An AB trust is a trust created by a married couple to avoid probate and minimize federal estate tax. An AB trust is created by each spouse placing property into a trust and naming someone other than his or her spouse as the final beneficiary of that trust. Upon the death of the first spouse, the surviving spouse does not own the assets in that spouse's trust outright, but has a limited power over the assets in accordance with the terms of the trust. Such powers may include the right to receive interest or income earned by the trust, to use the trust property during his or her lifetime, e.g. to live in a house, and/or to use the trust principal for his or her health, education, or support. Upon the death of the second spouse, the trust passes to the final beneficiary of the trust. For estate tax purposes, the trust is included in the first, but not the second, spouse's estate and therefore, avoids double taxation.

Pompano Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B

Description

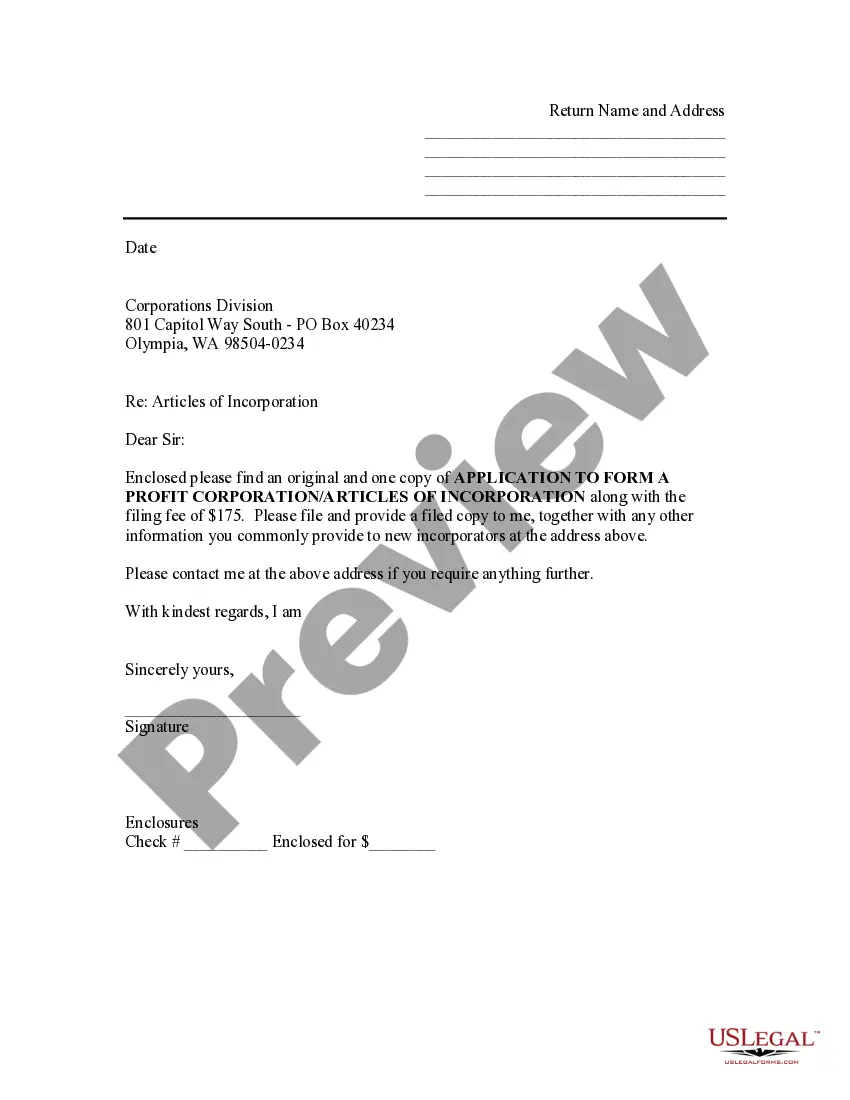

How to fill out Florida Marital Deduction Trust - Trust A And Bypass Trust B?

Do you require a reliable and affordable legal forms supplier to purchase the Pompano Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B? US Legal Forms is your best option.

