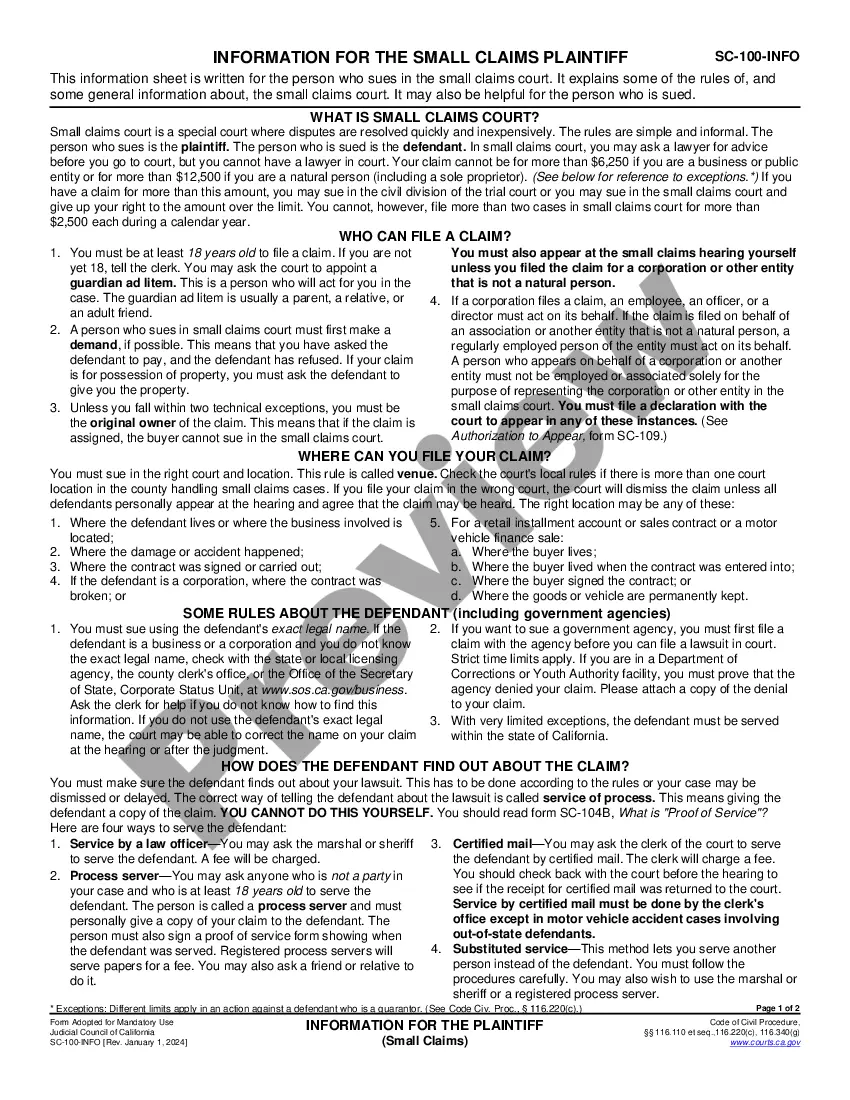

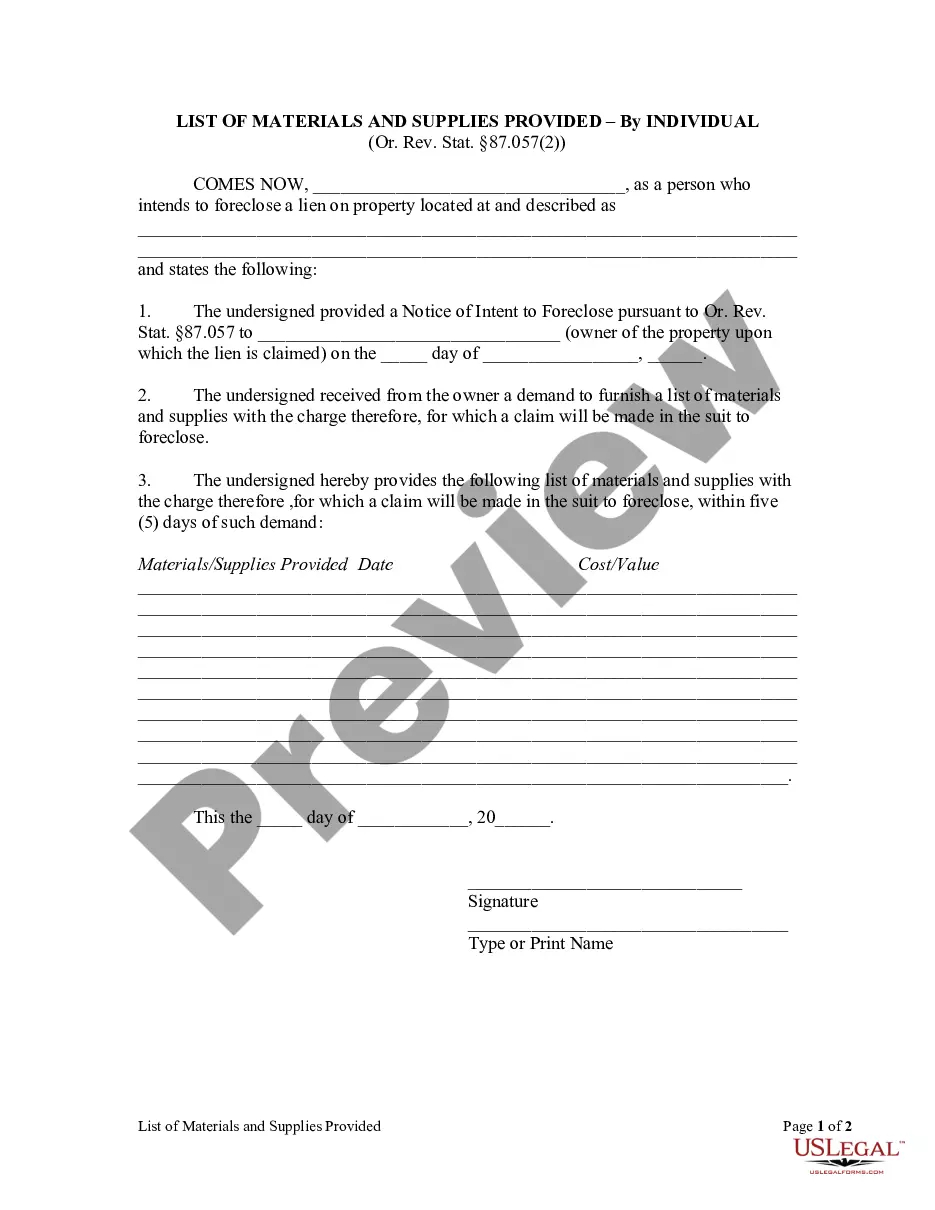

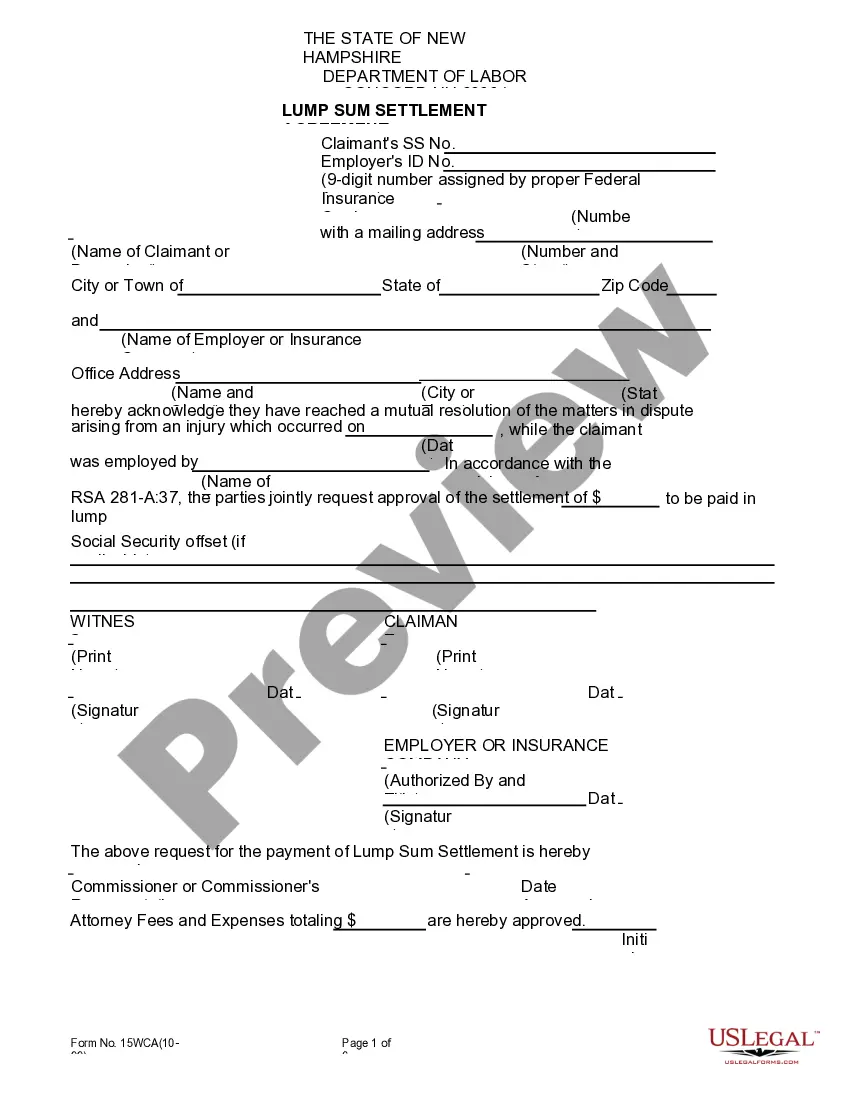

This form, How to Serve a Business, is used to make sure you serve the right business and persons. This form is to be used in conjunction with form SC-104 Proof of Service. USLF control no. CA-SC-104C

Thousand Oaks California How to Serve a Business

Description

How to fill out California How To Serve A Business?

Locating approved templates tailored to your regional regulations can be challenging unless you access the US Legal Forms database.

It is an online resource comprising over 85,000 legal documents for both personal and business requirements and every real-world scenario.

All forms are systematically organized by category and jurisdiction, making it as simple as pie to find the Thousand Oaks California How to Serve a Business.

Maintaining your paperwork orderly and in compliance with legal standards is crucial. Utilize the US Legal Forms library to have vital document templates for any requirements readily available!

- Verify the Preview mode and form details.

- Ensure you’ve selected the appropriate one that satisfies your needs and aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancy, utilize the Search tab above to locate the correct one.

- If it meets your criteria, proceed to the next step.

Form popularity

FAQ

Yes, you typically need a business license in each city where you conduct business activities, including Thousand Oaks, California. Each city has its own regulations and fees, so it's essential to research local requirements. This ensures that your business operates legally and avoids potential fines. For assistance navigating this process, consider using US Legal Forms to simplify your business licensing needs.

