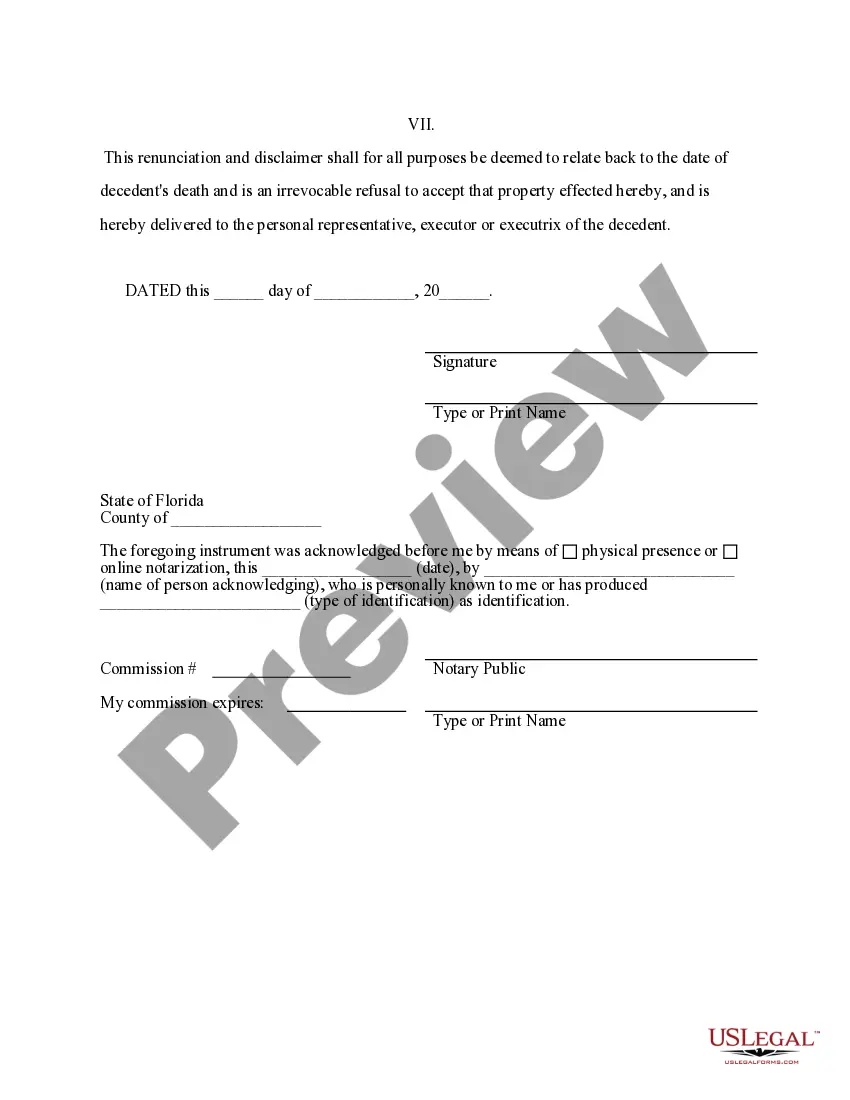

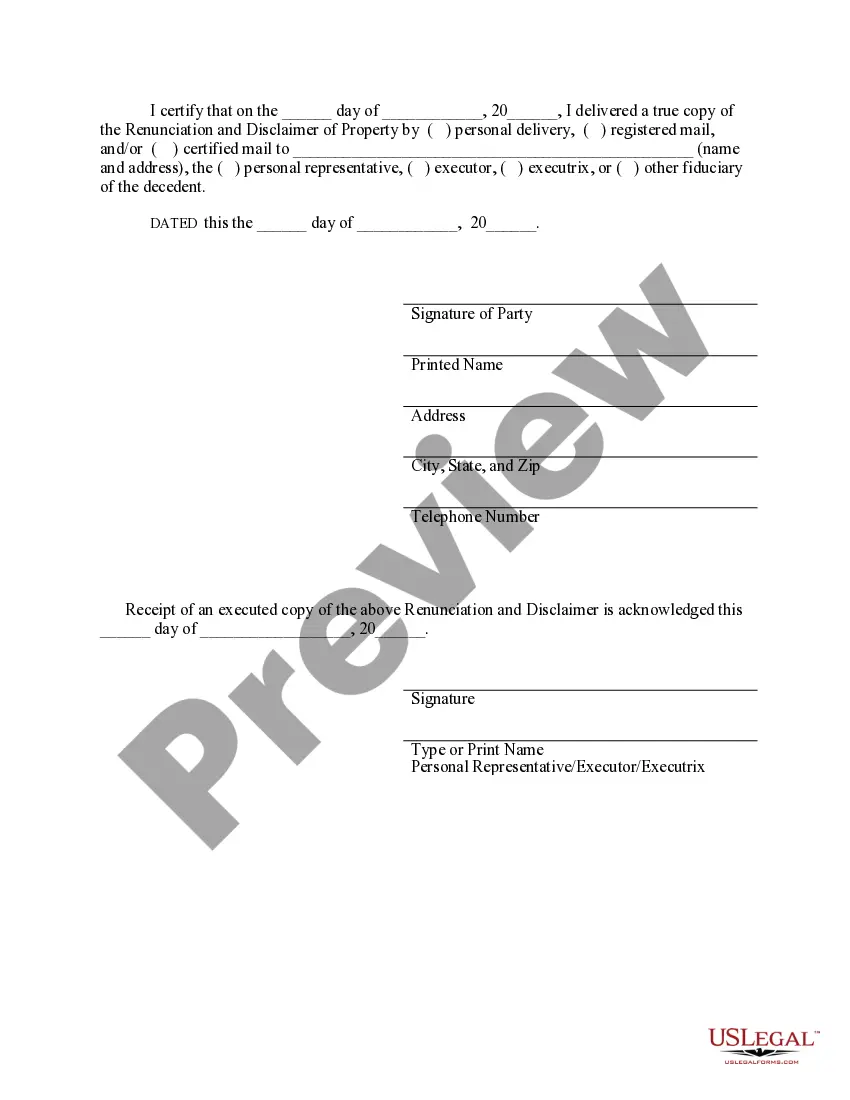

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Palm Bay Florida Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Florida Renunciation And Disclaimer Of Property Received By Intestate Succession?

Are you in search of a reliable and affordable legal documents provider to obtain the Palm Bay Florida Renunciation And Disclaimer of Property resulting from Intestate Succession? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to set guidelines for living together with your partner or a bundle of forms to facilitate your divorce through the courts, we have you covered. Our site offers more than 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic and tailored based on the needs of different states and regions.

To acquire the document, you must Log In to your account, locate the desired template, and click the Download button beside it. Please remember that you can retrieve your previously purchased document templates at any time in the My documents section.

Are you unfamiliar with our platform? No problem. You can create an account quickly, but before doing that, ensure to follow these steps.

You can now set up your account. Then select the subscription option and proceed with payment. After the payment is completed, download the Palm Bay Florida Renunciation And Disclaimer of Property resulting from Intestate Succession in any available format. You can revisit the website anytime and redownload the document at no additional cost.

Obtaining contemporary legal forms has never been simpler. Try US Legal Forms today, and stop wasting hours trying to understand legal documents online once and for all.

- Check if the Palm Bay Florida Renunciation And Disclaimer of Property resulting from Intestate Succession aligns with your state and local requirements.

- Review the specifics of the form (if available) to understand who and what the document is designed for.

- Reinitiate the search if the template does not meet your legal needs.

Form popularity

FAQ

To write an inheritance disclaimer letter, begin by clearly stating your intention to decline the inherited property or assets. Include specific details about the estate, such as the decedent's name and any relevant information about the Palm Bay Florida Renunciation And Disclaimer of Property received by Intestate Succession. Make your letter formal and ensure that it is signed and dated. When you prepare your disclaimer, using resources from USLegalForms can help ensure that you meet all legal requirements and formats needed for the disclaimer to be effective.

A disclaimer of estate occurs when an individual decides not to accept property or assets they inherited through intestate succession. For instance, if you receive a home from a relative who died without a will, you can formally decline that inheritance, which is an example of a Palm Bay Florida Renunciation And Disclaimer of Property received by Intestate Succession. This decision can have significant implications for avoiding taxes or debts associated with the property. It's essential to understand your options fully, and platforms like USLegalForms can provide guidance on how to navigate this legal process.

