Thornton Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S

Description

How to fill out Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S?

Regardless of one’s societal or occupational rank, completing legal documents is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly impossible for someone without a legal background to generate such documents from scratch, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms provides assistance.

Verify that the form you’ve selected is appropriate for your region since the regulations of one state or county are not applicable in another.

Review the document and read through a brief description (if available) of situations the form may be used for.

- Our platform offers an extensive database with over 85,000 ready-to-use documents tailored to specific states that cater to almost any legal situation.

- US Legal Forms is also an excellent source for associates or legal advisors aiming to enhance their time efficiency using our DIY papers.

- Whether you need the Thornton Colorado Statement Of Personal Representative Closing Small Estate Pursuant To §15-12-1204, C.R.S or any other pertinent document for your state or county, US Legal Forms makes everything accessible.

- Here’s the procedure to obtain the Thornton Colorado Statement Of Personal Representative Closing Small Estate Pursuant To §15-12-1204, C.R.S quickly using our dependable platform.

- If you are already a registered user, proceed to Log In to your account to download the required form.

- But if you are a new user, ensure you follow these steps before downloading the Thornton Colorado Statement Of Personal Representative Closing Small Estate Pursuant To §15-12-1204, C.R.S.

Form popularity

FAQ

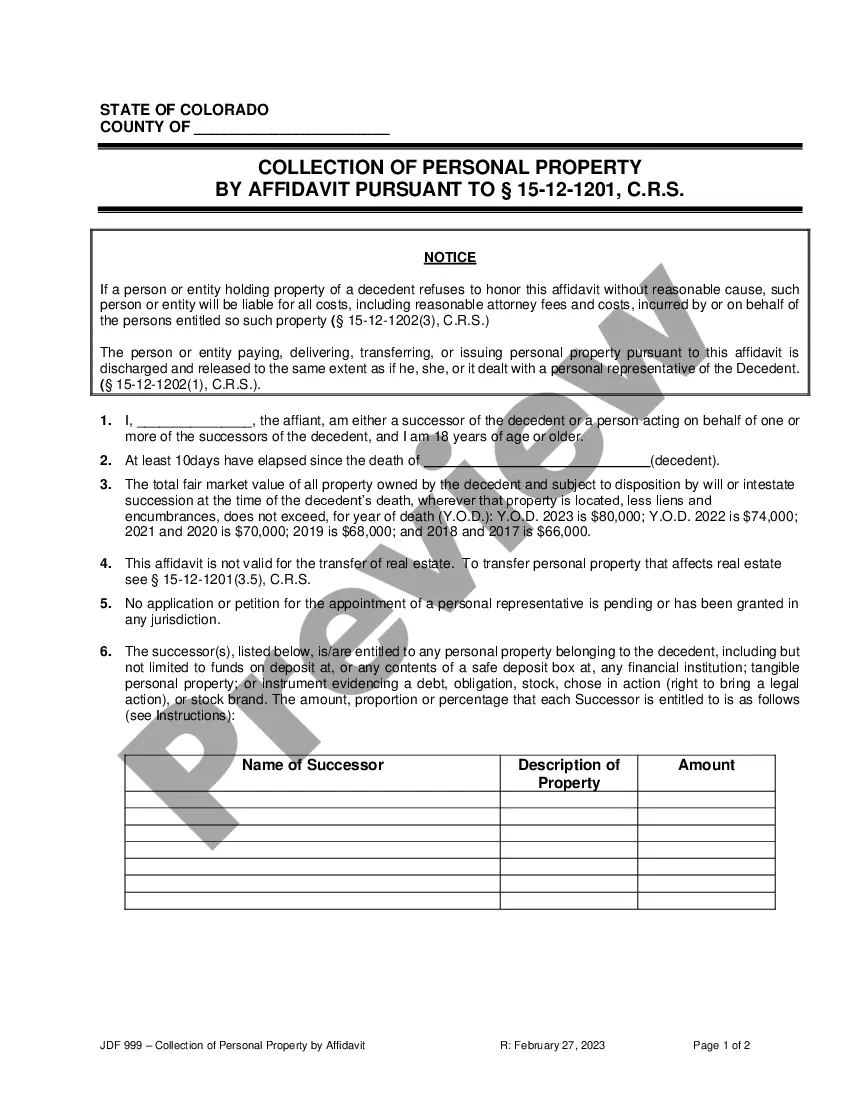

A Colorado small estate affidavit is a legal document that can help someone collect property that is owed to them and that formerly belonged to a person who died (a ?decedent.?) The process is also called a 'Collection of Personal Property by Affidavit,' and it is useful because it allows successors or heirs to avoid a

According to tariff, the executor is entitled to 3.5% on the gross value of assets in an estate and 6% on income accrued and collected after the death of the deceased. It is best to discuss the fees with your family upfront so that they are aware of how the fees will be calculated.

In Colorado, it takes a minimum of six months to probate a will. If the will is contested or if there are other complexities involved, the process can take longer.

As an Executor, you should ideally wait 10 months from the date of the Grant of Probate before distributing the estate. The Grant of Probate is the document obtained from the court which gives the legal authority for you to deal with the estate.

A small estate is defined as an estate worth less than $70,000 (as of 2020). There is also no real property. A small estate affidavit is used and the heirs are not required to go through the probate court for the estate administration process.

Length of time for probate to be completed varies in Colorado. The minimum time for formal and informal probate is six months by law. However, it can take much longer for an estate to be ready for distribution, depending on the size, complexity and any issues that may arise.

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

STEP 1: Download and complete your forms.STEP 2: Mail or hand deliver a copy of your forms to all people who have an interest in the estate.STEP 3: File JDF 965 Statement of Personal Representative Closing Administration with the court.STEP 1: Download and complete your forms.

Typical Executor Fees in Colorado The compensation received by a personal representative can vary according to the wishes of the deceased, but two percent of the probate estate is common. The larger the estate, the greater the time involved in settling the affairs and the higher the fee.

Executor fees (Colorado does not have a statute governing the amount of executor compensation, which means that reasonable compensation can be determined by probate court. According to org a reasonable executor fee is about 1.5% of the estate);