If you operate a business in California without a valid business license, you may face various consequences. This could include fines, penalties, and potential legal action. Additionally, not having a license can damage your business reputation, making it hard to gain new customers. To ensure compliance, it is vital to understand the requirements in Thousand Oaks, California, and how to serve a business properly.

To register as a small business in Thousand Oaks, California, start by determining your business structure, such as sole proprietorship or LLC. Next, select a unique business name and check its availability through the California Secretary of State's website. After that, you will need to file the necessary paperwork and obtain any required licenses or permits to operate legally. Consider using US Legal Forms to access templates and resources that simplify the process of serving your business needs effectively.

Yes, even if you have an LLC in California, you still need a business license to operate legally in Thousand Oaks. The LLC status does not automatically exempt you from local licensing requirements. By understanding these essentials, you can better navigate how to serve a business in Thousand Oaks, California, and ensure compliance with all regulations. For further assistance, consider exploring USLegalForms for guidance.

The key difference lies in their function and necessity. A business license is required for you to legally operate in Thousand Oaks, California, while a business permit may be required for particular operations depending on local regulations. It’s essential to check what applies to your situation, especially when evaluating how to serve a business in your locality.

While both a business permit and a business license are essential for operating in Thousand Oaks, California, they are not the same. A business license is a legal document that allows you to operate your business within a jurisdiction, whereas a business permit is often needed for specific activities such as zoning or health compliance. Thus, they serve unique roles when you consider how to serve a business in this area.

A permit and a license serve distinct purposes in Thousand Oaks, California. A permit typically authorizes specific activities within regulated areas, such as construction projects or environmental work. On the other hand, a license grants the ability to conduct business or offer certain services legally. Understanding these differences is crucial when considering how to serve a business in Thousand Oaks, California.

Yes, if you are a sole proprietor in California, obtaining a business license is generally required. This license allows you to operate your business legally and keeps you informed about local regulations in Thousand Oaks. As a sole proprietor, having this license can also boost your visibility and attract potential clients. For assistance with the licensing process, consider using U.S. Legal Forms.

As an independent contractor in California, you typically need a business license. This license legitimizes your work and ensures compliance with local regulations in Thousand Oaks. Additionally, it enhances your professional reputation and trustworthiness among clients. You can find detailed information on how to serve a business and fulfill licensing obligations through U.S. Legal Forms.

Yes, in Ventura County, you usually need a business license to legally operate your business. This requirement ensures your business adheres to local laws and serves the community properly. If you aim to understand how to serve a business in Thousand Oaks effectively, it’s important to obtain the necessary licenses. U.S. Legal Forms can help simplify this process for you.