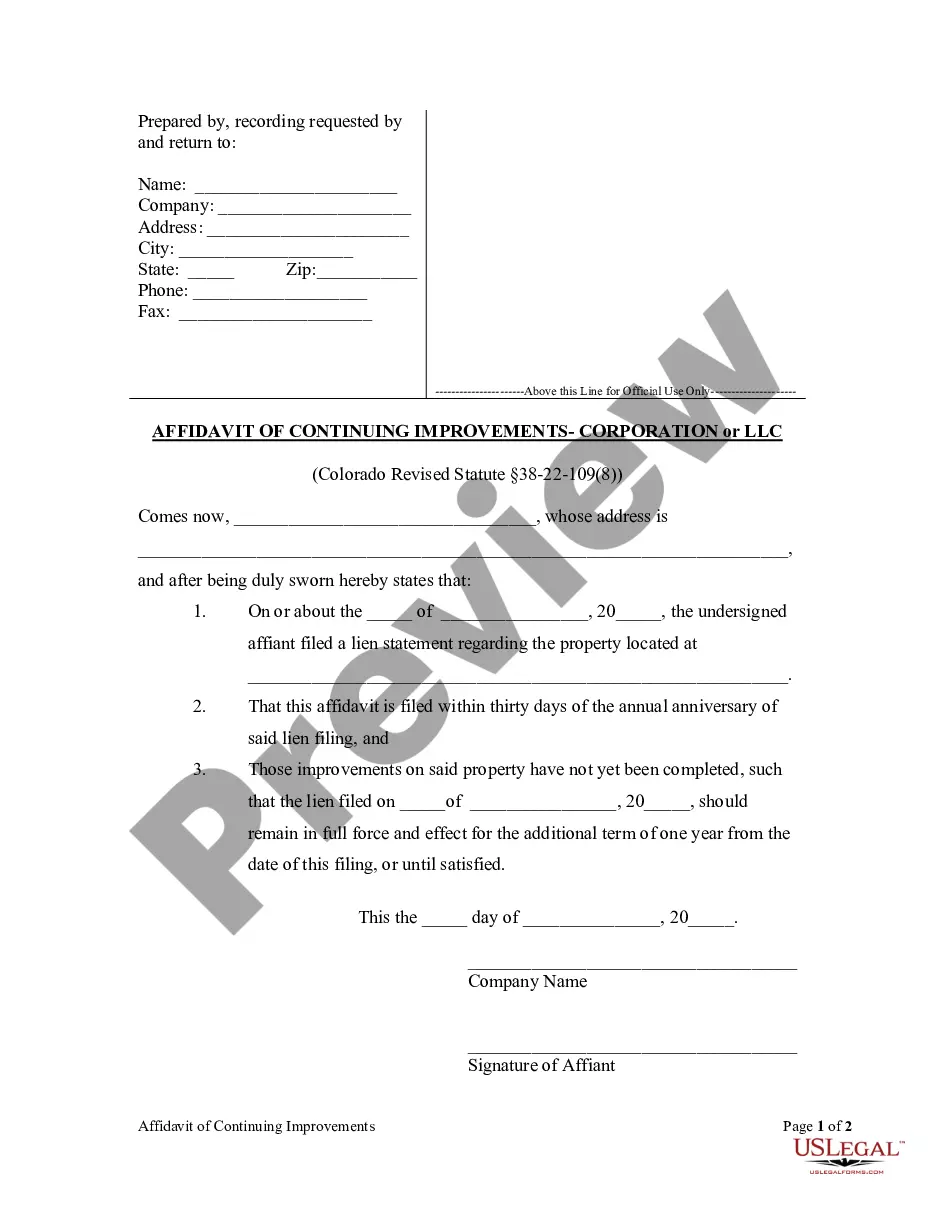

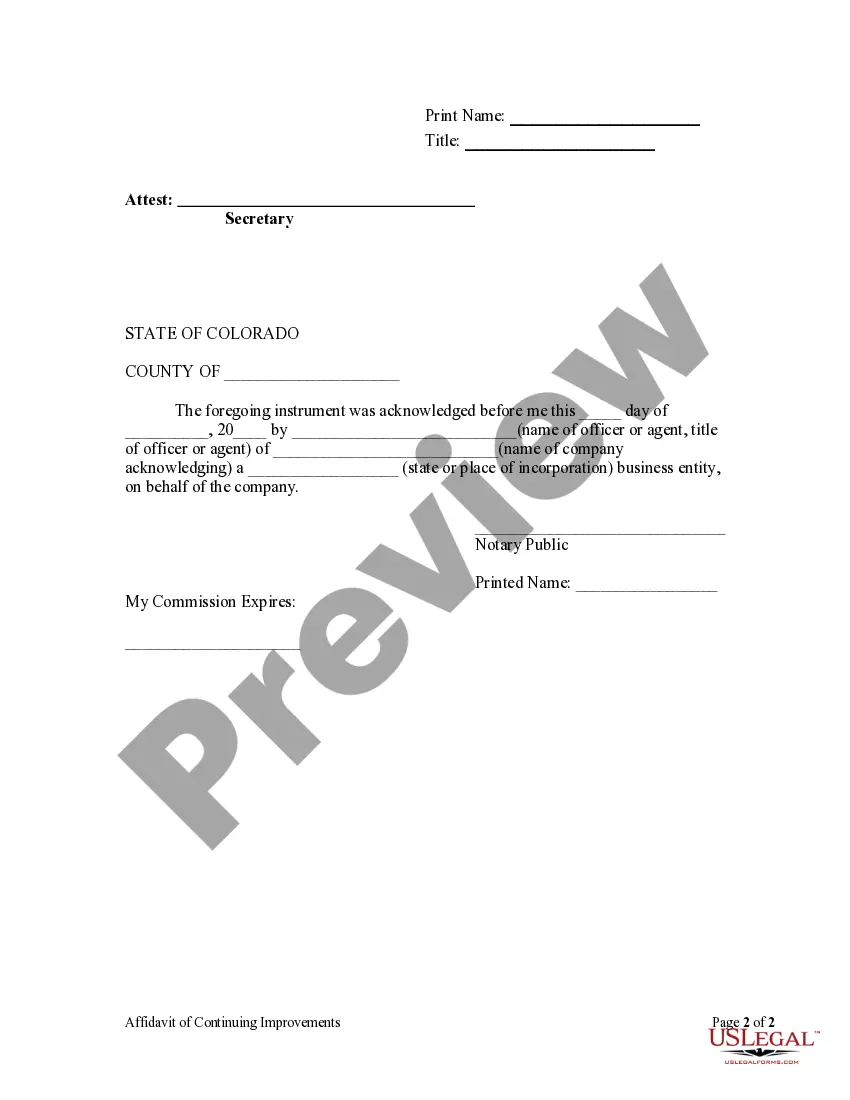

This Affidavit of Continuing Improvements form is for use by a corporation to extend the effectiveness of a lien by attesting that improvements on the property have not been completed. This Affidavit must be filed within 30 days of the one year anniversary of the original lien filing.

Aurora Colorado Affidavit of Continuing Improvements - Corporation

Description

How to fill out Aurora Colorado Affidavit Of Continuing Improvements - Corporation?

We consistently endeavor to reduce or evade legal complications when addressing intricate legal or financial issues.

To achieve this, we seek out legal assistance, which is typically very high-priced.

Nonetheless, not every legal situation is as convoluted; many can be resolved independently.

US Legal Forms is an online repository of current self-service legal forms encompassing a range of documents from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always re-download it in the My documents tab. The process is equally simple if you’re new to the platform! You can set up your account in a matter of minutes. Ensure that the Aurora Colorado Affidavit of Continuing Improvements - Corporation or LLC adheres to your state and local regulations. Additionally, it’s crucial to review the form’s description (if available), and if you notice any inconsistencies with your initial expectations, look for an alternative template. Once you confirm that the Aurora Colorado Affidavit of Continuing Improvements - Corporation or LLC meets your needs, select a subscription option and complete your payment. Afterward, you can download the document in any offered format. For over 24 years, we’ve assisted millions of individuals by providing customizable and up-to-date legal forms. Take advantage of US Legal Forms today to conserve time and resources!

- Our platform enables you to manage your legal matters without relying on legal counsel.

- We offer access to legal document templates that aren't always publicly accessible.

