This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Finding validated templates tailored to your local statutes can be challenging unless you utilize the US Legal Forms repository.

It’s a digital archive of over 85,000 legal documents for both personal and business requirements and any real-world situations.

All the files are correctly categorized by function and jurisdictional regions, so finding the Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate becomes as simple as 1-2-3.

Keep your paperwork organized and in line with legal standards is crucial. Leverage the US Legal Forms repository to always have necessary templates for any requirements right at your fingertips!

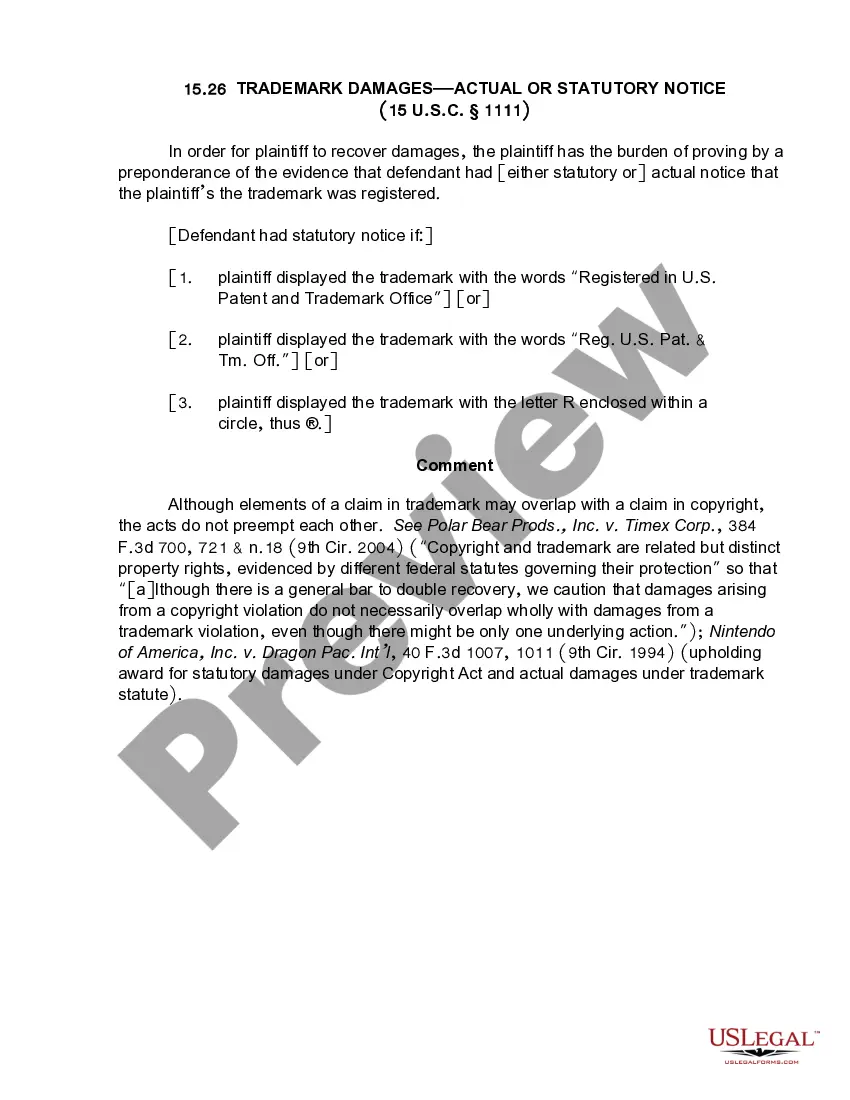

- Review the Preview mode and document description.

- Ensure you’ve chosen the appropriate one that fulfills your needs and entirely aligns with your local jurisdiction stipulations.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct version. If it meets your criteria, proceed to the following step.

- Purchase the document.

Form popularity

FAQ

Filling out a promissory demand note requires specific information about the lender and borrower. Start by stating the amount owed, the repayment terms, and any collateral — for instance, referencing a Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. After completing the information, both parties must sign the document to ensure it is enforceable.

Writing a secured promissory note requires clarity and detail. Start by clearly stating the names of the borrower and lender, the amount borrowed, interest rate, repayment schedule, and any collateral, like Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Make sure to include all necessary legally binding terms to protect both parties.

The entry of the promissory note is where the basic terms and conditions of the note are recorded. This typically includes names of the parties involved, repayment terms, interest rate, and the description of the secured asset, such as Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. This entry serves as the foundation for the entire agreement.

