Alameda California Certificate of Delinquent Personal Property Tax

Description

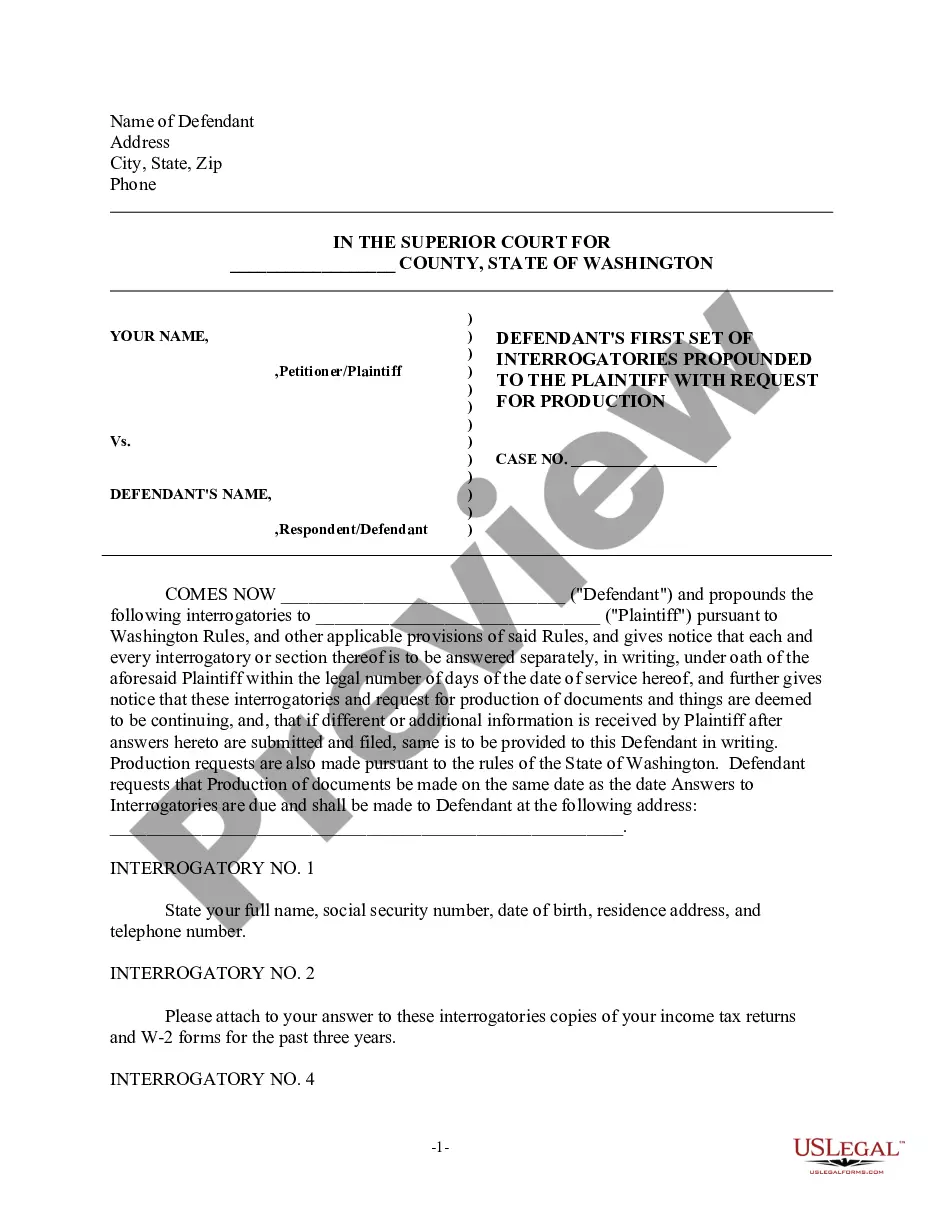

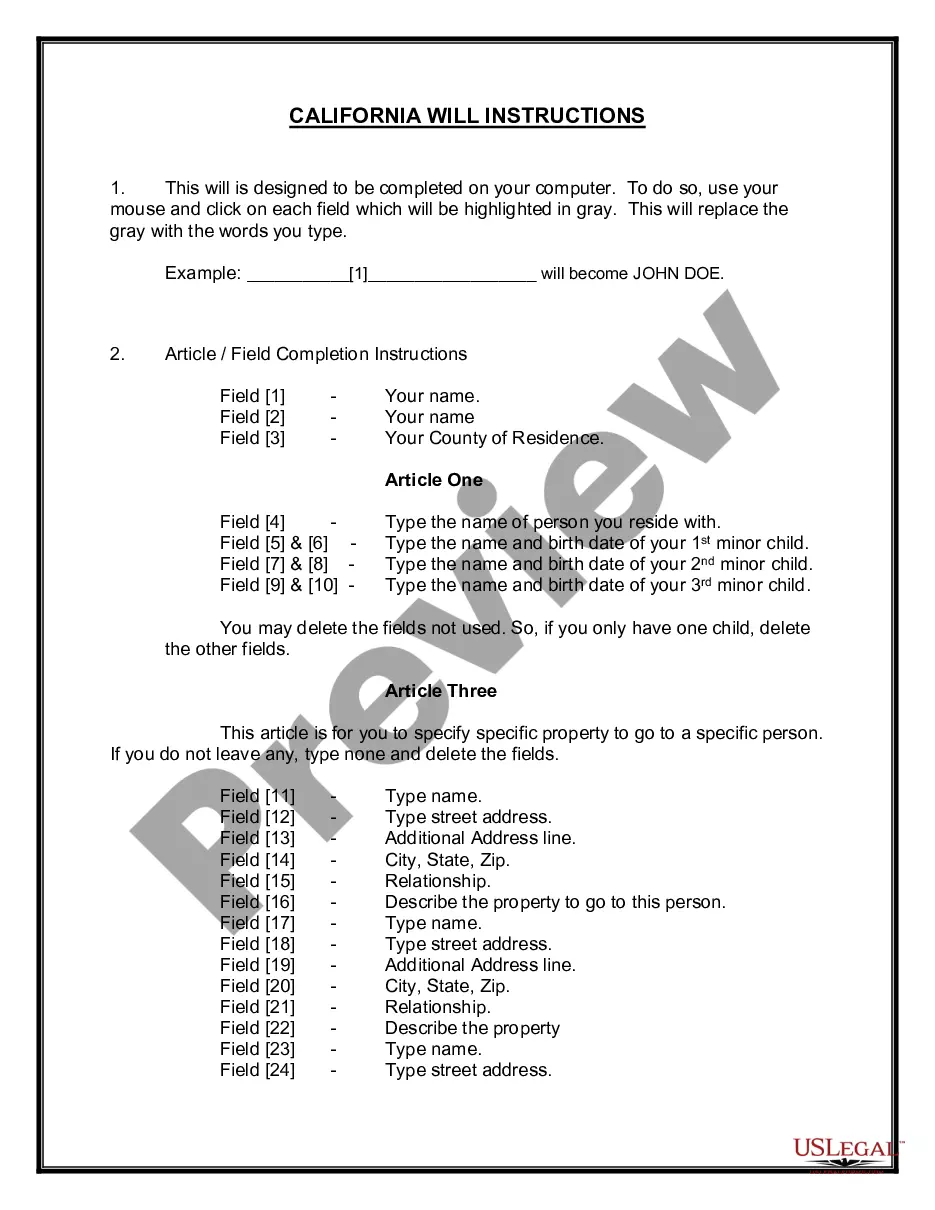

How to fill out California Certificate Of Delinquent Personal Property Tax?

If you are looking for a pertinent form template, it’s incredibly challenging to select a superior platform compared to the US Legal Forms site – likely the most comprehensive libraries available online.

With this collection, you can obtain a vast number of document samples for both commercial and personal use categorized by types and geographical locations, or keywords.

