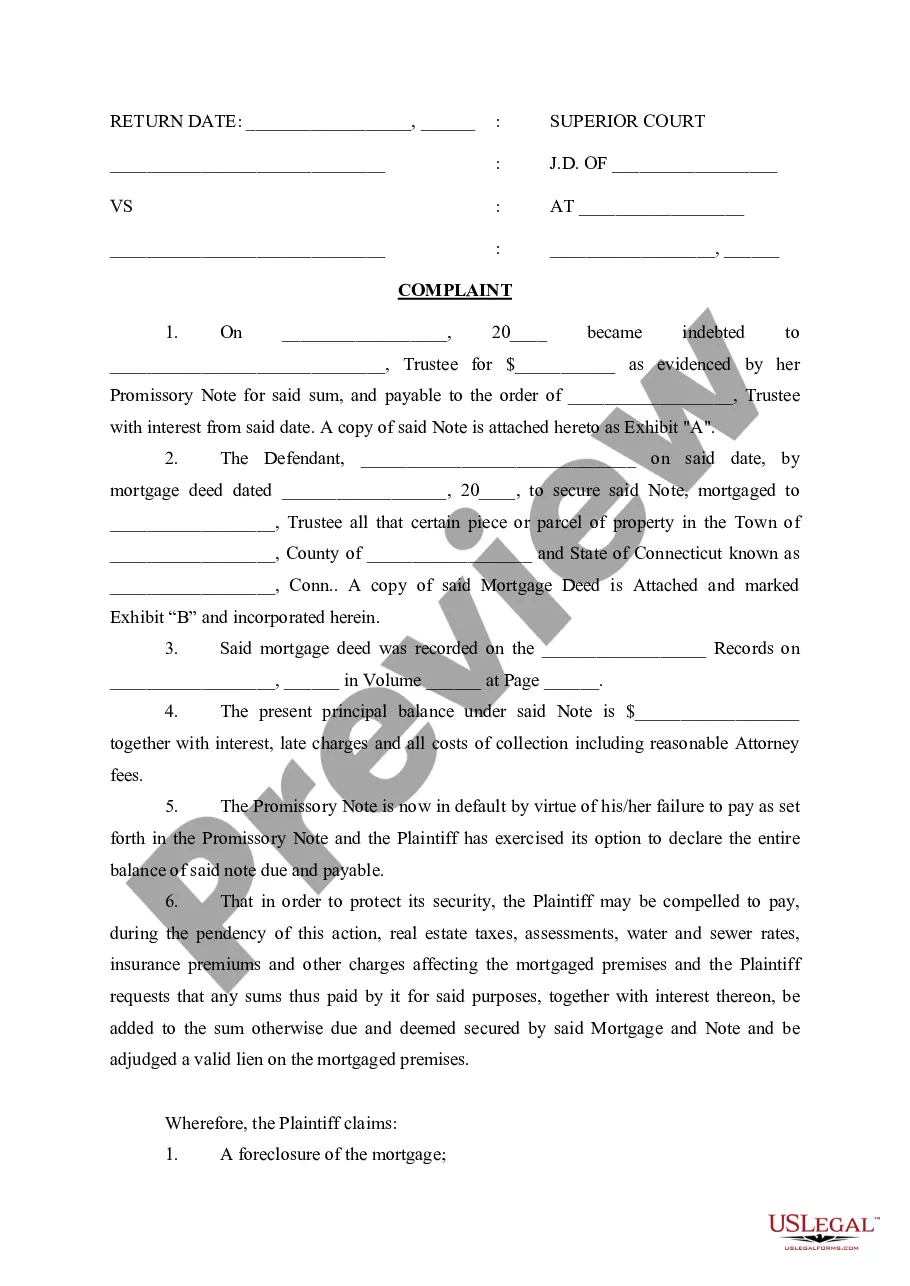

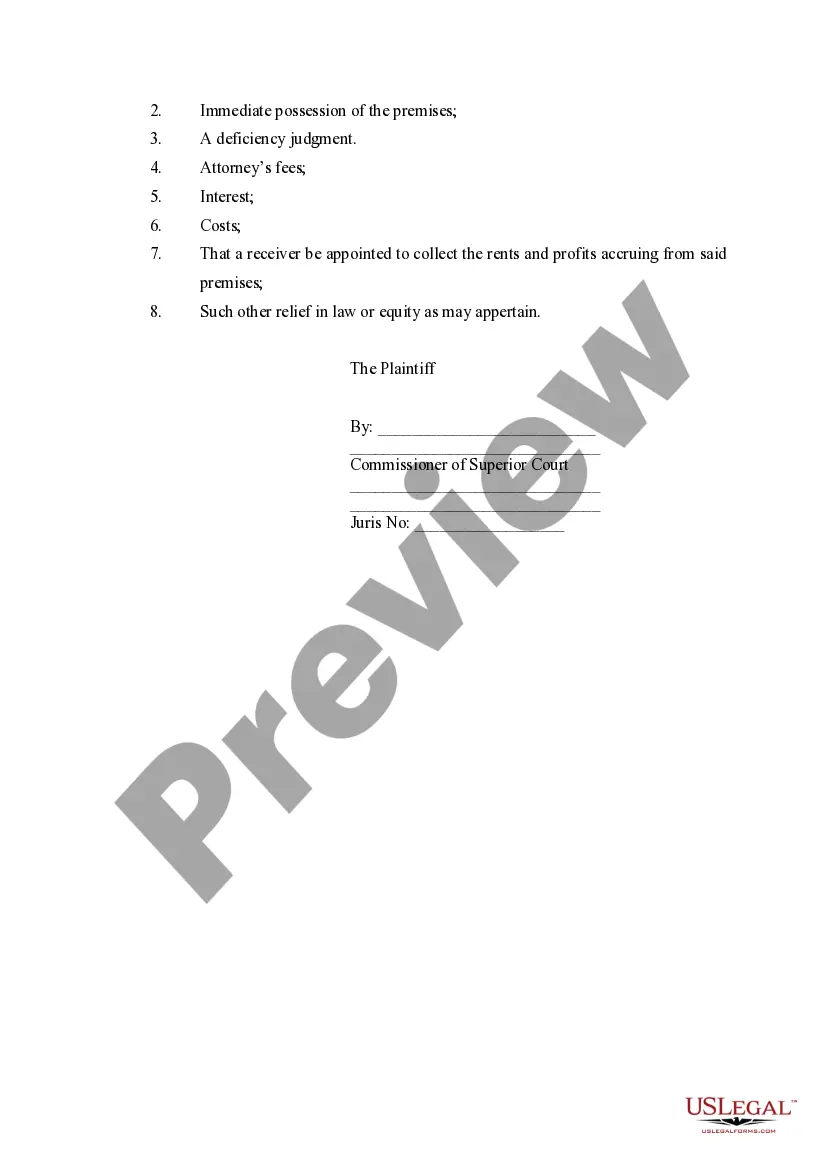

Bridgeport Connecticut Complaint (Default of Promissory Note)

Description

How to fill out Connecticut Complaint (Default Of Promissory Note)?

We consistently endeavor to minimize or avert legal complications when managing intricate law-related or financial matters.

To achieve this, we seek legal services that typically are quite costly.

However, not every legal issue is equally intricate; many of them can be handled independently.

