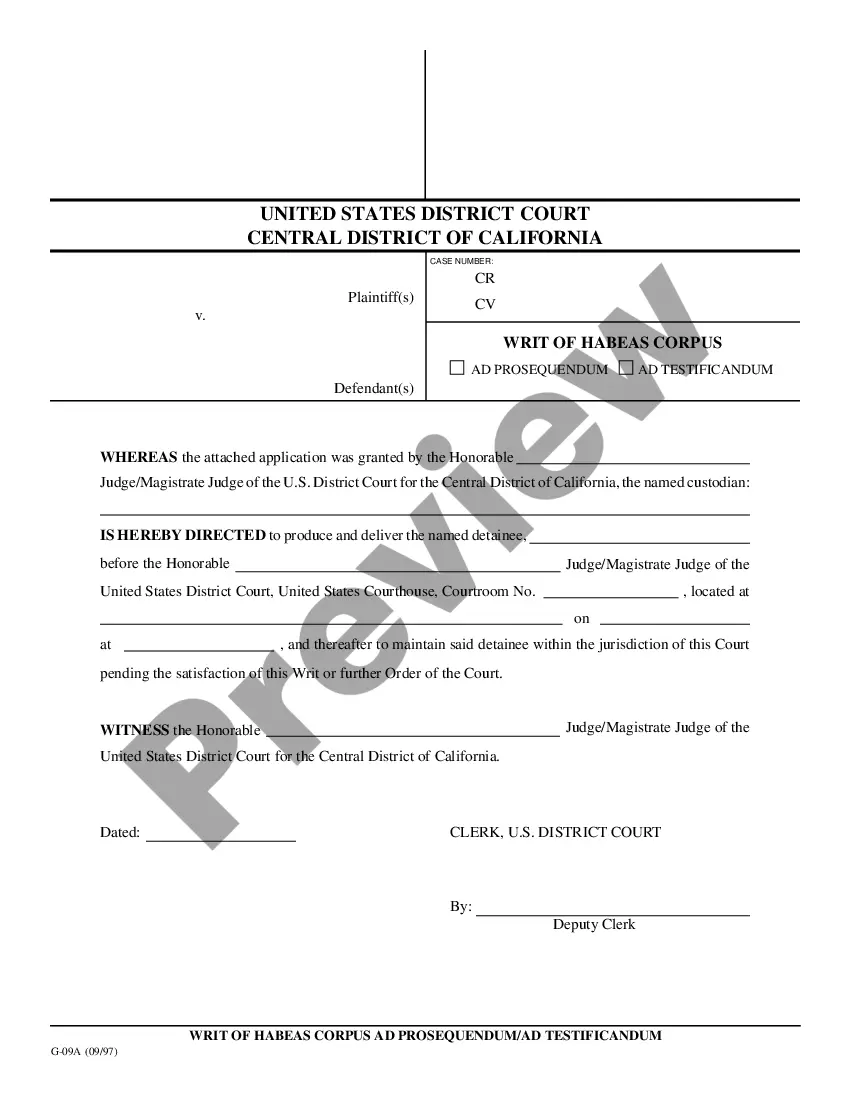

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Title: Understanding Anaheim California Schedule A, Receipts, and Other Receipts-Standard Account Introduction: Anaheim, California, is a vibrant city known for its attractions, entertainment, and business opportunities. When it comes to managing financial records, it's essential to understand the various aspects of Anaheim California Schedule A, Receipts, and Other Receipts-Standard Account. In this article, we will delve into the details of these terms, their significance, and any distinct types associated with them. 1. Anaheim California Schedule A: Anaheim California Schedule A refers to a specific form used for reporting itemized deductions on your California state income tax return. It is aimed at capturing eligible deductions that could potentially reduce your overall tax liability. This schedule is crucial for individuals and businesses alike to ensure accurate tax reporting. 2. Receipts: Receipts are written or electronic documents providing evidence of a financial transaction, typically issued by a seller to a buyer. In the context of Anaheim California Schedule A, receipts play a vital role in substantiating the claimed deductions. They validate the expenses incurred in areas such as healthcare, education, mortgage interest, state and local taxes paid, charitable contributions, and many more. Accurately maintaining and organizing receipts is paramount to avoid any issues during tax audits. 3. Other Receipts-Standard Account: Under Anaheim California Schedule A, the category of "Other Receipts-Standard Account" encompasses miscellaneous expenses eligible for tax deductions but not covered by specific deduction types. These expenses might include reimbursed employee business expenses, job-related moving costs, expenses related to tax preparation, and certain legal fees. By utilizing the Standard Account option when filing your Schedule A, you can easily deduct these miscellaneous expenses, subject to specific limitations and criteria. Different Types of Anaheim California Schedule A, Receipts, Other Receipts-Standard Account: While there might not be distinct types of Anaheim California Schedule A, receipts and other expenses under the "Other Receipts-Standard Account" category can vary based on individual circumstances. Some common types can include: 1. Reimbursed Employee Business Expenses: These could include business travel expenses, work-related tools and equipment, union/association dues, work-related education, and professional development expenses. 2. Job-Related Moving Costs: If you moved for a new job within a certain time frame and meet certain distance and time tests, certain moving expenses such as transportation, lodging, and storage can be claimed as deductions. 3. Tax Preparation Expenses: Costs associated with professional tax preparation services or specific tax software used can be included as deductions. 4. Legal Fees: Under certain circumstances, legal fees incurred for the preparation or review of documents related to income producing properties can be claimed as itemized deductions. Conclusion: Understanding Anaheim California Schedule A, Receipts, and Other Receipts-Standard Account is crucial for diligent tax reporting in Anaheim, California. By keeping detailed records, organizing receipts, and familiarizing yourself with the specific types of expenses eligible under the "Other Receipts-Standard Account," you can maximize your tax deductions while complying with the state's regulations. Remember to consult with a tax professional or refer to official tax resources for precise