Whether you need a basic agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your separation or divorce process through the court system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and commercial use. All templates that we provide access to are not generic and are tailored based on the needs of specific states and regions.

To download the form, you must Log In to your account, locate the required form, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased document templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can create an account in minutes, but before that, ensure you do the following.

Now you can set up your account. Then choose the subscription plan and continue to payment. Once the payment is completed, download the Pompano Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B in any available file format. You can revisit the website whenever needed and redownload the form free of charge.

Locating up-to-date legal documents has never been simpler. Try US Legal Forms today, and no longer waste your precious time searching for legal paperwork online.

- Verify if the Pompano Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B complies with the laws of your state and local jurisdiction.

- Review the form’s specifications (if available) to understand who and what the form is designed for.

- Start your search again if the form does not suit your legal situation.

Form popularity

FAQ

The Bypass Trust B associated with the Pompano Beach Florida Marital Deduction Trust may lead to complexities in estate management. One major drawback is the potential for increased administrative costs, as it requires separate tax filings. Additionally, depending on the circumstances, it might limit access to funds for surviving spouses, impacting their financial flexibility.

A marital trust, specifically the Pompano Beach Florida Marital Deduction Trust - Trust A, enables a spouse to receive income from the trust during their lifetime, with the principal going to the heirs later. This setup minimizes estate taxes and provides financial security for the surviving spouse. By using this trust, couples can effectively manage their assets while ensuring that their loved ones benefit in the long run.

No, a bypass trust and a marital trust are distinctly different. A bypass trust is aimed at preserving wealth by ensuring that certain assets are not included in the estate of the surviving spouse, thus avoiding estate taxes. Familiarizing yourself with the Pompano Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B allows you to make informed choices that suit your estate planning needs.

One disadvantage of a marital trust is that it does not protect the assets from estate taxes upon the death of the surviving spouse. Additionally, the surviving spouse has control over the trust assets, which may lead to unintended consequences regarding inheritance. A better understanding of the Pompano Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B can guide you in avoiding common pitfalls associated with marital trusts.

The main difference lies in how each trust is treated for estate tax purposes. A marital trust allows the surviving spouse to access the trust’s assets without immediate tax consequences, while a Bypass Trust preserves wealth by keeping assets out of the surviving spouse's estate. Understanding these differences, specifically through the lens of Pompano Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B, can be crucial for effective estate planning.

A Trust A, often referred to as a marital trust, is designed to provide income to a surviving spouse during their lifetime. In contrast, a Trust B, or Bypass Trust, allows assets to bypass the surviving spouse's estate, minimizing estate taxes. In Pompano Beach Florida, utilizing the Pompano Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B can help couples effectively manage their estates while ensuring financial security.

The three primary types of trusts include revocable trusts, irrevocable trusts, and charitable trusts. Revocable trusts allow the grantor to maintain control over the assets and change terms as needed. Irrevocable trusts, like the Bypass Trust B, transfer assets out of the grantor's estate, typically offering tax advantages. Charitable trusts are designed for philanthropic purposes, ensuring that your legacy supports charitable causes.

In a marital deduction trust context, Trust A generally refers to the Marital Trust, which provides for the surviving spouse. Trust B, often the Bypass Trust, protects the deceased spouse's assets from estate taxes upon the surviving spouse's death. Together, these trusts optimize tax benefits and asset distribution, particularly in Pompano Beach Florida Marital Deduction Trust scenarios. Utilizing them strategically can provide lasting financial security.

A trust is a legal arrangement where one party holds property for the benefit of another. On the other hand, a unit trust divides interest in the trust into units, allowing more flexibility in investment. While both serve to manage and distribute assets, the Pompano Beach Florida Marital Deduction Trust can provide specific tax benefits that a unit trust may not offer. Understanding these distinctions is vital for effective estate planning.

In the context of Pompano Beach Florida Marital Deduction Trust, a trust that starts with B is typically referred to as Bypass Trust B. This type of trust allows assets to be passed on while minimizing estate taxes for a surviving spouse. Essentially, Bypass Trust B helps preserve wealth for heirs by 'bypassing' the surviving spouse's estate. This trust structure is beneficial for those looking to optimize tax savings.