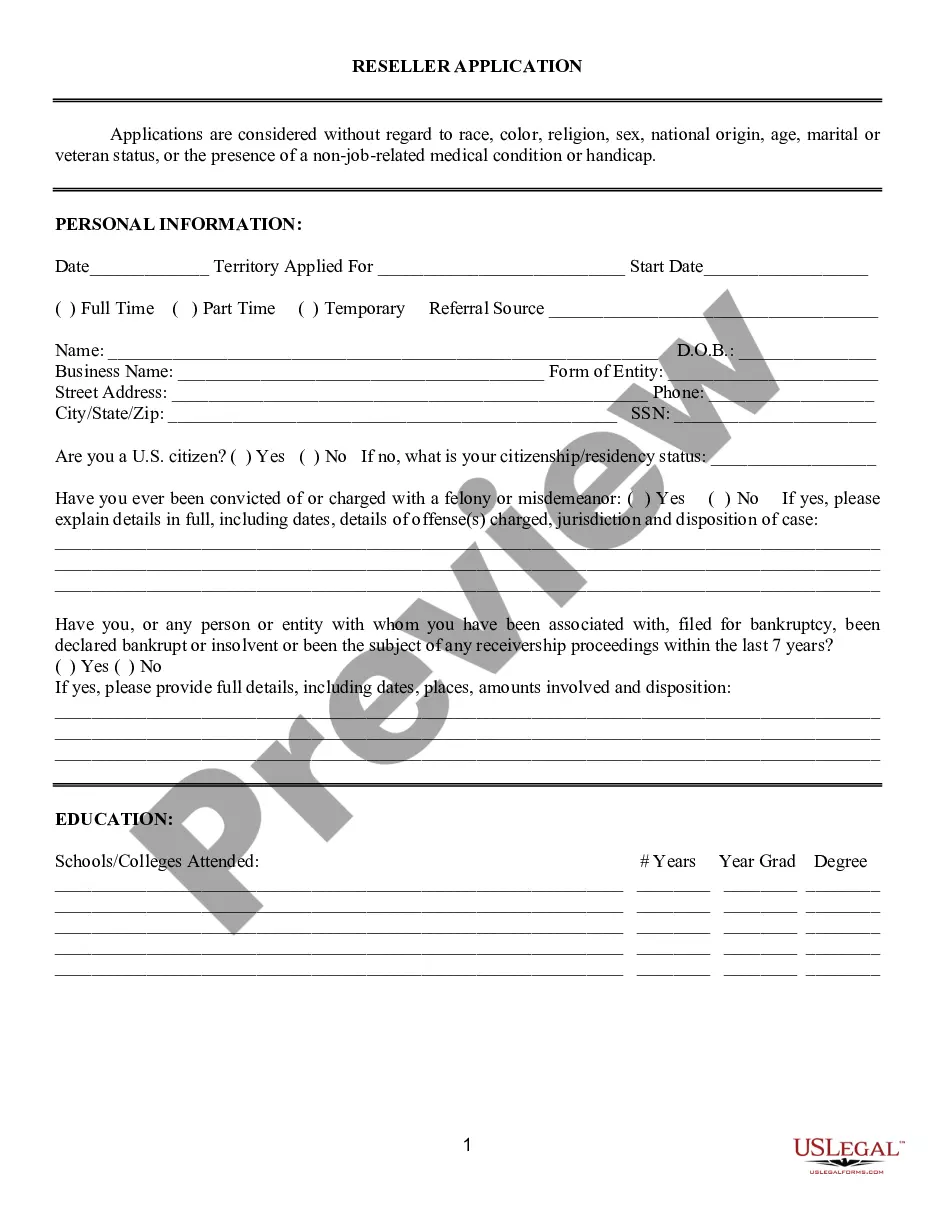

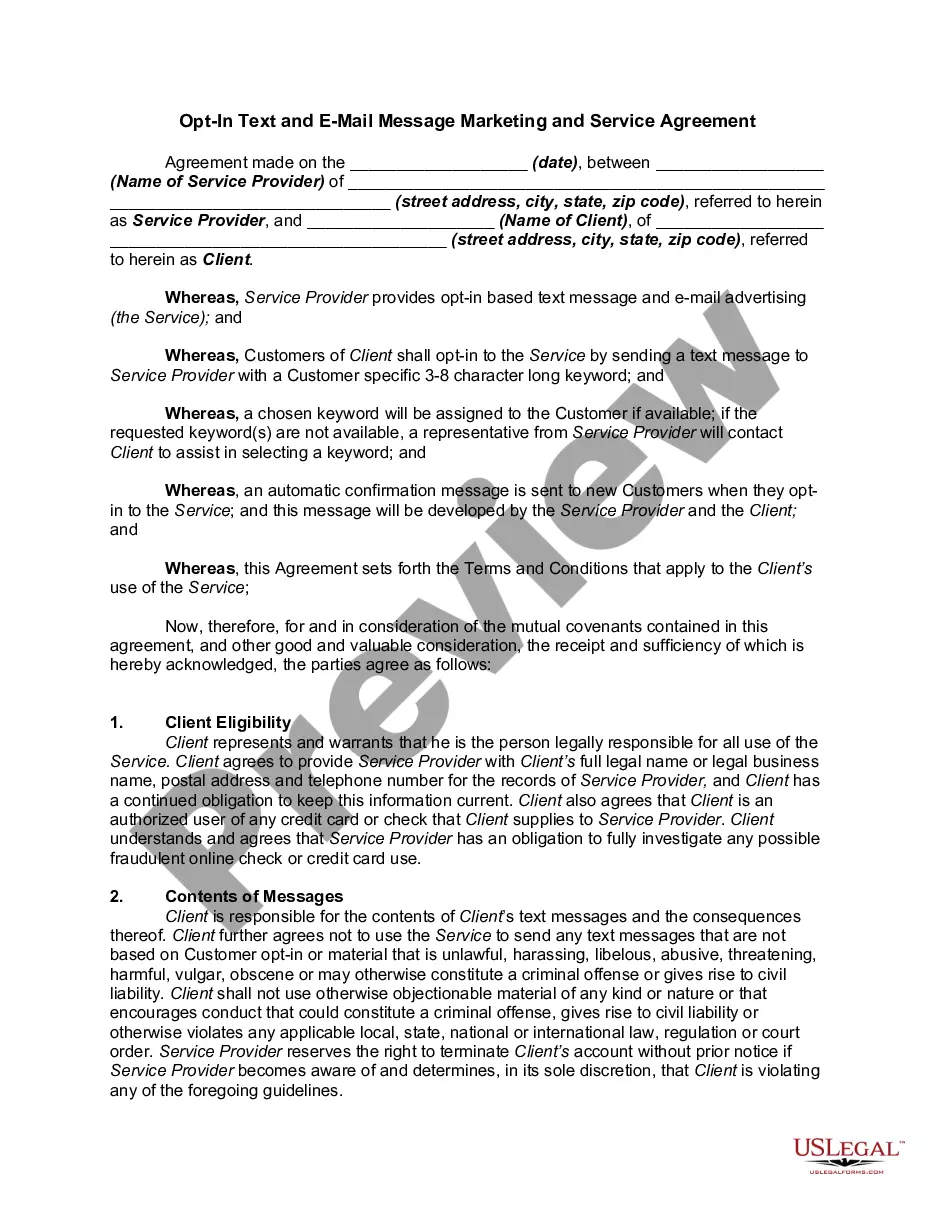

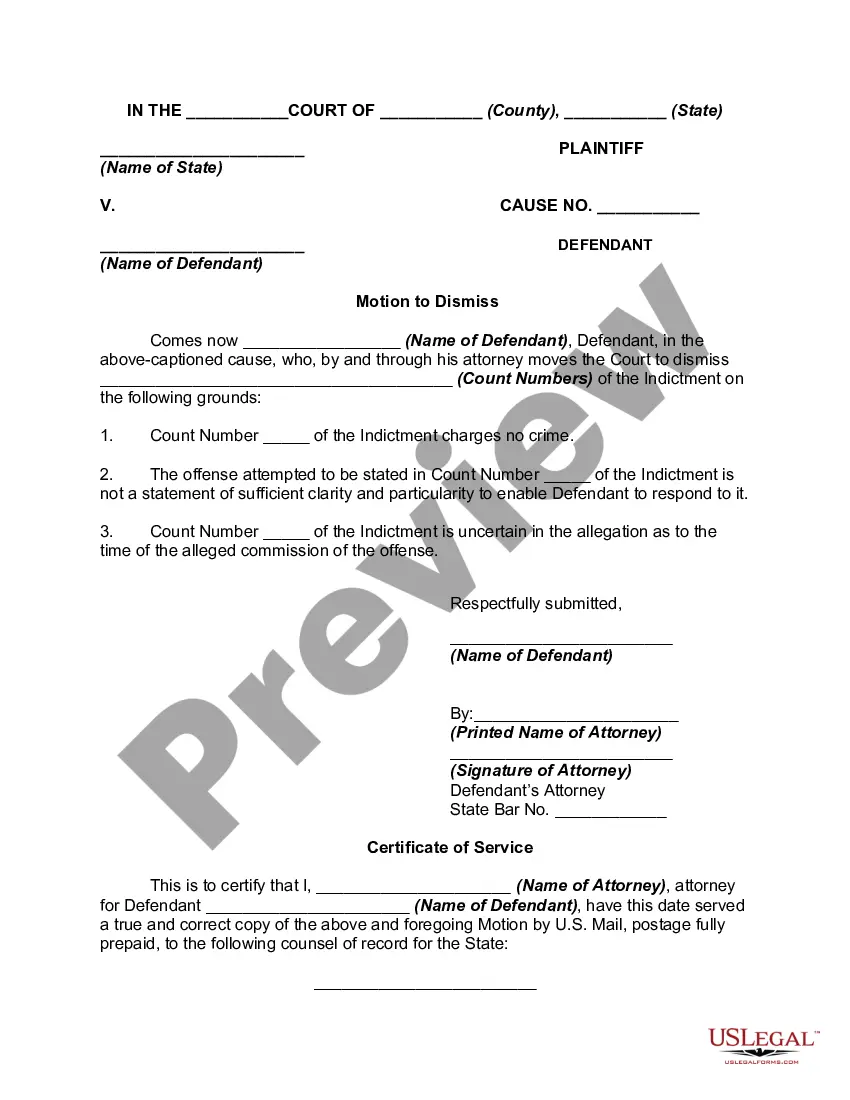

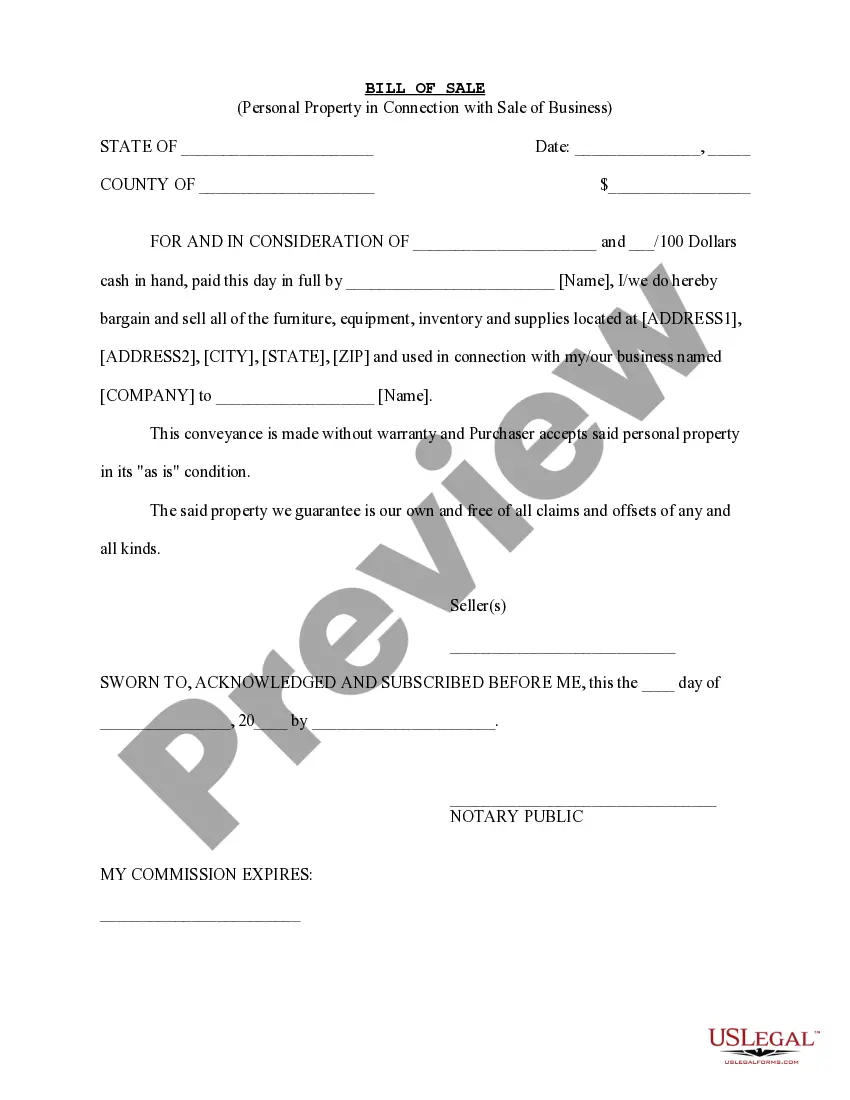

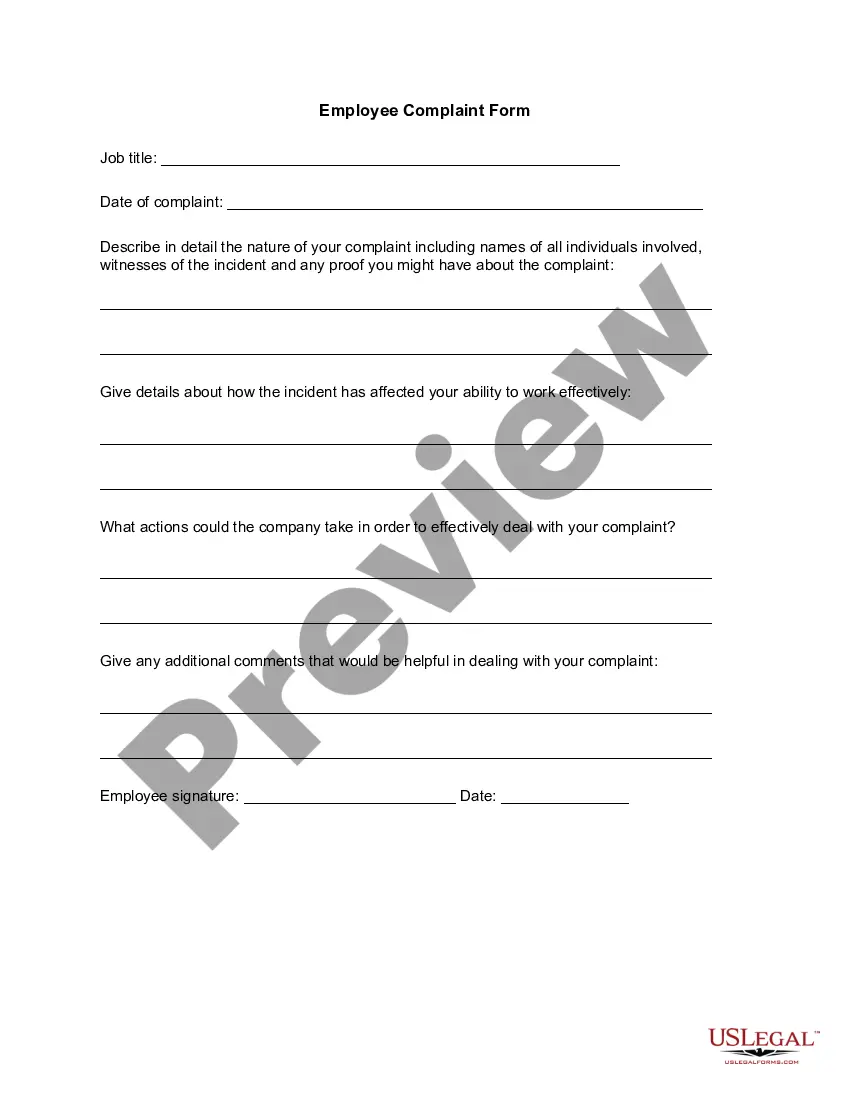

US Legal Forms is an online repository of current DIY legal documents covering a range of needs from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to the document. If you lose the form, you can easily re-download it from the My documents section. The process is just as simple for new users! You can create an account within minutes. Ensure that the Bridgeport Connecticut Complaint (Default of Promissory Note) adheres to the laws and regulations in your state and area. It's also vital to review the form’s outline (if available), and if you notice any inconsistencies with what you initially sought, look for an alternate template. Once you have confirmed that the Bridgeport Connecticut Complaint (Default of Promissory Note) is suitable for your situation, you can choose a subscription plan and proceed to payment. Subsequently, you can download the form in any compatible file format. For over 24 years, we have assisted millions by providing customizable and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your legal affairs without relying on attorney services.

