A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust

Description

How to fill out Connecticut Revocable Living Trust Agreement With Sum Certain To Spouse In Trust, Part Of Remainder To Two Of Children And Final Remainder To Education Trust?

If you've previously utilized our service, Log In to your account and store the Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust on your device by clicking the Download button. Confirm that your subscription is current. If it is not, renew it as per your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have lifelong access to all documents you have purchased: you can find them in your profile within the My documents menu whenever you need to use them again. Utilize the US Legal Forms service to efficiently discover and save any template for your personal or business requirements!

- Make sure you've located a suitable document. Review the description and utilize the Preview feature, if available, to verify if it fulfills your needs. If it does not meet your criteria, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Enter your credit card information or use the PayPal option to finalize the purchase.

- Obtain your Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust. Select the file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

Yes, an irrevocable trust is subject to the 5-year rule under Medicaid regulations. This rule states that any assets transferred into an irrevocable trust may affect eligibility for Medicaid benefits if you apply within five years of those transfers. Therefore, it's crucial to understand how a Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust, is structured to avoid potential complications later. Consulting resources like USLegalForms can help clarify your options.

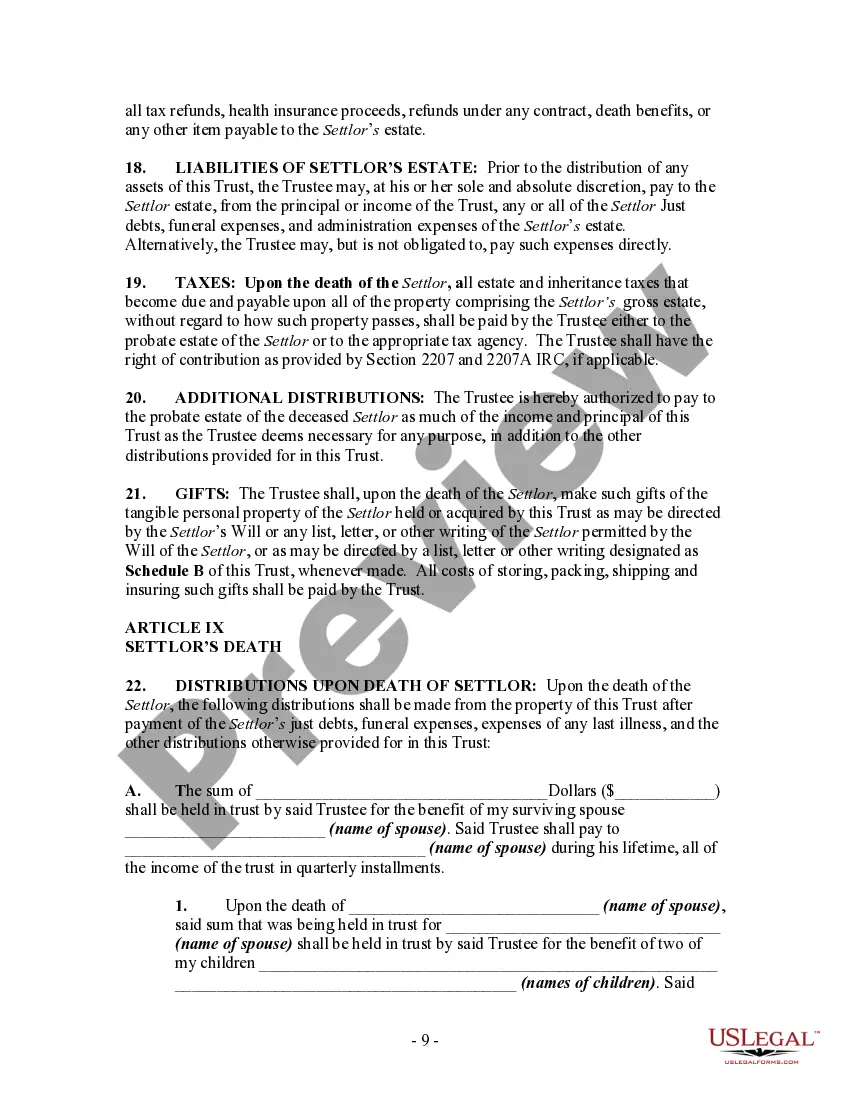

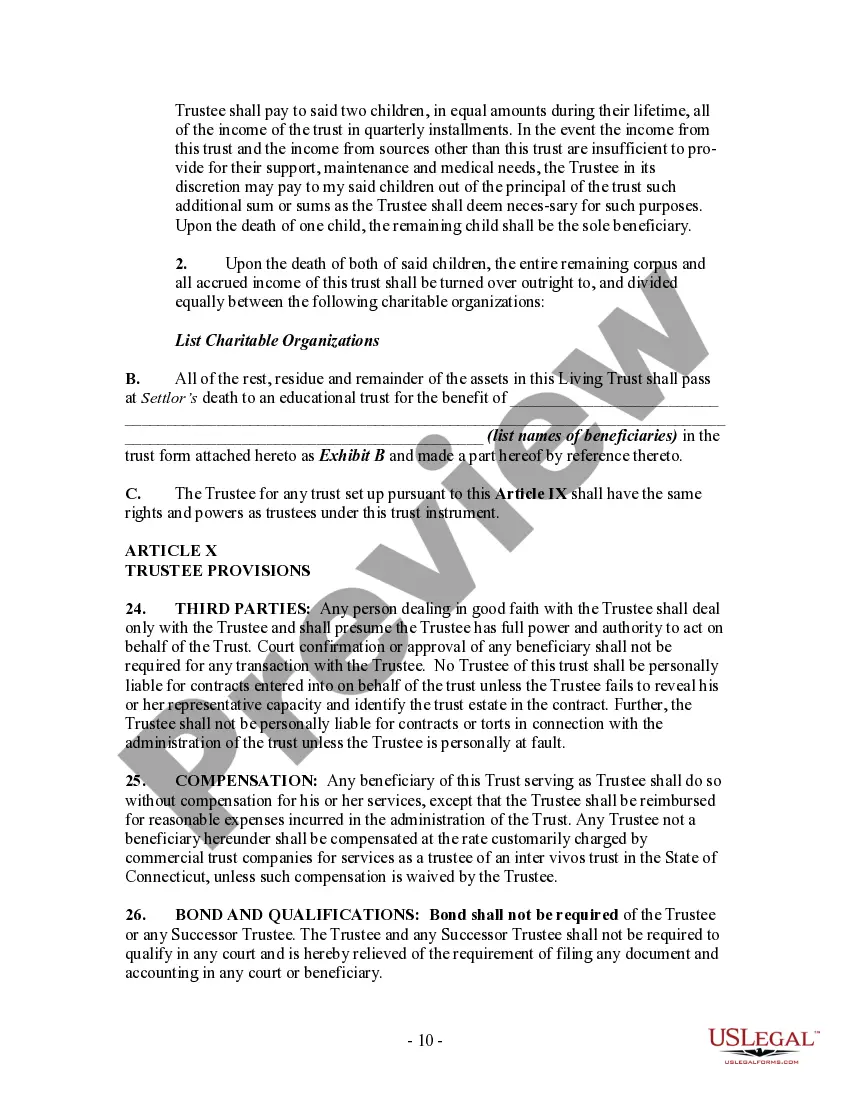

The payout rule for trusts determines how and when distributions occur to beneficiaries. In the context of a Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust, the trustee must follow the specific instructions laid out in the trust document. Generally, distributions can be made at certain intervals or upon particular events, ensuring that the intended beneficiaries receive their benefits according to your wishes.

Yes, a significant downside of a revocable trust is its lack of protection from creditors and lawsuits, unlike irrevocable trusts. Moreover, assets in a Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust are still considered part of your taxable estate. It's essential to weigh these factors against your estate planning goals and consult with a knowledgeable advisor.

