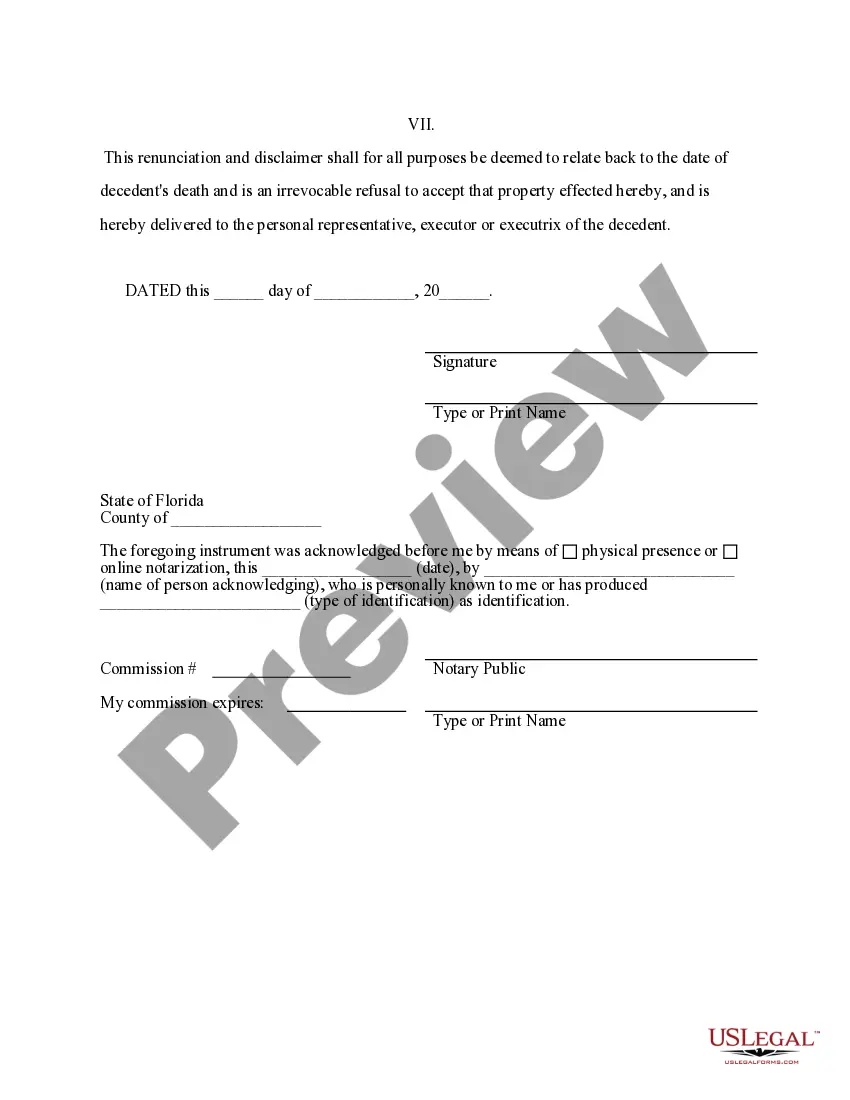

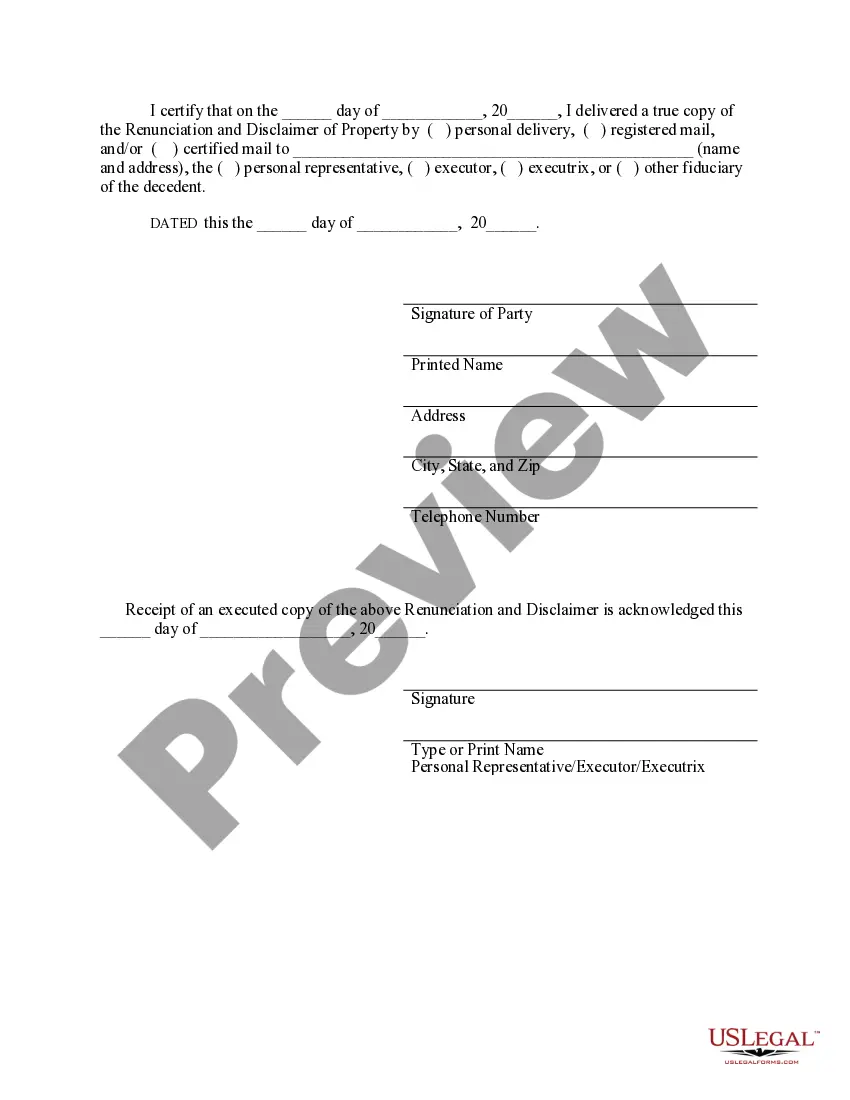

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Lakeland Florida Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Florida Renunciation And Disclaimer Of Property Received By Intestate Succession?

Acquiring verified templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online database of over 85,000 legal documents catering to both individual and business requirements as well as various real-world situations.

All the files are adequately categorized by application area and jurisdiction zones, making it simple and straightforward to find the Lakeland Florida Renunciation And Disclaimer of Property obtained through Intestate Succession.

Maintain orderly documentation in accordance with legal standards is crucial. Leverage the US Legal Forms repository to have vital document templates readily available for any requirements!

- Ensure you check the Preview mode and form details.

- Confirm that you’ve chosen the appropriate document that fulfills your needs and aligns with your local jurisdiction specifications.

- Search for an alternative template if necessary.

- If you detect any discrepancies, use the Search tab above to find the correct one. If it fits your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

A beneficiary may choose to disclaim property received through intestate succession for several reasons. Firstly, the beneficiary might want to avoid tax liabilities associated with the inherited property. Secondly, they may wish to keep the property out of their estate for personal reasons or to protect creditors. Ultimately, understanding the Lakeland Florida Renunciation And Disclaimer of Property received by Intestate Succession can help beneficiaries navigate their options and make informed decisions.

In Florida, a disclaimer of inheritance does not necessarily need to be notarized, but having it notarized can add an extra layer of authenticity. It's important to ensure that the disclaimer meets all legal requirements outlined by Florida law. Proper documentation can help avoid any complications later on with the Lakeland Florida Renunciation And Disclaimer of Property received by Intestate Succession. Always check local laws or consult a legal expert for guidance.

A beneficiary has nine months to disclaim an inheritance in Florida. This time frame starts from the date they receive the property through intestate succession. If you are considering renouncing your inheritance, it is important to act promptly to meet this deadline. Utilizing resources such as uslegalforms can simplify the process and ensure you meet all legal requirements.

Filing a disclaimer after nine months is generally not permitted in Florida law. However, under certain circumstances, you might be able to seek approval from the court. It is best to consult with a legal professional to explore your options and understand the implications of any late actions regarding the Lakeland Florida Renunciation And Disclaimer of Property received by Intestate Succession.

