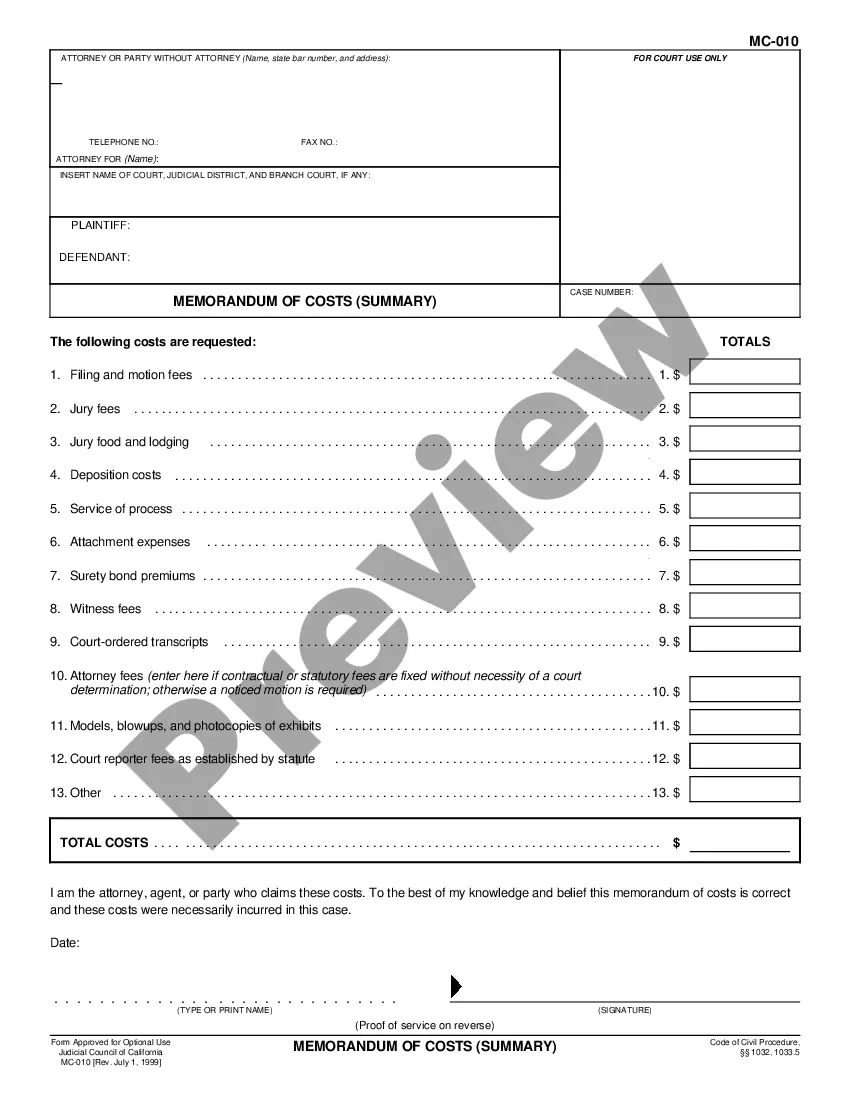

Memorandum of Costs - Worksheet: This Memorandum is simply a list of costs associated with litigation. All costs are broken down into all individual expenses, such as attorney fees, filing fees, juror food expenses, etc.

Long Beach California Memorandum of Costs - Worksheet

Description

How to fill out California Memorandum Of Costs - Worksheet?

Obtaining verified templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents catering to both personal and business requirements and any real-world circumstances.

All the files are systematically categorized by purpose and jurisdiction, making it as straightforward as one-two-three to find the Long Beach California Memorandum of Costs - Worksheet.

Keep your paperwork organized and compliant with legal standards; utilize the US Legal Forms library to always have necessary document templates at your fingertips!

- Familiarize yourself with the Preview mode and document description.

- Ensure you’ve selected the appropriate version that satisfies your requirements and aligns fully with your local jurisdiction regulations.

- If necessary, look for another template.

- Should you discover any discrepancies, employ the Search tab above to find the correct variant. If it fits your needs, proceed to the next stage.

- Click the Buy Now button to acquire the document and choose your desired subscription plan.