- We offer access to legal document templates that are not always readily available to the public.

- Our templates are tailored to specific states and regions, making the search process significantly easier.

- Utilize US Legal Forms whenever you need to quickly and securely locate and download the Bridgeport Connecticut Complaint (Default of Promissory Note) or any other document.

Form popularity

FAQ

The best way to complain about a bank involves first gathering all relevant documents and details pertaining to your issue. Once you have this information, contact the appropriate regulatory body or the bank’s customer service directly. If your complaint relates to a Bridgeport Connecticut Complaint (Default of Promissory Note), you might also consider using uslegalforms as a resource for documentation and further assistance.

In Connecticut, the Department of Banking regulates state-chartered banks and financial institutions. They ensure that these institutions operate fairly and protect consumers. If you have a concern, such as a Bridgeport Connecticut Complaint (Default of Promissory Note), reaching out to them can lead to necessary actions being taken.

Yes, you can file a lawsuit against a bank under certain circumstances. If you believe you have a valid claim, such as a Bridgeport Connecticut Complaint (Default of Promissory Note), it is advisable to consult with an attorney. They can guide you through the legal process and help strengthen your case.

To file a complaint against a bank in Connecticut, you should reach out to the Connecticut Department of Banking. They provide a platform for consumers to voice their concerns and help resolve issues. When detailing your complaint, especially if it involves a Bridgeport Connecticut Complaint (Default of Promissory Note), ensure you include all pertinent information to facilitate the process.

Filing a complaint against a bank with the Federal Deposit Insurance Corporation (FDIC) is straightforward. You can do this by visiting the FDIC’s website and completing their online complaint form. Providing specifics about your situation, especially regarding any Bridgeport Connecticut Complaint (Default of Promissory Note), can aid in resolving your issue efficiently.

To file a consumer complaint in Connecticut, you can start by visiting the Connecticut Department of Consumer Protection website. There, you will find the necessary forms and guidance for submitting your complaint. It is important to provide detailed information about your issue, especially if it relates to a Bridgeport Connecticut Complaint (Default of Promissory Note). This clarity will help them assist you more effectively.

In Connecticut, the statute of limitations for a promissory note is typically six years. This period starts from the date of default, leading to an important attachment to your Bridgeport Connecticut Complaint (Default of Promissory Note). Understanding this timeframe can help you evaluate your legal options effectively. US Legal Forms provides helpful templates and legal insights to support your case and keep you informed.

In Connecticut, a judgment lien can last for 20 years from the date it is recorded. This means the creditor retains the right to collect on the judgment for this period, impacting your property. If you are dealing with a Bridgeport Connecticut Complaint (Default of Promissory Note), it is essential to grasp how judgment liens work. For further assistance, US Legal Forms provides valuable documents and guidance focused on your specific needs.

A demand for disclosure of defense is a formal request made by a creditor to obtain information about defenses you may have against a claim. This typically happens early in the process of a Bridgeport Connecticut Complaint (Default of Promissory Note). Responding to such demands is vital, and understanding your obligations can be complex. US Legal Forms offers tools that simplify legal language and processes to help you respond appropriately.

A judgment typically falls off your credit report seven years after the date it was filed. Keep in mind, though, that the judgment remains enforceable for a longer period, often as long as 20 years in Connecticut. If you're facing issues related to a Bridgeport Connecticut Complaint (Default of Promissory Note), knowing how judgments affect your situation can help you strategize. US Legal Forms can provide resources to navigate this process effectively.