The primary rules for disclaiming inheritance in Florida include the requirement that the disclaimer must be in writing and must clearly express your intent to renounce the inheritance. You must not have accepted any benefits from the estate, and it must be filed within the stipulated time frame. Following these rules ensures that your Lakeland Florida Renunciation And Disclaimer of Property received by Intestate Succession is legally recognized.

Yes, there is a time limit to disclaim an inheritance in Florida. Generally, you must file your disclaimer within nine months after the date of the inheritance. If you miss this window, you may be unable to renounce your interest in the property received through intestate succession. Be aware of these deadlines to protect your rights.

To disclaim an inheritance in Florida, you must file a written disclaimer with the estate's personal representative. The disclaimer document should clearly state your intention to renounce any interest in the property you received by intestate succession. It is crucial to follow the specific legal format required by Florida law to ensure your disclaimer is valid. Consider using uslegalforms to help draft the necessary documents effectively.

A qualified disclaimer must meet certain criteria to be recognized legally. First, it should be executed in writing and presented within the statutory time limit. Additionally, it must not benefit the disclaimant in any way, as accepting any benefit can invalidate the disclaimer. Understanding these parameters concerning the Lakeland Florida Renunciation And Disclaimer of Property received by Intestate Succession is crucial, and platforms like uslegalforms can guide you in ensuring compliance with all requirements.

Disclaiming an inheritance involves specific rules that vary by jurisdiction but generally include the requirement to act voluntarily and without any pressure. You must submit your disclaimer within a designated time frame, usually nine months, from the date of the decedent’s death. It's essential to follow the guidelines outlined in the Lakeland Florida Renunciation And Disclaimer of Property received by Intestate Succession to ensure your disclaimer is valid. Consulting with legal professionals or using uslegalforms can help you navigate these rules effectively.

Proof of inheritance typically comes in the form of a death certificate and a will, if one exists. In cases involving intestate succession, the court may issue letters of administration or letters testamentary that establish your right to inherit. These documents affirm your position in accordance with the laws regarding Lakeland Florida Renunciation And Disclaimer of Property received by Intestate Succession. For more streamlined processes, you can utilize platforms like uslegalforms to generate necessary legal documentation.