information based on your unique circumstances.Title: Understanding Anaheim California Schedule A, Receipts, and Other Receipts-Standard Account Introduction: Anaheim, California, is a vibrant city known for its attractions, entertainment, and business opportunities. When it comes to managing financial records, it's essential to understand the various aspects of Anaheim California Schedule A, Receipts, and Other Receipts-Standard Account. In this article, we will delve into the details of these terms, their significance, and any distinct types associated with them. 1. Anaheim California Schedule A: Anaheim California Schedule A refers to a specific form used for reporting itemized deductions on your California state income tax return. It is aimed at capturing eligible deductions that could potentially reduce your overall tax liability. This schedule is crucial for individuals and businesses alike to ensure accurate tax reporting. 2. Receipts: Receipts are written or electronic documents providing evidence of a financial transaction, typically issued by a seller to a buyer. In the context of Anaheim California Schedule A, receipts play a vital role in substantiating the claimed deductions. They validate the expenses incurred in areas such as healthcare, education, mortgage interest, state and local taxes paid, charitable contributions, and many more. Accurately maintaining and organizing receipts is paramount to avoid any issues during tax audits. 3. Other Receipts-Standard Account: Under Anaheim California Schedule A, the category of "Other Receipts-Standard Account" encompasses miscellaneous expenses eligible for tax deductions but not covered by specific deduction types. These expenses might include reimbursed employee business expenses, job-related moving costs, expenses related to tax preparation, and certain legal fees. By utilizing the Standard Account option when filing your Schedule A, you can easily deduct these miscellaneous expenses, subject to specific limitations and criteria. Different Types of Anaheim California Schedule A, Receipts, Other Receipts-Standard Account: While there might not be distinct types of Anaheim California Schedule A, receipts and other expenses under the "Other Receipts-Standard Account" category can vary based on individual circumstances. Some common types can include: 1. Reimbursed Employee Business Expenses: These could include business travel expenses, work-related tools and equipment, union/association dues, work-related education, and professional development expenses. 2. Job-Related Moving Costs: If you moved for a new job within a certain time frame and meet certain distance and time tests, certain moving expenses such as transportation, lodging, and storage can be claimed as deductions. 3. Tax Preparation Expenses: Costs associated with professional tax preparation services or specific tax software used can be included as deductions. 4. Legal Fees: Under certain circumstances, legal fees incurred for the preparation or review of documents related to income producing properties can be claimed as itemized deductions. Conclusion: Understanding Anaheim California Schedule A, Receipts, and Other Receipts-Standard Account is crucial for diligent tax reporting in Anaheim, California. By keeping detailed records, organizing receipts, and familiarizing yourself with the specific types of expenses eligible under the "Other Receipts-Standard Account," you can maximize your tax deductions while complying with the state's regulations. Remember to consult with a tax professional or refer to official tax resources for precise information based on your unique circumstances.