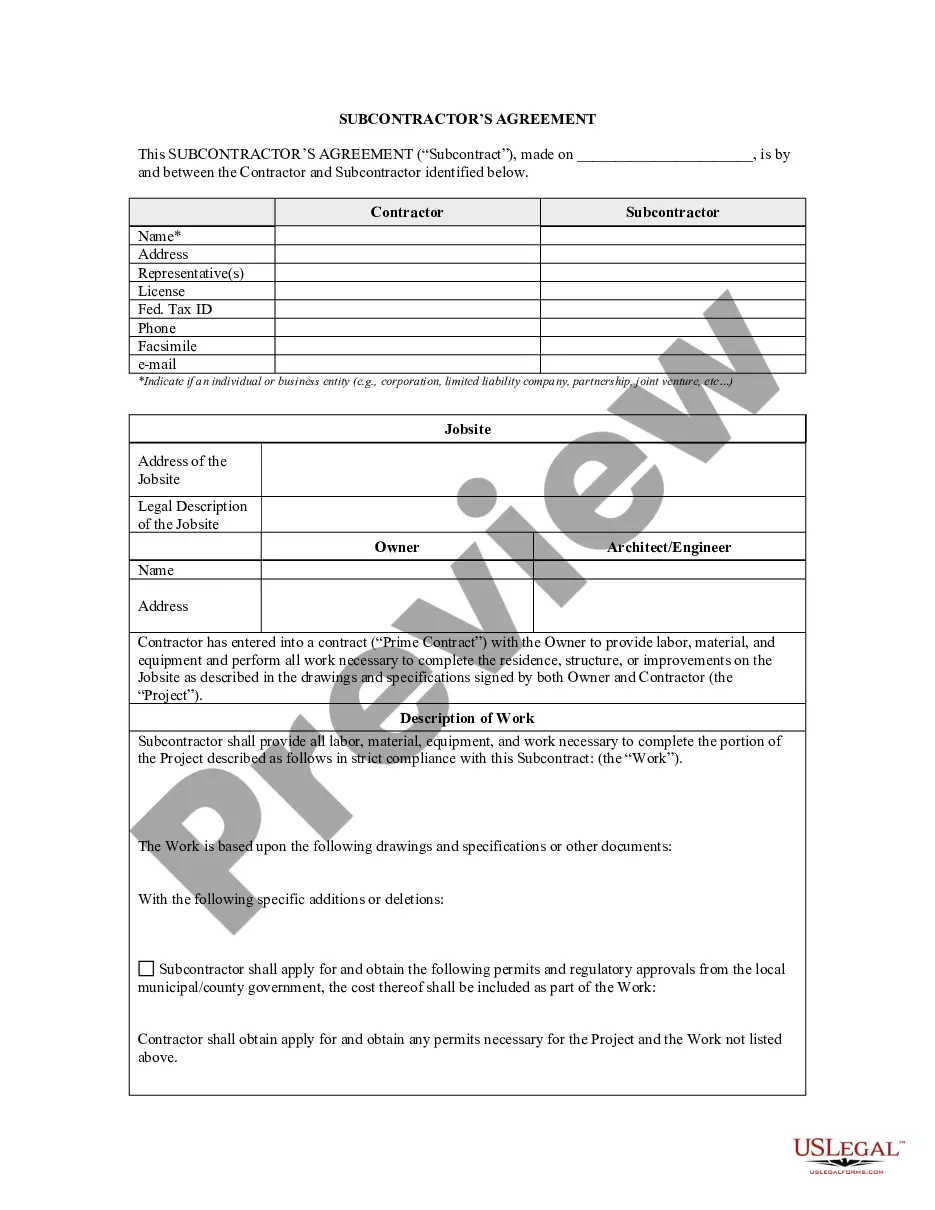

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Miami-Dade Florida Articles of Incorporation for Domestic Nonprofit Corporation

Description

How to fill out Florida Articles Of Incorporation For Domestic Nonprofit Corporation?