Utilizing our sophisticated search feature, locating the latest Alameda California Certificate of Delinquent Personal Property Tax is as simple as 1-2-3.

Verify your selection. Click on the Buy now option. Subsequently, select the desired pricing plan and provide information to create an account.

Complete the payment. Use your credit card or PayPal account to finalize the registration process. Obtain the template. Choose the format and store it on your device.

- Moreover, the relevance of every document is validated by a team of proficient attorneys who routinely review the templates on our site and refresh them in accordance with the latest state and county requirements.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Alameda California Certificate of Delinquent Personal Property Tax is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the steps outlined below.

- Ensure you have located the template you need. Review its details and utilize the Preview option (if available) to examine its content.

- If it does not fulfill your requirements, use the Search bar near the top of the page to locate the necessary document.

Form popularity

FAQ

In California, paying property taxes late usually incurs a penalty of 10% on the overdue amount. This penalty will be added if the payment remains unpaid after the due date. Additionally, if the taxes remain unpaid for a longer duration, further penalties and fees may apply. To avoid these penalties, timely payments are crucial, and understanding the implications of an Alameda California Certificate of Delinquent Personal Property Tax can help keep your finances on track.

In California, property taxes can go unpaid for up to five years before the county can initiate foreclosure proceedings. After the tax becomes delinquent, the county provides a grace period during which you can settle your tax bill without severe consequences. Ignoring your taxes ultimately leads to the issuance of an Alameda California Certificate of Delinquent Personal Property Tax, which could significantly impact your financial situation. It’s wise to address your overdue taxes as soon as possible.

To contact Alameda property tax, visit the official Alameda County Assessor's website for the most accurate information and contact details. You can also call their office directly to ask specific questions about your property tax situation. It's essential to have your property details on hand for a more efficient conversation. For issues related to the Alameda California Certificate of Delinquent Personal Property Tax, their team can provide valuable assistance.

If someone pays your delinquent property taxes, they may acquire a lien on your property. This means they could potentially claim your property if you do not repay the amount, including any interest or fees. It's crucial to address your delinquent taxes promptly to avoid any complications such as a transfer of ownership. For specific guidance, consider consulting resources related to the Alameda California Certificate of Delinquent Personal Property Tax.

Yes, in California, you can potentially own property by paying delinquent taxes. When you settle the outstanding taxes, you may redeem the property, depending on the situation. If you are dealing with the Alameda California Certificate of Delinquent Personal Property Tax, you’ll want to ensure the debts are cleared to prevent losing rights to the property. This can be a beneficial pathway for those looking to acquire property through tax payments.

To find property that is delinquent on your taxes in Alameda, you can start by checking the local tax assessor's website. They typically provide a list of properties with delinquent taxes. Additionally, consider obtaining an Alameda California Certificate of Delinquent Personal Property Tax to gain further insights into specific delinquent cases. This certificate can help identify properties affected by tax liens.

Yes, you can buy tax lien certificates in California, including the Alameda California Certificate of Delinquent Personal Property Tax. These certificates become available during tax lien sales conducted by counties. It's an opportunity for investors to earn returns while assisting local governments in recovering tax revenue.

You can obtain a copy of your property tax bill in California by visiting your local county tax assessor's office or through their website. Many counties now provide online access, making it easy to search by property address or owner’s name. If you need assistance, uslegalforms offers resources to help you navigate these procedures efficiently.

Paying property taxes does not automatically grant ownership in California. However, it helps maintain your claim to the property and prevents the risk of losing it due to tax default. In situations where property taxes remain unpaid, acquiring an Alameda California Certificate of Delinquent Personal Property Tax can lead to eventual ownership through a tax deed sale.

When property taxes are delinquent in California, the local government typically begins a process to recover the owed amount. This can eventually lead to the issuance of a delinquent tax certificate, like the one in Alameda. Additionally, property owners may incur penalties and interest, making it even more crucial to address delinquency promptly.