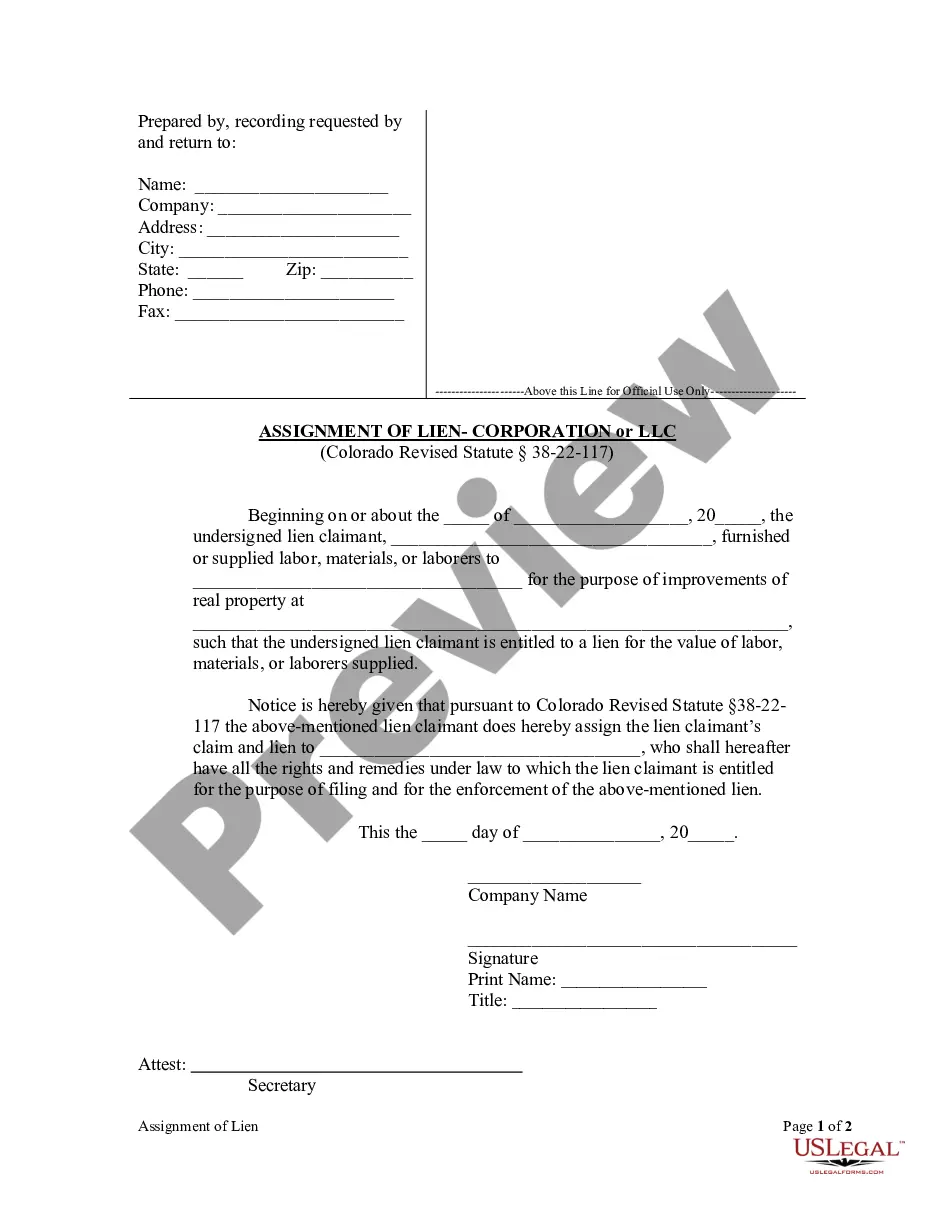

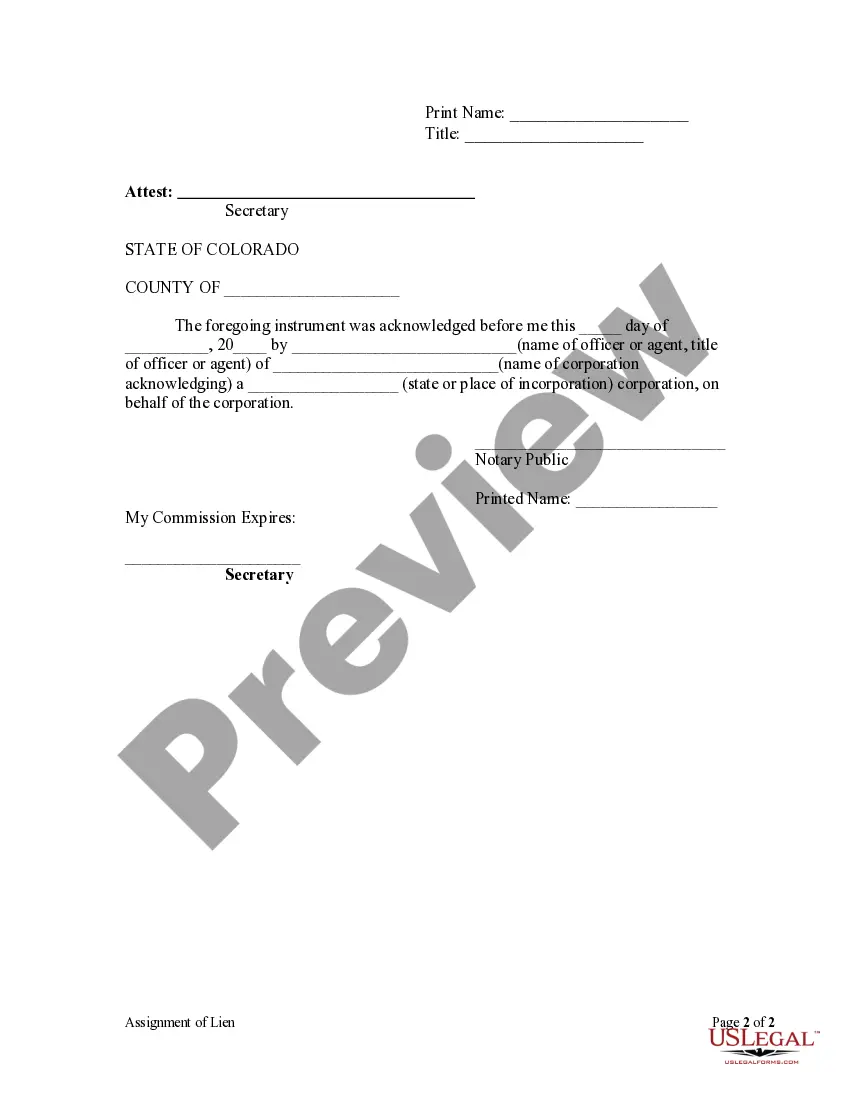

This Assignment of Lien form is for use by a corporate lien claimant to assign his claim and lien to another party who will have all the rights and remedies of the assignor. This assignment may be made before or after the filing of a statement of lien.

Colorado Springs Colorado Assignment of Lien - Corporation

Description

How to fill out Colorado Assignment Of Lien - Corporation?

We consistently aim to reduce or evade legal complications when managing intricate law-related or financial matters.

To achieve this, we seek attorney services that are typically quite costly.

Nevertheless, not all legal issues are equally intricate; many can be handled independently.

US Legal Forms is a web-based directory of current self-service legal documents covering a range from wills and power of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it from the My documents section.

- Our collection empowers you to manage your affairs independently without the necessity of legal representation.

- We provide access to legal document templates that may not always be available to the public.

- Our templates are tailored to state and regional specifications, greatly simplifying the search process.

- Utilize US Legal Forms anytime you need to quickly and securely find and download the Colorado Springs Colorado Assignment of Lien - Corporation or LLC or any other document.

Form popularity

FAQ

Timely File Your Lien: Your mechanics lien in Colorado must be filed within 4 months, or 120 days, of the last date you provided labor and materials for the project. However, if you did not provide materials and only provided labor, you only have 2 months from your last day of providing labor to file your lien.

No, Colorado does not require or have statutory forms for lien waivers.