Husbands and wives might benefit from having separate revocable trusts, particularly to manage individual assets or specific wishes. A Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust makes it easier to distribute distinct assets while maintaining control over shared property. Assess your situation and consult with professionals to determine the best approach for your estate plans.

One downside of a revocable trust includes the lack of asset protection; creditors can still access these assets. Additionally, setting up a Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust can be more expensive than a will initially. However, many people find these costs worthwhile for avoiding potential probate fees in the long run.

Typically, assets such as retirement accounts and life insurance policies should not be placed in a revocable trust due to tax implications. Instead, it’s advisable to designate beneficiaries directly on those accounts, ensuring they align with your overall plan. A Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust allows for careful consideration of how various assets are managed.

Suze Orman emphasizes the importance of a revocable trust as a key estate planning tool. She notes that a Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust can simplify your estate management and avoid probate. By creating a trust, you streamline the distribution of your assets according to your wishes.

The remainder of a trust refers to the assets that remain after specific distributions have been made, such as the Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust. This means that after your spouse receives their designated share, the remainder passes to your children and, ultimately, to an education trust. Understanding this structure helps ensure your loved ones receive their intended inheritances.

You should consider placing a variety of assets in your revocable trust, including your home, investment accounts, and other valuable property. This helps facilitate smooth asset transfer and avoid probate. When establishing your Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust, having a diverse portfolio within the trust ensures your loved ones receive the intended benefits efficiently.

Upon the death of one spouse, a revocable trust typically becomes irrevocable. This means that only the surviving spouse can manage and distribute the trust assets without further changes. In light of a Stamford Connecticut Revocable Living Trust Agreement with Sum Certain to Spouse in Trust, Part of Remainder to Two of Children and Final Remainder to Education Trust, it's essential to have clear language in the trust document to guide the remaining spouse through this transition.