Form popularity

FAQ

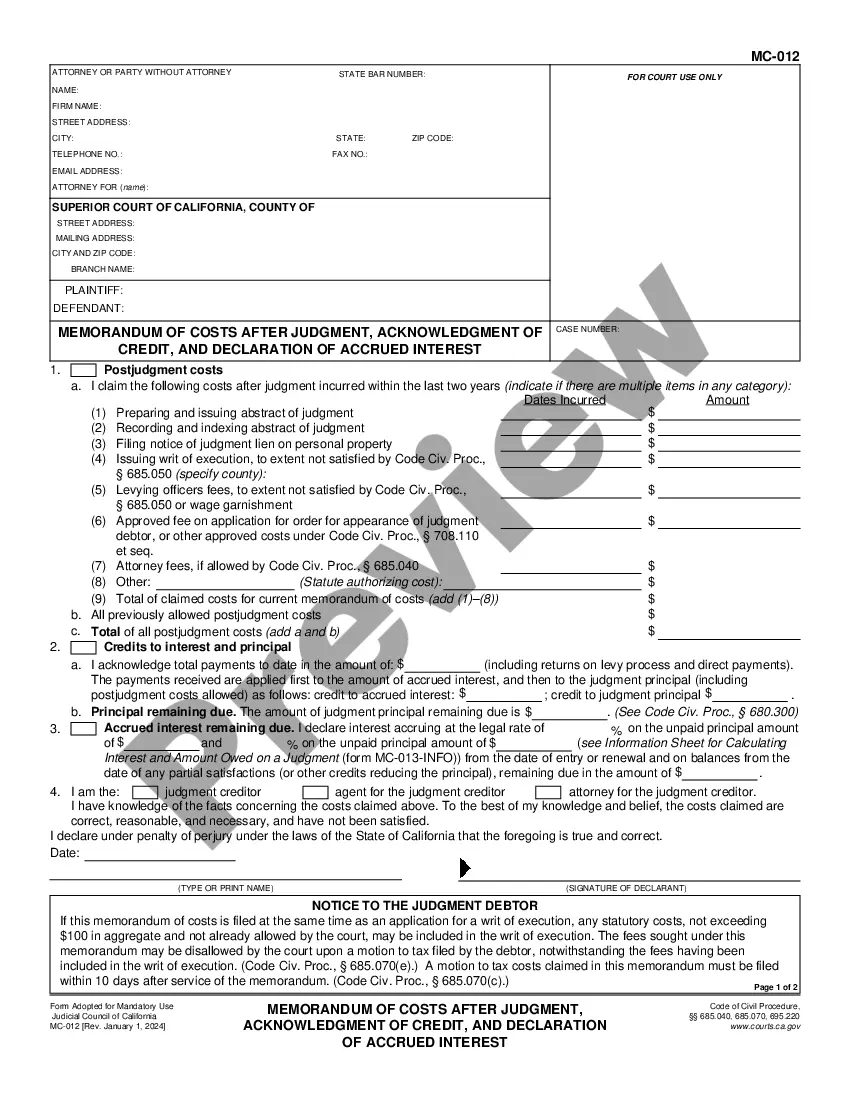

The MC 012 is used to keep a running total of all costs, credits/payments, and interest accrued after. the final Entry of Judgment. Number 1. a) I claim the following costs after Judgment incurred within the last two years. 1) Complete if you filed an Abstract of Judgment (Form EJ-001).

Tells the sheriff to take action to enforce a judgment. Used with instructions to the sheriff to levy bank accounts, garnish wages, or take possession of personal property.

Step 1: Calculate Your Costs and Interest.Step 2: Complete and Copy Your Form.Step 3: Serve Your Memorandum of Costs After Judgment.Step 4: Make Photocopies.Step 5: File Your Documents.Step 6: Oppose the Debtor's Motion to Tax Costs, if Filed.

A prevailing party who claims costs must serve and file a memorandum of costs within 15 days after the date of service of the notice of entry of judgment or dismissal by the clerk under Code of Civil Procedure section 664.5 or the date of service of written notice of entry of judgment or dismissal, or within 180 days

Tells the court and others that a judgment has been paid in full or in part. Can be recorded with a county to release a lien against the judgment debtor's land or filed with the Secretary of State to release a lien against the debtor's personal property. Get form EJ-100.

To have costs and interest added to the amount owed, you must file and serve a Memorandum of Costs After Judgment (MC-012). On this form, you must include the exact amount of all allowable costs, the payments credited toward the principal and interest, and the amount of accrued interest.

Writ of Execution (EJ-130) Tells the sheriff to take action to enforce a judgment. Used with instructions to the sheriff to levy bank accounts, garnish wages, or take possession of personal property. Get form EJ-130.

A writ of execution is a court order granted to you that typically orders a sheriff or other similar official to take possession of property owned by the judgment debtor.

Writ of Execution (EJ-130) Tells the sheriff to take action to enforce a judgment. Used with instructions to the sheriff to levy bank accounts, garnish wages, or take possession of personal property. Get form EJ-130. Revised: September 1, 2020. View EJ-130 Writ of Execution form.

Step 1: Obtain a Writ of Execution.Step 1a: Complete the Writ of Execution (EJ-130) form.Step 1b: Adding Costs and Interest (optional)Step 1c: Obtain a File-Endorsed Copy of Your Judgment.Step 1d: File Your Documents.Step 2: Complete the Application for Earnings Withholding Order.Step 3: Have Your Documents Served.