Timely File Your Lien: Your mechanics lien in Colorado must be filed within 4 months, or 120 days, of the last date you provided labor and materials for the project.

Filing a mechanics lien The Colorado mechanics lien statute doesn't specifically require that claimants be licensed in order to file a valid and enforceable mechanics lien claim. So, unlicensed CO lien claimants may be able to pursue debts via mechanics lien.

Colorado: Colorado's lien statute is relatively straightforward, and the written contract requirement is based on the contract price. The relevant part of the statute states that if the amount to be paid exceeds $500, the contract must be in writing in order to claim a mechanics lien.

No, California statute specifically prohibits waiving lien rights in the contract.

Steps to file a Colorado mechanics lien Fill out the right Colorado mechanics lien form. Using a mechanics lien form that meets the statutory requirements, fill it out completely and accurately. Send a Notice of Intent to Lien to the property owner.File your lien claim with the Colorado county recorder.

If the lien on your property is not valid or it is not a legal lien, then you can take legal action. You will want to file what is called a spurious lien action. A spurious lien is an invalid or illegal lien. You must file a spurious lien action in court, and a judge eventually decides whether the lien is valid or not.

This involves filling out a Colorado Statement of Lien and sending a copy of the claim along with a Notice of Intent to Lien at least 10 days prior to filing. Once the 10-day period has passed, the Statement of Lien needs to be filed in the county clerk's office where the property is located.

How should the Colorado Notice of Intent to Lien be sent? A Colorado Notice of Intent to Lien can either be served by personal service or by mail. If mailing, then the notice must be sent by registered or certified mail with return receipt requested to the last known address of such persons.