This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Jacksonville Florida Quitclaim Deed from Corporation to LLC

Description

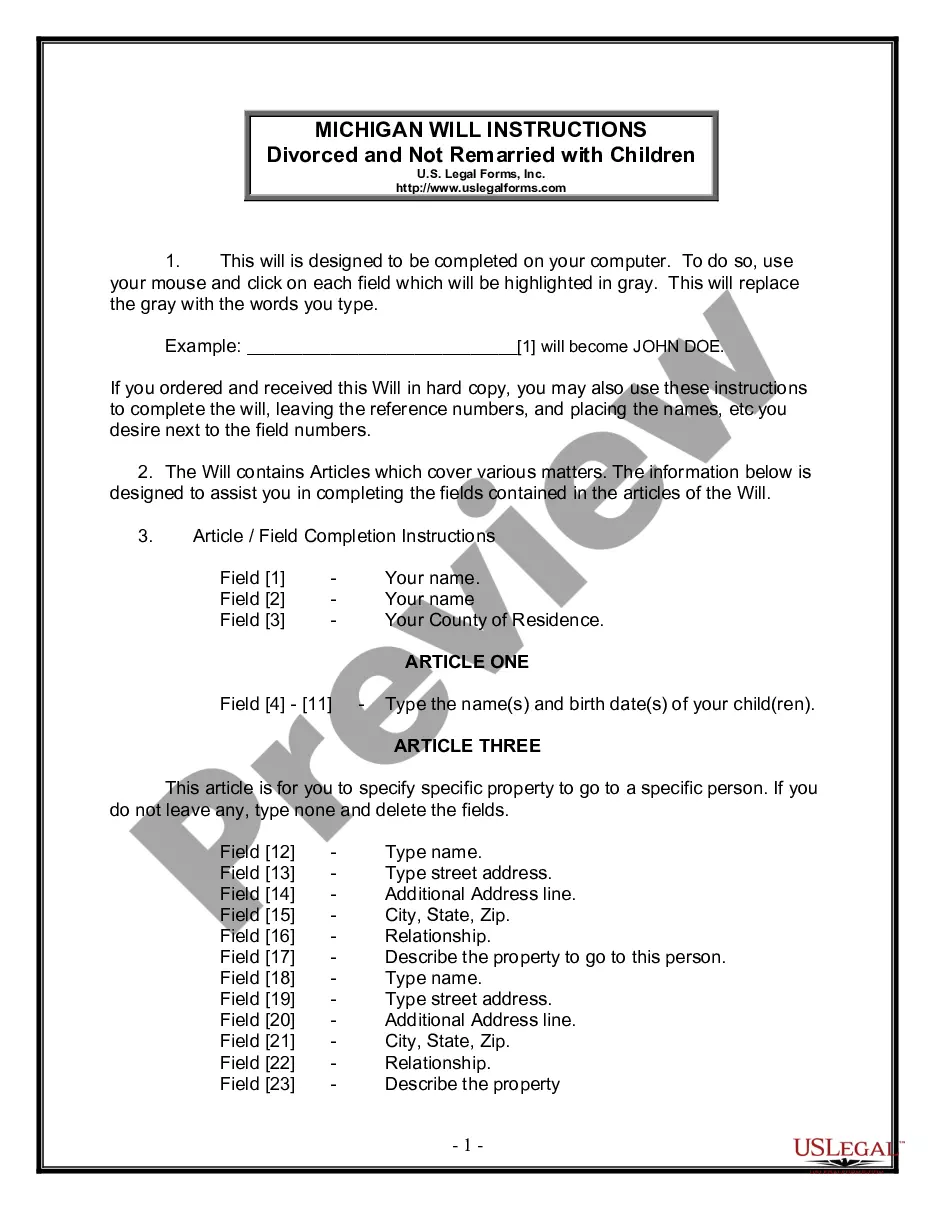

How to fill out Florida Quitclaim Deed From Corporation To LLC?

Acquiring authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal forms for both personal and business purposes and various real-world situations.

All documents are meticulously organized by usage area and jurisdiction, making it simple and swift to locate the Jacksonville Florida Quitclaim Deed from Corporation to LLC.

Keeping your paperwork organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to always have vital document templates for any requirements easily accessible!

- Examine the Preview mode and form description.

- Ensure that you’ve chosen the correct one that fulfills your needs and fully aligns with your local jurisdiction rules.

- Search for another template, if necessary.

- If you spot any discrepancies, use the Search tab above to find the appropriate template.

- Proceed to purchase the document.

Form popularity

FAQ

Think about the capital gains tax implications; a transfer of property to a company is chargeable to Capital Gain Tax (CGT) at the deemed Market Value of the property. Even if you are gifting property to limited company or transferring it at a lower value, it is chargeable to CGT.

