This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

If you are looking for a legitimate form template, it’s incredibly difficult to find a more suitable location than the US Legal Forms site – one of the most comprehensive libraries online.

Here you can find numerous form samples for corporate and personal purposes by categories and areas, or keywords.

Utilizing our advanced search feature, locating the latest Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finish the registration process.

Receive the form. Choose the format and download it to your device.

- Additionally, the relevance of each document is confirmed by a team of professional attorneys who routinely review the templates on our platform and revise them according to the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is to Log In to your account and select the Download option.

- If you are utilizing US Legal Forms for the first time, just follow the guidelines provided below.

- Ensure you have opened the form you desire. Review its details and make use of the Preview option (if accessible) to examine its contents. If it doesn’t satisfy your requirements, utilize the Search feature at the top of the page to find the suitable document.

- Confirm your choice. Click the Buy now button. Then, select the desired subscription plan and input the information to register for an account.

Form popularity

FAQ

Writing a simple promissory note involves keeping the language clear and direct. Start by stating the amount due, the names of the lender and borrower, and the repayment terms. By labeling it as a Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you set the context for the agreement, making it easy to understand and enforce.

Yes, a handwritten promissory note can be legal as long as it contains the necessary elements of a valid contract, such as the amount, terms, and signatures. Many people create a Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate by hand; however, it's often recommended to use a standard template for clarity and completeness. Always keep a copy for your records.

To write a promissory note for payment, you should include essential details such as the amount owed, the borrower's name, and the terms of repayment. It's helpful to specify that this is a Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, which ensures clarity about collateral. Always include the date and signatures of all parties involved to validate the agreement.

Yes, promissory notes can indeed be backed by collateral, providing increased security for lenders. In the context of a Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, real property typically serves as the collateral. This means that if the borrower fails to repay, the lender can claim the property to satisfy the debt. It's a common practice that adds a layer of assurance for both parties involved.