Are you seeking a reliable and economical provider of legal forms to obtain the Miami-Dade Florida Articles of Incorporation for Domestic Nonprofit Corporation? US Legal Forms is your ideal choice.

Whether you require a basic contract to establish guidelines for cohabiting with your partner or a collection of documents to facilitate your separation or divorce through the court, we have you covered. Our platform presents over 85,000 current legal document templates for personal and business applications. All templates we provide are not generic and tailored based on the demands of specific state and county.

To acquire the form, you need to Log In to your account, locate the required form, and click the Download button adjacent to it. Please remember that you can download your previously acquired form templates at any time from the My documents tab.

Is this your first visit to our website? No problem. You can create an account in a few minutes, but first, ensure that you do the following: Check if the Miami-Dade Florida Articles of Incorporation for Domestic Nonprofit Corporation adheres to the regulations of your state and local jurisdiction. Review the form’s specifications (if provided) to determine who and what the form is designed for. Restart the search if the form doesn’t suit your particular circumstances.

Try US Legal Forms today, and eliminate the need to spend hours searching for legal paperwork online once and for all.

- Now you can set up your account.

- Select the subscription plan and proceed to payment.

- Once the payment is completed, download the Miami-Dade Florida Articles of Incorporation for Domestic Nonprofit Corporation in any available format.

- You can revisit the site whenever necessary and redownload the form at no additional cost.

- Finding current legal documents has never been simpler.

