Aurora Colorado Acknowledgment for Partnership

Description

How to fill out Colorado Acknowledgment For Partnership?

No matter the social or professional level, finalizing legal documents is an unfortunate requirement in contemporary society.

Frequently, it’s nearly unattainable for an individual lacking any legal expertise to compose such documents from the ground up, primarily due to the intricate terminology and legal subtleties they include.

This is where US Legal Forms proves beneficial.

Verify that the template you have located is appropriate for your area as the laws of one state or jurisdiction do not apply to another.

Examine the form and review a short summary (if available) of situations the document can be utilized for.

- Our service offers an extensive collection of over 85,000 ready-to-use state-specific documents that cater to nearly every legal circumstance.

- US Legal Forms also acts as an excellent resource for associates or legal advisors who wish to conserve time by utilizing our DIY forms.

- Whether you need the Aurora Colorado Acknowledgment for Partnership or any other document that will be applicable in your state or region, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Aurora Colorado Acknowledgment for Partnership swiftly by utilizing our dependable service.

- If you are already a subscriber, you may proceed to Log In to your account to access the required form.

- However, if you are not familiar with our platform, ensure to follow these steps before downloading the Aurora Colorado Acknowledgment for Partnership.

Form popularity

FAQ

Yes, if your partnership operates in Aurora, Colorado, you need to file a partnership tax return. This filing informs the Colorado government about your partnership's income and distribution to partners. Utilizing services from U.S. Legal Forms can simplify this process, guiding you through the necessary steps to ensure compliance with state laws.

Colorado form 1706 is the Partnership Income Tax Return form. This document is crucial for partnerships to report their income and expenses to the state. Understanding this form is vital for compliance, and U.S. Legal Forms offers helpful resources to navigate it effectively, ensuring your partnership adheres to Colorado tax regulations.

Yes, you can file Colorado K-1s electronically. E-filing provides a convenient way to submit your tax documents while ensuring accuracy and efficiency. Utilize platforms like U.S. Legal Forms for guidance on electronic submission processes, specifically tailored for partnerships in Aurora, Colorado.

Residents and businesses earning income in Colorado, including those involved in partnerships, must file a tax return. This requirement ensures that all earners contribute to state revenue. U.S. Legal Forms can help clarify your filing responsibilities, ensuring you meet all necessary regulations without hassle.

If you don't file a partnership tax return in Aurora, Colorado, you may face significant consequences, including fines and increased scrutiny from tax authorities. Additionally, partners may be personally liable for tax liabilities that arise, further complicating your financial standing. It is crucial to prioritize this filing to maintain good standing with tax regulations.

Yes, your partnership is typically required to file a tax return in Aurora, Colorado. Partnerships are generally considered pass-through entities, meaning the income is reported on partners' individual returns. Failing to file can lead to complications, so it is essential to adhere to this regulation for a smooth tax process.

Yes, as a business operating in Aurora, Colorado, you must file a Colorado business tax return. This requirement applies even if your partnership does not owe any tax. By ensuring compliance, you can avoid potential fines and penalties that may arise from neglecting this obligation. Consider using resources like U.S. Legal Forms for streamlined assistance.

Key words for an acknowledgment notary include 'signature verification,' 'identity confirmation,' and 'notarial certificate.' These terms help outline the responsibilities and duties involved in the acknowledgment process. Having a grasp on these key concepts is essential for effective practice. For comprehensive guides, visit uslegalforms to learn more about the Aurora Colorado Acknowledgment for Partnership.

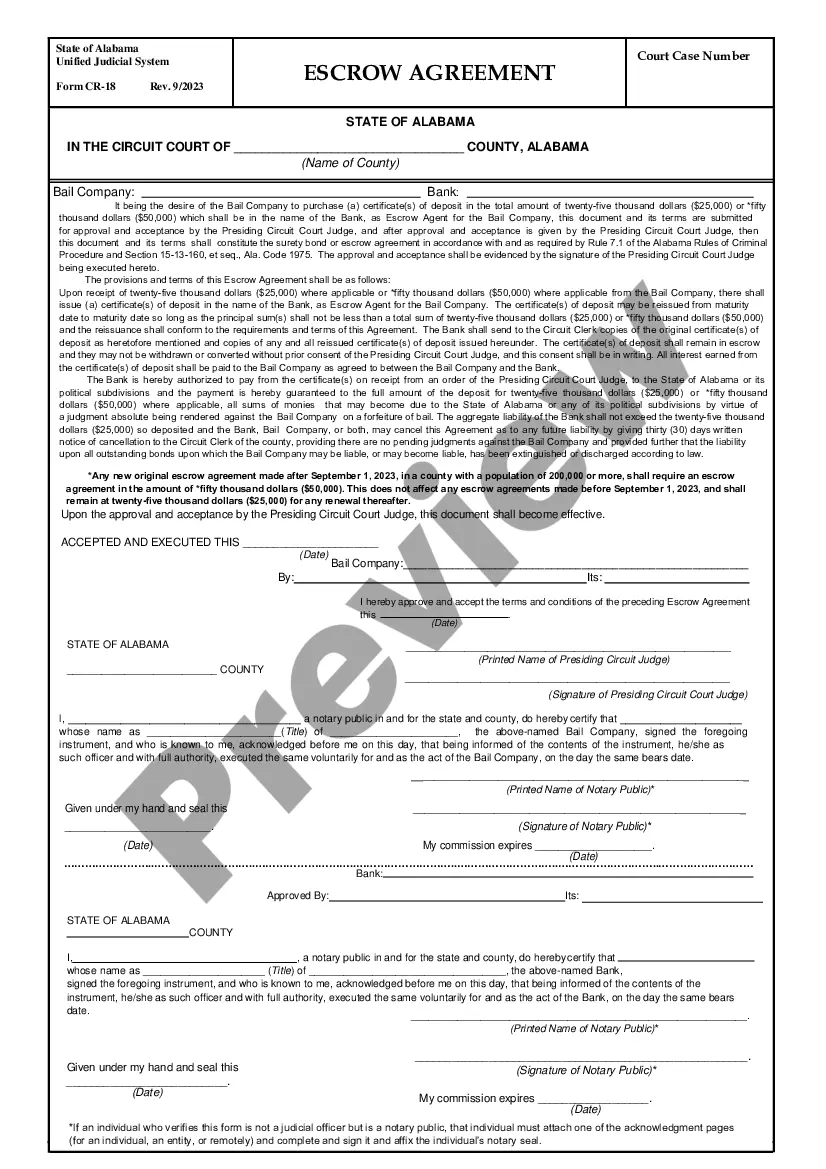

Filling out a partnership form requires entering details such as the names of the partners, their contributions, and the agreed terms of the partnership. It is crucial to ensure that all information is accurate and complete before signature. Consider using our easy-to-follow templates for the Aurora Colorado Acknowledgment for Partnership to make this process as smooth as possible.

An example of acknowledgment of signature includes a notary witnessing a signer completing a legal document and then providing a statement affirming that the signature is genuine. This statement is often included in an official acknowledgment certificate. For effective examples of acknowledgment processes, refer to our user-friendly materials on Aurora Colorado Acknowledgment for Partnership available at uslegalforms.