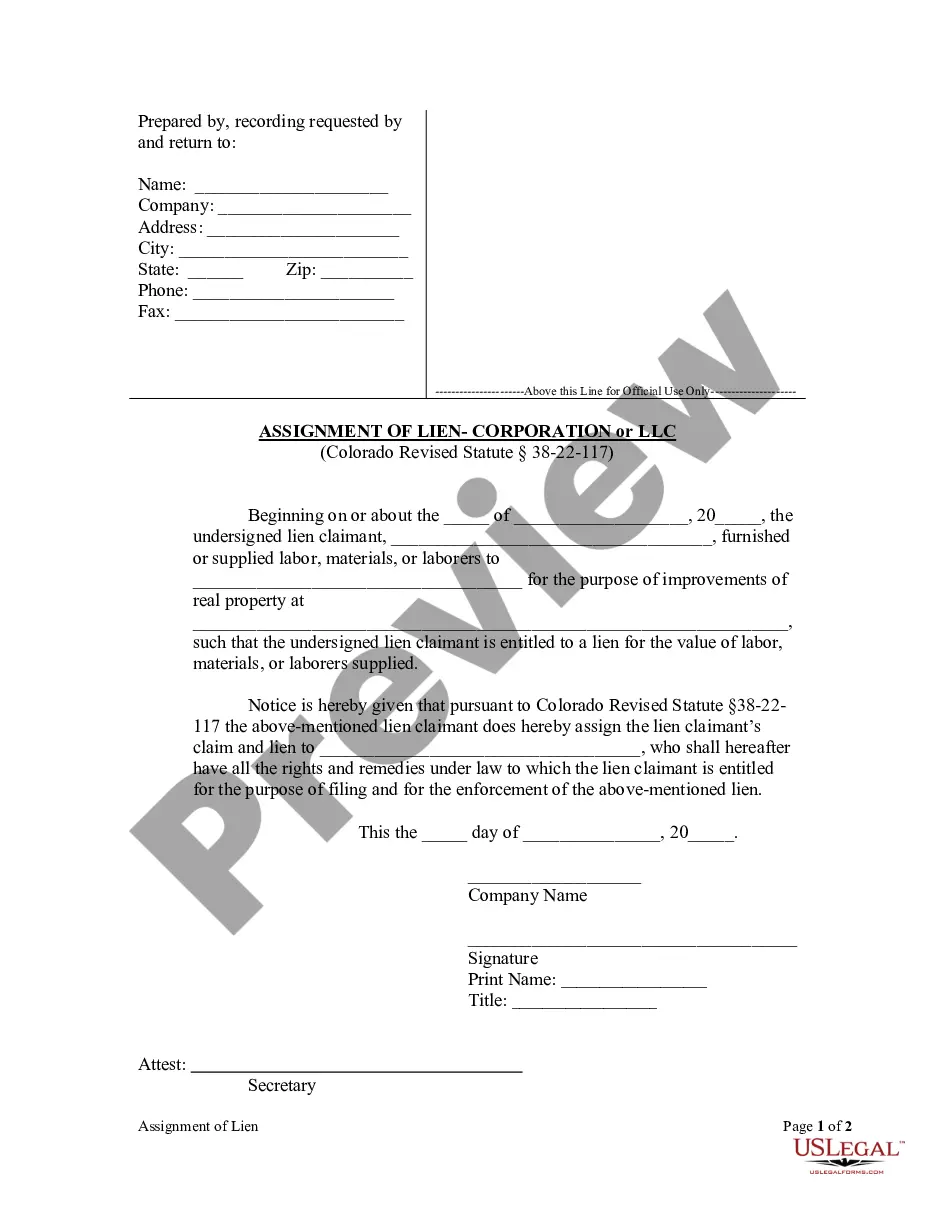

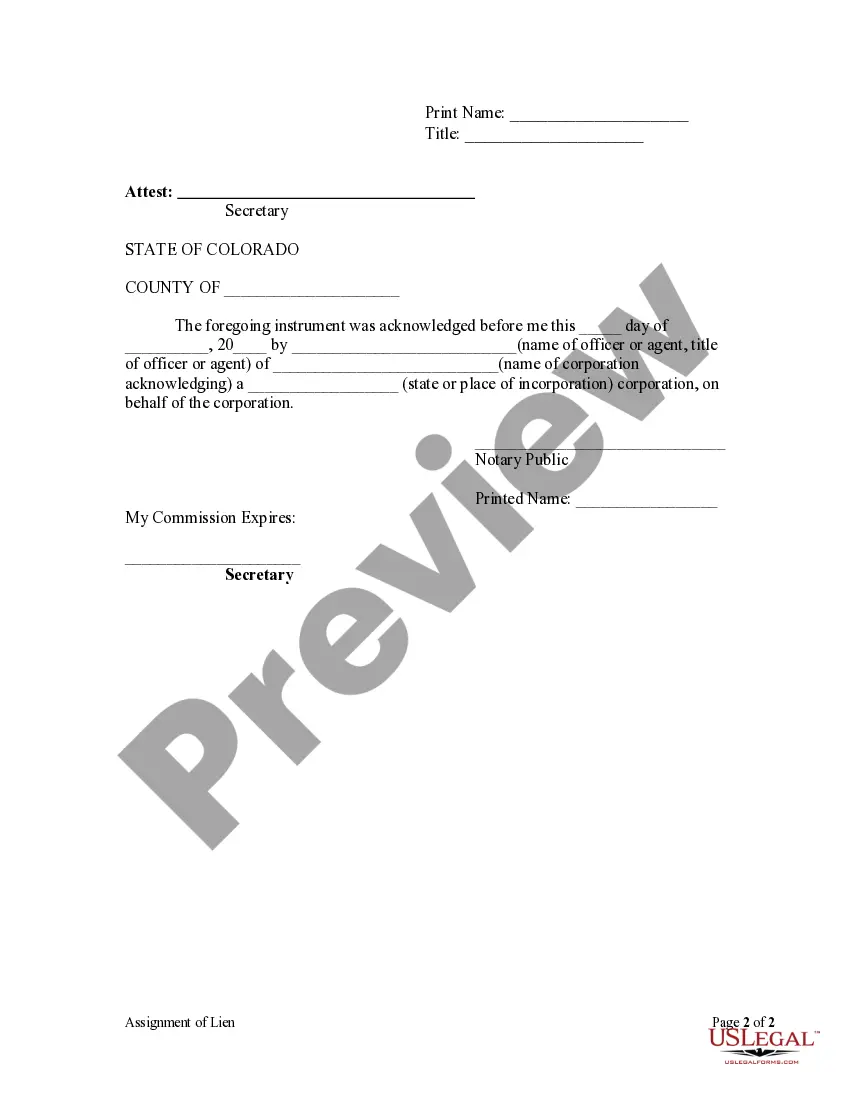

This Assignment of Lien form is for use by a corporate lien claimant to assign his claim and lien to another party who will have all the rights and remedies of the assignor. This assignment may be made before or after the filing of a statement of lien.

Centennial Colorado Assignment of Lien - Corporation

Description

How to fill out Colorado Assignment Of Lien - Corporation?

Regardless of the social or occupational position, finishing legal documents is a regrettable requirement in today's work atmosphere.

Too frequently, it's nearly unfeasible for someone without a legal background to compose such documents from the ground up, primarily due to the intricate language and legal nuances they involve. This is where US Legal Forms can be a game-changer.

Our service provides an extensive collection with over 85,000 ready-to-use state-specific documents that cater to nearly any legal situation. US Legal Forms is also a valuable resource for associates or legal advisors aiming to enhance their time efficiency by using our DIY forms.

If the one you picked does not meet your requirements, you can restart and search for the necessary form.

Click Buy now and select the subscription option that suits you best. Use your credentials or register anew. Choose the payment method and proceed to download the Centennial Colorado Assignment of Lien - Corporation or LLC as soon as the payment is completed. You're set to go! Now you can either print out the document or fill it in online. Should you encounter any difficulties accessing your purchased documents, you can conveniently find them in the My documents tab. Whatever issue you're attempting to address, US Legal Forms has you covered. Give it a shot today and observe it for yourself.

