This form is a Quitclaim Deed where the Grantors are an individual and a corporation and the Grantee is an LLC. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company

Description

How to fill out Colorado Quitclaim Deed From An Individual And A Corporation To A Limited Liability Company?

Take advantage of the US Legal Forms and gain immediate access to any form template you require.

Our advantageous website with an extensive array of templates enables you to locate and acquire almost any document sample you will need.

You can save, complete, and authenticate the Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company in just a few minutes rather than spending hours online searching for an appropriate template.

Utilizing our catalog is an excellent method to enhance the security of your form submissions.

Navigate to the page with the form you need. Ensure that it is the form you anticipated finding: review its title and description, and utilize the Preview option if it is available.

Initiate the downloading process. Click Buy Now and select your preferred pricing plan. Then, create an account and finalize your order using a credit card or PayPal.

- Our knowledgeable legal experts frequently examine all the documents to ensure that the forms are pertinent to a specific state and comply with new laws and regulations.

- How can you procure the Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company.

- If you have a subscription, simply Log In to your account. The Download feature will be activated on all the documents you view.

- Furthermore, you can access all the previously saved documents under the My documents section.

- If you haven't registered for a profile yet, follow the steps outlined below.

Form popularity

FAQ

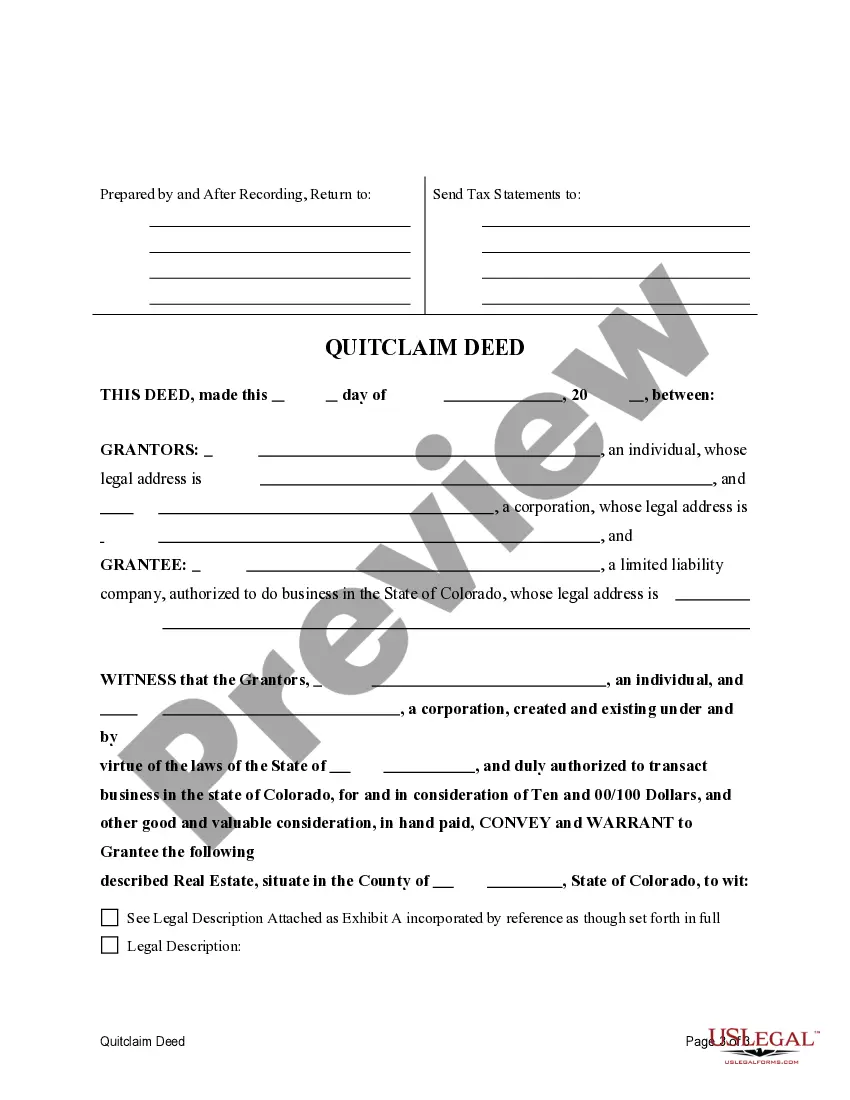

Filling out a Colorado quitclaim deed requires attention to detail to ensure accuracy. First, provide the names and addresses of both the grantor and the grantee, typically an individual or a corporation transferring ownership to a limited liability company. Next, include a legal description of the property being transferred and specify the intention to transfer ownership. For a seamless experience, consider using the US Legal Forms platform, which offers templates and guidance specifically for the Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company, making the process straightforward.

