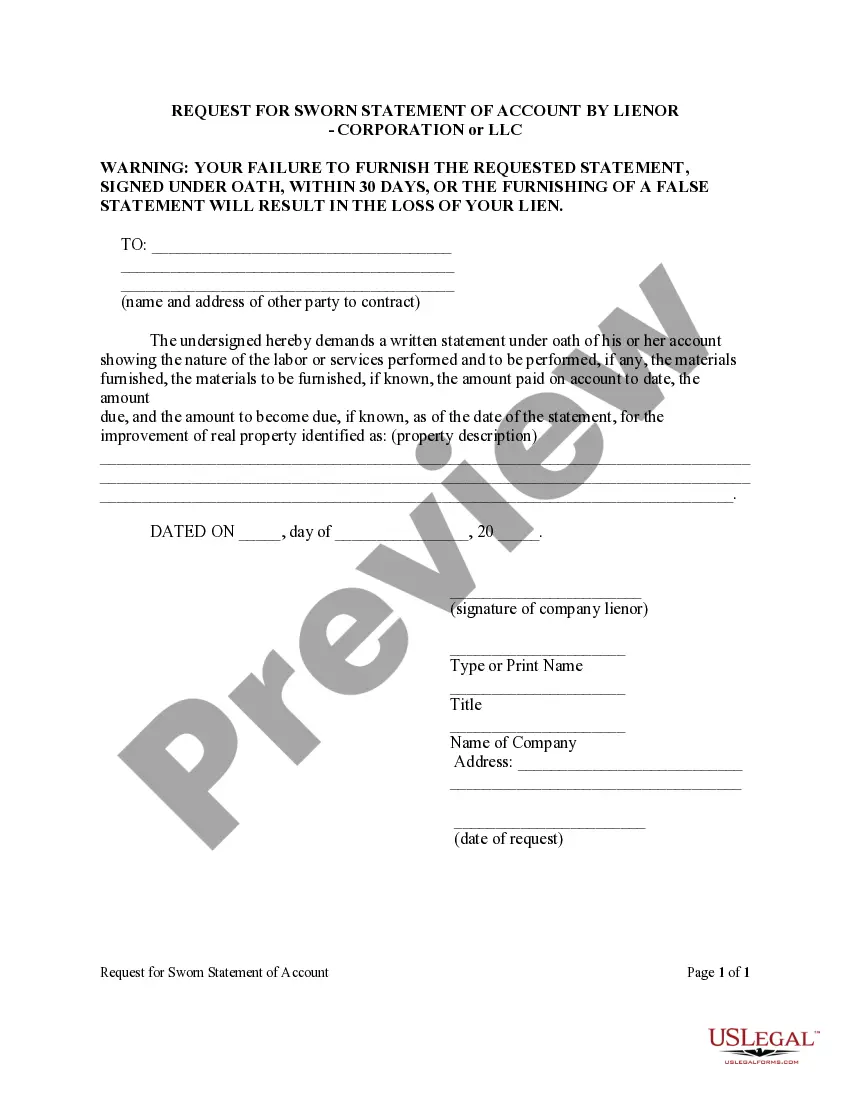

Title: Understanding the Palm Bay Florida Request for Sworn Statement of Account by Lie nor — Corporation or LLC Introduction: When conducting business transactions in Palm Bay, Florida, certain legal requirements must be met, particularly concerning lien holders and account statements. One such requirement is the Palm Bay Florida Request for Sworn Statement of Account by Lie nor, specific to corporations or limited liability companies (LLC). This article aims to provide a comprehensive description of this request, its purpose, and any variations that may exist. Keywords: Palm Bay Florida, Request for Sworn Statement, Account, Lie nor, Corporation, LLC. Overview of the Palm Bay Florida Request for Sworn Statement of Account by Lie nor: The Palm Bay Florida Request for Sworn Statement of Account by Lie nor is a legal document designed to enable corporations or LCS acting as lien holders to request and obtain a detailed statement of account from a debtor. Its purpose is to establish transparency and facilitate the resolution of payment disputes by providing accurate financial information related to the lie nor's account. Key Elements of the Request for Sworn Statement of Account: 1. Identification of Parties: The request clearly identifies the lie nor (corporation or LLC) seeking the account statement and the debtor (property owner) subject to the lien. 2. Sworn Statement: The request must be sworn under oath, certifying the accuracy and completeness of the information provided in the account statement. 3. Account Details: The lie nor is required to provide a detailed breakdown of any outstanding amounts, including principal, interest, costs, and attorney fees related to the lien. Each item must be clearly specified and supported by relevant documentation. 4. Payment History: A comprehensive payment history, covering both the amount received and the allocation of payments made, should be included. This helps establish a clear understanding of the outstanding balance and any potential discrepancies. 5. Supporting Documents: The lie nor should attach all relevant supporting documents, such as invoices, contracts, lien documentation, and any legal notices sent to the debtor. Types of Palm Bay Florida Request for Sworn Statement of Account by Lie nor — Corporation or LLC: While there may not be different versions of the Palm Bay Florida Request for Sworn Statement of Account by Lie nor specifically designated for corporations versus LCS, the request can be tailored to accommodate the specific business structures. The primary difference lies in how the requesting party identifies itself. For a corporation, the request should reflect the corporate name, while for an LLC, the request should reflect the LLC name, along with the appropriate certification or authorization. Conclusion: The Palm Bay Florida Request for Sworn Statement of Account by Lie nor plays a crucial role in maintaining transparency and resolving payment disputes between sailors and debtors. This document, when executed with accuracy and detail, aids in establishing clear financial statements and promotes fair resolutions. Corporations or LCS acting as lien holders in Palm Bay must adhere to the requirements outlined in this request to ensure compliance with the legal framework governing such matters.

Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC

Description

How to fill out Palm Bay Florida Request For Sworn Statement Of Account By Lienor - Corporation Or LLC?

If you’ve already used our service before, log in to your account and save the Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!

Form popularity

FAQ

In Florida, individuals authorized to take a sworn statement include notaries public and certain corporate officers. This process ensures that the sworn statement is legally binding and recognized by the court. If you're seeking a Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC, utilizing a reputable platform like USLegalForms can simplify your submission and ensure compliance.