Yes, promissory notes are enforceable in California when they meet certain legal requirements. To ensure your Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is valid, it must clearly outline the terms, including the repayment schedule and interest rate. Additionally, both parties should sign the document to establish their consent. By using resources from uslegalforms, you can create a legally sound promissory note, providing you with peace of mind and security in your financial transactions.

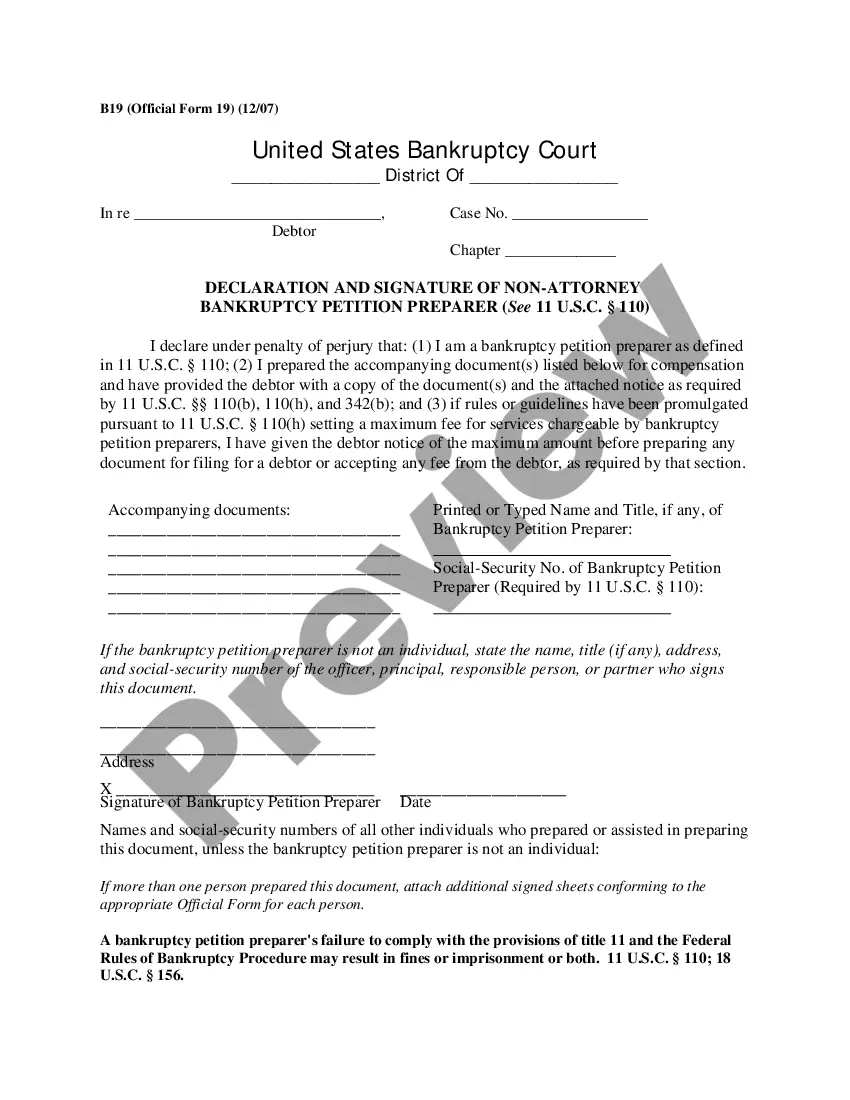

To secure a promissory note with real property, you typically record a deed of trust or mortgage with the county recorder’s office, linking the note to the property. This process involves drafting the relevant documents and ensuring compliance with California laws. Utilizing platforms like US Legal Forms can simplify the preparation of these documents for your Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

Yes, a promissory note can indeed be secured by real property. In fact, a Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate offers an effective way to ensure payment while providing the lender with a claim over the property. This arrangement adds an extra layer of security for lenders, making it a favorable option in real estate financing.

The document that secures a promissory note to real property is called a deed of trust or mortgage. This legal agreement allows the lender to take possession of the property if the borrower defaults on the Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Understanding this relationship is crucial for both buyers and investors.

Yes, promissory notes can be backed by collateral, providing lenders additional security. When you secure a Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the collateral often consists of the commercial property itself. This backing minimizes risk for lenders and establishes a clear claim against the property in the event of a default.

To create a valid promissory note in California, you must include essential elements like the amount borrowed, interest rates, payment terms, and signatures from all parties involved. Additionally, the promise to repay the amount must be clear and unconditional. When considering a Sacramento California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it’s important to ensure that all necessary details are included to enforce the note effectively.