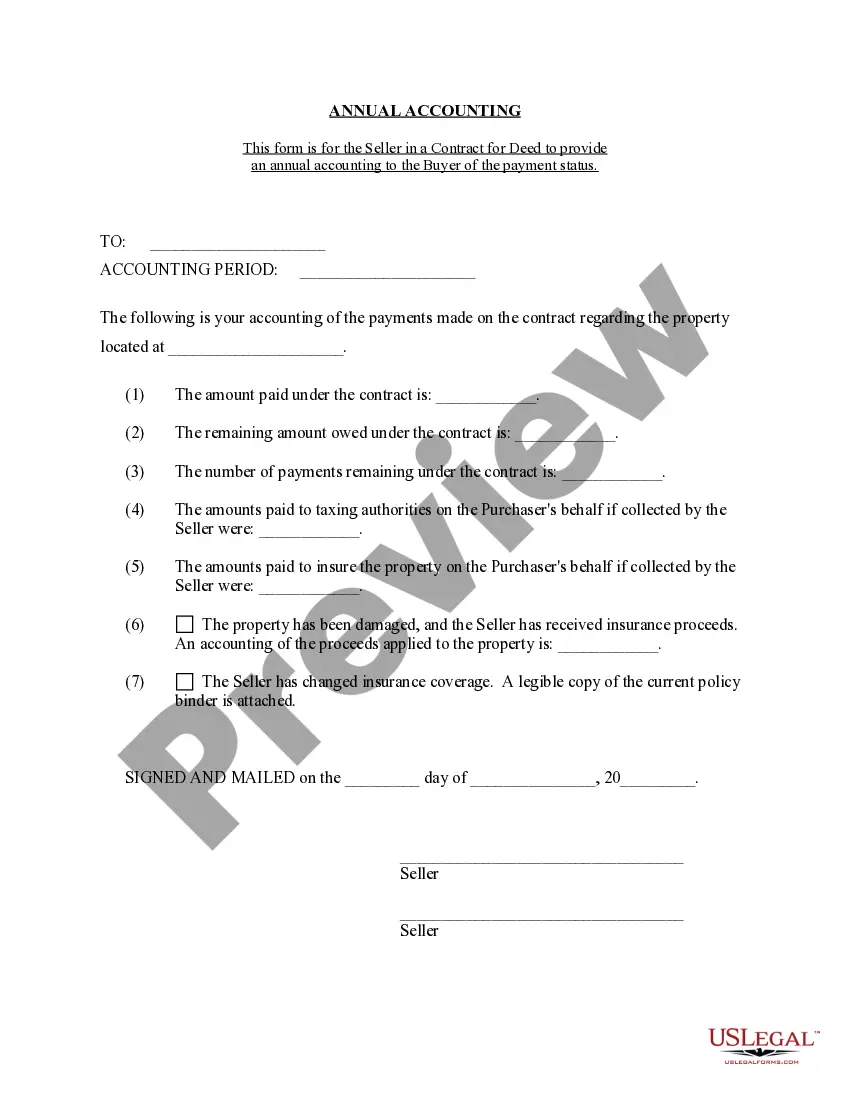

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Fort Collins Colorado Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Colorado Contract For Deed Seller's Annual Accounting Statement?

Finding authenticated templates tailored to your regional laws can be tough unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents for both personal and professional requirements and various real-life scenarios.

All the files are properly organized by category and jurisdiction, making it as easy as pie to search for the Fort Collins Colorado Contract for Deed Seller's Annual Accounting Statement.

Maintaining documentation orderly and compliant with legal standards is crucial. Take advantage of the US Legal Forms library to always have vital document templates readily available for any requirement!

- Familiarize yourself with the Preview mode and form details.

- Ensure you’ve selected the correct one that fits your needs and conforms to your local jurisdiction standards.

- Look for an alternative template if needed.

- If you spot any discrepancies, use the Search tab above to locate the right one.

- Once you find it suitable, proceed to the next step.

Form popularity

FAQ

The standard forms used in the vast majority of Colorado real estate transactions provide that an earnest money deposit is subject to forfeiture as ?liquidated damages? to the seller in the event of a default by the buyer.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

Land contracts (aka ?land installment contracts? or ?contracts for deed?) are agreements in which a homebuyer makes regular payments to the seller but the deed does not transfer at the outset; instead, the seller retains full ownership of the property until the final payment.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

Which of the following is correct according to the Colorado Real Estate Commission Position Statement regarding Rule F? Brokers may not add exculpatory language limiting their liability to any contract to which they are not a party such as the Contract to Buy and Sell.

In the state of Colorado one agent cannot represent both the buyer and seller.

Commission Rule E-23 states that a Colorado broker who cooperates with a broker who is licensed in another state or country may pay such out-of-state broker a finder's fee or share of the commission if: (1) such broker resides and maintains an office in the other state or county, (2) all advertising, negotiations,

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

According to Rule F, the rule that specifically give guidelines regarding Commission-approved forms: A broker who is not a principal party to the contract may not insert personal provisions, personal disclaimers or exculpatory language in favor of the broker in the ?Additional Provisions? section of a Commission-

If you're considering purchasing or selling a resale home (meaning an existing home rather than a new build home) in Colorado, the agreement under which you might purchase or sell the property is the Colorado Real Estate Commission's (?CREC?) Contract to Buy and Sell Real Estate (Residential).