Transferring Property Titles from an Individual to a Florida LLC. Meet with Your Mortgage Lender. Form a Florida LLC. Obtain a Form for a Deed. Fill Out Warranty or Quitclaim Deed Form. Sign the Deed to Transfer Property to the Florida LLC. Submit the Deed for Public Record. Update the Lease.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

It is not just a case of forming a limited company and transferring your property by signing it over. You must sell your property to your new company at the market value, and this will attract some costs, for example: Capital Gains Tax. Stamp Duty Land Tax.

Transferring Property Titles from an Individual to a Florida LLC. Meet with Your Mortgage Lender. Form a Florida LLC. Obtain a Form for a Deed. Fill Out Warranty or Quitclaim Deed Form. Sign the Deed to Transfer Property to the Florida LLC. Submit the Deed for Public Record. Update the Lease.

Avoiding Personal Liability This is the major advantage of an LLC. You want the best option for limiting your personal liability should an unforeseen circumstance arise relating to your property. LLCs provide that protection.

You can use a quitclaim deed in Florida even if the property is encumbered by a mortgage. The quitclaim deed does alter or transfer the mortgage and does not change personal liability to pay the mortgage note.

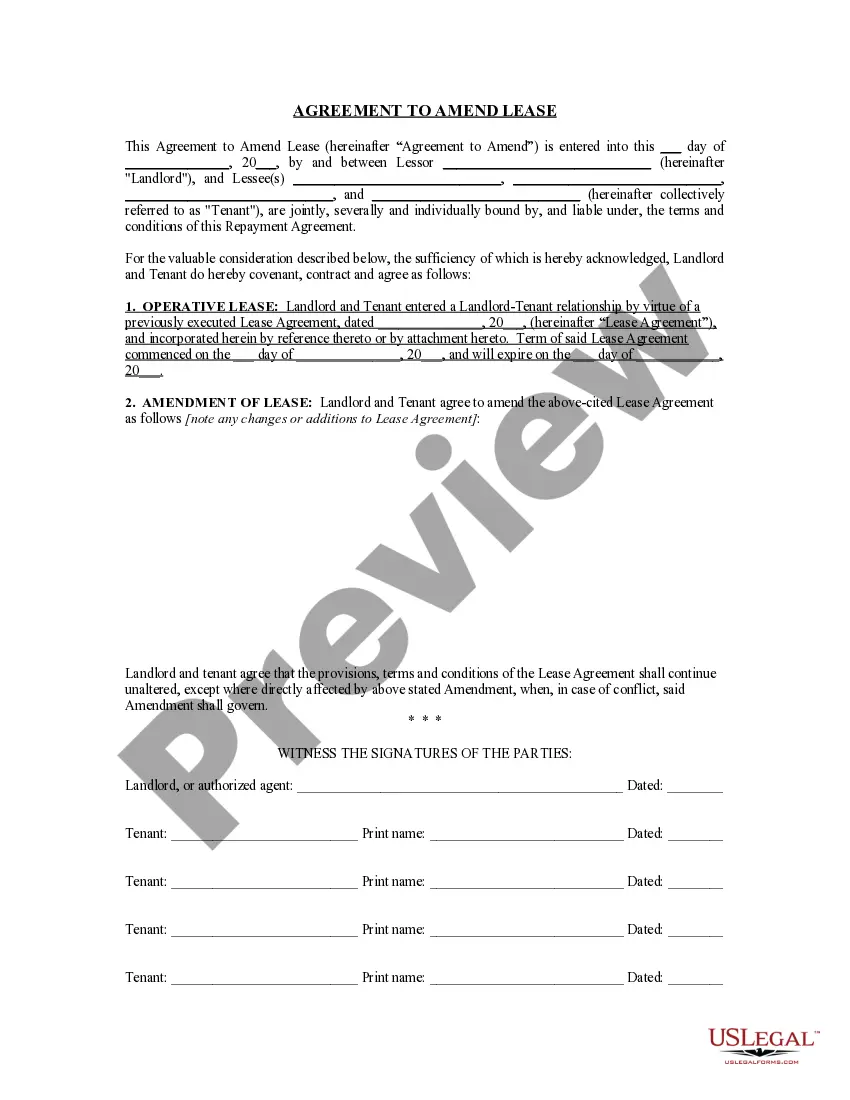

Transferring your property to an LLC is usually achieved by filing a quitclaim deed, a general warranty deed, or some other kind of deed to facilitate a transfer of the property from you to your LLC. Otherwise, as you acquire property, it can be directly purchased in the name of your LLC.

Although you own the property, you cannot sell it at a discount to your limited company. This is because it is a sale and purchase transaction and tax implications must be considered. Consequently, the property must be sold at open market value.

You can fill out the Transfer Document and then bring it to a notary. Once the document is notarized, you can file the original deed/title and the Transfer Document with the filing agency. A new deed/title will be issued showing that your LLC is now the owner.