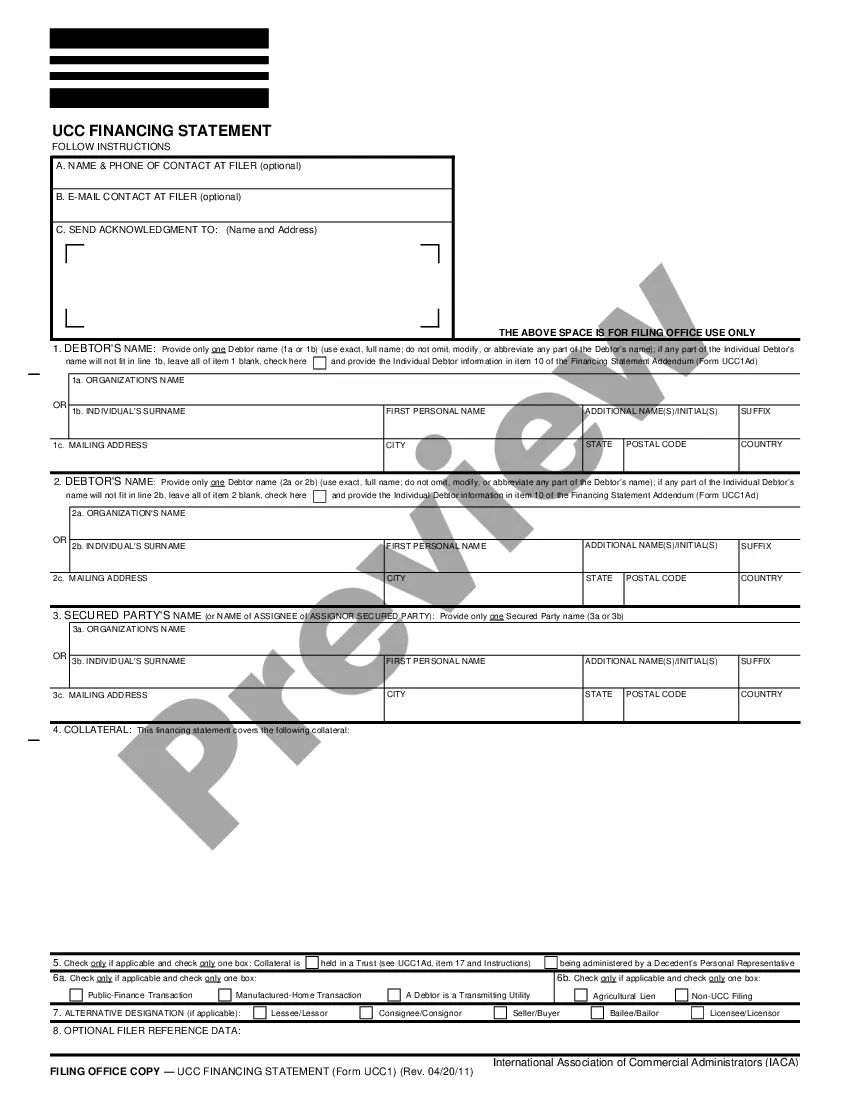

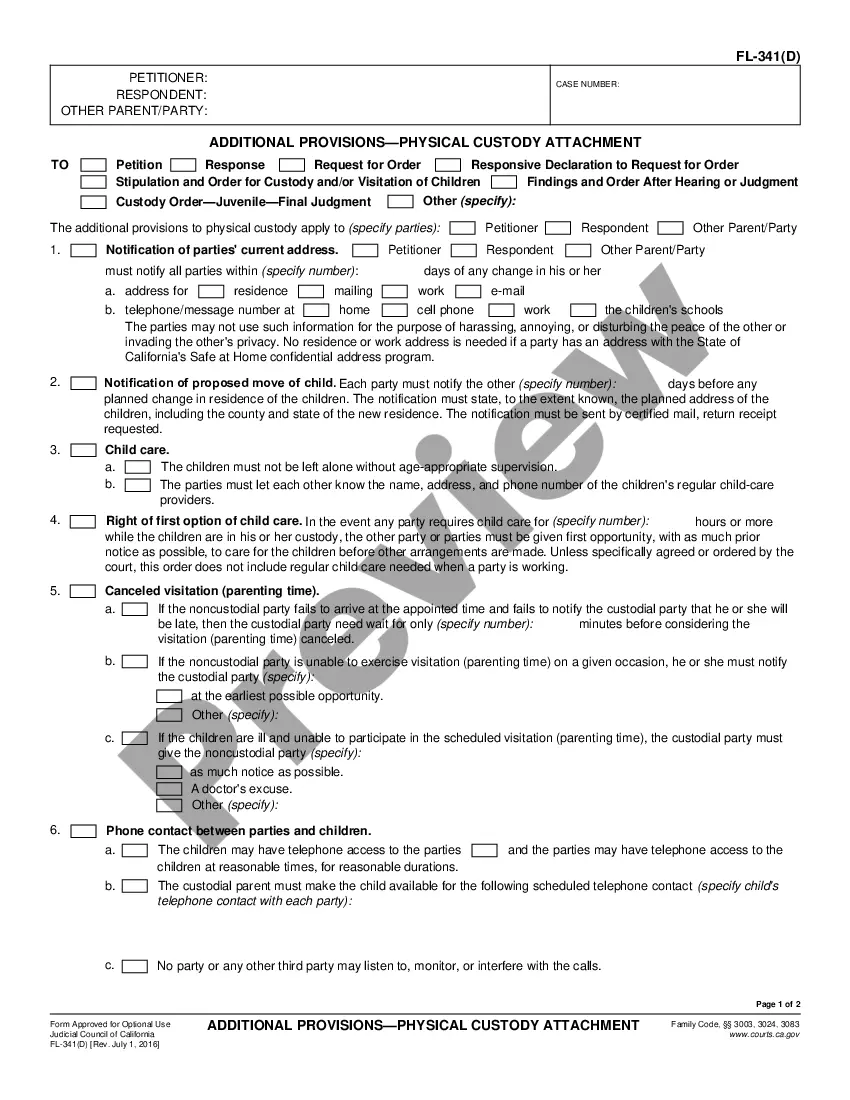

The document that secures the promissory note to the real property is commonly referred to as a deed of trust or a mortgage. For a Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this document establishes the lender's interest in the property. It lays out the terms under which the lender can take possession if the borrower defaults. This legal document is essential for formalizing the security agreement.

You do not typically file a promissory note with any government office. Instead, it remains privately held between the parties involved, often alongside the associated collateral documents. However, in the case of a Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you should file the deed of trust or mortgage with the county recorder’s office. This action publicly documents the security interest in the property.

Securing a promissory note with real property involves creating a lien against the property. This process typically includes drafting a deed of trust or mortgage, which links the Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate to the property itself. If the borrower defaults, the lender has the right to sell the property to recover the owed amount. This adds a layer of security for lenders in real estate transactions.

You report promissory note interest as income on your tax return. The IRS expects you to accurately reflect the interest earned from a Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Typically, you will include this information on Schedule B of your Form 1040. This helps ensure compliance with federal tax regulations.

A promissory note must include several key elements to be legally binding, particularly when it involves Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. These elements include the amount owed, the interest rate, payment terms, and signatures from both parties. It's vital to ensure compliance with state laws, which can be navigated easily through resources like USLegalForms.

You can acquire a promissory note for your mortgage from various channels, including banks, credit unions, and online platforms specializing in Simi Valley California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Additionally, online resources like USLegalForms can guide you in creating a customized promissory note that meets your specific requirements and legal standards.