- Our templates are tailored to specific states and regions, making your search much easier.

- Benefit from US Legal Forms whenever you wish to locate and download the Aurora Colorado Affidavit of Continuing Improvements - Corporation or LLC, or any other document safely and effortlessly.

Form popularity

FAQ

To convert your sole proprietorship to LLC, follow these seven steps. Check your business name.File articles of organization.Write an LLC operating agreement.Announce your LLC.Apply for a new bank account.Apply for an EIN.Apply for business licenses and permits.

Sales Tax ArapahoeAdamsCity of Aurora3.75%3.75%State2.90%2.90%RTD1.00%1.00%Cultural0.10%0.10%2 more rows

LLCs offer more protection, tax benefits, and other advantages that make them worth considering as business entities. by Michelle Kaminsky, J.D. If you currently own a sole proprietorship and wonder whether you can change it to a limited liability company (LLC), the simple answer is yes.

Aurora (/??ro?r?/, /??r??r?/) is a home rule municipality located in Arapahoe, Adams, and Douglas counties, Colorado, United States.

Five Colorado cities impose an income tax as a flat dollar amount on compensation earned by both residents and nonresidents: Aurora: $2 per month. Denver: $5.75 per month.

How much does it cost to form an LLC in Colorado? The Colorado Secretary of State charges $50 to file the Articles of Organization. You can reserve your LLC name with the Colorado Secretary of State for $25.

Sales Tax ArapahoeAdamsRTD1.00%1.00%Cultural0.10%0.10%County0.25%0.75%Total Rate8.00%8.50%2 more rows

How to Form a Single-Member LLC in Colorado Name Your SMLLC.File Articles of Organization.Prepare an Operating Agreement.Do You Need an EIN?Register With the Department of Revenue.Obtain Business Licenses.File Your Annual (Periodic) Report.

The Colorado sales tax rate is currently 2.9%. The County sales tax rate is 0.25%. The Aurora sales tax rate is 3.75%.

You can transfer assets owned by your Sole Proprietorship to your LLC by: making a capital contribution, by sale, or. by assignment.