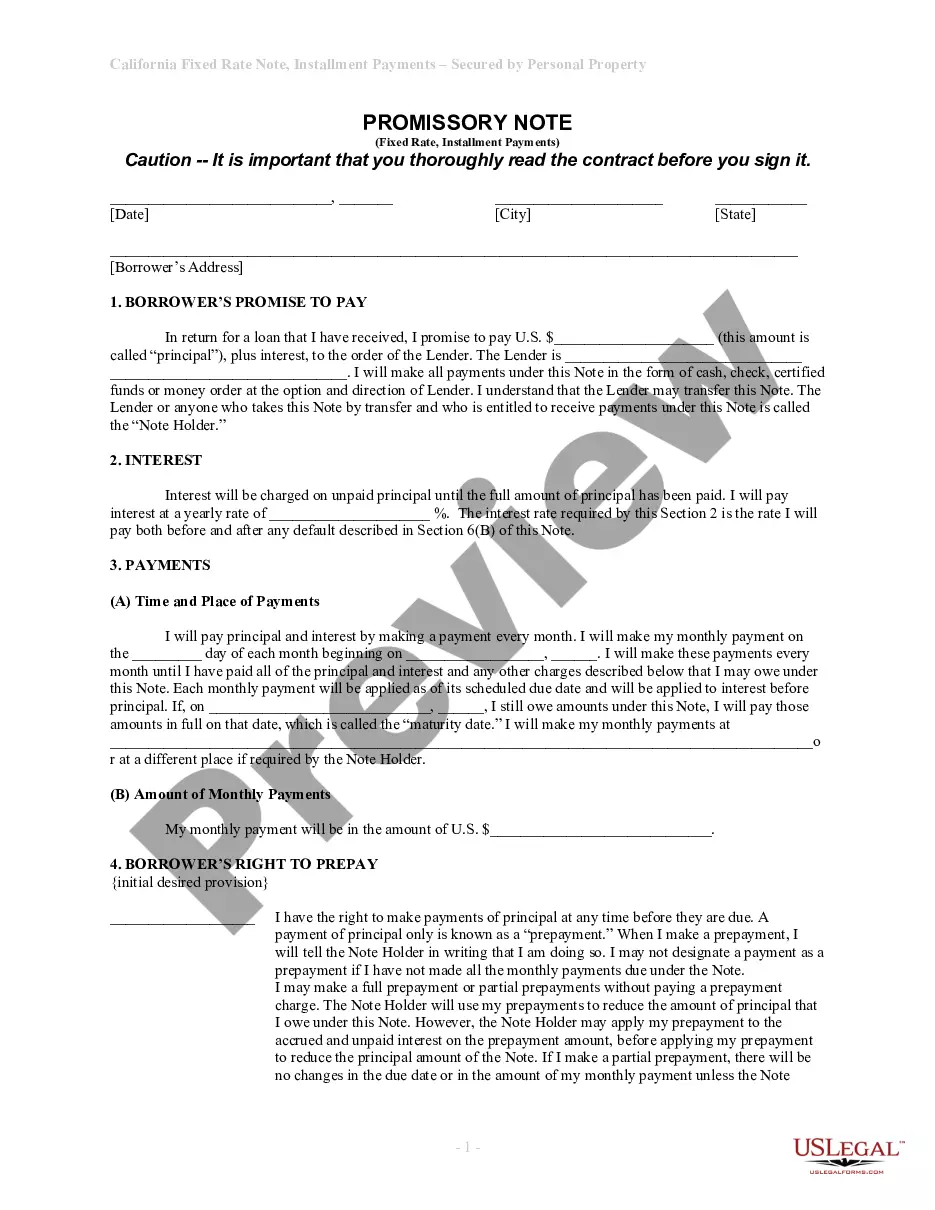

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Sacramento California Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Personal Property?

Irrespective of social or occupational rank, completing legal documents is a regrettable requirement in the modern world.

Often, it’s nearly unfeasible for individuals without any legal expertise to create such documents from the ground up, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Verify that the template you have identified is appropriate for your jurisdiction since the regulations of one state or county do not apply to another.

Examine the document and peruse a brief description (if available) of scenarios for which the document can be utilized.

- Our platform boasts an extensive collection of over 85,000 ready-to-use state-specific forms applicable for nearly any legal scenario.

- US Legal Forms is also an excellent tool for associates or legal advisors looking to conserve time by using our DIY documents.

- Whether you require the Sacramento California Installments Fixed Rate Promissory Note Secured by Personal Property or any other paperwork that is valid in your state or county, with US Legal Forms, everything is readily available.

- Here’s how you can quickly obtain the Sacramento California Installments Fixed Rate Promissory Note Secured by Personal Property using our dependable platform.

- If you are already an existing customer, you can proceed to Log In to your account to retrieve the necessary form.

- However, if you are new to our platform, ensure that you adhere to these steps prior to downloading the Sacramento California Installments Fixed Rate Promissory Note Secured by Personal Property.

Form popularity

FAQ

Filling out a promissory note involves several key steps. Start by clearly stating the principal amount, the interest rate, and the repayment schedule. For a Sacramento California Installments Fixed Rate Promissory Note Secured by Personal Property, include specifics about the collateral and ensure both parties sign the document to solidify the agreement.

In most cases, notarization is not required for a secured promissory note, including Sacramento California Installments Fixed Rate Promissory Notes Secured by Personal Property. However, notarizing the document can add an extra layer of security and validation. It may also make the document more credible in case of disputes.

Yes, a handwritten promissory note is legal in California as long as it contains essential elements. To serve as a Sacramento California Installments Fixed Rate Promissory Note Secured by Personal Property, it must include details such as the amount borrowed, the borrower's information, payment terms, and the signatures of both parties. While handwritten notes are valid, using a template can ensure all legal requirements are met.

Yes, promissory notes are enforceable in California, provided they meet specific legal requirements. When you create a Sacramento California Installments Fixed Rate Promissory Note Secured by Personal Property, you ensure that it complies with state laws. This means that both the borrower and lender must clearly understand their roles and obligations. Utilizing a platform like uslegalforms can help you draft a valid promissory note that protects your interests.

To secure a promissory note with real property, you must draft and sign a security agreement that clearly details the property being used as collateral. This agreement should outline the rights and responsibilities of both the borrower and the lender concerning the secured property. Utilizing platforms like uslegalforms can simplify this process, providing you with templates and resources for creating a Sacramento California Installments Fixed Rate Promissory Note Secured by Personal Property effectively.

The document that secures a promissory note to real property is called a security agreement or a collateral agreement. This document outlines the terms of the security and specifies the collateral that backs the promissory note. In the context of a Sacramento California Installments Fixed Rate Promissory Note Secured by Personal Property, this document is crucial for establishing rights and obligations between the parties involved.

Yes, promissory notes can indeed be backed by collateral. This collateral can be personal property, such as vehicles, equipment, or other valuable assets. By securing a Sacramento California Installments Fixed Rate Promissory Note Secured by Personal Property with collateral, lenders gain an added layer of security, reducing their risk if the borrower defaults.