Yes, to be enforceable in Florida, a disclaimer must indeed be notarized. Notarization confirms your identity and ensures that the disclaimer is a legitimate and binding document. It adds an extra level of security to your renunciation of the property. If you are using a service like US Legal Forms, they can guide you through the proper notarization process.

In Florida, you can disclaim an inheritance if you do so in writing and within the specified time frame of nine months after the decedent's death. The disclaimer must be absolute and cannot be conditional. Also, be aware that disclaiming an inheritance means you will not receive any benefits or responsibilities from that property. Familiarizing yourself with these rules can save you from unexpected consequences.

The primary document that serves as proof of inheritance is the probate court's order of distribution. This legal document outlines the beneficiaries entitled to receive property following the intestate succession process. Keep copies of the death certificate and the will, if available, as additional documentation. Having these documents organized will streamline the process of disclaiming any property later.

When writing a disclaimer letter for inheritance, start with your full name, address, and the date. Include a clear statement that you wish to disclaim the property and the specific details about the inheritance. Mention the relationship to the deceased and sign the letter before a notary. This document should be filed promptly with the probate court to ensure proper processing.

Yes, a disclaimer of inheritance in Florida should be notarized to ensure its validity. This adds an essential layer of authenticity to your declarations. Notarization confirms your identity and intention, which can protect you from potential disputes in the future. Always check with an attorney to ensure you meet all legal requirements before filing.

In Florida, a beneficiary has nine months from the date of the decedent's death to submit a disclaimer of inheritance. If you are uncertain about your decision during this period, consider carefully weighing your options. It’s important to understand that once this time frame lapses, you might lose the opportunity to renounce the property. Seeking legal guidance during this time can be beneficial.

To disclaim an inheritance in Florida, you must file a written disclaimer with the probate court. This document should clearly state your intention to renounce your rights to the property received through intestate succession. Make sure to include specific details regarding the property and your relationship to the deceased. Doing this properly can help prevent tax responsibilities or issues with the property later.

The disclaimer statute in Florida provides the legal framework for individuals wishing to renounce their inheritance. This statute outlines the necessary steps and requirements for disclaiming property, ensuring clarity and adherence to the law. For more comprehensive understanding, it’s advisable to review information specific to Palm Bay Florida Renunciation And Disclaimer of Property received by Intestate Succession