The purpose of the Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC is to formally document the amounts owed by a debtor. This statement serves as evidence in financial transactions and can help prevent disputes over payments. With this sworn statement, you assert the validity of the account and the need for payment, making it an essential tool for creditors.

A lien release letter is a formal document that indicates that a lien on a property has been removed. This letter is typically issued by the creditor or lienor and confirms that the outstanding debt has been cleared. Receiving this letter is essential in assuring potential buyers or lenders that there are no outstanding claims against your property. The Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC can provide you with the necessary tools to obtain this letter.

A sworn statement of account is a legal declaration detailing the amounts owed to a creditor. This document is often used in construction and real estate transactions to outline payments for work completed. It provides transparency and helps clarify any financial obligations. You can use the Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC to generate this important document.

A release of lien in Florida is a document that confirms the removal of a recorded lien against a property. It serves as proof that the obligations tied to that lien have been satisfied, allowing the property owner to enjoy unrestricted ownership. Obtaining a release is vital for maintaining clear title and avoiding future legal disputes. You might want to explore the Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC for further assistance.

If a contractor places a lien on your house in Florida, it can prevent you from selling or refinancing your property. This action usually occurs when a payment is overdue for work performed. To resolve the lien, you should communicate with the contractor to negotiate payment or seek a release. The Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC can assist you in understanding your options.

After a lien is released, you will need to update your property title to reflect the change. This typically involves recording the release document with your local county clerk's office. It's important to ensure all paperwork is correctly filed to avoid future complications. Utilizing the Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC may streamline this process.

When a lien is released, it signifies that the creditor no longer claims an interest in your property. This release clears the way for you to sell or refinance your home without the burden of that lien. It's an essential process that protects your ownership rights and ensures your property is marketable. The Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC can help you navigate this situation.

Formatting a sworn statement involves writing a clear and straightforward declaration that includes essential elements such as the title, statement of facts, and a concluding oath. Use structured paragraphs to convey the information logically. When preparing your Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC, ensure that your formatting adheres to local legal standards for clarity and professionalism.

To notarize a written statement, you must first prepare the document and then present it to a notary public. During the notarization process, you will need to sign the statement in front of the notary, who will verify your identity and administer an oath. After your signature is witnessed, the notary will complete their portion by adding their seal of approval, making your statement lawful, especially when making a Palm Bay Florida Request for Sworn Statement of Account by Lienor - Corporation or LLC.