This Living Trust for Individual as Single, Divorced or Widow(er) with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Colorado Springs Colorado Living Trust for Individual as Single, Divorced or Widow or Widower with No Children

Description

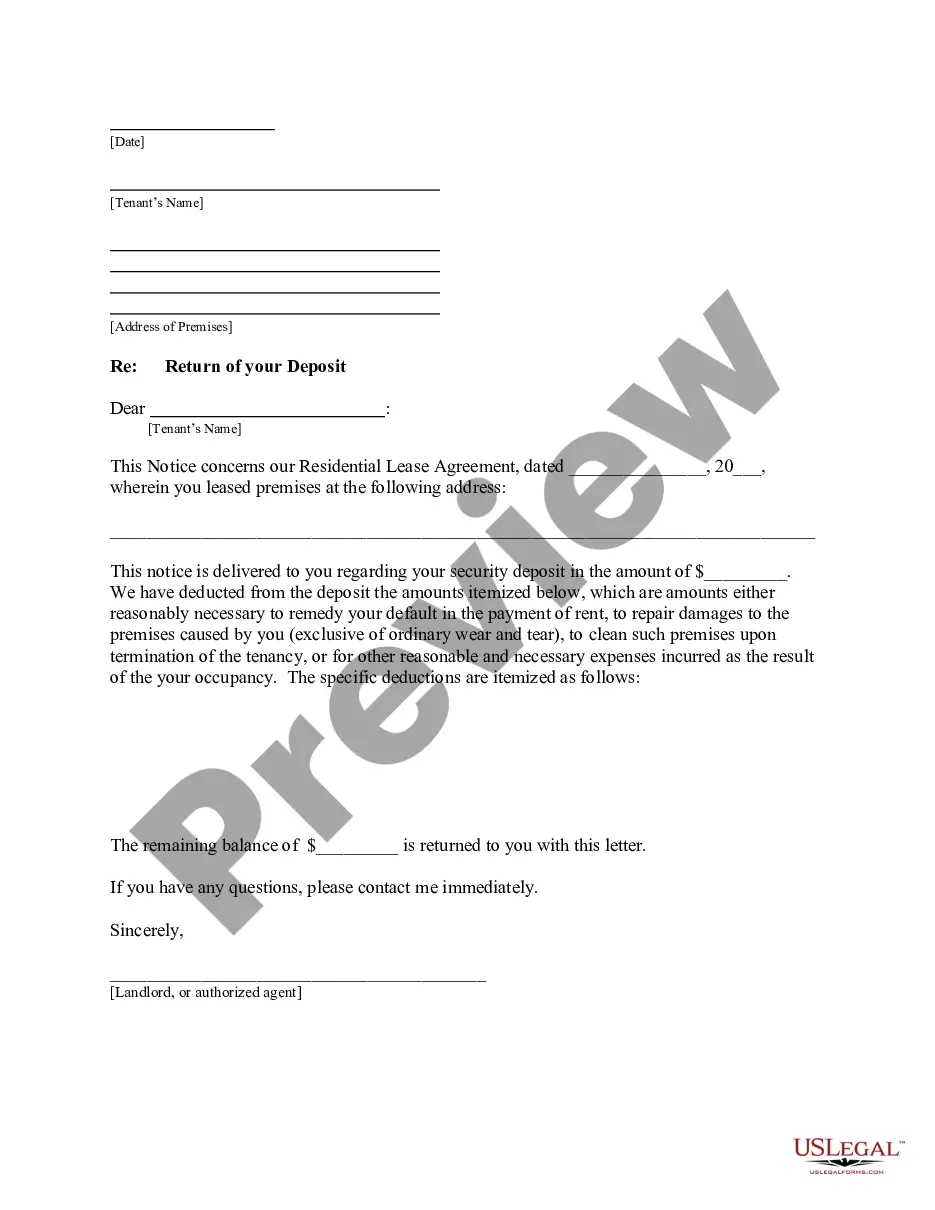

How to fill out Colorado Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children?

Regardless of social or professional rank, filling out legal documents is an unfortunate requirement in today’s business landscape.

Often, it’s nearly unfeasible for an individual lacking legal education to draft such documents from scratch, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms comes into play.

If you are not familiar with our platform, please take the following steps before acquiring the Colorado Springs Colorado Living Trust for Individuals as Single, Divorced, or a Widow or Widower with No Children.

Ensure that the form you have located is suitable for your area, as the laws of one state or county do not apply to another. Review the form and read a brief description (if available) of the cases for which the document can be utilized. If the selected form does not fulfill your needs, you may restart and search for the correct form. Click Buy now and select your preferred subscription option, using your credentials or creating one from scratch. Choose your payment method and proceed to download the Colorado Springs Colorado Living Trust for Individuals as Single, Divorced, or a Widow or Widower with No Children once the transaction is completed. You’re all set! Now, you can either print the document or complete it online. Should you encounter any issues locating your purchased forms, you can easily find them in the My documents tab. Whatever legal matter you're aiming to resolve, US Legal Forms has you covered. Give it a try now and experience it for yourself.

- Our service offers an extensive library of over 85,000 ready-to-use state-specific documents applicable to nearly any legal situation.

- US Legal Forms is also an excellent asset for colleagues or legal advisors looking to save time using our DIY forms.

- Whether you require the Colorado Springs Colorado Living Trust for Individuals as Single, Divorced, or a Widow or Widower with No Children, or any other document that will be legitimate in your region or county, US Legal Forms has everything readily available.

- Here’s how you can acquire the Colorado Springs Colorado Living Trust for Individuals as Single, Divorced, or a Widow or Widower with No Children in minutes through our reliable service.

- If you are already a subscriber, simply Log In to your account to access the appropriate document.

Form popularity

FAQ

A living trust is a handy arrow in the estate planner's quiver. The state uses the Uniform Probate Code, though, so unless your estate is particularly large or complex, it may not be needed in Colorado.

You can create a living trust document by yourself with the help of an online program. This option will likely run you a few hundred dollars. You can also use an attorney, which will cost, possibly more than $1,000.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

A will does not go into effect until after you die, whereas a living trust is active once it is created and funded. This means that a trust can provide protection and direct your assets if you become mentally incapacitated, something a will is unable to do.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

A trust offers more control than a will. If you have concerns about how your heirs or beneficiaries will handle the assets you're leaving them, a trust offers you significantly more control than a will does.

A Colorado living trust, also called an inter vivos trust, allows the trustmaker to transfer ownership of personal assets into a trust during his life. The trustmaker continues to use the assets during his life (living in the home, driving the car, and spending the money).

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.