Form popularity

FAQ

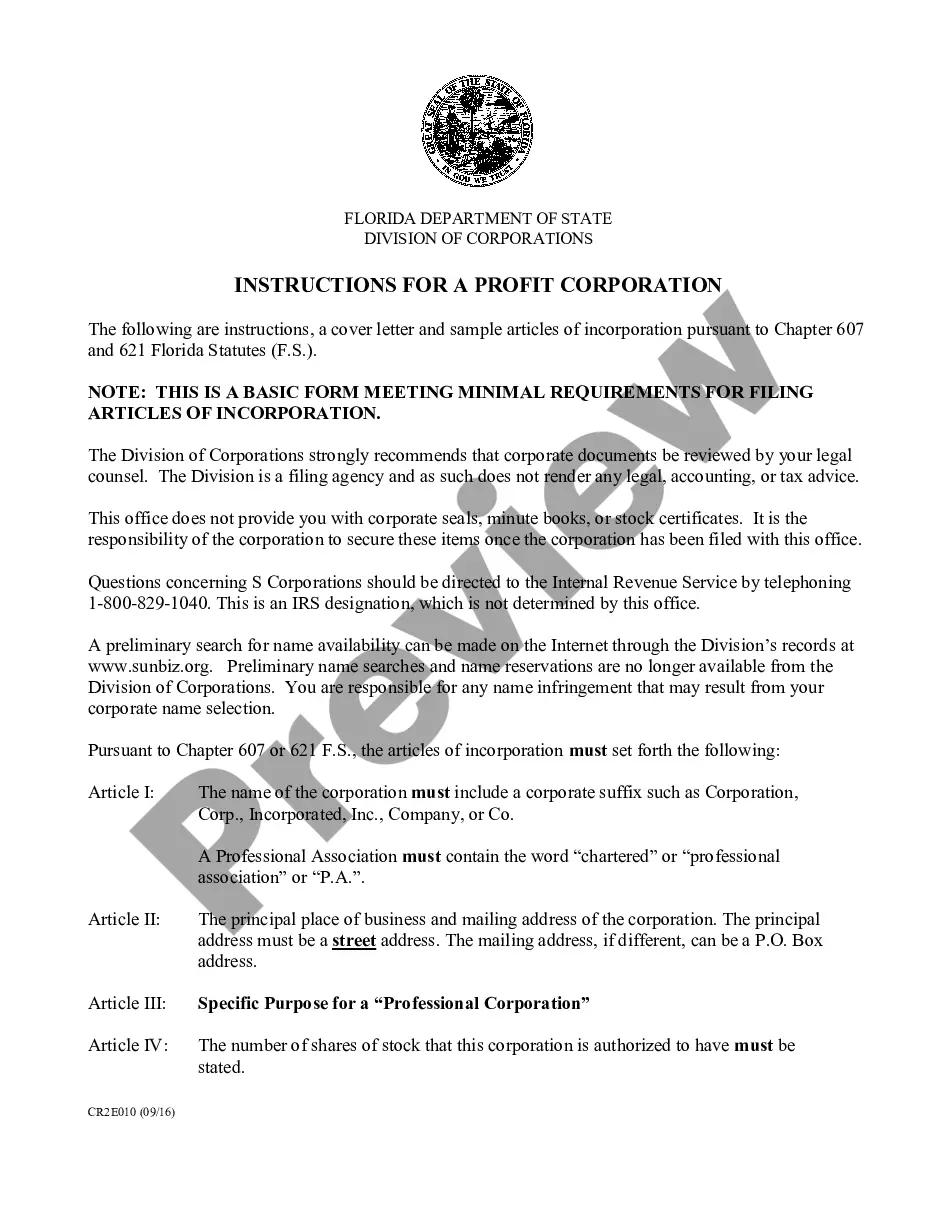

To register a nonprofit organization in Florida, you need to file your Articles of Incorporation with the Florida Division of Corporations. Make sure to outline your organization’s purpose and provide necessary details in accordance with state laws. Utilizing platforms like US Legal Forms can streamline this process and ensure that you meet all legal requirements.

A domestic nonprofit and a 501(c)(3) are not the same, as a domestic nonprofit is the organizational structure while a 501(c)(3) refers to a specific tax status. Many domestic nonprofits aspire to become 501(c)(3) entities to qualify for tax exemptions. If you are considering starting an organization under Miami-Dade Florida Articles of Incorporation, it's vital to aim for this status.

A domestic nonprofit corporation is a legal entity formed under state laws to operate for a nonprofit purpose. In Miami-Dade, Florida, this type of corporation is distinct in that it does not distribute profits to members or directors. Understanding its structure helps ensure compliance with both state and federal laws.

You can verify if a nonprofit is a 501(c)(3) by checking the IRS database or by requesting their determination letter, which confirms this status. This status allows donors to claim tax deductions on donations made to the organization. For organizations formed using Miami-Dade Florida Articles of Incorporation, obtaining this designation is often a goal.

While all 501(c)(3) organizations are nonprofit corporations, not all nonprofit corporations are 501(c)(3) entities. The key difference lies in the tax-exempt status granted by the IRS. If you are forming a nonprofit in Miami-Dade, it’s crucial to understand these distinctions to ensure tax compliance and eligibility for grants.

Not all domestic nonprofit corporations qualify as 501(c)(3) organizations. A 501(c)(3) status indicates that the organization is specifically established for charitable, educational, religious, or scientific purposes. If your Miami-Dade Florida Articles of Incorporation meet certain IRS criteria, you can apply for this federal tax-exempt status.

A domestic nonprofit corporation operates to serve a public or mutual benefit, while a nonprofit cooperative corporation is owned and managed by its members for their collective benefit. In Miami-Dade, Florida, both structures can serve charitable goals, but their operational models differ. Understanding this distinction can help you choose the right structure for your organization.

