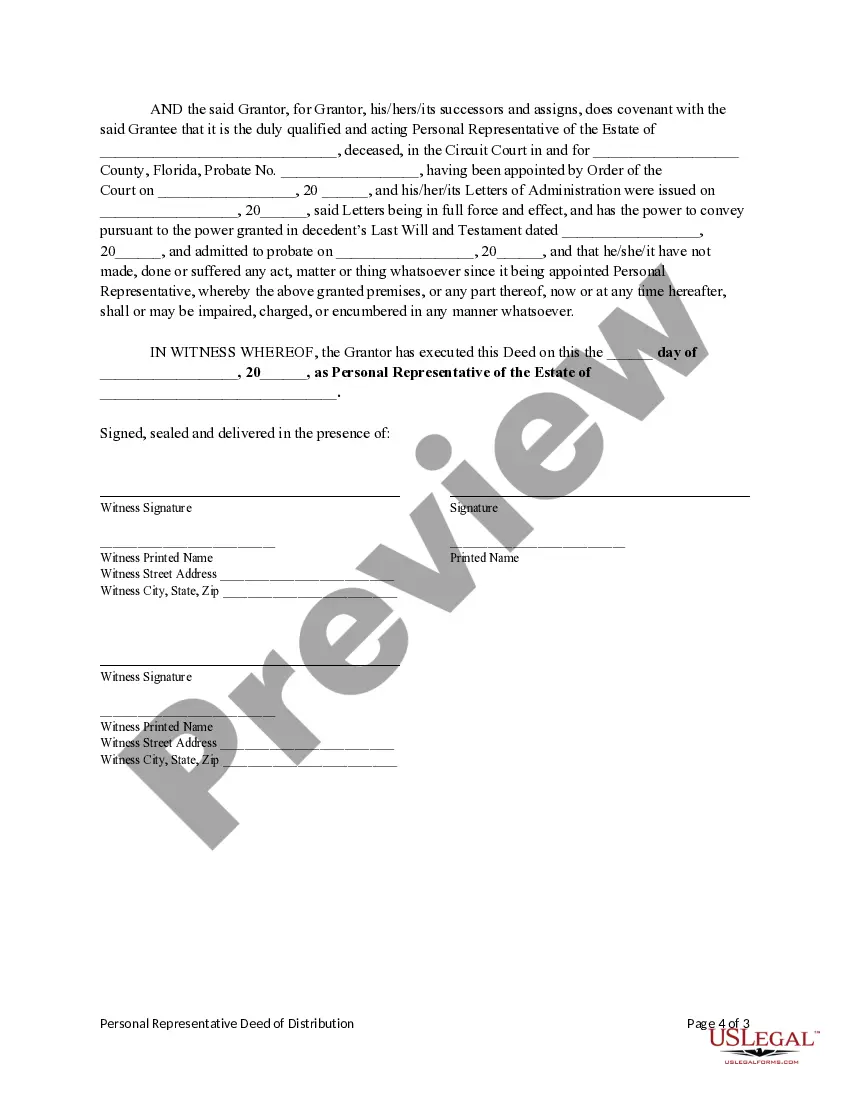

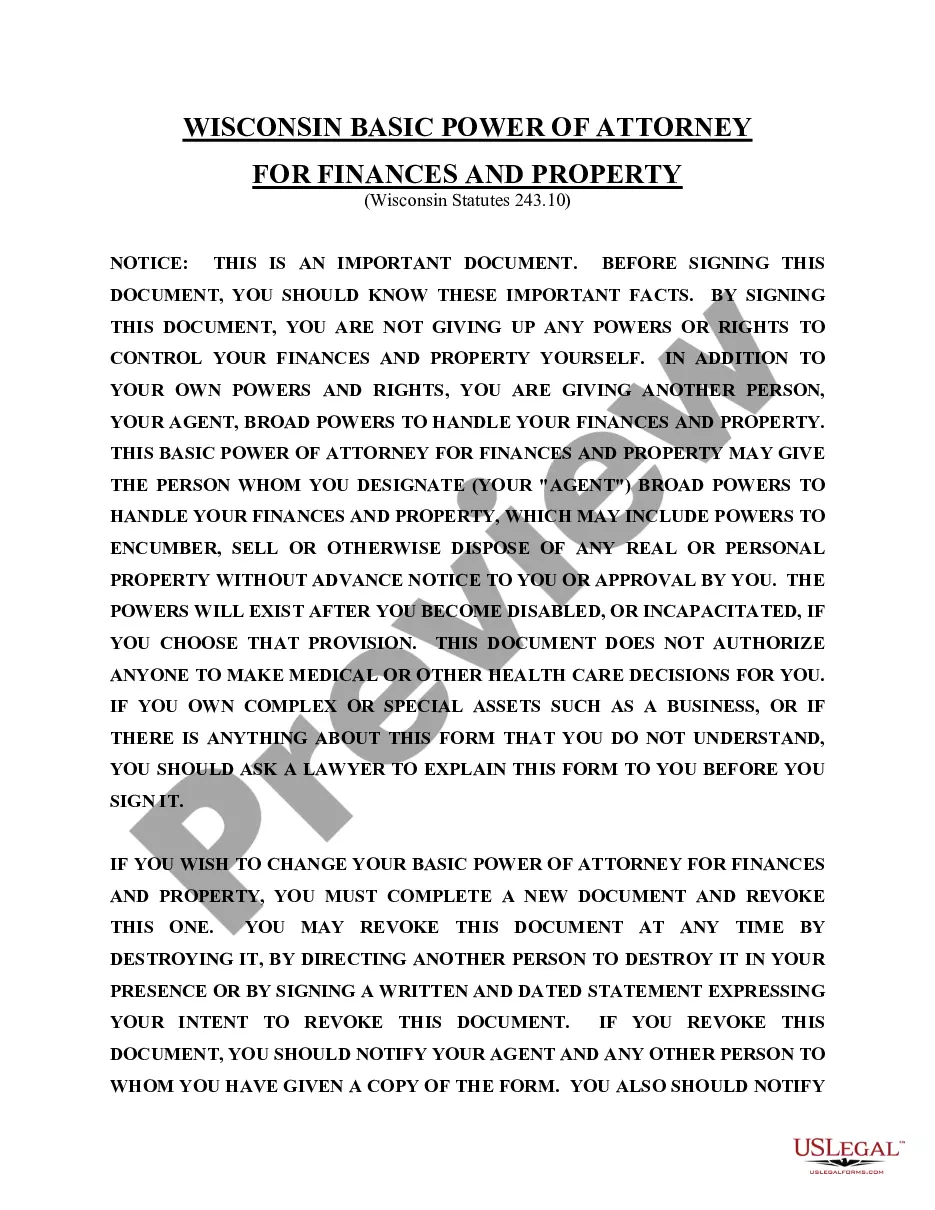

Once appointed, a document called ?Letters of Administration? will be provided to the Personal Representative. This document allows a Personal Representative to open an estate account and deal with third parties to either marshal assets of the deceased or pay any outstanding bills.

(2) Exempt property shall consist of: (a) Household furniture, furnishings, and appliances in the decedent's usual place of abode up to a net value of $20,000 as of the date of death. (b) Two motor vehicles as defined in s.(c) All qualified tuition programs authorized by s.(d) All benefits paid pursuant to s.

On the death of a sole or surviving personal representative, the court shall appoint a successor personal representative to complete the administration of the estate.