- Regardless of whether you need the Centennial Colorado Assignment of Lien - Corporation or LLC or any other documentation that is pertinent in your state or region, with US Legal Forms, everything is at your disposal.

- Here’s how you can obtain the Centennial Colorado Assignment of Lien - Corporation or LLC in moments using our trustworthy service.

- If you are already a current customer, you can proceed to Log In to your account to access the proper form.

- However, if you are not acquainted with our platform, be sure to follow these instructions before downloading the Centennial Colorado Assignment of Lien - Corporation or LLC.

- Confirm that the form you have selected is appropriate for your location since the regulations of one state or area do not apply to another state or area.

- Examine the document and review a brief outline (if available) of situations the document can be utilized for.

Form popularity

FAQ

Liens in Colorado last for a specific duration based on their nature and the actions taken by the lien holder. For example, a mechanic's lien typically lasts for six months without further action. Understanding these timelines helps property owners manage their assets effectively. You can rely on information from USLegalForms to navigate issues regarding Centennial Colorado Assignment of Lien - Corporation.

The duration a lien can be placed on a property varies depending on the type of lien. In Colorado, some liens, like judgment liens, can stay in effect for up to 6 years if renewed. However, specific conditions may apply, making it essential to stay informed about your situation. Comprehensive support on the Centennial Colorado Assignment of Lien - Corporation is available through platforms like USLegalForms.

In Colorado, a lien can remain on your property until the underlying debt is satisfied or a court order removes the lien. Typically, mechanics liens last for six months if no legal action is taken. Understanding these timeframes is crucial for homeowners dealing with liens. For further clarification, refer to resources concerning Centennial Colorado Assignment of Lien - Corporation.

In Colorado, lien laws dictate how and when liens can be placed on properties. Generally, a lien can be established by creditors to secure debts, ensuring they have a legal claim to the property. It's essential to comply with local statutes to safeguard your rights. Utilizing platforms such as USLegalForms can help you navigate the intricacies of Centennial Colorado Assignment of Lien - Corporation.

An assignment of lien occurs when the original lien holder transfers their rights to another party. This transaction is commonly part of business arrangements, where the new lien holder can then enforce the lien. Understanding this concept is important for any entity involved in property transactions. For detailed information, consider exploring resources on Centennial Colorado Assignment of Lien - Corporation.

To remove a lien on your property in Colorado, start by contacting the lien holder. You may need to settle the debt associated with the lien or negotiate a payment plan. If you resolve the issue, ensure the lien is officially released by obtaining a lien release document. Additionally, you can use resources like USLegalForms for guidance on managing a Centennial Colorado Assignment of Lien - Corporation.

To obtain a lien release in Colorado, you need the original lien document and proof of payment. This proof may include receipts, canceled checks, or a statement from the creditor confirming payment. Once you have these documents, you can file the lien release with the appropriate county clerk and recorder, ensuring the lien is officially removed. For a smooth process, consider using US Legal Forms to access templates specifically designed for the Centennial Colorado Assignment of Lien - Corporation.

In most cases, placing a lien without notification is legally permissible in Colorado. The lien typically becomes effective upon recording, regardless of whether the property owner is informed beforehand. Understanding the implications of a Centennial Colorado Assignment of Lien - Corporation helps ensure you stay ahead of potential issues.

In Colorado, it is possible for someone to place a lien on your house without your direct knowledge. Once the lien is recorded with the county's office, it becomes a matter of public record, which may go unnoticed unless you actively monitor your property status. Being aware of the processes involved with a Centennial Colorado Assignment of Lien - Corporation can help you stay informed.

To file a lien against a corporation, you must complete the necessary paperwork and submit it to the appropriate government office, typically the county clerk or recorder. It is essential to provide accurate information to fulfill legal requirements effectively. Using a platform like US Legal Forms can streamline the process of filing a Centennial Colorado Assignment of Lien - Corporation.