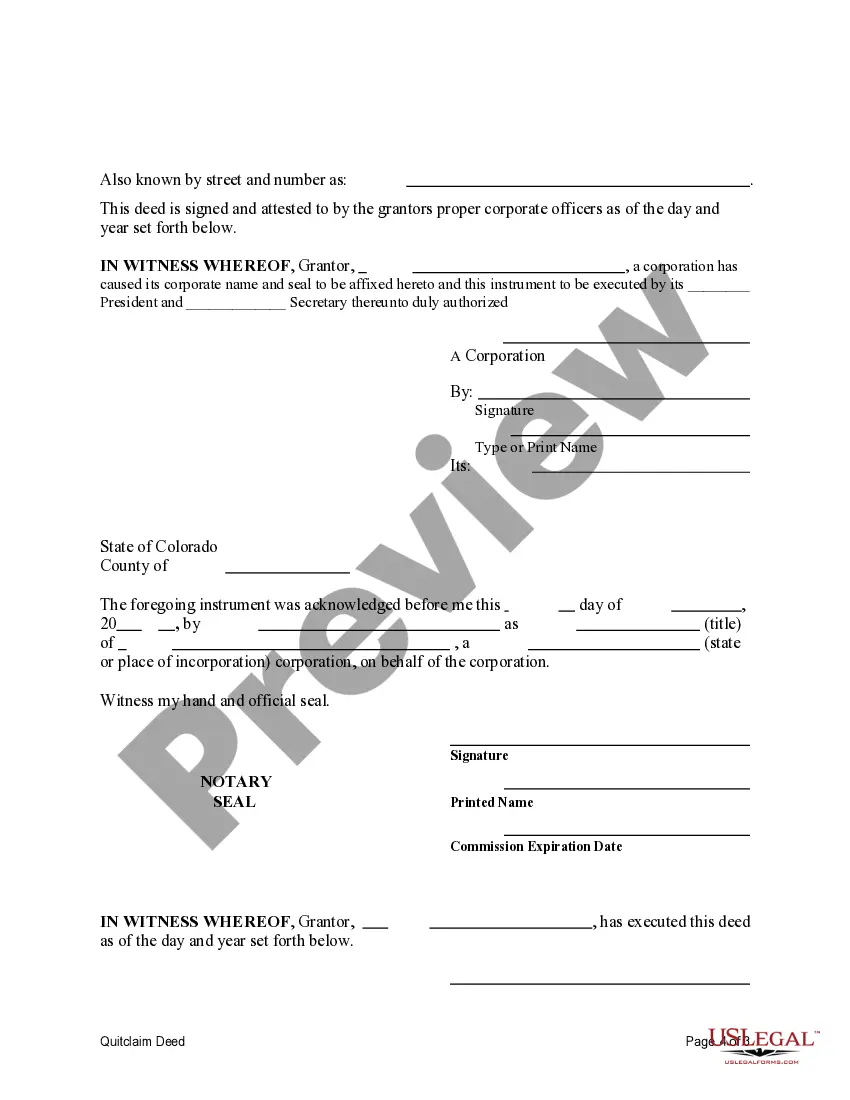

You can file a quit claim deed yourself in Colorado. After preparing the deed and signing it, take it to the local county clerk and recorder's office for submission. Keep in mind that an Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company needs proper notarization. Using a resource like USLegalForms can offer guidance and ensure you meet all requirements.

Yes, you can complete a quit claim deed on your own. However, accurately filling out all required information is vital to ensure the document is legally binding. When using an Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company, small mistakes could lead to complications in ownership transfers. If you're uncertain, USLegalForms can help you navigate the paperwork with ease and confidence.

To file a quitclaim deed in Colorado, you must prepare the deed and ensure all information is accurate. After signing the document, you can submit it to the county clerk and recorder where the property is located. It's important to note that using an Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company requires a proper acknowledgment by a notary. Utilizing platforms like USLegalForms can streamline this process, providing you with the necessary forms.

A quit claim deed transfers ownership without guaranteeing the property's title. This means buyers could inherit issues, such as liens or claims from previous owners. Moreover, using an Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company may not offer the same legal protections as other deed types. As a result, it's crucial to conduct proper due diligence and consider potential risks.

One disadvantage of transferring property into an LLC is the potential for added costs, such as legal fees and annual filing requirements. Additionally, an Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company may limit certain homeowner benefits, such as homestead exemptions. Furthermore, lenders may impose stricter terms if you want to refinance or obtain a mortgage for the property after transferring it to an LLC. It's important to weigh these factors when considering your options.

To transfer the deed of your house to an LLC, start by drafting an Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company. Clearly identify the property, the current owners, and the LLC. Once you sign and notarize the deed, file it with your local county clerk’s office to make the transfer official. It's a straightforward process, but consider using a platform like US Legal Forms for assistance with the documentation.

People often place their property into an LLC to protect their personal assets from potential liabilities associated with the property. Using an Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company helps separate personal and business finances. This separation can also facilitate easier transfer of property and provide potential tax benefits. Overall, many choose this approach to enhance personal security and manage their investments more effectively.

While it's possible to transfer a deed without a lawyer, consulting an attorney can provide you with valuable guidance. Lawyers can help ensure that your Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company complies with all legal requirements. Additionally, they can help you avoid potential pitfalls and clarify any complexities related to your specific situation. Ultimately, the choice is yours, but expert advice can be beneficial.

To transfer property to an LLC in Colorado, you'll need to complete an Arvada Colorado Quitclaim Deed from an individual and a corporation to a limited liability company. First, prepare the quitclaim deed, ensuring that it includes both the current owner's name and the LLC's name. After that, sign the document, have it notarized, and then file it with the county clerk and recorder's office. This process solidifies the transfer of ownership to your LLC.