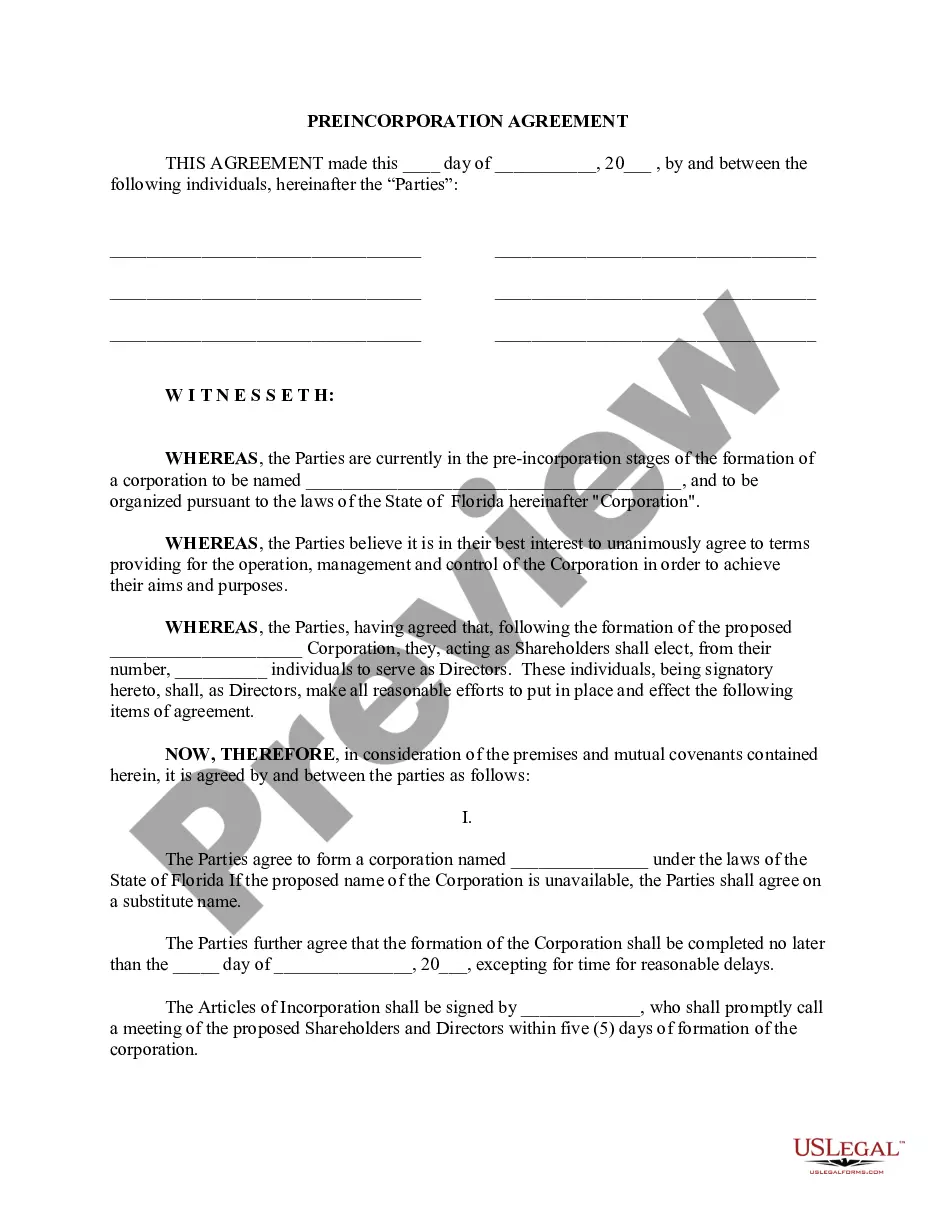

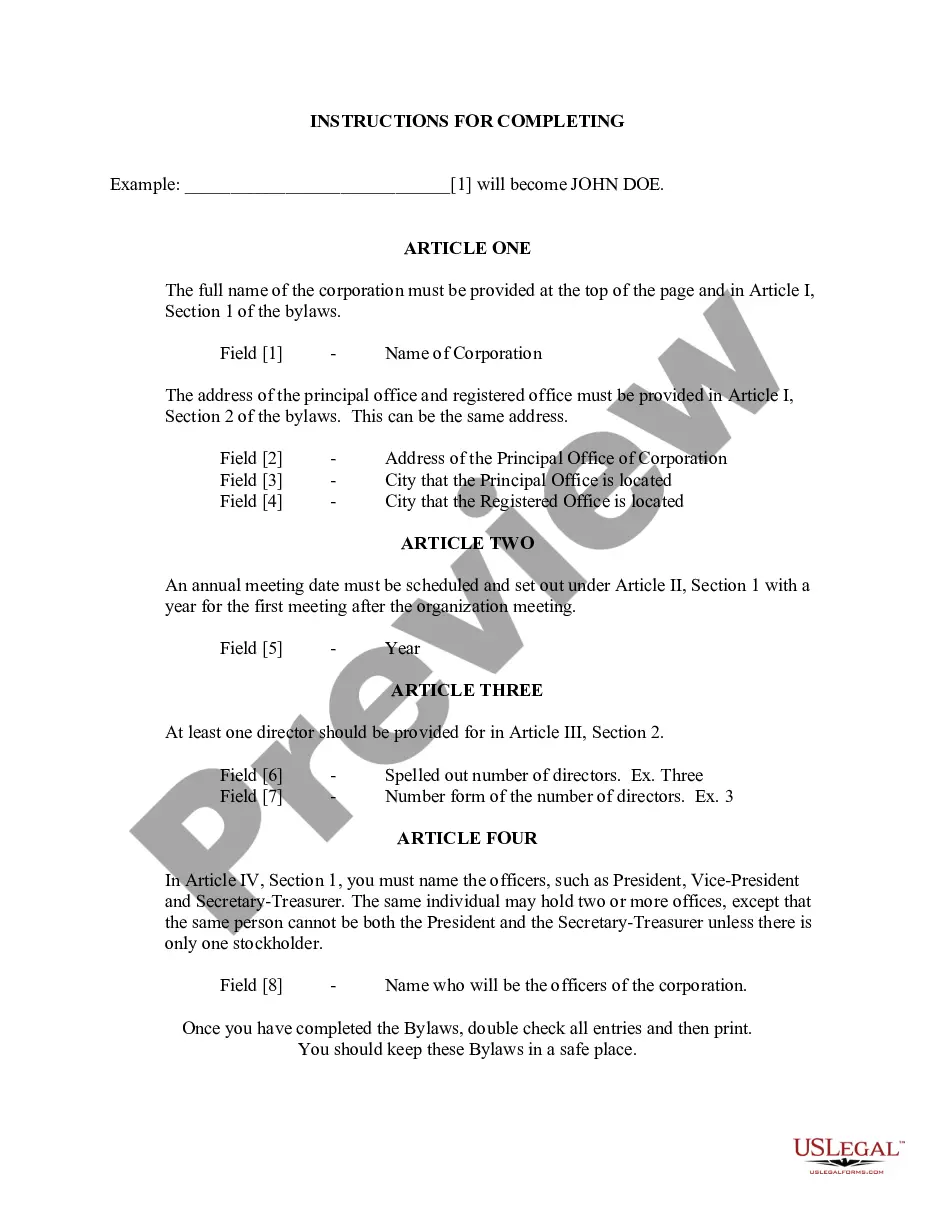

To create Articles of Incorporation for a nonprofit organization in Miami-Dade, Florida, you must include essential information such as the nonprofit's name, purpose, and address. It's beneficial to use a reputable service like US Legal Forms to ensure that you comply with state requirements. After drafting these articles, file them with the Florida Division of Corporations, along with any required fees.

Writing Articles of Incorporation for a non-profit involves outlining key details such as the corporation's name, purpose, and structure. You need to comply with Florida’s requirements, ensuring that your documents reflect your mission and governance policies. Platforms like uslegalforms can guide you through this process, ensuring you include all necessary information for a successful filing of your Miami-Dade Florida Articles of Incorporation for Domestic Nonprofit Corporation.

A domestic non-profit corporation is an organization that operates in the state where it is formed, primarily to serve a public or community benefit. Established under specific state laws, these corporations can apply for tax-exempt status if they meet certain criteria. Filing the Miami-Dade Florida Articles of Incorporation for Domestic Nonprofit Corporation is a crucial step in defining your organization’s purpose and governance.